Executive bonus plans are a type of compensation plan designed to provide additional monetary rewards to top-level executives in addition to their base salary. These plans are often used by companies as a way to incentivize and retain their key executives, align their interests with those of the company's shareholders, and motivate them to work toward achieving the company's strategic objectives. Executive bonus plans are often influenced by factors such as company performance, industry standards, individual performance, and market competition. By tying bonuses to specific performance metrics, companies can encourage executives to work harder and contribute more to the company's success. A cash bonus plan is a type of executive bonus plan in which an executive receives a cash payment in addition to their base salary. These plans are often used as a way to reward executives for their performance or achievements throughout the year. Cash bonus plans can be based on individual or company performance, and the bonus amount is typically a percentage of the executive's base salary. A stock option plan is a type of executive bonus plan in which an executive is granted the option to purchase company stock at a predetermined price. The executive can exercise the option at a later date, typically after a vesting period, at which point they can purchase the stock at the predetermined price. If the stock price has increased since the grant date, the executive can sell the stock at a profit. Stock option plans are often used as a way to align executive interests with those of the company's shareholders. A restricted stock plan is a type of executive bonus plan in which an executive is granted company stock, but the stock is subject to certain restrictions. For example, the executive may not be able to sell the stock for a certain period of time, or the stock may be forfeited if certain conditions are not met. Restricted stock plans are often used as a way to incentivize executives to stay with the company for a longer period of time. A phantom stock plan is a type of executive bonus plan in which an executive is awarded "phantom" shares of company stock. These shares do not actually represent ownership in the company, but they are tied to the company's stock price. If the stock price increases, the executive receives a cash payment based on the increase in value of their phantom shares. Phantom stock plans are often used as a way to provide executives with a stake in the company's success without diluting the ownership of existing shareholders. A deferred compensation plan is a type of executive bonus plan in which an executive defers a portion of their salary or bonus until a later date, typically after retirement. The deferred compensation is invested and grows tax-free until it is paid out to the executive. Deferred compensation plans are often used as a way to provide executives with a retirement benefit while also allowing the company to defer the cost of the compensation until a later date. One of the most significant factors that influence executive bonus plans is the company's performance. If the company performs well, executives may be eligible for larger bonuses. On the other hand, if the company performs poorly, bonuses may be reduced or eliminated entirely. Industry standards also play a role in executive bonus plans. Companies may benchmark their executive compensation packages against those of their competitors to ensure that they are offering competitive compensation. This can include not only base salary but also bonus plans and other types of incentives. The performance of individual executives is also a significant factor in executive bonus plans. Bonuses may be tied to specific performance metrics, such as revenue growth, profit margins, or customer satisfaction. This helps to ensure that bonuses are awarded to executives who contribute significantly to the company's success. Market competition can also influence executive bonus plans. In industries where top talent is in high demand, companies may need to offer more generous compensation packages, including executive bonus plans, to attract and retain key employees. This can be particularly true in industries such as technology or finance, where skilled executives are in high demand. One of the primary advantages of executive bonus plans is that they can help to retain key employees. By offering additional compensation beyond base salary, companies can incentivize executives to stay with the company and remain committed to its long-term success. This is particularly important for companies that rely heavily on the skills and expertise of their executives. Executive bonus plans can also help to motivate and increase the productivity of executives. By tying bonuses to specific performance metrics, companies can encourage executives to work harder and contribute more to the company's success. This can be particularly effective for companies that are trying to drive growth or improve operational efficiency. Executive bonus plans can also help to align the interests of executives with those of the company's shareholders. By tying bonuses to specific performance metrics, companies can ensure that executives are focused on achieving the company's strategic objectives. This can help to create a culture of accountability and ensure that executives are working toward the company's long-term goals. Executive bonus plans can offer tax benefits for both the company and the executives. For example, deferred compensation plans can allow executives to defer taxes on their bonus until they retire and are in a lower tax bracket. Additionally, certain types of stock-based compensation plans can offer tax advantages for both the company and the executive. One of the potential disadvantages of executive bonus plans is that they can create inequity among employees. If bonuses are awarded only to top executives, other employees may feel undervalued or underappreciated. This can lead to morale issues and reduced productivity among non-executive employees. Executive bonus plans can also have negative effects on organizational culture. If bonuses are seen as the primary motivator for executives, this can lead to a culture of competition and individualism rather than collaboration and teamwork. Additionally, if bonuses are tied to short-term performance metrics, this can encourage executives to focus on short-term gains at the expense of long-term strategic objectives. Executive bonus plans can also carry the risk of unintended consequences. For example, if bonuses are tied to specific performance metrics, executives may focus on achieving those metrics at the expense of other important aspects of the business. This can lead to a narrow focus and a lack of innovation or creativity. Executive bonus plans can be subject to legal and regulatory issues. For example, if bonuses are tied to specific performance metrics that are difficult to measure or subjective, this can lead to disputes between executives and the company. Also, if bonus plans are deemed to be excessive or unfair, this can lead to negative publicity and potential legal action. One of the best practices for implementing executive bonus plans is to align them with the company's strategic objectives. This can help to ensure that executives are focused on achieving the company's long-term goals rather than short-term gains. It is also important to establish clear performance metrics for executive bonus plans. This can help to ensure that bonuses are awarded based on objective criteria rather than subjective opinions. Clear performance metrics can also help to motivate executives and increase their accountability. Companies should also ensure that their executive bonus plans are equitable and transparent. This can help to avoid morale issues among non-executive employees and reduce the risk of legal or regulatory issues. Additionally, transparent bonus plans can help to build trust between executives and the company. Effective communication is also essential when implementing executive bonus plans. Companies should clearly communicate the terms of the bonus plans to executives and ensure that they understand how they can earn bonuses. Additionally, companies should communicate the importance of executive bonus plans to other employees to avoid morale issues. Companies should regularly review and adjust their executive bonus plans as needed. This can help to ensure that the plans remain aligned with the company's strategic objectives and that they continue to incentivize and retain key executives. Executive bonus plans are a crucial component of a company's compensation strategy for its top executives. They can serve as a way to incentivize and retain key employees, align executive interests with those of the company's shareholders, and increase productivity and motivation. However, executive bonus plans can also have disadvantages, including the potential for inequity, negative effects on organizational culture, unintended consequences, and legal and regulatory issues. To implement effective executive bonus plans, companies should align them with business objectives, establish clear performance metrics, ensure equity and transparency, communicate effectively, and regularly review and adjust the plans. By following these best practices, companies can create executive bonus plans that effectively incentivize and retain their top talent while also driving the long-term success of the company.What Are Executive Bonus Plans?

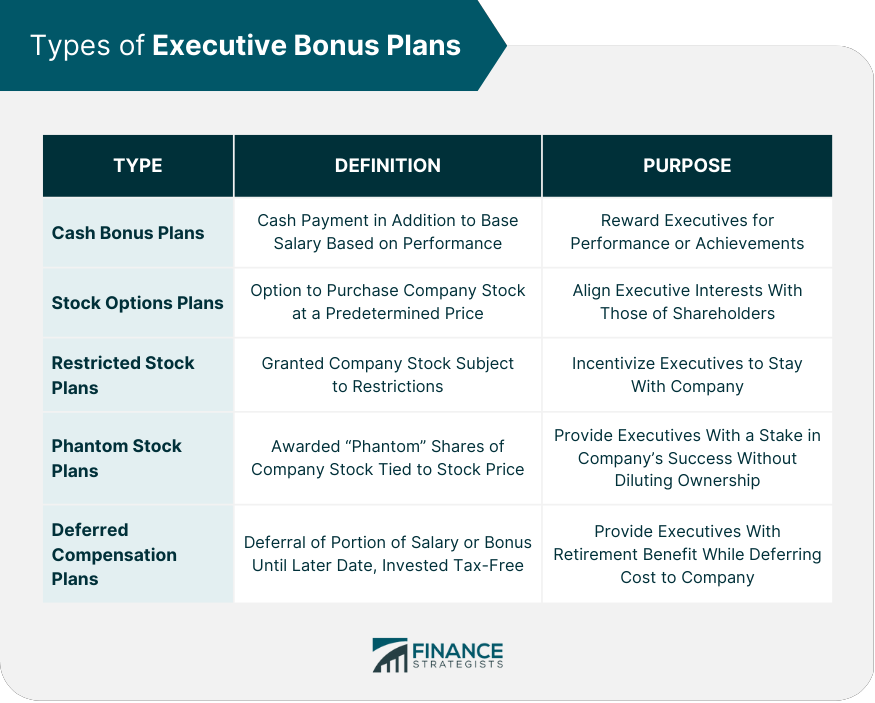

Types of Executive Bonus Plans

Cash Bonus Plans

Stock Options Plans

Restricted Stock Plans

Phantom Stock Plans

Deferred Compensation Plans

Factors that Influence Executive Bonus Plans

Company Performance

Industry Standards

Individual Performance

Market Competition

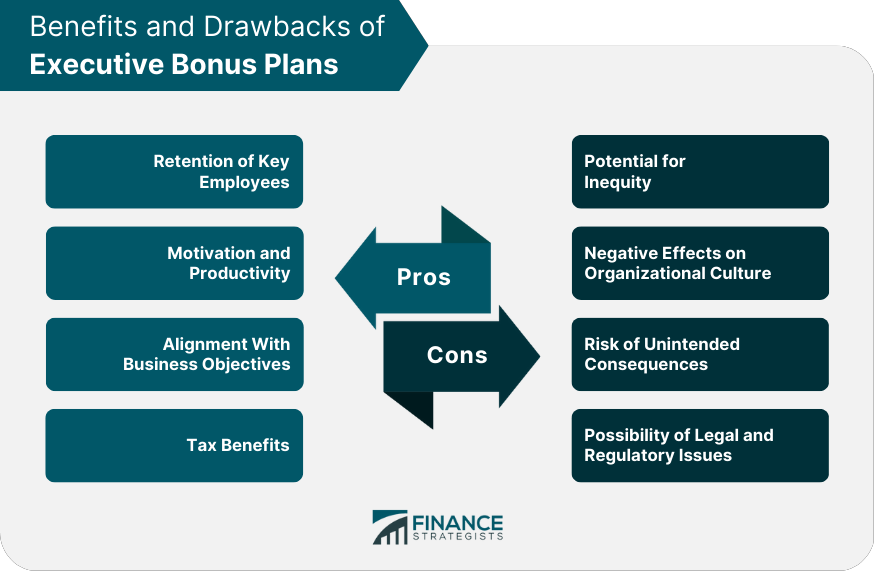

Advantages of Executive Bonus Plans

Retention of Key Employees

Motivation and Productivity

Alignment With Business Objectives

Tax Benefits

Disadvantages of Executive Bonus Plans

Potential for Inequity

Negative Effects on Organizational Culture

Risk of Unintended Consequences

Possibility of Legal and Regulatory Issues

Best Practices for Implementing Executive Bonus Plans

Aligning With Business Objectives

Establishing Clear Performance Metrics

Ensuring Equity and Transparency

Communicating Effectively

Regular Review and Adjustment

Final Thoughts

Executive Bonus Plans FAQs

The most common types of executive bonus plans include cash bonus plans, stock options plans, restricted stock plans, phantom stock plans, and deferred compensation plans.

Factors that can influence executive bonus plans include company performance, industry standards, individual performance, and market competition.

Executive bonus plans can align executive interests with those of the company's shareholders by tying bonuses to specific performance metrics and long-term strategic objectives. This can help to ensure that executives are focused on achieving the company's goals rather than short-term gains.

Potential disadvantages of executive bonus plans include the potential for inequity, negative effects on organizational culture, unintended consequences, and legal and regulatory issues.

Companies can ensure that their executive bonus plans are effective by aligning them with business objectives, establishing clear performance metrics, ensuring equity and transparency, communicating effectively, and regularly reviewing and adjusting the plans. By following these best practices, companies can create executive bonus plans that effectively incentivize and retain their top talent while also driving the long-term success of the company.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.