Retirement refers to the period in a person's life when they choose to stop working and rely on their savings, investments, or pension benefits to cover their living expenses. Creditor protection is a crucial aspect of retirement planning, as it helps to safeguard one's assets from potential creditors and financial setbacks. By implementing creditor protection strategies, retirees can minimize the impact of unexpected financial challenges and ensure a stable income throughout their retirement years. The primary goals of creditor protection in retirement are to preserve one's assets, protect income streams, and maintain a comfortable standard of living. Creditor protection is a set of legal strategies and tools aimed at shielding an individual's assets and income from seizure by creditors in the event of financial hardship or bankruptcy. These protections can be crucial for maintaining financial stability during retirement. Market volatility refers to fluctuations in the value of investments due to changing economic conditions. Retirees must be prepared to manage these fluctuations, as they can significantly impact the value of their retirement savings and affect their ability to generate sufficient income. Inflation is the gradual increase in the cost of goods and services over time. It can erode the purchasing power of retirement savings, making it more challenging for retirees to maintain their desired standard of living. Longevity risk is the possibility of outliving one's retirement savings. As life expectancies continue to rise, retirees must plan for longer retirement periods and ensure that their savings and investments can support them for the duration. Health care expenses often increase with age, making them a significant financial risk for retirees. Planning for these costs is crucial to ensure retirees can access the care they need without jeopardizing their financial security. Mortgage debt can be a burden in retirement, as it requires ongoing payments that may strain a retiree's limited income. Retirees should aim to pay off their mortgage before retiring to minimize this financial burden. Credit card debt can carry high interest rates, making it difficult for retirees to pay off and potentially impacting their financial stability. Reducing or eliminating credit card debt before retirement is critical for long-term financial success. Student loans, whether for oneself or a family member, can be a significant financial burden in retirement. Retirees should prioritize repaying these loans before retiring to ensure a more secure financial future. Medical debt can accumulate quickly, especially in the absence of comprehensive health insurance. Retirees should plan for potential medical expenses and consider strategies to reduce the risk of incurring unmanageable debt. Asset protection trusts are legal entities that can hold and protect an individual's assets from creditors. These trusts can be an effective way to preserve wealth and maintain financial security in retirement. Certain insurance products, such as life insurance and annuities, can offer creditor protection by providing a source of income that is exempt from seizure. These products can help retirees maintain their standard of living even in the face of financial challenges. Retirement accounts provide a level of creditor protection under federal and state laws. These protections vary depending on the type of account and the specific circumstances, but generally, they help to secure a retiree's savings from potential creditors. Homestead exemptions are legal provisions that protect a portion of a homeowner's primary residence from creditors. These exemptions can be an essential tool for retirees, allowing them to protect their homes and maintain stability in the face of financial difficulties. Bankruptcy laws provide a framework for individuals facing financial hardship to discharge or restructure their debts. These laws offer varying levels of creditor protection, helping retirees preserve essential assets and income while navigating the bankruptcy process. State laws often provide additional creditor protections beyond those offered at the federal level. These may include exemptions for specific types of assets or income, which can be crucial for retirees seeking to safeguard their financial security. Debt repayment strategies, such as the debt snowball or debt avalanche methods, can help retirees pay down their outstanding obligations more effectively. By reducing debt before retirement, individuals can minimize financial risks and improve their overall financial stability. Refinancing options, such as consolidating loans or renegotiating interest rates, can help retirees lower their monthly payments and reduce their overall debt burden. These strategies can be particularly beneficial for individuals with high-interest debt or multiple loans. Diversifying investments across different asset classes and sectors can help protect a retiree's portfolio from market volatility and reduce the risk of significant losses. A well-diversified investment portfolio can provide greater financial stability and support throughout retirement. Trusts and other legal entities, such as limited liability companies (LLCs), can help retirees protect their assets from creditors. By transferring ownership of assets to these entities, individuals can safeguard their wealth and maintain financial security in retirement. The Employee Retirement Income Security Act (ERISA) offers robust creditor protection for qualified retirement plans, such as 401(k)s and defined benefit pensions. These protections can be a valuable tool for retirees seeking to secure their retirement savings from potential creditors. Individual retirement accounts (IRAs) also offer creditor protection, although the extent of these protections can vary by state. Understanding the specific protections available for IRAs can help retirees make informed decisions about their retirement planning. Annuities and life insurance products can provide additional creditor protection by generating income streams that are often exempt from seizure. These products can be an essential component of a comprehensive retirement plan, helping individuals maintain their standard of living even during financial difficulties. Wills and trusts are essential estate planning tools that help retirees manage the distribution of their assets and protect their wealth for future generations. Properly drafted and executed wills and trusts can provide a level of creditor protection for beneficiaries. A power of attorney is a legal document that allows an individual to appoint someone else to manage their financial and legal affairs. This tool can be particularly valuable for retirees who may become incapacitated or otherwise unable to manage their financial matters. Health care directives can help protect retirees' financial resources by ensuring that their medical wishes are honored, potentially avoiding costly and undesired treatments. Properly executed healthcare directives can contribute to a more secure and stable retirement. Proactive retirement planning is essential for achieving financial security and a comfortable lifestyle in retirement. By addressing potential risks and implementing creditor protection strategies, retirees can reduce the impact of financial challenges and safeguard their hard-earned assets. Creditor protection offers long-term benefits by preserving an individual's wealth and income from potential financial setbacks. By implementing effective creditor protection strategies, retirees can maintain their standard of living and enjoy a more secure and stable retirement. A secure and worry-free retirement is achievable through comprehensive planning, including debt reduction, asset protection, and estate planning strategies. By taking a proactive approach and working with financial professionals, retirees can successfully navigate potential financial risks and enjoy a fulfilling retirement. If you are planning for retirement or concerned about creditor protection, consider seeking the guidance of a qualified financial advisor.What Is Retirement and Creditor Protection?

Retirement Planning and Financial Risks

Common Financial Risks in Retirement

Market Volatility

Inflation

Longevity Risk

Health Care Expenses

Impact of Debt on Retirement

Mortgage Debt

Credit Card Debt

Student Loans

Medical Debt

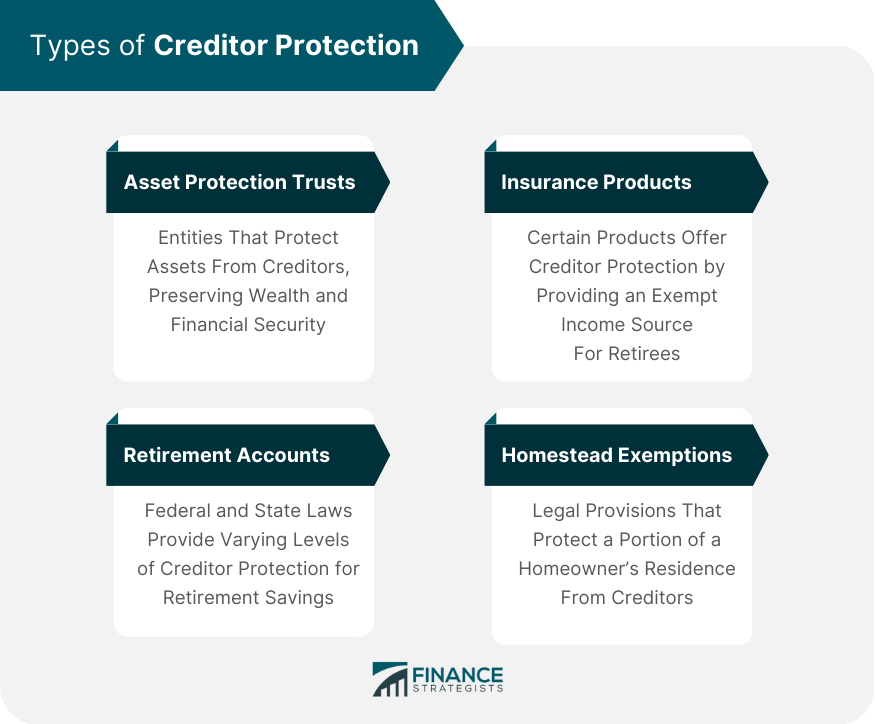

Types of Creditor Protection

Asset Protection Trusts

Insurance Products

Retirement Accounts

Homestead Exemptions

Federal and State Laws on Creditor Protection

Bankruptcy Laws

State-Specific Exemptions and Protections

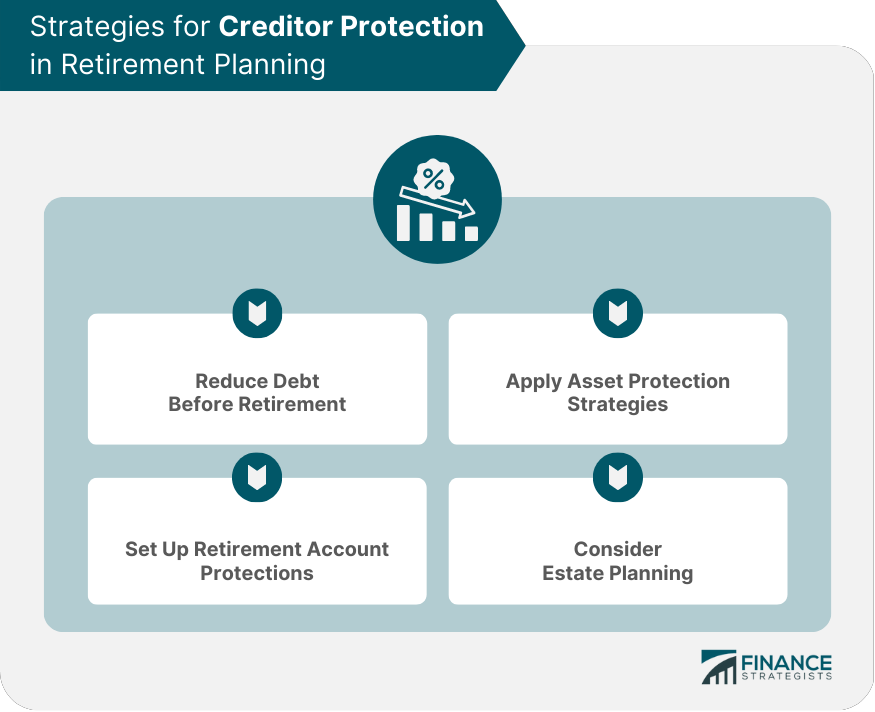

Strategies for Creditor Protection in Retirement Planning

Reduce Debt Before Retirement

Debt Repayment Strategies

Refinancing Options

Apply Asset Protection Strategies

Diversifying Investments

Utilizing Trusts and Legal Entities

Set Up Retirement Account Protections

ERISA-Qualified Plans

IRA Protections

Annuities and Life Insurance Products

Consider Estate Planning

Wills and Trusts

Power of Attorney

Health Care Directives

Final Thoughts

Retirement and Creditor Protection FAQs

Creditor protection is a crucial aspect of retirement planning that involves safeguarding assets and income from potential creditors and financial setbacks. By implementing creditor protection strategies, retirees can minimize the impact of unexpected financial challenges and ensure a stable income throughout their retirement years.

Retirement accounts, such as 401(k)s and IRAs, often have built-in creditor protection provisions under federal and state laws. These protections help to secure retirees' savings from potential creditors, ensuring that their retirement accounts remain intact and available for generating income during retirement.

Some key strategies for implementing creditor protection in retirement planning include reducing debt before retirement, diversifying investments, utilizing trusts and legal entities, taking advantage of retirement account protections, and incorporating estate planning considerations such as wills, trusts, power of attorney, and health care directives.

Working with financial professionals, such as financial advisors, estate planning attorneys, and tax professionals, can provide valuable guidance and expertise in developing a comprehensive retirement plan that addresses potential risks and includes effective creditor protection strategies. These professionals can help retirees navigate complex financial matters, ensuring a more secure and stable retirement.

Annuities and life insurance products can provide additional creditor protection by generating income streams that are often exempt from seizure by creditors. By incorporating these products into a comprehensive retirement plan, retirees can maintain their standard of living even in the face of financial difficulties and protect their assets from potential creditors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.