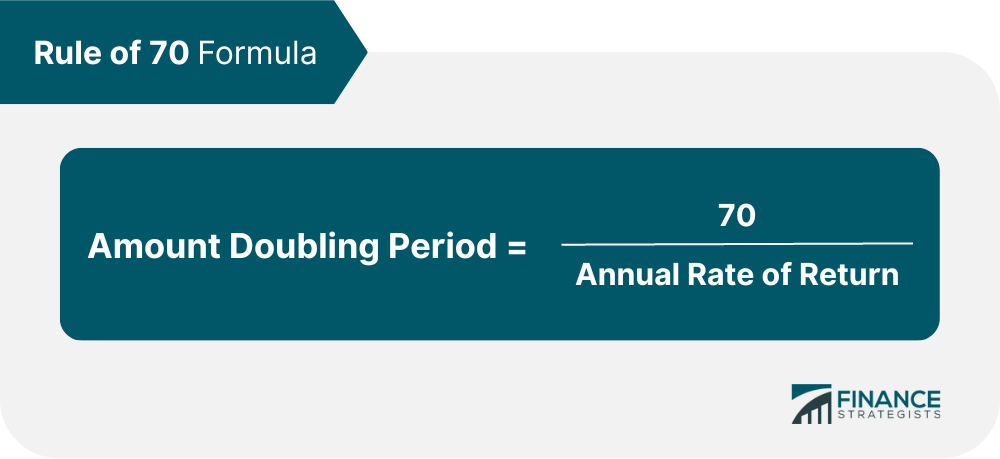

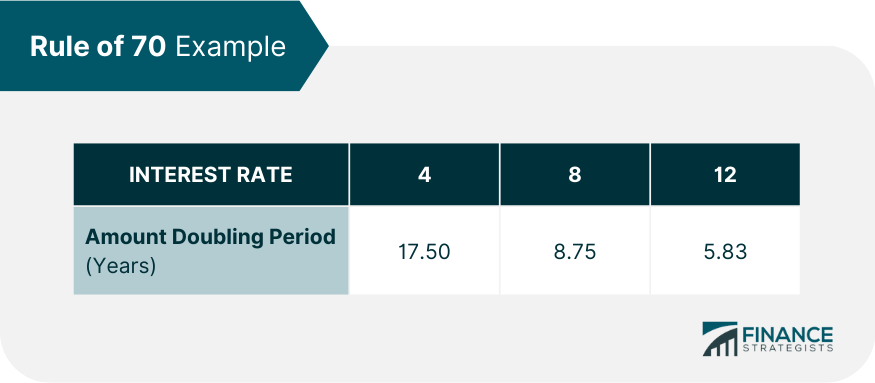

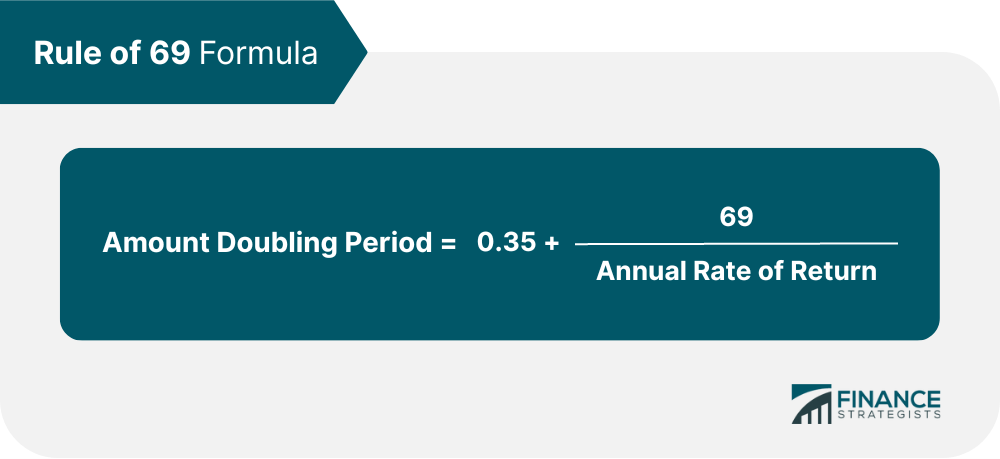

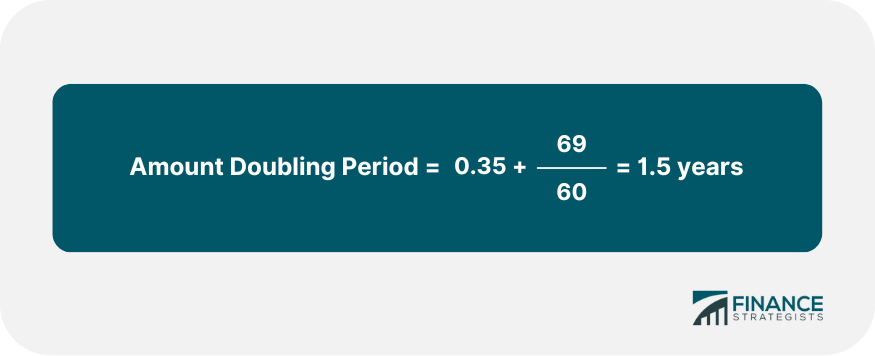

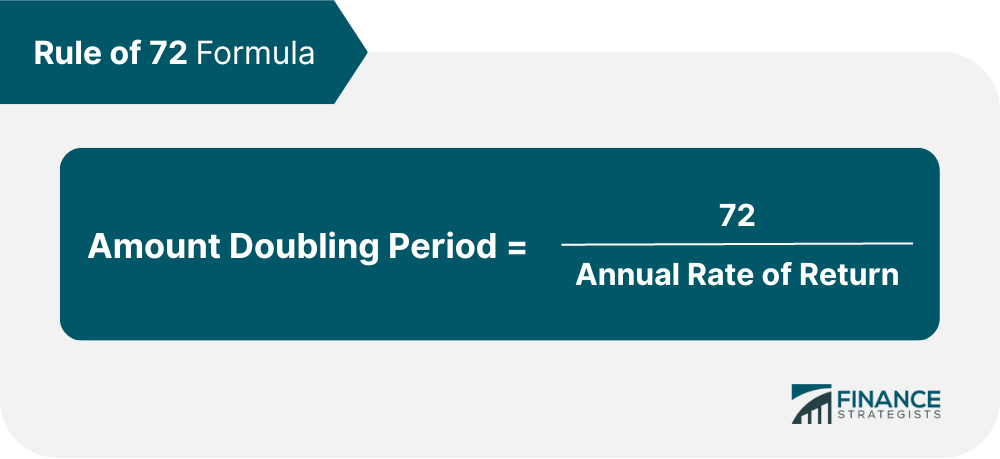

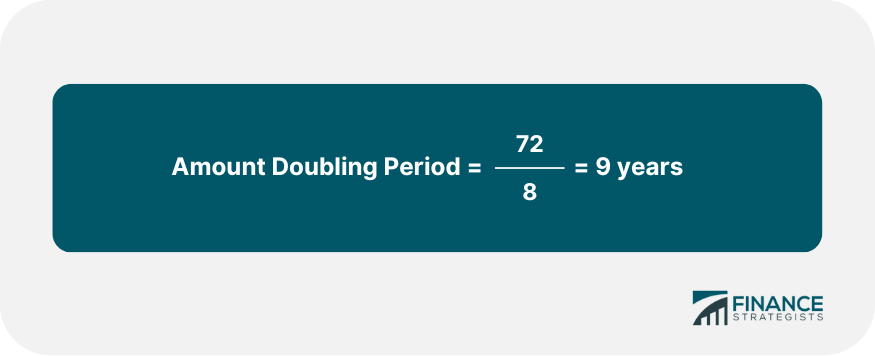

The rule of 70 determines the number of years it takes for a variable to double. The calculation is made by dividing 70 by the variable's growth rate. The most common variable the rule of 70 is used for is in investments, but it may also be used in predicting population or GDP (Gross Domestic Product) growth. Another common term for the rule of 70 is doubling time. With this information in hand, an investor can decide which investment opportunity bears more excellent fruit over the long term, regardless of the yearly returns on each one. To calculate the rule of 70, you need to divide 70 by the growth rate percentage or an annual rate of return. For example, if you wanted to determine the number of years it would take for an investment with an 8% annual rate of return, you would divide 70 by 8, which is 8.75. Based on the current rate of return, it would take 8.75 years for this investment to double in value. Using the same formula, an annual rate of return of 4% and 12% translates to 17.50 years and 5.83 years doubling period, respectively. This formula makes it convenient to determine the doubling time of a particular investment to double in value given a specific rate of return. The rule of 70 is a practical guide for investors evaluating investment value now and in the future. By estimating an investment's growth rate, this powerful tool allows investors to understand how long it will take for their money to double. By utilizing metrics-driven approaches to investing, investors can fine-tune their portfolio allocations and realize more attractive returns. For example, suppose a doubling time of 20 years is only partially up to par with an investor's expectations of 15 years. In that case, they could consider adjusting the mix within their portfolios for optimal growth potential. Despite potential risks associated with investing, this method proves a valuable tool in predicting growth over time. As long as there are no significant obstacles during the process - such as market volatility- it can be an effective way of forecasting success. This concept also calculates the time a country's GDP takes to double, which helps compare growth rates across economies. Similarly, this can be applied to any instrument where long-term steady growth is expected, such as population growth. We can gain more accurate predictions in an ever-evolving environment by integrating average growth rates into the equation. The simplicity and accuracy of the calculation of this rule make it particularly attractive for anyone looking to balance risk with potential reward. A robust investment growth prediction model allows investment managers to take actions that result in optimal decisions. The rule of 70 is a convenient estimation of the years it may take for an investment to double in value. The straightforward formula can be used to estimate an investment's doubling time. All you need is the annual rate of return – divide 70 by the annual rate of return to calculate the years it will take for your investment to double. The rule of 70 provides an informed projection of how long it may take for an investment to double its value; however, this is only an estimate. The growth rate of that investment could fluctuate due to external influences. The rule of 70 calculation assumes that interest accrues continuously, which is not always the case. Most financial institutions compute interest less frequently, meaning the rule may be inaccurate in reflecting growth over time. To ensure a more accurate forecast in some instances with continual compound interest, the rule of 69 may be a better alternative. The rule of 70 is most effective if the current growth rate is consistent. If a growth or annual interest rate changes in any way, the estimate will be inaccurate. Although commonly used by money managers and business owners alike, there are other formulas out there. Two common alternatives are the rule of 69 and the rule of 72. The rule of 69 is a way to approximately calculate how long an investment will take to double when compounded continuously. This calculation is determined by dividing the number 69 by the rate of return and then increasing the result by 0.35. The formula for calculating the rule of 69 is: To illustrate, if an investor can earn a 60% return on property investment, they would need one year and six months for their money to double. This rule allows investors to work out rough fiscal timelines confidently when deciding between options. For annual interest rates, the rule of 72 works best. The rule of 70, on the other hand, is better for semi-annual compounding. The rule of 72 allows investors to quickly ascertain how an investment would fare given a specific rate of return over time without needing complex calculations. To use the rule of 72, one needs to divide 72 by the annual rate of return. The formula for calculating this is: For example, an investor hoping to realize 8% returns can expect their investment to double in nine years if interest accrues annually. Knowing this number allows investors to set expectations and plan accordingly. The rule of 72 is reasonably accurate for rates between 6% and 10%. The rule of 70 is a mathematical formula that can help estimate how long it takes for a certain amount to double. This formula involves dividing the number 70 by the growth rate percentage. The result gives an approximate number of years needed for a population, or asset, with its current growth rate to double in size. Knowing such information helps predict future outcomes and make educated decisions. For instance, it can help investors decide when to sell and buy stock and assist businesses in projecting future profits. Although the rule of 70 can be pretty helpful, it has some limitations, such as inaccuracy with changing growth rates and being less accurate for compounding interest calculations. As with all financial planning strategies, it is best to consult a financial advisor before utilizing the rule of 70 to make essential decisions regarding investments or assets.What Is the Rule of 70?

How to Calculate the Rule of 70

When to Use the Rule of 70

Advantages of the Rule of 70

Reliable Investment Growth Prediction Model

Simple Calculation

Disadvantages of the Rule of 70

Only a Projection

Based on Flawed Assumptions

Alternatives to the Rule of 70

Rule of 69

Rule of 72

Final Thoughts

Rule of 70 FAQs

The rule of 70 is primarily used to determine the number of years it takes for a certain quantity or value to double. It can also measure the rate of growth or decline of any given system, such as population growth.

The rule of 70 provides a straightforward way to estimate the doubling time for a given amount without using complex calculations. This is especially useful when making projections about the future since it accurately indicates how quickly something will grow or shrink over time.

The rule of 70 and other doubling rules are commonly used to estimate future growth rates or returns on investments. However, they can be inaccurate due to their limited capacity to predict larger-scale changes over time.

The rule of 70 does not just apply when growth rates are favorable; it can also be used in scenarios with negative growth rates. In such cases, the figure approximates how long a quantity will take to halve instead of double.

The rule of 70 can be calculated by dividing 70 by the growth rate. For example, if a population grows at a rate of 5%, you would divide 70 by 5 to get 14. This means that it will take approximately 14 years for the population to double from its initial size.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.