A variable annuity is a contract between an insurance company and an individual that combines insurance features and long-term investments. The funds in a variable annuity are invested in various subaccounts that may contain a mix of bonds, stocks, and money market instruments. The variable annuity's value can fluctuate with the market performance of its underlying investments. However, variable annuities do offer security in the form of a guaranteed death benefit. They also offer the potential for tax-sheltered growth. Like other annuities, variable annuities are designed to provide an income stream during retirement. Investors can fund the annuity with single payments or purchase units over time to build cash value. Payouts may start when an individual reaches retirement age. Variable annuities have the following features, which differentiate them from other investment vehicles. Within variable annuities, investments can grow without tax until the money is paid out at retirement, withdrawn, or taken as a benefit payment. Income tax is also deferred when you change investment options within a variable annuity, say transferring from stocks to mutual funds. Generally, tax deferral savings offset a variable annuity's cost if you hold it as an extended investment. The longer your money stays in a variable annuity, the more potential it has to accumulate and compound over time. Some variable annuities offer riders that provide the option to purchase a guaranteed income stream for life or a specific period. This feature, known as annuitization, is attractive to those looking for steady income after retirement. Provided you meet specific qualifications and pay an additional premium, some policies also allow you to convert your contract into a “Joint and Survivor Annuity,” a type of benefit payment that continues with your spouse in the event of death. Variable annuities typically guarantee payments for beneficiaries when you die. This is especially true if a plan holder dies before income payments from the annuity starts. Benefits can be a lump sum or a steady stream of payments over time. Depending on the company and plan chosen, death benefits could be either the current annuity balance plus gains (or minus losses, withdrawals, and other fees) or the total premiums paid, whichever is greater. These benefits can be enjoyed while policyholders are still alive. One of the most common living benefits involves an insurance rider that guarantees a certain number of income payouts, even if the underlying cash value within the variable annuity cannot support these payments. Another living benefit protects your income from the annuity against market downturns by promising a minimum amount regardless of investment performance. It is important to note that these benefits come with additional fees. Variable annuities often follow a deferred payout structure, meaning you must hold your money for specific years before payouts are released. This process involves two main stages: accumulation and annuitization. This phase involves making payments and retaining your money in your annuity. You can pay on a lump sum or installment basis. The accumulation phase can last anywhere from a few months to many years, with typical holding periods averaging 10 to 15 years. During this time, you can select and switch between different investment options, such as stocks, bonds, and money market funds. The type of financial vehicles you choose in your variable annuity's subaccounts will depend on your financial goals and risk tolerance. Your account value will rise or fall based on subaccount performance. The extended lock-up period protects your money and allows a better chance of withstanding short-term market volatility. Also, most variable annuities charge surrender fees for early withdrawals. Once the accumulation phase is complete, you can either annuitize your policy and receive periodic payments or withdraw your money in one lump sum. The payment structure depends on the type of variable annuity you have chosen. The best option depends on your financial goals and life stage. A lump sum payout might be the way to go if you need more liquidity. Alternatively, a periodic payment plan could make more sense if income security is what you are after, especially in retirement. You can customize the periodic payments to last throughout your lifetime or for a specified number of years. Nonetheless, you should expect lower payment amounts for more extended distribution periods, reflecting the risk-reward tradeoff between you and the insurance company. An extended distribution period provides more significant benefits for the policyholder while increasing the risk for the insurer. Thus, a payment reduction is a way to balance out such risks involved. Variable annuities offer tax-deferred growth. Generally, your investment gains (both principal and interest) are not taxed until you withdraw your funds. Only then are they subject to ordinary income tax rates. Taxes on any potential withdrawals made before age 59 ½ may incur an additional 10% penalty from the Internal Revenue Service (IRS) if deemed an “early withdrawal” from the variable annuity. On top of federal income tax, there may also be state tax obligations. Individual Retirement Accounts (IRAs) and 401(k) plans can also provide you with tax advantages. The Securities and Exchange Commission (SEC) suggests maximizing contributions in these retirement strategies before purchasing a variable annuity. Consult professional retirement planning or tax services for further guidance on variable annuities and their tax implications. When investing in a variable annuity, you should consider the various fees involved, which can reach around 3% to 4% of the contract value. A major cost is the mortality and expense risk charge (M&E), an annual fee that covers the cost of providing you with insurance. In addition, you typically have to pay a surrender charge if you withdraw funds before the annuitization phase. Surrender charges decrease over time but are often high in the early years of your contract. Individuals who invest in variable annuities can enjoy the following benefits: When you invest in a variable annuity, your money is held by an insurance company in separate accounts. Usually, the company guarantees access to your initial investment, even if your subaccounts perform poorly. Surrender charges can motivate you to hold your money within the variable annuity for the set period. Your funds are also protected from potential bankruptcy and are not subject to creditor claims if either you or the insurer were to become insolvent. As mentioned previously, variable annuity earnings are tax-deferred until withdrawal. You do not have to pay taxes on capital gains within the annuity as long as you keep your funds invested. With this, your investment has the potential to grow at an accelerated rate. Variable annuities also offer the option for a lifetime income stream regardless of the performance of your underlying investments. It is a feature that other retirement accounts, such as 401(k)s and IRAs, may lack. In many cases, variable annuities offer death benefits, which are paid out when the annuity holder passes away. This benefit is a feature that can protect your family and heirs, who may inherit the annuity balance should something happen to you. The beneficiary of the variable annuity will have access to the remaining funds without any taxes or penalties. In some cases, these benefits can be withdrawn in installments as well. Variable annuities also come with several drawbacks: Variable annuities have high fees that can significantly reduce returns. These costs are deducted from your account and may equal 3% to 4% of your balance annually. Generally, the fee structure of variable annuities includes mortality and expense charges, administrative costs, and investment management fees. In addition to these upfront charges, you may incur other costs, depending on the additional riders you include, such as a guaranteed lifetime withdrawal benefit. Variable annuities are quite complex investments and may be difficult to understand. It is essential to do your research before investing in one, as the options offered by each insurer can vary. You should always read the contract thoroughly and have a knowledgeable professional explain any terms you do not understand. It is also important to remember that variable annuities come with various risks, like the potential for losses due to poor performance of subaccounts. Variable annuity investors may be subject to surrender charges if they withdraw money from the account before a certain period, typically before age 59 ½. These fees can range from 1% to 10%, depending on the rates for your specific contract. The surrender charge schedule generally decreases in each year of ownership. Some contracts also allow a small amount to be withdrawn without surrender charges. Nonetheless, variable annuities are usually less liquid than other investment products. The most significant difference between variable annuities and fixed annuities is the provision for guaranteed rate of return in the latter. Unlike fixed annuities, the value of the variable annuity and retirement payments will be based on the performance of the subaccounts chosen and their returns. There is potential for both losses and gains with a variable annuity. You can mitigate this risk by availing of an insurance rider which guarantees a minimum income regardless of market performance. However, this comes with additional fees, which can outweigh its benefits. When deciding whether to invest in a variable annuity, you should first consider your financial goals, risk tolerance, and investment horizon. Variable annuities come with several attractive features, such as tax-deferred growth. However, there are also potential risks involved. Consider how long you are comfortable investing since these insurance products come with surrender charges. You should also be aware of any fees associated with the purchase and management of the annuity and compounded fees that accumulate over time. Generally, variable annuities should be considered secondary retirement savings options compared to IRAs and 401(k) plans. If you have already maxed out your contribution limits to your regular retirement plans, then investing in a variable annuity may suit you. A variable annuity is an insurance product that allows you to invest in various subaccounts containing money market funds, stocks, or bonds. Funds are invested for potential growth during the accumulation phase and distributed as income during the annuitization phase. It offers tax-deferred growth, fund protection, steady income, and insurance features like death and living benefits. However, variable annuities can be complex investments, with high fees, surrender charges for early withdrawal, and no guarantee of returns. It is best to consult a qualified financial advisor to compare variable annuities with other investment options before availing of one.What Are Variable Annuities?

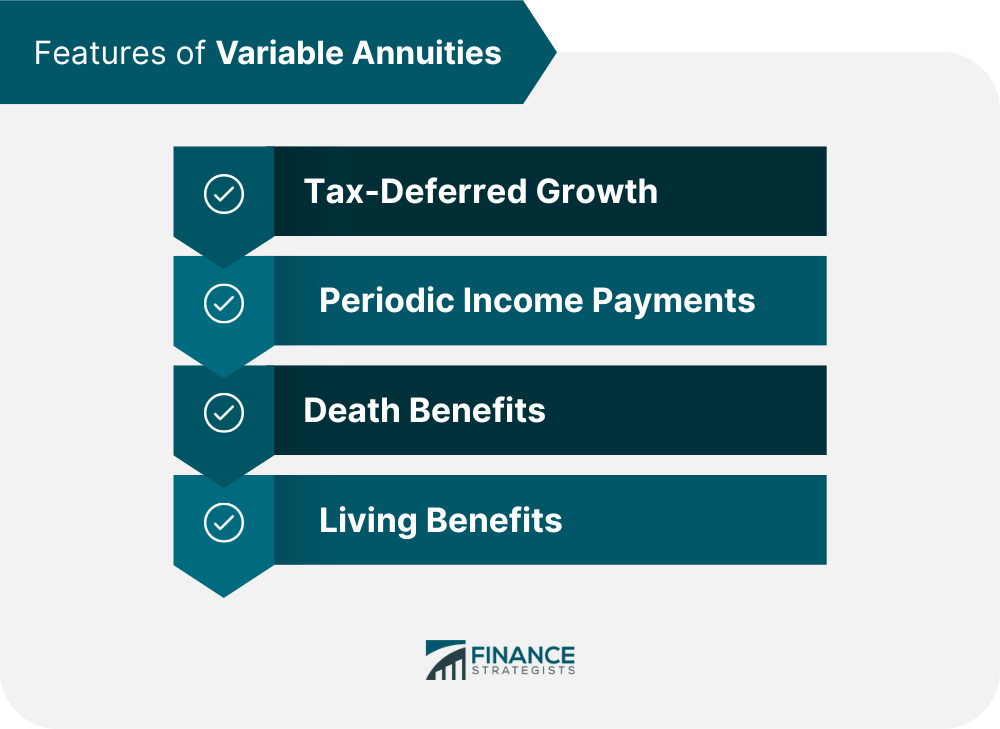

Features of Variable Annuities

Tax-Deferred Growth

Periodic Income Payments

Death Benefits

Living Benefits

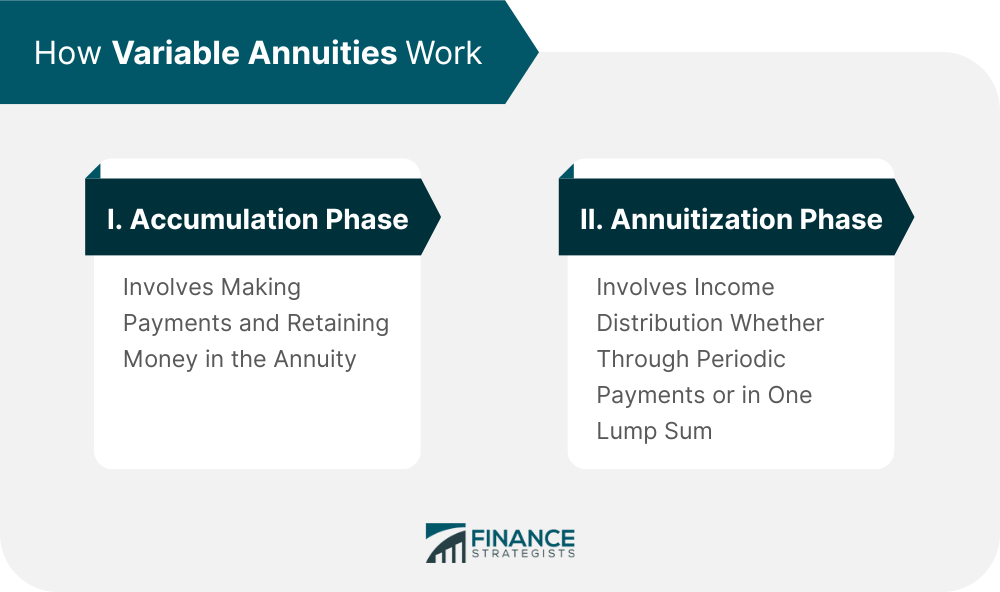

How Variable Annuities Work

Accumulation Phase

Annuitization Phase

Tax Rules for Variable Annuities

Variable Annuities Fees and Expenses

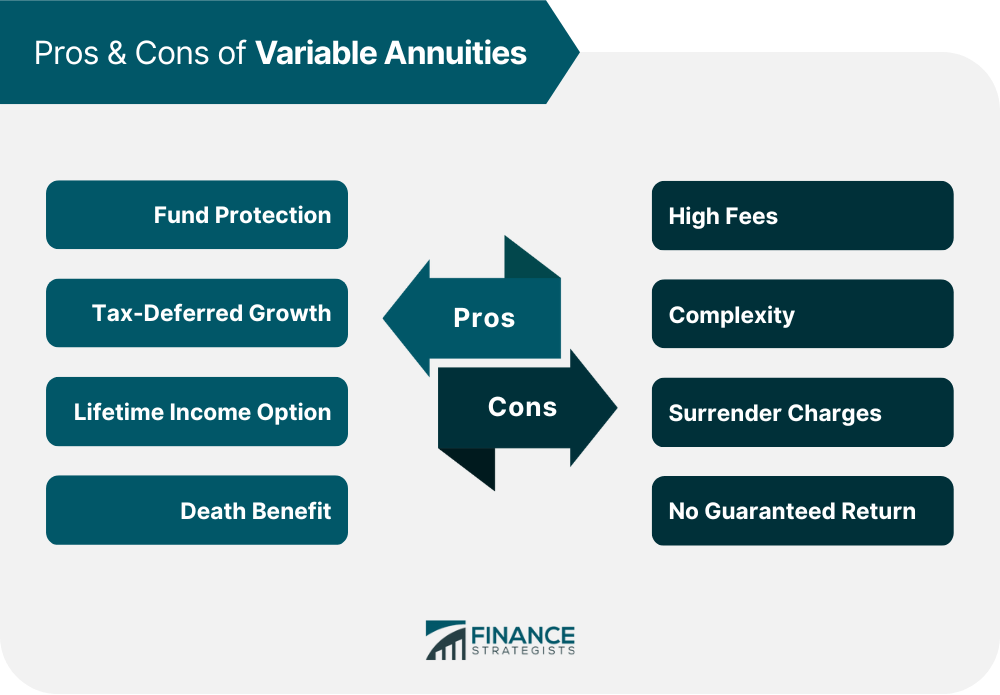

Investment management fees are also charged depending on the assets in your subaccounts and how actively they are managed. Aside from these costs, other fees include administrative and service charges for transfers, rollovers, and moving money between subaccounts.Advantages of Variable Annuities

Fund Protection

Tax-Deferred Growth

Lifetime Income Option

Death Benefits

Disadvantages of Variable Annuities

High Fees

Complexity

Surrender Charges

No Guaranteed Return

Is a Variable Annuity Right for You?

Final Thoughts

Variable Annuities FAQs

A variable annuity is a type of investment contract that combines features of insurance and investments. It provides you with tax-deferred growth potential, a guaranteed death benefit, and access to multiple investments within your portfolio.

It depends. While it comes with growth potential, market volatility can also negatively affect it. Consider your financial goals and risk profile. Consult a financial advisor for further guidance.

Some advantages include fund protection, lifetime income, tax deferral, and death benefits. Other features may also be added depending on the insurance company.

It depends on your specific contract. You can choose to have payouts throughout your life. You can also opt for a lump sum payment after the surrender period has expired.

The risks of variable annuities include high costs, complexity, no guaranteed returns, and lack of liquidity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.