An income annuity is a financial product designed to provide a steady stream of income during retirement. Purchased through an insurance company or financial institution, income annuities offer guaranteed payments over a specific period or for life. They can be an essential component of a retirement plan, helping to ensure financial security and stability during one's retirement years. There are several types of income annuities, each with unique features and benefits. The three primary types include immediate annuities, deferred income annuities, and variable annuities with income riders. Understanding the differences between these types can help individuals select the most suitable annuity product for their financial goals and needs. Immediate annuities provide a guaranteed income stream starting shortly after the initial investment. They are ideal for individuals who require immediate access to a steady flow of income, typically during retirement. Payments from an immediate annuity are based on factors such as the initial investment amount, the annuitant's age, and prevailing interest rates. Deferred income annuities begin paying out at a future date specified by the annuitant. This allows for tax-deferred growth of the invested funds until the payout phase begins. Deferred income annuities can be a valuable option for individuals who want to secure a guaranteed income stream in the future but do not require immediate income. Variable annuities with income riders offer the potential for investment growth based on market performance while still providing a guaranteed income stream. The income rider is an optional feature that can be added to a variable annuity for an additional fee. It guarantees a minimum level of income, regardless of market fluctuations, thus providing a measure of security for the annuitant. One of the main benefits of an income annuity is the guaranteed income it provides. Annuitants can rely on a consistent stream of payments throughout their retirement, ensuring they have the financial resources needed to maintain their desired lifestyle. This guaranteed income can also help alleviate financial stress and provide peace of mind for retirees. Income annuities, particularly deferred income annuities, offer tax-deferred growth on the invested funds until the payout phase begins. This allows the investment to grow over time without incurring taxes on the gains, potentially leading to higher overall returns. When the payout phase begins, taxes are assessed only on the income received, which can help minimize tax liabilities during retirement. Some income annuities offer the option to include inflation protection, which helps maintain the purchasing power of the income stream over time. This feature adjusts the annuity payments to account for rising costs of living, ensuring that the income remains sufficient to cover expenses in retirement. Inflation protection can be an essential consideration, especially for individuals with long life expectancies. Income annuities offer various payout options to accommodate the needs and preferences of the annuitant. These options can provide income for a single life, joint lives, or a specified period, allowing for customization to suit each individual's financial goals and objectives. A single life annuity provides income for the lifetime of the annuitant, with payments ceasing upon their death. This option is suitable for individuals without dependents or those whose spouse or partner has their retirement income sources. A joint life annuity provides income for the lifetimes of two annuitants, typically spouses or partners. Payments continue until the death of the last surviving annuitant. This option is beneficial for couples who want to ensure that both parties have a guaranteed income throughout their retirement years. A period certain annuity guarantees income for a specified number of years, regardless of the annuitant's lifespan. If the annuitant passes away before the end of the specified period, the remaining payments are made to a designated beneficiary. Income annuities typically have limited liquidity, as they are designed to provide long-term income rather than immediate access to funds. Surrender charges may apply if the annuitant decides to withdraw a portion or all of their investment before a specified period. It is essential to understand the surrender charges and any other withdrawal restrictions associated with an annuity before purchasing. Inflation risk refers to the possibility that the purchasing power of an annuity's income stream will decrease over time due to rising costs of living. If an annuity does not offer inflation protection, the income received may not be sufficient to cover expenses in later years of retirement. This risk can be mitigated by selecting an annuity with inflation protection or incorporating other investments with growth potential in the retirement plan. Longevity risk is the possibility that an annuitant will outlive their retirement savings. Income annuities can help manage this risk by providing a guaranteed income stream for life. However, it is essential to balance annuity investments with other financial assets to ensure adequate funds are available in case of unexpected expenses or increased longevity. The credit risk of the annuity provider refers to the possibility that the company may not be able to meet its financial obligations to the annuitant. This risk can be mitigated by choosing an annuity provider with strong financial ratings and a solid reputation in the industry. The age and gender of the annuitant play a significant role in determining the amount of income provided by an annuity. Older individuals typically receive higher payments because they have a shorter life expectancy, while women generally receive lower payments due to their longer life expectancies. These factors are taken into account when calculating annuity payouts to ensure the financial viability of the product for the insurance company. Prevailing interest rates can impact the amount of income provided by an annuity. Higher interest rates generally result in higher annuity payouts, while lower interest rates lead to lower payouts. It is essential to consider the interest rate environment when purchasing an annuity, as it can significantly affect the income stream received during retirement. The type of annuity and any additional features or riders selected can also influence the payout amount. For example, adding inflation protection or a guaranteed minimum income benefit to a variable annuity may result in lower initial payouts. However, these features can provide long-term benefits, such as increased income over time or protection from market fluctuations. The financial strength and stability of the insurance company providing the annuity can impact the safety and reliability of the income stream. It is crucial to evaluate the financial ratings of potential annuity providers, as this can influence the company's ability to meet its long-term obligations to annuitants. There are two primary types of annuity providers: insurance companies and financial institutions. Both types of providers offer a range of annuity products to suit the needs of individual investors. Insurance companies are the most common providers of income annuities, as they specialize in managing long-term financial risks. They offer a variety of annuity products and often have extensive experience in managing and distributing annuities. Financial institutions, such as banks and brokerage firms, also offer annuity products. These providers may have partnerships with insurance companies to distribute their annuity products or may have their annuity offerings. When selecting an annuity provider, it is essential to consider several factors, including financial ratings, customer service and reputation, and fees and expenses associated with the annuity product. Financial ratings agencies, such as A.M. Best, Standard & Poor's, and Moody's, assess the financial strength and stability of insurance companies and financial institutions. These ratings can provide valuable insight into the provider's ability to meet its long-term obligations to annuitants. The quality of customer service and the provider's reputation within the industry should also be considered when selecting an annuity provider. Researching reviews and testimonials from current and former customers can provide insight into the provider's commitment to customer satisfaction and the overall experience of working with the company. It is crucial to understand and compare the fees and expenses associated with various annuity products and providers. These costs can include management fees, surrender charges, and rider fees, which can impact the overall return on investment and the amount of income received during retirement. Incorporating income annuities into a retirement plan should be done in conjunction with other investments to ensure a well-diversified portfolio. Annuities can provide a stable income base, while other investments, such as stocks and bonds, can offer growth potential and additional income sources to help manage inflation and longevity risks. An income annuity can be an integral part of a retirement income strategy, providing a guaranteed income stream to cover essential expenses. By combining annuity income with other sources, such as Social Security, pensions, and investment income, retirees can create a comprehensive plan to ensure financial security throughout their retirement years. When planning for retirement, it is essential to consider the role of Social Security and pension benefits in addition to annuity income. These sources of guaranteed income can be integrated with annuity payouts to create a stable and secure income foundation for retirement. Proper coordination of these income streams can help optimize tax efficiency and ensure adequate funds are available to cover expenses throughout retirement. Income annuities can play a crucial role in financial planning by providing a guaranteed income stream during retirement. By understanding the different types of income annuities, evaluating their features and benefits, and considering the various risks and factors that can impact annuity payouts, individuals can make informed decisions about incorporating annuities into their retirement plans. Working with an insurance broker and carefully balancing annuity investments with other financial assets can help create a well-diversified portfolio that meets the needs and goals of each retiree. In conclusion, income annuities can be an essential component of a comprehensive financial plan, providing financial security and peace of mind throughout one's retirement years.Definition of Income Annuities

Types of Income Annuities

Immediate Annuities

Deferred Income Annuities

Variable Annuities With Income Riders

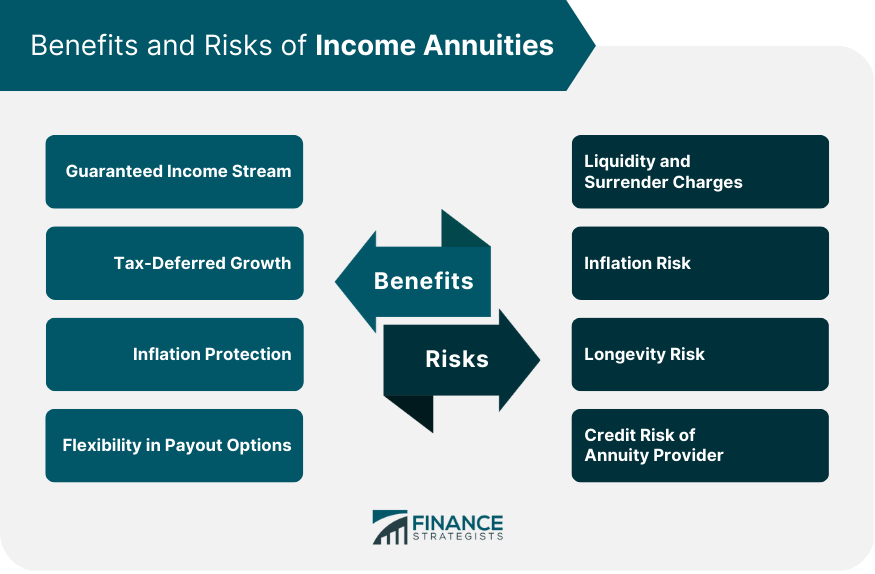

Benefits of Income Annuities

Guaranteed Income Stream

Tax-Deferred Growth

Inflation Protection

Flexibility in Payout Options

Risks of Income Annuities

Liquidity and Surrender Charges

Inflation Risk

Longevity Risk

Credit Risk of Annuity Provider

Factors Affecting Income Annuity Payouts

Age and Gender

Interest Rates

Annuity Type and Features

Insurance Company Financial Strength

Types of Annuity Providers

Insurance Companies

Financial Institutions

Evaluating Annuity Providers

Financial Ratings

Customer Service and Reputation

Fees and Expenses

Income Annuities in Retirement Planning

Balancing Income Annuities With Other Investments

Integrating Income Annuities into Retirement Income Strategy

Social Security and Pension Considerations

Bottom Line

Income Annuities FAQs

Income annuities are financial products provided by insurance companies or financial institutions, designed to provide a steady stream of income during retirement. Investors purchase the annuity, and in return, they receive regular payments, either for a specified period or for the rest of their lives, depending on the payout option chosen.

There are two main types of income annuities: immediate income annuities and deferred income annuities. Immediate income annuities start providing payments shortly after the purchase, while deferred income annuities delay the payout start date, allowing the investment to grow before providing income during retirement.

The tax treatment of income annuities depends on the type of annuity and the investor's individual tax situation. For non-qualified annuities, a portion of each payment is considered a return of principal and is tax-free, while the remaining portion is treated as taxable income. Qualified annuities, such as those funded with pre-tax dollars, have their entire payment treated as taxable income.

Yes, income annuities can be an integral part of a retirement plan, providing a guaranteed income stream to cover essential expenses. By combining annuity income with other sources, such as Social Security, pensions, and investment income, retirees can create a comprehensive plan to ensure financial security throughout their retirement years.

When selecting an income annuity provider, it is essential to consider several factors, including the provider's financial ratings, customer service and reputation, and fees and expenses associated with the annuity product. Evaluating these factors can help ensure the safety and reliability of the income stream provided by the annuity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.