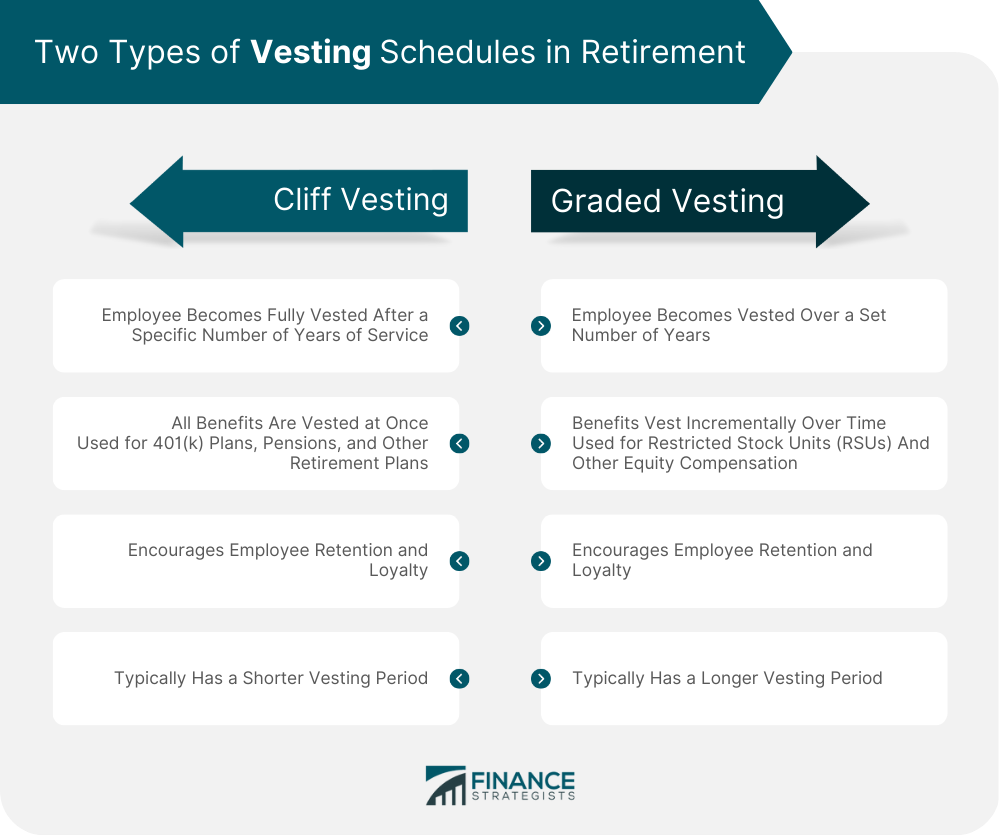

Fully vested refers to the point at which an individual has earned the right to receive full benefits from their employer's retirement plan or stock options. In other words, it is the point at which the individual has met all the requirements for vesting and has full ownership of the benefits or investments. Fully vested in a retirement plan such as a 401(k) means that an employee has earned the right to receive the full benefits of the plan, including the employer's contributions and earnings. Employers use vesting schedules to encourage employee loyalty and retention, requiring employees to work for a certain amount of time before becoming fully vested. Once an employee has met the vesting requirements, they become fully vested and have the right to the benefits they have earned, even if they leave the company. Being fully vested in a retirement plan provides financial security and peace of mind for employees. A vesting schedule is a plan that determines when an employee or investor becomes fully vested in their benefits or investments. There are typically two types of vesting schedules: cliff vesting and graded vesting. The importance of vesting schedules cannot be overstated. They ensure that employees or investors stay with an organization for a certain amount of time before they are entitled to certain benefits or investments. For employers, vesting schedules can be used to encourage employee retention and loyalty. For employees and investors, vesting schedules provide a clear path toward earning full ownership of their benefits or investments. There are typically two types of retirement vesting schedules – cliff vesting and graded vesting. In cliff vesting, an employee becomes fully vested in a retirement plan after a specific number of years of service. For example, an employer may have a cliff vesting schedule that requires an employee to work for five years before becoming fully vested in the retirement plan. Once the employee has worked for five years, they are fully vested, meaning they have earned the right to receive all of the benefits. In graded vesting, an employee becomes vested in their retirement plan over a set number of years. For example, an employer may have a graded vesting schedule that requires an employee to work for three years before becoming 20% vested in the plan, four years before becoming 40% vested, and so on. This means that an employee will gradually earn the right to receive the full benefits of the plan over time. Being fully vested in stock options means that an employee has earned the right to exercise their options and purchase the underlying stock at the predetermined strike price. Vesting schedules for stock options can vary, with some employers using cliff vesting and others using graded vesting. Once an employee is fully vested, they have the right to exercise their options and purchase the stock, even if they leave the company. Being fully vested in stock options provides employees with the opportunity to own stock in the company they work for and potentially profit from its success. As stock options are often used as a form of equity compensation, it is important for employees to understand their employer's vesting schedule and how it affects their stock options to make informed decisions about their benefits and investments. Vesting can also apply to investments. When an investor is fully vested in an investment, they have complete ownership and control over it and can sell or transfer it without any restrictions. Some types of investments that may have vesting schedules include retirement accounts, restricted stock units, and mutual funds. Retirement accounts, such as individual retirement accounts (IRAs) and 401(k) plans, can have vesting schedules. For example, if an individual has a traditional IRA, they become fully vested in their contributions immediately, while for a 401(k) plan, the vesting schedule can vary depending on the employer. Restricted stock units (RSUs) are another type of investment that may have a vesting schedule. RSUs are often used as a form of compensation in addition to salary and bonuses. They give the recipient the right to receive company stock after a certain period of time, often with a vesting schedule. Mutual funds can also have vesting schedules, particularly when it comes to loading charges. Such are charged by mutual funds when an investor buys or sells shares. Some mutual funds have a vesting schedule for load fees, which means that the fees decrease over time as the investor holds onto the shares. The legal aspects of being fully vested relate to the ownership and transfer of property rights. When an employee or investor is fully vested, they have complete ownership and control over their benefits or investments, including the ability to sell or transfer them without any restrictions. Legal vesting is crucial in ensuring that the transfer of ownership is lawful and valid. In some cases, vesting can be a complex legal issue, particularly when it comes to intellectual property or complex financial instruments. It is important for both employers and employees to understand the legal implications of vesting to ensure compliance with regulations and protect their rights. Understanding the concept of vesting is essential for employees, employers, and investors. Vesting determines when an individual becomes fully vested in their benefits or investments, and there are typically two types of vesting schedules: cliff vesting and graded vesting. Vesting schedules are important for encouraging employee retention and loyalty while providing a clear path toward earning full ownership of their benefits or investments. Legal vesting is also important in ensuring compliance with regulations and protecting the rights of employers and employees. Overall, by understanding vesting schedules and the legal implications of vesting, individuals can make informed decisions about their benefits and investments, leading to financial security and peace of mind. A financial advisor can guide you in your investment options.What Is Fully Vested?

Fully Vested in Retirement Plan

Vesting Schedules

Types of Vesting Schedules in Retirement

Cliff Vesting

Graded Vesting

Fully Vested in Stock Options

Fully Vested in Investments

Types of Vesting Schedules in Investments

Retirement Accounts

Restricted Stock Units (RSUs)

Mutual Funds

Legal Aspects of Fully Vested

Final Thoughts

Fully Vested FAQs

Being fully vested in a retirement plan means that an employee has earned the right to receive the full benefits of the plan, including the employer's contributions and earnings.

Being fully vested in stock options means that an employee has earned the right to exercise their options and purchase the underlying stock at the predetermined strike price.

Cliff vesting involves an employee becoming fully vested after a specific number of years of service, while graded vesting involves an employee becoming vested over a set number of years.

Vesting is important for encouraging employee loyalty and retention while providing a clear path toward earning full ownership of benefits or investments.

Yes, vesting can have legal implications, particularly when it comes to ownership and transfer of property rights. Legal vesting is important in ensuring compliance with regulations and protecting the rights of employers and employees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.