An annuity is an insurance product that pays you a regular income stream. An inherited annuity comes into possession as a result of the death of the annuity owner or annuitant. The beneficiary will then become entitled to the payouts provided by the annuity contract. Individuals who purchase an annuity seek a secure and reliable income during retirement or at a specified period. The buyer controls the contract and is often the annuitant but may also designate it to someone else. Death benefits are not automatic with annuities. A buyer works with the insurance company to specify beneficiaries and payout options in case of the owner or the annuitant's death. It is important to note that beneficiaries receive payments from an inherited annuity only after the original annuitant has died. Also, an annuitant and a beneficiary cannot be the same person. Nonetheless, you can inherit an annuity from an owner or annuitant. A death benefit provides inherited annuity payouts to beneficiaries if specified in the original annuity contract. An owner or the annuitant can select one of several death benefit options, such as: This benefit involves the insurance company paying the annuity contract value, minus withdrawals and fees, to the beneficiaries. It entails no additional costs to the annuity buyer but typically has the least value compared to other death benefit options. The insurance company determines the annuity contract amount upon receipt of proof of the annuitant's death or when beneficiaries file a claim. The amount of inherited annuity payments can decrease depending on the annuity type. For example, in the case of variable annuities, if a claim was made at a time when underlying stocks are underperforming, it will negatively affect the annuity contract value and mean lesser payouts to beneficiaries. It can also decrease based on fees and prior withdrawals. The standard death benefit ensures that beneficiaries receive payouts after an annuitant's death at no additional cost but may be lower than other options. This option involves receiving the greater of a contract's market value or the full premium minus withdrawals and fees. It can include all payments made toward an annuity, including extra contributions from bonuses or riders added to the contract. The return of premium option provides more money than the standard death benefit because of the added possibility of full reimbursement of all annuity contributions. As such, this benefit usually means extra costs to the buyer. Some insurance companies may charge an annual fee of 0.05% of the annuity contract for this benefit. Insurance companies calculate an annuity contract's value every year. With a stepped-up death benefit rider, the beneficiary payouts will be based on the highest value recorded instead of the current market value at the time of the annuitant's death, minus fees, and withdrawals. This rider secures the best payouts to beneficiaries compared to the other death benefit options. It is also the most expensive, costing as much as 0.2% of the contract's annual value in additional fees. Some variable annuities offer a variation of the stepped-up death benefit rider. Instead of the yearly valuation, the insurance company determines the beneficiary payouts based on the highest recorded monthly value. This option is advantageous because it protects from market fluctuations that can decrease death benefit amounts. It ensures the beneficiaries receive the highest possible amount based on more frequent calculations. Nonetheless, additional riders mean extra costs to the annuity buyer. When you inherit an annuity, you may choose how you want to receive the death benefits. Options include the following: With a lump-sum distribution, you receive the full death benefit as one single payment. This option may appeal if you need immediate access to funds or want to avoid future payments. It is a straightforward payout option. Remember that you would have to pay taxes in the year you receive the lump-sum death benefit. This option allows you to stretch the annuity payments over your life expectancy. It can be attractive as it allows you to spread out the tax liability of the payment and potentially benefit from tax deferral on the remaining funds. Depending on the insurance company and contract, some rules are associated with this payout option, such as required minimum distribution (RMD) limits. It is crucial to check the specifics of this provision before selecting it. This rule allows you to receive the death benefit in increments over five years or one lump sum in the last year. Each payment depends on the contract balance at the time of the annuitant's death and is not subject to taxes until it is paid out. This option can help you manage your tax liability and give you more control over when you receive payments and how much money you get each year. Note that any remaining funds are subject to estate tax if the entire balance is not withdrawn within five years. If the annuitant is married at the time of death, a surviving spouse may opt for spousal distribution payments. This provides an alternative to taking over ownership of the annuity contract. The surviving spouse can receive a lump-sum payment or choose to have it paid in regular installments over time. Spousal distributions are not subject to any tax liability until withdrawn and are generally not included as part of their estate when calculating taxes upon death. The final option is to annuitize the contract, which means it will pay a fixed sum for a specified period. This allows you to receive regular payments on a monthly or quarterly basis and can provide an income stream in retirement. This option also offers tax advantages, allowing you to spread your tax liability over time. Note that there are generally surrender charges associated with this option, so make sure you understand all the details before making any decisions. Inherited annuities are subject to tax depending on whether the original annuity contract is qualified or non-qualified. A qualified annuity is bought using pre-tax contributions, usually through a 401(k) plan or individual retirement account (IRA). The annuitant pays taxes in the year they receive payouts. Withdrawals before age 59 ½ are also charged a 10% penalty. Qualified annuities are also subject to RMD rules. Non-qualified annuities are purchased with after-tax contributions and may seem like any Roth account, but there are some distinctions. Growth and earnings of the initial post-tax investment are taxable. It means an annuitant pays income taxes on any distributions that include such earnings from the contract. Nonetheless, non-qualified annuities are not subject to early withdrawal penalties and RMD limitations. Inherited annuities are not tax-exempt. However, the following techniques can be used for tax deferral purposes: If you are a surviving spouse, you can choose the spousal distribution payment option instead of taking over the annuity. You can continue the tax deferral on the inherited annuity until you withdraw payments. You may withdraw a lump sum later or extend the payment period over time to lessen the tax burden. Likewise, if you inherit an annuity as a non-spouse, you can reduce your tax liability by electing non qualified stretch payments based on your life expectancy or periodic payments. You can substitute your inherited annuity for another, provided you select a similar contract. An inherited qualified annuity can be exchanged for another, and a nonqualified annuity for a new nonqualified annuity. The 1035 exchange can give you more favorable features and terms, including tax benefits. Given specific limitations, you can also roll over an inherited annuity to your IRA. This option is available if the deceased person had an IRA of their own and included it in the inheritance, along with the annuity passed on to you. After the rollover, you can defer taxes based on the rules governing inherited IRAs. An inherited annuity is a financial product that allows an individual to receive income from the assets of another person who has passed away. Annuities are bequeathed if the original contract came with a death benefit provision. Inherited annuity death benefits come in various options, including the standard death benefit, return of premiums, stepped-up rider, and others. Payout amounts are determined based on the provision stipulated. You may also choose how the annuity is distributed to you with differing tax implications. Usually, when you inherit an annuity, you become responsible for all associated tax liabilities. However, you can defer taxes through spousal distribution, IRA rollover, and 1035 exchange. Consult a qualified financial advisor to learn more about inherited annuities. Some other professionals can provide further guidance on inherited annuities and general retirement planning needs.What Is an Inherited Annuity?

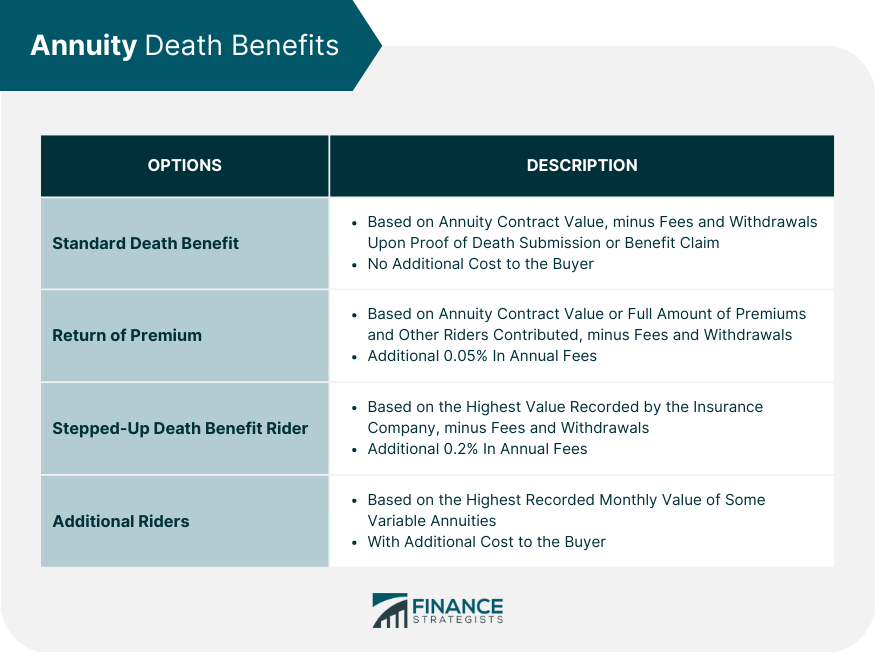

Annuity Death Benefits Options

Standard Death Benefit

Return of Premium

Stepped-Up Death Benefit Rider

Additional Riders

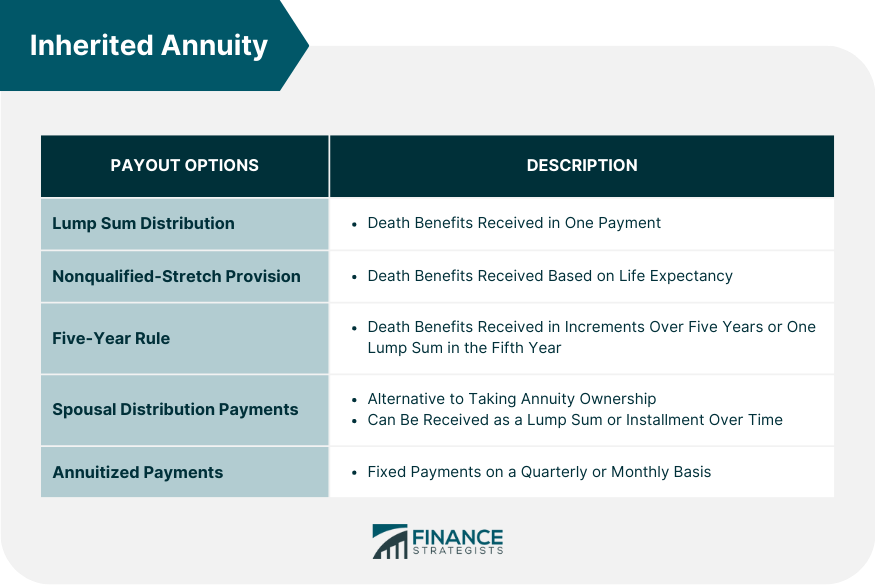

Inherited Annuity Payout Options

Lump-Sum Distribution

Nonqualified-Stretch Provision

Five-Year Rule

Spousal Distribution Payments

Annuitized Payments

Tax Implications on Inherited Qualified vs Inherited Non-Qualified Annuities

Inherited Qualified Annuity

Inherited Non-Qualified Annuity

How to Avoid Paying Taxes on an Inherited Annuity

Surviving Spouse

1035 Exchange

Rollover Into an IRA

Final Thoughts

Inherited Annuity FAQs

An annuity is a financial product that provides payments to the owner over a set period of time or for the lifetime of the owner. Annuities can be either immediate or deferred.

An inherited annuity is an annuity that is transferred to a beneficiary after the owner's death.

The three distribution options for an inherited annuity are: taking payments over your lifetime, taking a lump-sum of the cash value, or continuing to receive payments as before.

The payout may depend on when the annuity was established. Inherited annuities can be immediate or deferred, which means that they usually start immediately or after a set amount of time from when they were established.

An inherited annuity is taxed as ordinary income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.