Business overhead expense insurance (BOE) is a type of insurance that benefits a business if the owner cannot work due to a covered illness or disability. The purpose of BOE insurance is to provide the business with cash flow to cover the day-to-day expenses while the owner is unable to work, such as rent or lease payments, loan payments, insurance premiums, utility bills, custodial services, payroll for employees, and tax obligations. Unlike personal disability insurance, which pays benefits directly to the owner to replace lost income, BOE insurance is designed to cover business expenses and keep the business running in the owner's absence. BOE insurance is especially important for small businesses that rely heavily on the owner's ability to work and generate income. If the owner becomes disabled or ill and cannot work, the business may suffer significant financial losses, and ongoing expenses may be difficult to cover without a steady source of income. BOE insurance can help business owners plan for unexpected events and provide peace of mind knowing that the business can continue to operate even when they are unable to work. While any small business owner or self-employed individual can benefit from BOE insurance, it is particularly important for businesses that rely heavily on the owner's ability to work and generate income. For example, businesses with few employees, sole proprietors, small partnerships, and businesses without significant financial resources or staff to draw from in case of unexpected events are good candidates for BOE insurance. Owners of businesses such as medical practices, law firms, consulting firms, and other professional services that require specialized skills and training may also benefit from BOE insurance. These businesses may have high overhead costs, including rent, utilities, and payroll, and may struggle to keep the business running without a steady source of income. Business owners should consider BOE insurance as part of their overall risk management strategy. While personal disability insurance can help replace lost income, it may not cover business expenses. The owner may need to dip into personal savings or retirement accounts to cover the costs of running the business. BOE insurance can provide financial support to help cover these expenses and keep the business running while the owner recovers. BOE insurance covers business-related expenses such as rent or lease payments, loan payments, insurance premiums, utility bills, custodial services, employee payroll, and tax obligations. It is important to note that BOE insurance does not cover expenses related to expanding or improving the business, such as buying new equipment or opening a second location. These types of expenses are typically not considered essential for the day-to-day operations of a business and are, therefore, not covered by BOE insurance. The coverage limits and duration of BOE insurance vary depending on the policy and the insurance provider. Some policies may cover expenses for up to two years, while others may have a shorter or longer coverage period. Reviewing the policy carefully to understand the coverage limits and duration and ensure they meet the business's needs is crucial. Additionally, it is imperative to note that BOE insurance typically has a waiting period before coverage kicks in. Depending on the policy, this waiting period may be 30, 60, or 90 days. Businesses should consider this waiting period when choosing a policy, as it may affect their ability to cover expenses in the event of a disability or illness. In some cases, BOE insurance policies may also include riders that provide additional coverage options. For example, some policies may allow for coverage of wages for someone who steps in to run the business on the owner's behalf when they are disabled. Other policies may automatically increase the benefit amount over time to keep up with inflation. Business overhead expense insurance offers businesses several benefits to ensure continuity in unexpected events. Here are some of the benefits of BOE insurance: BOE insurance ensures that your business can continue operating even if you are unable to be present due to disability or illness. The policy pays for essential business expenses such as rent, utilities, salaries, taxes, and other fixed expenses. This allows your business to continue operating, maintaining its customer base and reputation. BOE insurance covers essential business expenses, allowing you to preserve your business's cash reserves. This can be especially important in the event of an unexpected event or prolonged absence, preventing your business from falling behind on bills, rent, or other crucial financial commitments. Meeting payroll is crucial for retaining key employees. BOE insurance ensures that the policy benefits can be used to pay employee salaries, preventing employees from leaving and allowing the business to maintain its workforce. BOE insurance decreases the odds of having to dip into personal savings to cover business spending in the event of an unexpected absence. This can be especially important for small business owners who may rely on personal savings to finance business expenses. Some BOE policies may pay partial benefits if the business owner or key employee is partially disabled. This ensures that the policyholder receives financial support even if they are unable to work to their full capacity. BOE policies may be guaranteed renewable, meaning the policy can not be canceled as long as premiums are paid. This provides a level of security for business owners, ensuring that the policy benefits will be available when they need them. Premiums paid for BOE coverage may be tax-deductible, reducing the overall cost of the policy. Additionally, business expenses paid with policy benefits may also be tax-deductible, further reducing the financial burden on the business. Business overhead expense insurance has its benefits, but it also has some drawbacks. Here are some of the downsides to keep in mind: BOE insurance policies do not pay benefits to the policyholder directly. The policy benefits are meant to cover business overhead expenses, so separate disability coverage is still necessary to replace the policyholder's lost income. This means that the policyholder may need to purchase additional disability coverage to ensure adequate income replacement. The benefits from BOE insurance policies typically have a time limit and can not be paid indefinitely. The policy may have a maximum benefit period of 12 to 24 months. This means that if the disability or illness is prolonged, the policyholder may need to find alternative sources of income to cover ongoing business expenses. Any benefits received from BOE insurance policies may be considered taxable income for the business. This means that the business may need to pay taxes on the policy benefits, reducing the net amount of financial support received. BOE insurance policies may enforce a maximum monthly benefit limit, which may be less than what the policyholder needs to continue business operations. This means that the policyholder may need to find additional sources of income to cover the remaining business expenses. It is essential to ensure that the policy's benefit limit is sufficient to cover the business's ongoing expenses. BOE insurance can help protect your business in case of unexpected events, but getting the right coverage requires evaluating your expenses, comparing policies, and customizing your coverage. Here are the steps to get BOE insurance: The first step to getting BOE insurance is to evaluate your business expenses. Look at your fixed overhead expenses, such as rent, utilities, salaries, and taxes. This will help you determine how much coverage you need to cover these expenses in case of an unexpected event. Determining how much of your business revenue you drive directly through your involvement in the business is also essential. This information will help you determine how much income replacement you need to keep your business running in your absence. Research and compare BOE insurance policies from different insurance companies. Look for companies that offer coverage that meets your specific needs and offers competitive pricing. Remember that there may be initial restrictions based on age, business structure, industry, and minimum revenues on who can apply and be approved. Once you find a policy that suits your needs, you may be able to customize your coverage. Consider adding riders that allow you to receive benefits to cover wages for someone who steps in to run the business on your behalf when you are disabled or automatically increase your benefit amount over time. When comparing policies, be sure to check the coverage amounts and premium costs, as well as the cost to add-on riders. The goal should be getting the appropriate amount of coverage at the best price possible to accommodate your business budget. Getting BOE insurance requires some research and evaluation of your business's financial needs. Finding the right policy can provide peace of mind that your business will continue running even in the event of an unexpected absence. Choose a company that is expected to remain financially stable for a long time by referring to evaluations given by independent rating agencies. When choosing BOE insurance, it is important to consider several factors, including coverage amount, premium costs, benefit period, elimination period, riders, and the financial strength of the insurance company. Here is a closer look at each of these factors: The coverage amount is the maximum amount that the policy will pay for covered expenses. When choosing a BOE policy, consider the amount of coverage you need to cover your business expenses in case of an unexpected event. Ensure the coverage amount is sufficient to cover your business's fixed expenses, including rent, utilities, salaries, and taxes. Premium costs are the monthly or annual payments you make to maintain your BOE policy. When choosing a policy, compare the premium costs between different insurance companies to find a competitive pricing policy. Keep in mind that lower premiums may come with lower coverage amounts, so it is essential to find a balance between coverage and affordability. The benefit period is the length of time that the policy will pay for covered expenses. When choosing a policy, consider the benefit period and make sure it is sufficient to cover your expenses in the event of an unexpected event. Keep in mind that longer benefit periods may come with higher premium costs. The elimination period is the amount of time that must pass after a covered event before the policy starts paying benefits. When choosing a policy, consider the elimination period and make sure it is appropriate for your business's needs. A shorter elimination period may come with higher premium costs. Riders are add-ons to your BOE policy that provide additional coverage. Consider adding riders that allow you to receive benefits to cover wages for someone who steps in to run the business on your behalf when you are disabled or automatically increase your benefit amount over time. When choosing a BOE policy, consider the financial strength of the insurance company. Look for insurance companies with high financial ratings and a history of paying claims promptly. This ensures that the company will be able to pay out benefits when you need them. BOE insurance is a crucial safety net for small business owners, entrepreneurs, and self-employed individuals. It provides financial support to cover essential business expenses when the owner is unable to work due to a covered illness or disability. BOE insurance can help preserve cash reserves, retain key employees, and provide peace of mind knowing that the business can continue operating even when the owner cannot work. When choosing a BOE policy, it is important to consider factors such as coverage amount, premium costs, benefit period, elimination period, riders, and the insurance company's financial strength. Finding the right BOE policy requires careful evaluation of your business's financial needs and comparing policies from different insurance companies. An insurance broker can provide expert advice and guidance in selecting the right policy for your business. They can help you navigate the complex world of insurance, comparing policies and pricing from different companies to find the one that best meets your needs and budget. What Is Business Overhead Expense (BOE) Insurance?

Who Needs a Business Overhead Expense (BOE) Insurance?

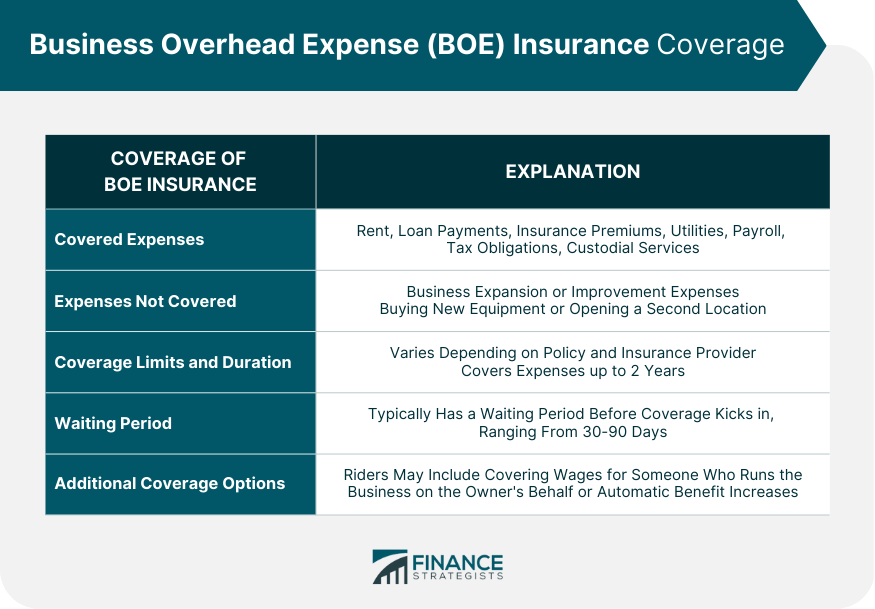

Coverage of Business Overhead Expense (BOE) Insurance

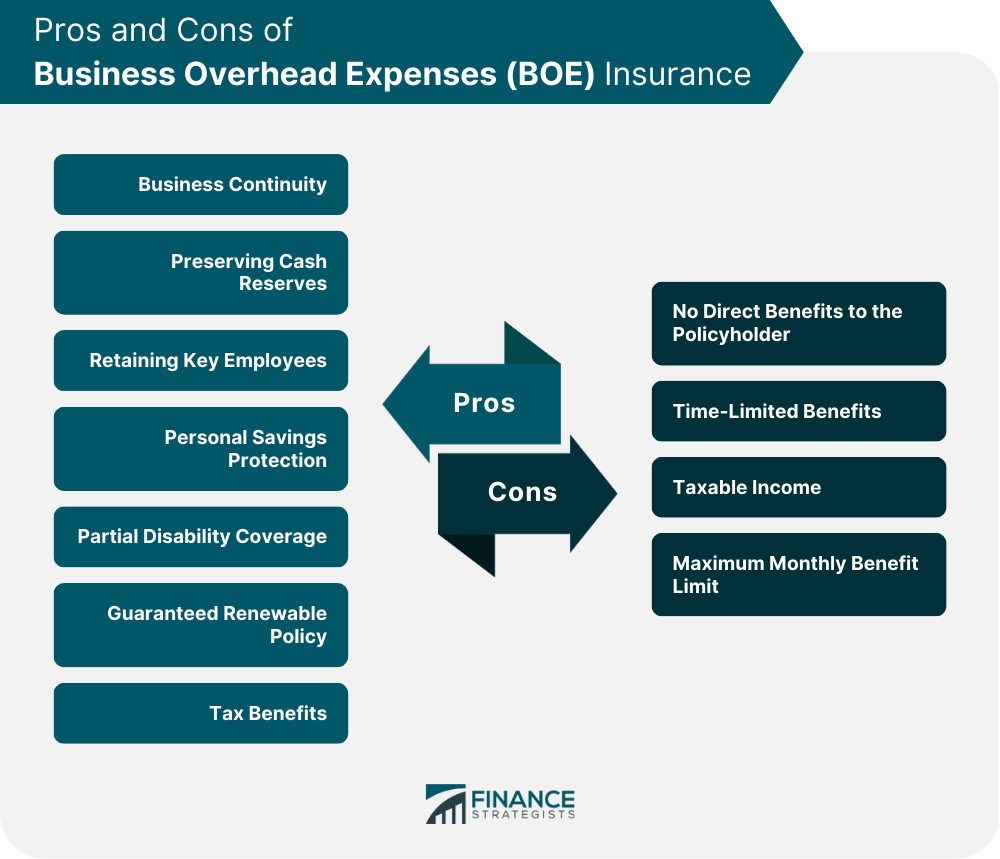

Pros of Business Overhead Expense (BOE) Insurance

Business Continuity

Preserving Cash Reserves

Retaining Key Employees

Personal Savings Protection

Partial Disability Coverage

Guaranteed Renewable Policy

Tax Benefits

Cons of BOE Insurance

No Direct Benefits to the Policyholder

Time-Limited Benefits

Taxable Income

Maximum Monthly Benefit Limit

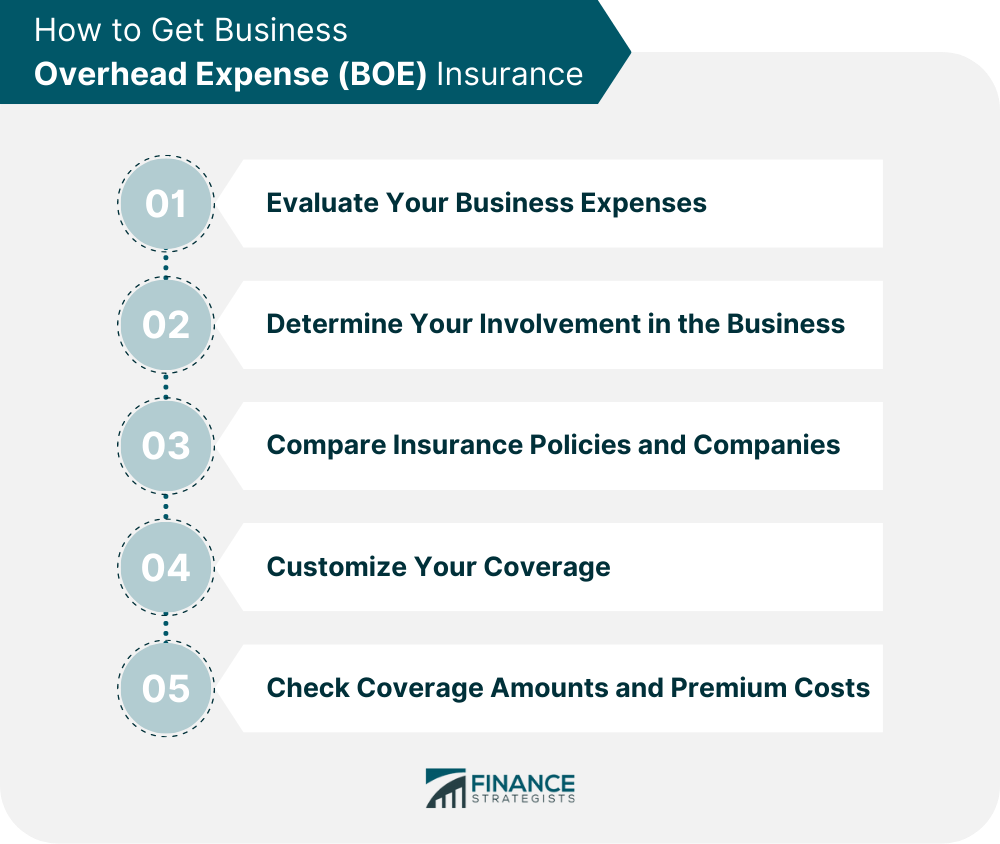

How to Get Business Overhead Expense (BOE) Insurance

Step 1: Evaluate Your Business Expenses

Step 2: Determine Your Involvement in the Business

Step 3: Compare Insurance Policies and Companies

Step 4: Customize Your Coverage

Step 5: Check Coverage Amounts and Premium Costs

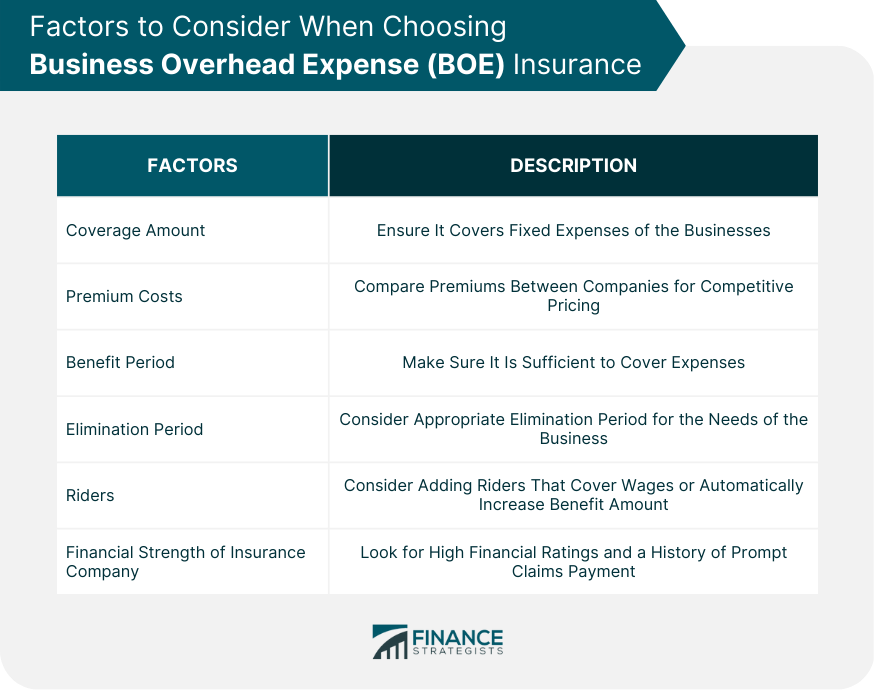

Factors to Consider When Choosing Business Overhead Expense (BOE) Insurance

Coverage Amount

Premium Costs

Benefit Period

Elimination Period

Riders

Financial Strength of the Insurance Company

Final Thoughts

Business Overhead Expense Insurance FAQs

BOE insurance is particularly important for small businesses that heavily rely on the owner's ability to work and generate income. Sole proprietors, small partnerships, and businesses without significant financial resources or staff to draw from in case of unexpected events are also good candidates for BOE insurance.

BOE insurance covers business expenses and is designed to keep the business running in the owner's absence. Personal disability insurance, on the other hand, pays benefits directly to the owner to replace lost income.

BOE insurance covers business-related expenses such as rent or lease payments, loan payments, insurance premiums, utility bills, custodial services, employee payroll, and tax obligations. It does not cover expenses related to expanding or improving the business, such as buying new equipment or opening a second location.

Businesses should consider factors such as coverage amount, premium costs, benefit period, elimination period, riders, and the financial strength of the insurance company when choosing a BOE policy.

Yes, some BOE policies may allow for customization with riders that provide additional coverage options. For example, some policies may allow for coverage of wages for someone who steps in to run the business on the owner's behalf when they are disabled or automatically increase the benefit amount over time to keep up with inflation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.