Incentive Stock Options are a type of employee stock option that provides tax advantages and allows employees to purchase company stock at a discounted price. Employers commonly use them to attract, retain, and motivate key employees. ISOs differ from Non-Qualified Stock Options (NQSOs) in terms of tax treatment and eligibility requirements. While ISOs offer favorable tax treatment, NQSOs are taxed as ordinary income upon exercise and do not have the same tax advantages. ISOs are beneficial for both employers and employees. Employers can use ISOs to align employee interests with those of the company, while employees can benefit from potential stock appreciation and favorable tax treatment. To be eligible for ISOs, an employee must meet certain criteria, such as being a full-time employee of the company and not owning more than 10% of the company's voting stock. These requirements ensure that ISOs are offered only to key employees who contribute significantly to the company's success. Grant and vesting schedules are two key components of ISOs. The grant is the date when an employee is offered the option to purchase company stock, while vesting is the period during which an employee earns the right to exercise the option. The exercise price is the price at which an employee can purchase company stock through an ISO. It is typically set at the fair market value (FMV) of the stock on the grant date, ensuring that employees have the opportunity to benefit from potential stock appreciation. ISOs have an expiration period, typically ten years from the grant date, during which the employee must exercise the option. If the option is not exercised within this period, it expires, and the employee loses the opportunity to purchase the stock at the exercise price. One of the main tax advantages of ISOs is that employees do not have to pay income tax at the time of grant or vesting. This allows employees to defer taxation until the stock is sold, potentially at a lower tax rate. If certain holding period requirements are met, employees can benefit from favorable long-term capital gains tax treatment on the profit from the sale of the stock acquired through ISOs, which is typically lower than ordinary income tax rates. Employees may be subject to the Alternative Minimum Tax (AMT) when exercising ISOs. The AMT is a parallel tax system designed to ensure that high-income taxpayers pay a minimum amount of tax, and it can impact the overall tax benefit of ISOs. To minimize the potential tax impact of ISOs, employees can employ various tax planning strategies, such as exercising options in years with lower income or spreading out the exercise of options over multiple years. When selling stock acquired through ISOs, the tax treatment depends on whether the sale is considered a qualifying or disqualifying disposition. Qualifying dispositions result in favorable long-term capital gains tax treatment while disqualifying dispositions are taxed as ordinary income. The tax treatment of ISO-related gains depends on whether the gains are classified as short-term or long-term capital gains. Long-term capital gains, which apply when the stock is held for more than one year after exercise, are taxed at a lower rate than short-term capital gains, which apply if the stock is sold within one year of exercise. Incentive Stock Options are often included as part of competitive compensation packages to attract and retain top talent. By offering the potential for significant financial rewards, ISOs can be a powerful tool for employers to motivate high-performing employees. Employers must strike a balance between cash and equity compensation when designing employee compensation packages. While ISOs can be an attractive incentive, employees still require a stable cash income to cover living expenses, making it crucial for employers to find the right mix of both types of compensation. ISOs can play a critical role in employee retention and motivation by aligning employee interests with the company's long-term success. By providing employees with a financial stake in the company, ISOs can foster a sense of ownership and commitment to the organization. Internal Revenue Code Section 422 governs the tax treatment of Incentive Stock Options. This section outlines the requirements that must be met for an employee stock option to qualify as an ISO and receive preferential tax treatment. The Securities and Exchange Commission (SEC) regulates the issuance of stock options, including ISOs, to ensure compliance with federal securities laws. Companies that issue ISOs must adhere to SEC regulations and disclosure requirements to avoid potential penalties. The Financial Accounting Standards Board (FASB) provides guidance on the accounting treatment of stock options, including ISOs. Companies must follow FASB standards when reporting the financial impact of their stock option programs on their financial statements. Effective communication is essential for ensuring that employees understand their ISOs' value and potential benefits. Employers should provide clear, concise information about the terms and conditions of the options and any related tax implications. Companies should have systems in place to monitor and track ISO grants, including key dates such as vesting periods and expiration dates. This will help ensure that employees have the necessary information to make informed decisions about exercising their options and managing their equity holdings. Establishing clear internal policies and procedures for managing ISOs can help companies avoid potential legal and regulatory issues. This includes developing guidelines for granting options, determining exercise prices, and ensuring compliance with tax and securities regulations. Incentive Stock Options have become an important component of modern compensation strategies, allowing employers to attract, retain, and motivate high-performing employees. By providing potential financial rewards tied to company performance, ISOs can help drive employee engagement and commitment to the organization's success. While ISOs offer numerous benefits for employers and employees, it is essential to carefully weigh the potential risks and tax implications of these arrangements. By staying informed about the evolving legal and regulatory landscape, and seeking guidance from financial advisors, both parties can better navigate the complex world of ISOs and other equity-based compensation. Incentive Stock Options (ISOs) and other equity-based compensation arrangements can be complex, with various tax implications, legal requirements, and financial considerations that must be taken into account. In order to navigate this intricate landscape and make informed decisions, both employers and employees need to consult with a qualified financial advisor. What Are Incentive Stock Options (ISOs)?

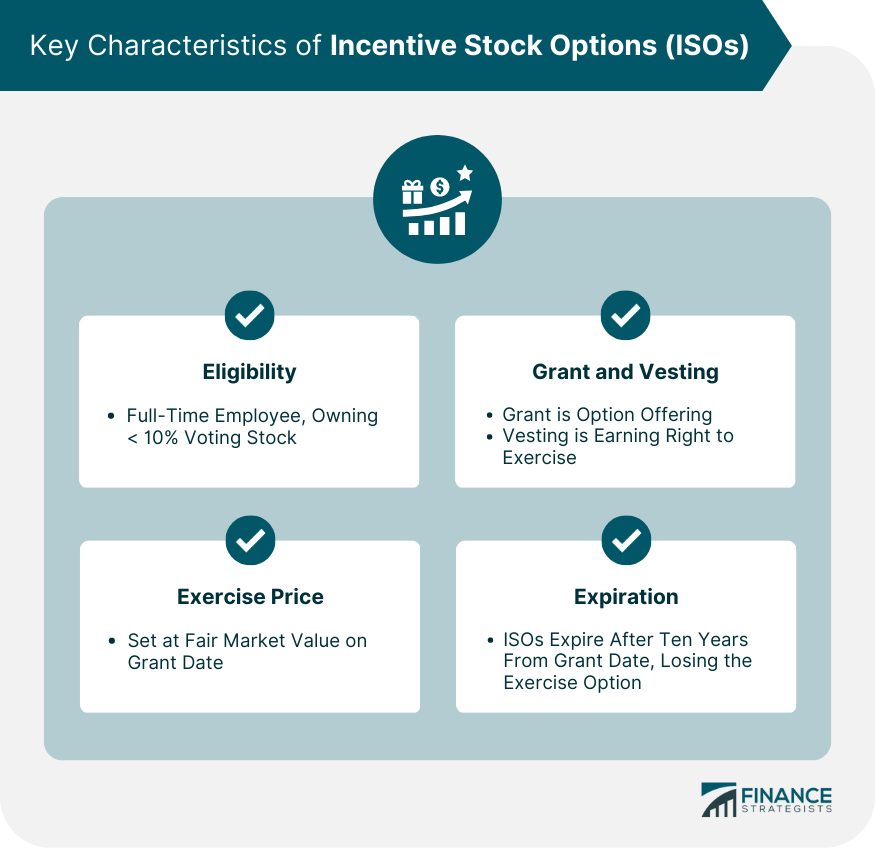

Key Characteristics of ISOs

Eligibility Requirements for Employees

Grant and Vesting Schedules

Exercise Price and Fair Market Value

Expiration Period

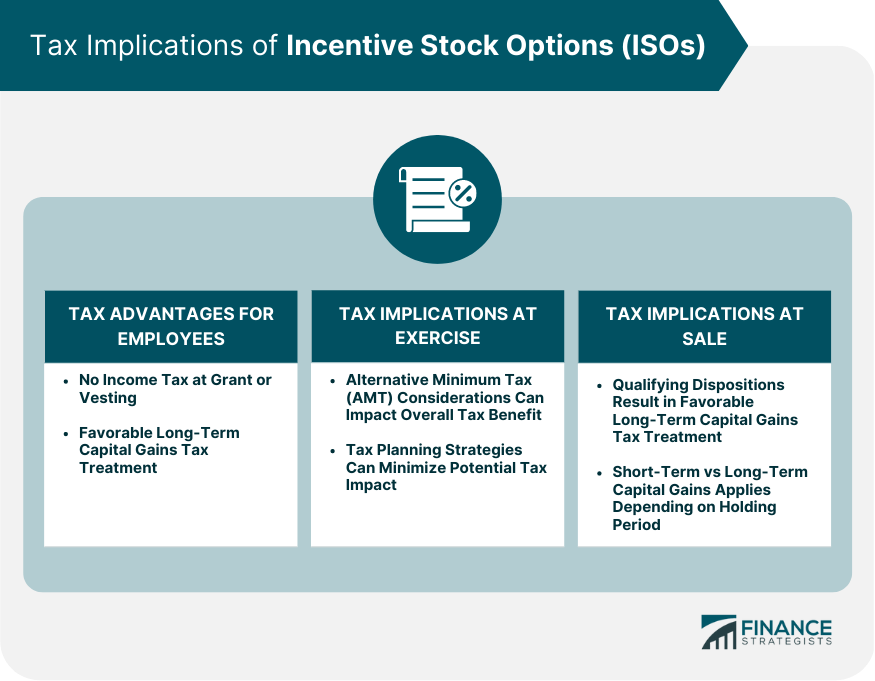

Tax Implications of ISOs

Tax Advantages for Employees

No Income Tax at the Time of Grant or Vesting

Favorable Long-Term Capital Gains Tax Treatment

Tax Implications at the Time of Exercise

Alternative Minimum Tax Considerations

Tax Planning Strategies

Tax Implications at the Time of Sale

Qualifying and Disqualifying Dispositions

Short-Term vs Long-Term Capital Gains

ISOs and Employee Compensation Packages

ISOs as a Component of Competitive Compensation Packages

Balancing Equity and Cash Compensation

Role of ISOs in Employee Retention and Motivation

Legal and Regulatory Framework for ISOs

Internal Revenue Code Section 422

Securities and Exchange Commission Regulations

Financial Accounting Standards Board (FASB) Guidance

Best Practices for Managing Incentive Stock Options (ISOs)

Effective Communication With Employees

Monitoring and Tracking of ISO Grants

Establishing Internal Policies and Procedures

Final Thoughts

Incentive Stock Options (ISOs) FAQs

Incentive Stock Options (ISOs) are a type of employee stock option that provides favorable tax treatment and can only be granted to employees. ISOs differ from non-qualified stock options (NQSOs) mainly in their tax treatment, with ISOs potentially allowing for lower capital gains taxes when the shares are eventually sold, as long as certain holding requirements are met.

When it comes to Incentive Stock Options (ISOs), employees do not owe income tax at the time of grant or vesting. Taxes come into play when the options are exercised and shares are sold. There may be Alternative Minimum Tax (AMT) considerations at the time of exercise, and the sale of shares may result in either long-term capital gains tax or short-term capital gains tax, depending on the holding period and whether the sale is considered a qualifying or disqualifying disposition.

Incentive Stock Options (ISOs) can only be granted to employees of the company, not to non-employee directors, consultants, or contractors. Additionally, an employee must own no more than 10% of the company's total combined voting power of all classes of stock, unless the option's exercise price is at least 110% of the fair market value and the option expires within 5 years from the grant date.

Incentive Stock Options (ISOs) can be an important component of an employee's overall compensation package, offering them the potential for long-term financial gain through equity ownership in the company. ISOs can be used as a tool for attracting, retaining, and motivating top talent, and can help to align employee and shareholder interests by tying a portion of the employee's compensation to the company's stock performance.

Some best practices for managing Incentive Stock Options (ISOs) include effective communication with employees about their equity compensation, monitoring and tracking ISO grants to ensure compliance with legal requirements and accounting standards, and establishing internal policies and procedures to govern the administration of ISOs and other equity-based compensation plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.