A charitable gift annuity (CGA) is a contract between a donor and a charity in which the donor makes a gift of cash or assets to the charity. In return, the charity agrees to pay the donor a fixed income stream for life. The income stream amount is based on several factors, including the donor's age at the time of the gift, the size of the gift, and the payout rate established by the charity. The purpose of a CGA is to provide the donor with an income stream while also supporting a charitable organization. CGAs offer several benefits to donors, including tax benefits, income security, and the ability to support a charity that is important to them. Immediate and deferred CGAs differ in terms of when the income stream starts. Immediate CGAs provide an income stream immediately after the gift is made, while deferred CGAs provide an income stream that starts at a future date. Each type of CGA has its advantages and disadvantages, which we will explore in the following sections. Immediate Charitable Gift Annuities are a popular charitable giving strategy that provides donors with a reliable source of income immediately after making the gift. Donors receive a fixed income stream for life, and the charity uses the gift to further its mission. Immediate CGAs offer immediate income, tax benefits, and the ability to support a chosen charity. However, they also have some potential drawbacks, such as the irrevocable nature of the gift and fixed income rates. Donors should carefully consider their financial situation and charitable goals before deciding if an immediate CGA is right for them. Immediate CGAs offer several advantages to donors, including: Immediate Income Stream: Donors receive an income stream immediately after making the gift, providing them with a reliable source of income. Tax Benefits: Donors receive a charitable income tax deduction for the year in which they make the gift. Additionally, a portion of the income stream may be tax-free. Support of a Chosen Charity: Donors are able to support a charity that is important to them while also receiving an income stream. Immediate CGAs also have some disadvantages that donors should consider, including: Irrevocable Nature of the Gift: Once the gift is made, it cannot be revoked. Donors must be certain they are comfortable with the fixed income stream and will not need the funds in the future. Fixed Income Rate: The income stream is fixed, which means that it does not increase with inflation. This could potentially lead to the income stream losing its purchasing power over time. Potential Lower Payout Compared to Deferred Annuities: The payout rate for immediate CGAs is generally lower than for deferred CGAs since the charity begins making payments immediately. Deferred Charitable Gift Annuities provide donors with a reliable source of income that starts at a future date, typically at the donor's retirement age. Donors receive a fixed income stream for life, and the charity uses the gift to further its mission. Deferred CGAs offer higher income streams in the future, flexible income start dates, and tax benefits. However, they also have potential drawbacks, such as the delayed income stream, the irrevocable nature of the gift, and fixed income rates. Deferred CGAs offer several advantages to donors, including: Higher Income Stream in the Future: The income stream is generally higher for deferred CGAs since the charity has more time to invest the gift before making payments. Flexible Income Start Date: Donors can choose the date on which the income stream begins, providing them with flexibility in their retirement planning. Tax Benefits: Donors receive a charitable income tax deduction for the year in which they make the gift, and the income stream is tax-deferred until it begins. Support of a Chosen Charity: Donors are able to support a charity that is important to them while also receiving an income stream. Deferred CGAs also have some disadvantages that donors should consider, including: Delayed Income Stream: Donors will not receive an income stream immediately after making the gift. The income stream will start at a future date, which could potentially leave the donor without additional income in the interim. Irrevocable Nature of the Gift: Once the gift is made, it cannot be revoked. Donors must be certain they are comfortable with the fixed income stream and will not need the funds in the future. Fixed Income Rate: The income stream is fixed, which means that it does not increase with inflation. This could potentially lead to the income stream losing its purchasing power over time. The key difference between immediate and deferred CGAs is the start date of the income stream. Immediate CGAs provide an income stream immediately after the gift is made, while deferred CGAs provide an income stream that starts at a future date. Additionally, the payout rate for deferred CGAs is generally higher than for immediate CGAs. Several factors should be considered when choosing between immediate and deferred CGAs, including: The age of the donor is an important factor to consider when choosing between immediate and deferred CGAs. Younger donors may benefit more from a deferred CGA since they have more time for the income stream to increase before it begins. Deferred CGAs can provide a higher income stream in the future, which can be beneficial for donors who are still in their earning years. Donors should consider their current and future financial needs when choosing between immediate and deferred CGAs. Immediate CGAs may be more suitable for donors who need additional income immediately, while deferred CGAs may be more suitable for donors who do not need additional income until a future date. Donors should consider their income tax situation when choosing between immediate and deferred CGAs. Immediate CGAs may provide a larger charitable income tax deduction for the year in which the gift is made, while deferred CGAs provide tax-deferred income until it begins. Donors should consider their retirement planning when choosing between immediate and deferred CGAs. Deferred CGAs may be more suitable for donors who want to supplement their retirement income at a future date. Donors should consider their charitable goals and priorities when choosing between immediate and deferred CGAs. Immediate CGAs may be more suitable for donors who want to support a charity immediately. In contrast, deferred CGAs may be more suitable for donors who want to provide long-term support for a charity. John is 65 years old and wants to provide support to his favorite charity while also receiving an income stream. John decides to give the charity a $100,000 gift in exchange for an immediate CGA. The charity offers a payout rate of 4%, which means that John will receive an income stream of $4,000 per year for life. John also receives a charitable income tax deduction of $35,030 for the year in which he made the gift. Sara is 45 years old and wants to support her favorite charity while also providing for her retirement. Sara decides to make a $100,000 gift to the charity in exchange for a deferred CGA that will begin making payments when she turns 65 years old. The charity offers a payout rate of 6%, which means that Sara will receive an income stream of $6,000 per year for life starting when she turns 65 years old. Sara also receives a charitable income tax deduction of $23,251 for the year in which she made the gift. Immediate and deferred CGAs can have different outcomes depending on the donor's age, the size of the gift, and the payout rate established by the charity. In general, deferred CGAs offer a higher income stream than immediate CGAs since the charity has more time to invest the gift before making payments. However, immediate CGAs provide donors with an income stream immediately after the gift is made, which can be beneficial for donors who need additional income immediately. For example, consider a donor who is 65 years old and wants to provide support for their favorite charity while also receiving an income stream. The donor decides to make a $100,000 gift to the charity and is considering either an immediate CGA or a deferred CGA that will begin making payments when the donor turns 70 years old. If the charity offers a payout rate of 4% for immediate CGAs and a payout rate of 6% for deferred CGAs, the income stream for each option would be as follows: Immediate CGA: $4,000 per year for life Deferred CGA: $6,000 per year for life starting when the donor turns 70 years old In this scenario, the deferred CGA would provide a higher income stream than the immediate CGA. However, the immediate CGA would provide the donor with an income stream immediately after the gift is made, which could be beneficial for donors who need additional income immediately. Charitable gift annuities provide donors with a way to support their favorite charities while also providing them with a guaranteed income stream for life. Immediate and deferred CGAs each have their advantages and disadvantages, and donors should carefully consider their financial situation, retirement planning, and charitable goals when choosing between them. Additionally, donors should consult with their financial and tax advisors to determine the best charitable giving strategy for their unique situation. Charitable gift annuities are a powerful tool for philanthropy and financial planning. Donors should carefully consider their financial situation, retirement planning, and charitable goals when choosing between immediate and deferred CGAs. Additionally, it is important to consult with financial and tax advisors to determine the best charitable giving strategy for their unique situation. If you are interested in exploring charitable gift annuities, seeking guidance from an insurance broker can be helpful. An insurance broker can provide information and assistance in selecting the best CGA product for your situation. By working with an insurance broker, you can ensure that you are making an informed decision that aligns with your philanthropic and financial goals.Immediate vs Deferred Charitable Gift Annuities: Overview

What Are Immediate Charitable Gift Annuities?

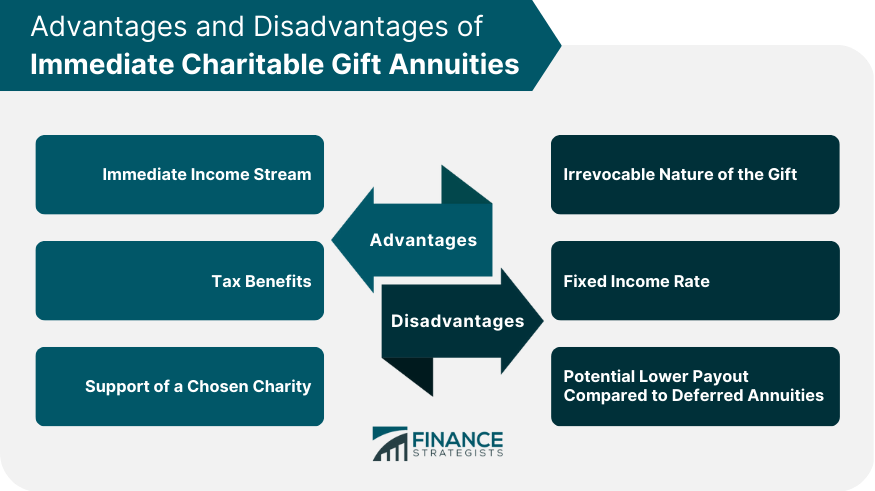

Advantages of Immediate Charitable Gift Annuities

Disadvantages of Immediate Charitable Gift Annuities

What Are Deferred Charitable Gift Annuities?

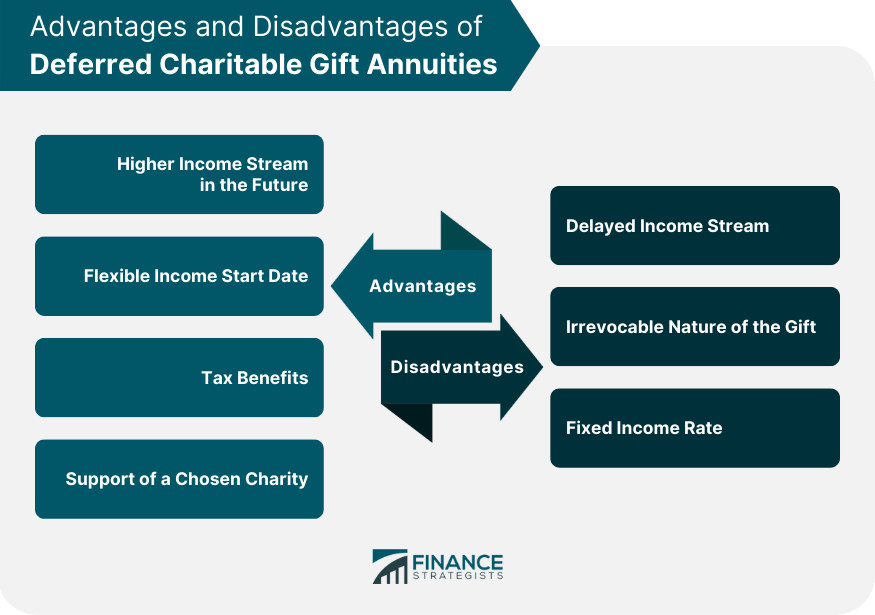

Advantages of Deferred Charitable Gift Annuities

Disadvantages of Deferred Charitable Gift Annuities

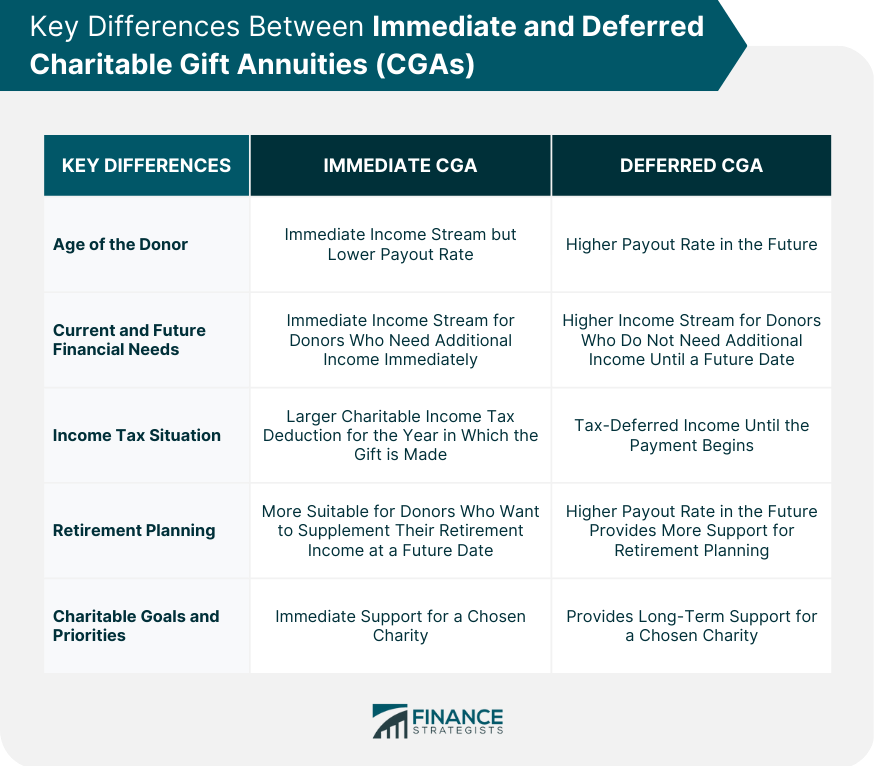

Key Differences Between Immediate and Deferred Charitable Gift Annuities

Age of the Donor

Current and Future Financial Needs

Income Tax Situation

Retirement Planning

Charitable Goals and Priorities

Examples of Immediate Charitable Gift Annuities and Deferred Charitable Gift Annuities

Immediate Charitable Gift Annuities

Deferred Charitable Gift Annuities

Comparison of Outcomes in Different Scenarios

Final Thoughts

Immediate vs Deferred Charitable Gift Annuities FAQs

An Immediate Charitable Gift Annuity is a contract between a donor and a charity that provides a guaranteed fixed income stream to the donor for life, starting immediately after the gift is made.

A Deferred Charitable Gift Annuity is a contract between a donor and a charity that provides a guaranteed fixed income stream to the donor for life starting at a future date, typically at the donor's retirement age.

Immediate Charitable Gift Annuities offer immediate income, tax benefits, and the ability to support a chosen charity. Donors receive an income stream immediately after the gift is made, which provides them with a reliable source of income.

Deferred Charitable Gift Annuities offer a higher income stream in the future, flexible income start date, tax benefits, and the ability to support a chosen charity. The income stream is generally higher for deferred CGAs since the charity has more time to invest the gift before making payments.

Several factors should be considered when choosing between Immediate and Deferred Charitable Gift Annuities, including the age of the donor, current and future financial needs, income tax situation, retirement planning, and charitable goals and priorities. Donors should consult with their financial and tax advisors to determine the best charitable giving strategy for their unique situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.