An immediate annuity is a financial product offered by insurance companies that provides a steady stream of income for the annuitant, typically for retirement purposes. The annuitant purchases the annuity with a lump sum, and the insurance company guarantees regular payments for a specified period or for the rest of the annuitant's life. The main purpose of an immediate annuity is to provide a reliable source of income during retirement. It helps individuals manage their finances by converting their savings into guaranteed, predictable payments. Immediate annuities can also act as a hedge against longevity risk, ensuring the annuitant doesn't outlive their retirement savings. Fixed immediate annuities provide a set amount of income that remains constant throughout the annuity's term. These payments are guaranteed by the insurance company and are unaffected by market fluctuations, providing the annuitant with a steady, predictable income. Variable immediate annuities offer a stream of income that can fluctuate based on the performance of underlying investments. The annuitant's payments may increase or decrease depending on the returns of the selected investment portfolio, providing the potential for higher returns but also exposing the annuitant to investment risk. Inflation-adjusted immediate annuities are designed to help protect the annuitant's purchasing power against inflation. These annuities offer payments that increase over time, typically at a fixed percentage or tied to a consumer price index, helping the annuitant maintain their standard of living during retirement. Immediate annuities offer several benefits that can make them an attractive option for individuals seeking financial security during retirement. These benefits include: Immediate annuities provide a steady stream of income either for the lifetime of the annuitant or a predetermined period. This guaranteed income can help retirees maintain their lifestyle and cover essential living expenses without worrying about running out of money. Longevity risk refers to the possibility of outliving one's retirement savings. Immediate annuities address this concern by providing income for as long as the annuitant lives, ensuring they won't run out of money even if they live longer than expected. Depending on the annuity structure and the annuitant's individual tax situation, immediate annuities may offer tax-deferred growth. This means that the earnings within the annuity are not taxed until they are withdrawn as income, allowing the investment to grow more efficiently and potentially leading to higher overall returns. Despite their benefits, immediate annuities also come with certain risks that prospective buyers should be aware of: Once an immediate annuity begins, the annuitant typically cannot withdraw their initial investment. This means that if the annuitant needs access to their principal for emergencies or other expenses, they may not have that option. Fixed immediate annuities provide a constant stream of income, but this can be a disadvantage if inflation erodes the purchasing power of those payments over time. Inflation-adjusted annuities can help mitigate this risk, but they may come with lower initial payments compared to fixed immediate annuities. Depending on the chosen payout option, the annuitant's beneficiaries may not receive the full value of the initial investment if the annuitant dies shortly after purchasing the annuity. To address this concern, annuitants can select a payout option that includes a period certain or joint and survivor feature, which ensures payments continue to their beneficiaries for a specified period or until the survivor's death. However, these options may result in lower payments compared to a single life annuity. When purchasing an immediate annuity, consider the following factors: Choose a reputable insurance company with a strong financial rating to ensure the long-term stability of your annuity payments. Select a payout option that best fits your needs, such as a life annuity for guaranteed income for life or a period of certain annuity for a specified duration. Consider current interest rates and market conditions, as they can influence the income generated by your immediate annuity. A life annuity provides income for the remainder of the annuitant's life, ensuring they won't outlive their savings. However, payments typically cease upon the annuitant's death, which may result in a loss of principal if the annuitant dies early. A joint and survivor annuity covers the lives of two individuals, typically a married couple, providing income until the second person's death. This payout option ensures both individuals receive income during their lifetimes but may result in lower payments compared to a single life annuity. A period certain annuity guarantees income for a specific duration, such as 10, 15, or 20 years. If the annuitant dies before the end of the specified period, their beneficiary will continue to receive the payments for the remaining term. A life annuity with period certain combines features of both life annuities and period certain annuities. It guarantees income for life, but also includes a specified minimum payout period. If the annuitant dies before the end of the period certain, their beneficiary will receive the remaining payments. Immediate annuities offer tax-deferred growth, meaning that the earnings within the annuity are not taxed until they are withdrawn as income. This allows the annuitant's investment to grow more efficiently, potentially leading to higher overall returns. The exclusion ratio is a tax concept that determines the portion of an annuity payment that is considered a return of the annuitant's initial investment and therefore not subject to income tax. This ratio can help reduce the taxable portion of annuity payments, offering additional tax advantages. Immediate annuities may have estate tax implications, depending on the annuitant's individual circumstances and the chosen payout option. In some cases, annuities can be structured to minimize estate taxes or provide a tax-advantaged inheritance for beneficiaries. An immediate annuity is a financial product that converts a lump sum investment into a guaranteed stream of income, providing financial security during retirement. There are several types of immediate annuities, each with its benefits and risks. When considering the purchase of an immediate annuity, it's essential to weigh factors such as the financial stability of the insurance company, payout options, and interest rates. Before making a decision, consult with an insurance broker to help determine if an immediate annuity is the right choice for your retirement needs.What Is an Immediate Annuity?

Types of Immediate Annuities

Fixed Immediate Annuities

Variable Immediate Annuities

Inflation-Adjusted Immediate Annuities

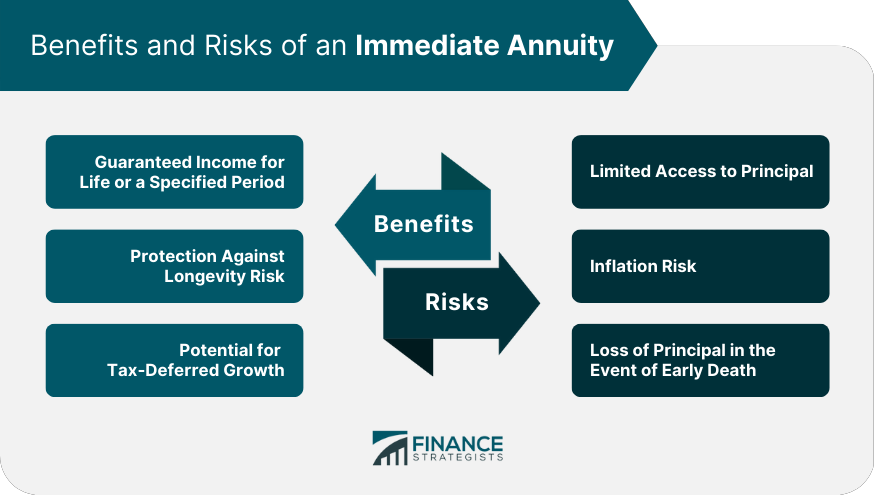

Benefits of an Immediate Annuity

Guaranteed Income for Life or a Specified Period

Protection Against Longevity Risk

Potential for Tax-Deferred Growth

Risks of an Immediate Annuity

Limited Access to Principal

Inflation Risk

Loss of Principal in the Event of Early Death

Factors to Consider When Purchasing an Immediate Annuity

Financial Stability of the Insurance Company

Payout Options

Interest Rates

Immediate Annuity Payout Options

Life Annuity

Joint and Survivor Annuity

Period Certain Annuity

Life Annuity with Period Certain

Tax Implications of Immediate Annuities

Tax-Deferred Growth

Exclusion Ratio

Estate Tax Considerations

Final Thoughts

Immediate Annuity FAQs

An immediate annuity is a financial product that provides a guaranteed income stream for life or a specified period, starting immediately after purchase.

Deferred annuities accumulate funds over a period before payouts begin, while immediate annuities start paying out income immediately after purchase.

Immediate annuities can be fixed or variable. Fixed immediate annuities offer a fixed income stream, while variable annuities offer a variable income stream based on investment performance.

Immediate annuities can provide a guaranteed income stream, protect against market volatility, and ensure income security during retirement.

Risks include inflation risk, interest rate risk, and the risk of the annuity provider going bankrupt. It is important to carefully consider these risks before purchasing an immediate annuity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.