Insurance policy reviews involve a thorough assessment of an individual's or business's insurance coverage, ensuring that it remains adequate and up-to-date in light of changing circumstances and needs. Regular insurance policy reviews are essential to ensure that policyholders maintain appropriate coverage levels, identify potential gaps in coverage, and keep premiums competitive. Several factors, such as changes in personal circumstances, property, or assets, may necessitate a review of an insurance policy to ensure continued protection and financial security. Regular policy reviews help policyholders verify that their coverage levels remain appropriate for their current needs, protecting their assets and financial well-being. Policy reviews can help identify potential gaps in coverage, enabling policyholders to address these issues and minimize their exposure to risk. By regularly reviewing their insurance policies, policyholders can ensure they are receiving the most competitive premiums available and take advantage of any discounts or credits they may qualify for. Policy reviews provide an opportunity to update personal information, ensuring that policyholders receive accurate coverage and premium quotes. Regular insurance policy reviews allow policyholders to identify and take advantage of available discounts and credits, potentially lowering their premium costs. Significant life events, such as marriage or divorce, may require adjustments to insurance coverage to reflect changes in assets and liabilities. The addition of children to a family may necessitate adjustments to life insurance policies or the addition of coverage for dependents. Retirement may trigger the need to review insurance policies, as coverage needs and risk exposure can change significantly during this life stage. Major home renovations or improvements can increase a property's value, necessitating adjustments to homeowners insurance coverage. Acquiring a new vehicle may require updates to auto insurance policies, including coverage levels and potential sales discounts or credits. The acquisition of valuable possessions, such as jewelry or artwork, may require adjustments to personal property coverage or the addition of specialized insurance policies. Starting a business can increase an individual's liability exposure, necessitating the addition of business insurance policies or adjustments to existing coverage. Becoming a landlord may require adjustments to insurance coverage, including the addition of landlord insurance or adjustments to existing property insurance policies. An increase in income or net worth may warrant a review of liability coverage levels, as higher-income individuals may face greater risk exposure. Insurance providers may introduce new discounts or credits, making policy reviews essential to ensure that policyholders are taking advantage of all available savings opportunities. As insurance providers update their coverage options and product offerings, policyholders should review their policies to ensure they have the most appropriate and up-to-date coverage. Policyholders should begin by reviewing their policy documents to understand their current coverage levels, deductibles, and any endorsements or exclusions. A thorough assessment of current coverage and deductible levels can help policyholders determine whether adjustments are necessary to ensure adequate protection. Evaluating potential gaps in coverage allows policyholders to address these issues and minimize their exposure to risk. Policyholders should compare different insurance providers and their policy offerings to ensure they have the most appropriate and competitive coverage. An insurance agent or broker can provide valuable guidance and expertise during the policy review process, helping policyholders make informed decisions about their coverage. It is generally recommended that policyholders conduct a comprehensive insurance policy review at least once a year, or whenever significant changes occur in their personal or financial circumstances. Certain events, such as purchasing a new home or vehicle, starting a business, or experiencing significant life changes, may trigger the need for an immediate policy review. Maintaining organized records of insurance policies, coverage levels, and premium payments can simplify the policy review process and ensure accuracy. Policyholders should regularly update their personal information with their insurance provider to ensure accurate coverage and premium quotes. Keeping abreast of changes in insurance regulations and industry trends can help policyholders stay informed and make necessary adjustments to their coverage. Establishing a relationship with an insurance agent or broker can provide valuable guidance and expertise throughout the policy review process. Failing to identify and address coverage gaps can leave policyholders exposed to risk and potential financial loss. While premium costs are an important consideration, policyholders should prioritize adequate coverage and protection over simply reducing their insurance expenses. Neglecting to update personal information can result in inaccurate coverage levels and premium quotes, potentially leading to insufficient coverage or higher premiums than necessary. Failing to review policy endorsements or exclusions can leave policyholders unaware of important coverage limitations, increasing their exposure to risk. Regular insurance policy reviews are essential to ensure that policyholders maintain appropriate coverage levels, identify potential gaps in coverage, and keep premiums competitive. By conducting thorough policy reviews, policyholders can ensure that they have adequate coverage and competitive premiums, protecting their assets and financial well-being. An up-to-date and comprehensive insurance portfolio is crucial for safeguarding against potential risks and financial loss. Regular policy reviews are key to achieving this goal and maintaining financial security.What Are Insurance Policy Reviews?

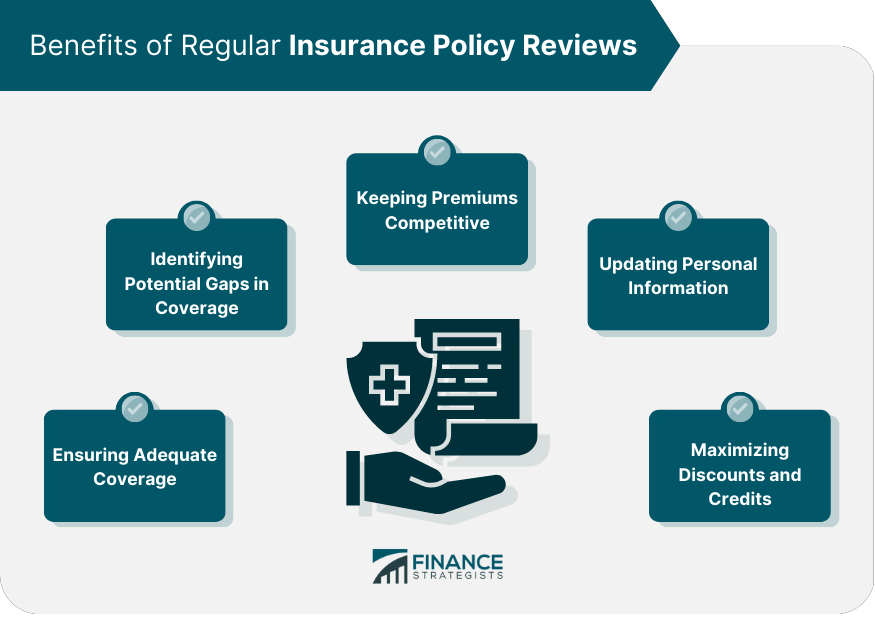

Benefits of Regular Insurance Policy Reviews

Ensuring Adequate Coverage

Identifying Potential Gaps in Coverage

Keeping Premiums Competitive

Updating Personal Information

Maximizing Discounts and Credits

Key Considerations for Insurance Policy Reviews

Changes in Personal Circumstances

Marriage or Divorce

Having Children

Retirement

Changes in Property or Assets

Home Renovations or Improvements

Purchasing a New Vehicle

Acquiring Valuable Possessions

Changes in Liability Exposure

Starting a Business

Becoming a Landlord

Increasing Income or Net Worth

Changes in Insurance Provider Offerings

New Discounts or Credits

Updated Coverage Options

How to Conduct an Insurance Policy Review

Reviewing Policy Documents

Assessing Current Coverage and Deductibles

Evaluating Potential Gaps in Coverage

Comparing Insurance Providers and Policy Offerings

Consulting With an Insurance Agent or Broker

Frequency of Insurance Policy Reviews

Recommended Frequency for Policy Reviews

Triggering Events for Immediate Policy Review

Tips for a Successful Insurance Policy Review

Keeping Organized Records

Regularly Updating Personal Information

Monitoring Changes in Insurance Regulations and Industry Trends

Developing a Relationship With an Insurance Agent or Broker

Potential Pitfalls to Avoid During Policy Reviews

Overlooking Coverage Gaps

Focusing Solely on Premium Costs

Failing to Update Personal Information

Neglecting to Review Policy Endorsements or Exclusions

Conclusion

Insurance Policy Reviews FAQs

It's important to review your insurance policy regularly to ensure that you have adequate coverage and that your policy still meets your needs. Life changes, such as a new job, a move, or a new family member, can impact your insurance needs.

It's recommended to review your insurance policy annually, or whenever you experience a significant life change. This will help you ensure that your coverage remains up-to-date and that you're not paying for unnecessary or insufficient coverage.

When reviewing your insurance policy, you should check your coverage limits, deductibles, premiums, and any exclusions or endorsements. You should also ensure that you understand the terms and conditions of your policy and that you have the appropriate types of coverage for your needs.

If you find errors or discrepancies in your insurance policy, you should contact your insurance provider as soon as possible to have them corrected. You may need to provide additional information or documentation to support your changes.

Yes, you can switch insurance providers at any time, but it's important to do your research and compare quotes from multiple providers before making a decision. Keep in mind that canceling your current policy before its expiration date may result in penalties or fees, so be sure to review your policy terms before making any changes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.