Disability insurance for physicians and dentists is a type of insurance policy that provides income protection to these professionals in the event of a disabling illness or injury that prevents them from working. It is designed to provide financial support and replace lost income if a physician or dentist becomes unable to work due to a covered disability. This type of insurance is particularly important for professionals whose income is closely tied to their ability to perform their duties, such as performing medical procedures or dental treatments. Own-occupation disability insurance provides benefits if the insured is unable to perform the duties of their specific occupation, even if they can still work in another capacity. This type of policy is particularly valuable for physicians and dentists, as their specialized skills may not easily transfer to other professions. Any-occupation disability insurance only provides benefits if the insured is unable to work in any occupation for which they are reasonably suited based on their education, training, and experience. This type of policy is typically less expensive but offers less comprehensive coverage. Group disability insurance is a policy provided by an employer or professional association. While often more affordable, it may not provide the same level of coverage as an individual policy and may not be portable if the insured changes jobs. Individual disability insurance is a policy purchased directly by the insured. These policies can be tailored to the specific needs of the individual and are generally more comprehensive than group policies. Business overhead expense insurance covers the ongoing expenses of a practice, such as rent, utilities, and staff salaries, if the insured becomes disabled. This type of policy helps to ensure the financial stability of a practice during the insured's absence. The benefit period is the length of time that disability benefits will be paid. Longer benefit periods typically come with higher premiums but provide more extended financial protection. The elimination or waiting period is the time between the onset of disability and when benefits begin. Longer elimination periods usually result in lower premium costs but can create financial strain while waiting for benefits to start. The definition of disability is a crucial factor in determining eligibility for benefits. A policy with a more comprehensive definition of disability, such as own-occupation, is generally preferable for physicians and dentists. Residual or partial disability benefits provide a percentage of the full benefit amount if the insured can work in a reduced capacity. This feature can help ease the financial burden during the transition back to full-time work. COLA is a rider that adjusts disability benefits to account for inflation, helping to maintain the purchasing power of the benefits over time. Future increase options allow the insured to increase their coverage without undergoing additional underwriting. This feature can be valuable for physicians and dentists as their income and financial responsibilities grow. Non-cancelable and guaranteed renewable policies ensure that the insurer cannot cancel or change the policy as long as the premiums are paid. This feature provides long-term stability in coverage and premium rates. Older individuals generally have higher premium rates due to the increased risk of illness and injury. Gender can influence premium rates, as women typically have higher rates due to their longer life expectancy and increased likelihood of experiencing a disability. Individuals with pre-existing conditions or poor health may face higher premium rates or exclusions in coverage. Certain medical and dental specialties may have higher premium rates due to increased occupational risks. More comprehensive policy features and riders typically result in higher premium rates but offer more extensive protection. Premium rates can vary depending on the state in which the insured resides, as different states have different regulations and insurance laws. Before purchasing a policy, physicians and dentists should evaluate their financial needs, including current and future expenses, and determine how much coverage is necessary. Comparing policies from different insurance providers can help identify the best coverage and pricing options. Independent insurance agents can provide unbiased advice and guidance in selecting the best policy for the individual's needs. Physicians and dentists should regularly review their coverage and make updates as needed to ensure their policy remains adequate for their financial situation. Disability insurance premium payments are generally not tax-deductible when paid with after-tax dollars. However, in some cases, premiums paid by a business may be tax-deductible. Disability insurance benefits are typically tax-free when premiums are paid with after-tax dollars. If premiums are paid with pre-tax dollars or are deducted as a business expense, benefits may be taxable. Disability insurance is vital for physicians and dentists to protect their financial well-being in case of disability. Choosing the right policy among own-occupation, any-occupation, group, individual, and business overhead expense insurance is crucial. Professionals can tailor their coverage with key features such as benefit periods, elimination periods, definitions of disability, and riders. Age, gender, health, specialty, policy features, and state of residence influence premium rates, so cost-effective decisions are possible by comparing providers and seeking independent advice. What Are Disability Insurance Policies for Physicians and Dentists?

Types of Disability Insurance Policies for Physicians and Dentists

Own-Occupation Disability Insurance

Any-Occupation Disability Insurance

Group Disability Insurance

Individual Disability Insurance

Business Overhead Expense Insurance

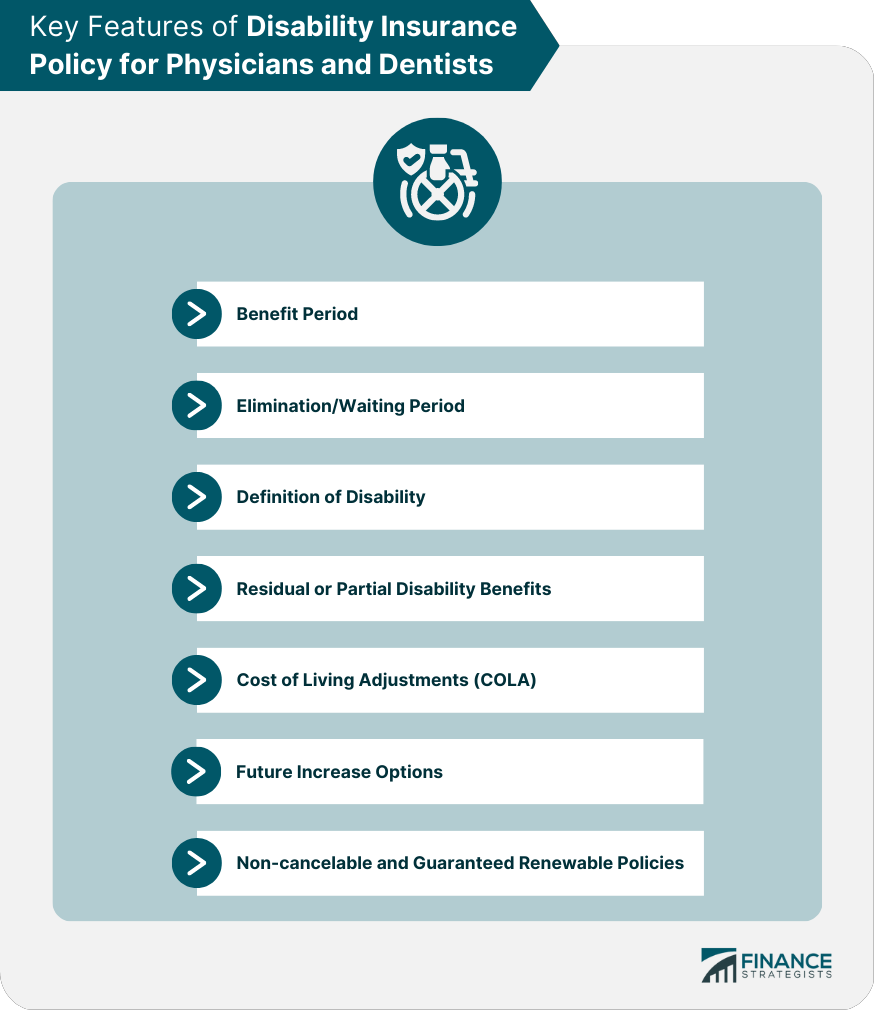

Key Features of Disability Insurance Policy for Physicians and Dentists

Benefit Period

Elimination/Waiting Period

Definition of Disability

Residual or Partial Disability Benefits

Cost of Living Adjustments (COLA)

Future Increase Options

Non-cancelable and Guaranteed Renewable Policies

Factors Affecting Premium Rates for Physicians and Dentists

Age

Gender

Health and Pre-existing Conditions

Specialty and Occupational Risk

Policy Features and Riders

State of Residence

Best Practices for Choosing Disability Insurance

Assess Personal Needs and Financial Situation

Compare Multiple Insurance Providers

Seek Professional Advice From an Independent Insurance Agent

Review and Update Coverage Periodically

Tax Implications of Disability Insurance Benefits

Premium Payments and Tax Deductions

Taxability of Benefits Received

Conclusion

Reviewing and updating coverage periodically is essential to meet changing circumstances. Understanding tax implications, such as paying premiums with after-tax dollars and the taxability of benefits, is also vital for financial planning.

Disability Insurance Policies for Physicians and Dentists FAQs

Disability insurance for physicians and dentists is a type of insurance policy that provides financial protection in the event that a medical professional becomes unable to work due to a disabling injury or illness. This insurance policy can provide a portion of the medical professional's income while they are unable to work and can also help cover the cost of medical expenses related to their disability.

Disability insurance is important for physicians and dentists because their income is directly tied to their ability to work. If a medical professional becomes disabled and is unable to work, their income will stop, and they may face financial hardship. Disability insurance can provide a safety net for medical professionals by helping to replace lost income and cover medical expenses, so they can focus on their recovery.

Disability insurance policies for physicians and dentists typically cover both physical and mental disabilities that prevent the medical professional from working. This can include disabilities caused by accidents, illnesses, or chronic conditions. Some policies may also cover disabilities caused by substance abuse or addiction.

The amount of disability insurance a physician or dentist needs depends on their individual circumstances, such as their income, expenses, and financial obligations. A good rule of thumb is to aim for disability insurance coverage that replaces at least 60% of their income. Medical professionals should also consider the length of their benefit period, which is the amount of time they will receive disability benefits.

Physicians and dentists can find disability insurance policies by researching insurance providers and comparing policy options. It's important to work with a reputable insurance provider that offers policies specifically designed for medical professionals. A licensed insurance agent can also provide guidance and help medical professionals find the right policy to meet their individual needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.