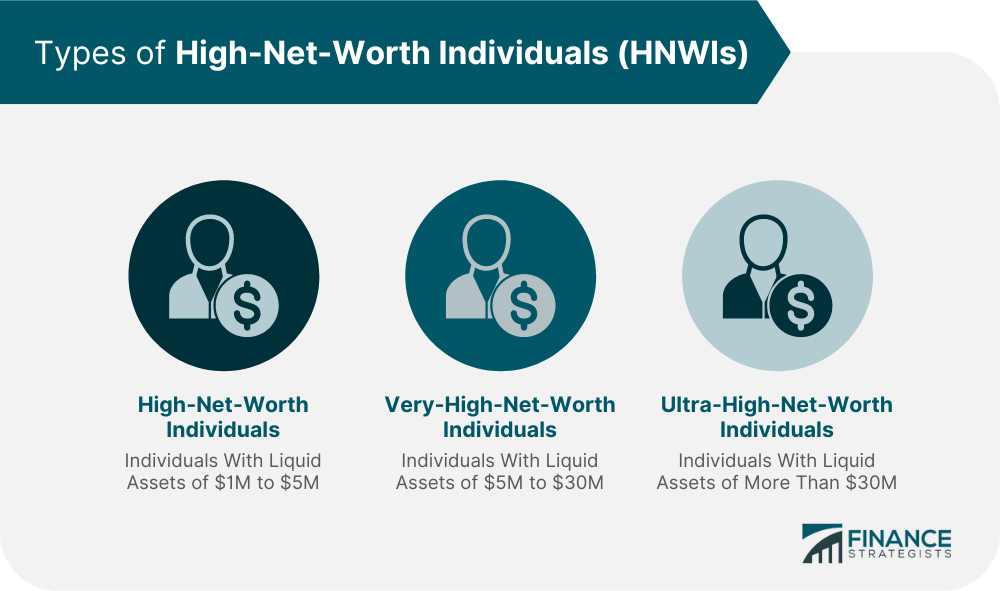

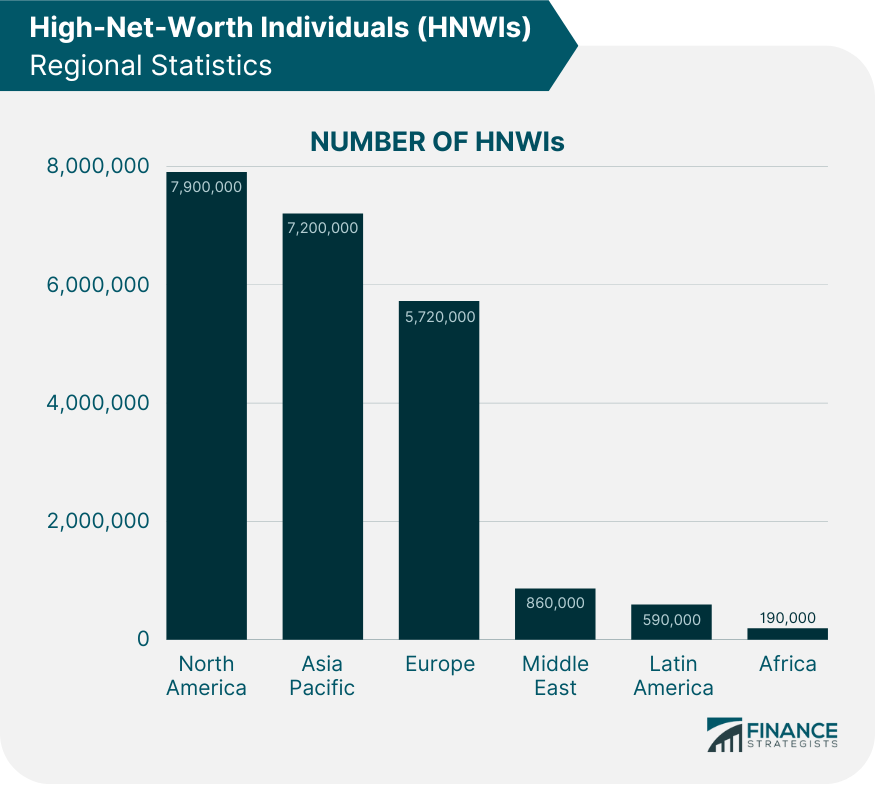

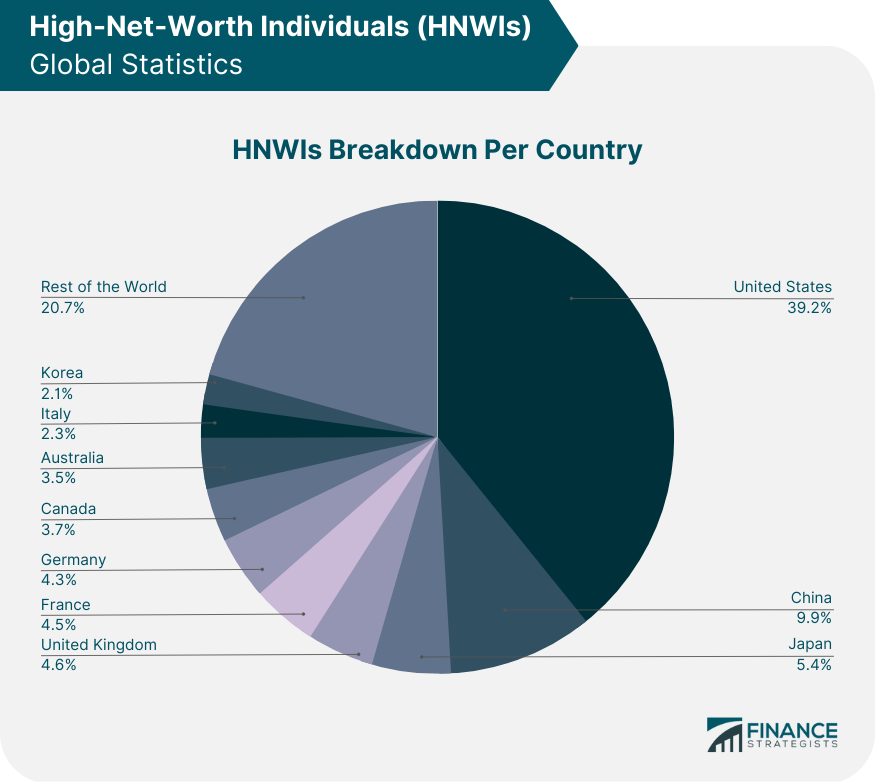

A high-net-worth individual (HNWI) describes a person with considerable wealth. Generally, high-net-worth individuals have liquid assets worth at least $1 million. However, advisory firms or professionals registered with the Securities and Exchange Commission (SEC) categorize their clients who possess $750,000 in liquid assets or a net worth of $1.5 million as high-net-worth individuals. Liquid assets usually refer to cash or assets that can easily be converted into cash, such as stocks and bonds, on top of their savings, checking, and money market accounts. HNWIs can be classified according to the size of their wealth: Financial institutions provide favorable treatment to high-net-worth individuals because of their massive business. The more money a person owns, the more capital management is required to protect and multiply the invested money. The more work there is, the greater the profit for any financial institution. Being a high-net-worth individual allows access to exclusive services from banks, financial advisors, and other professionals. They get perks such as 24/7 customer service, access to luxury products and services, higher credit limits, and personalized financial advice. It is common for them to become members of an elite club or network where they get access to events and activities not available to the general public. These activities can range from private art tours to VIP sporting events. They can have exclusive access to private equity (PE) and venture capital (VC) funds. In addition, HNWIs may be able to invest in real estate and other alternative assets that are difficult for the average population to acquire. Other privileges afforded to HNWIs are investing in hedge funds from recognized firms, taking part in pre-IPO placements, participating in the pre-ICO sales of particular enterprises, and gaining opportunities to become a stakeholder in high-quality firms. The wealth amassed by HNWIs allows them greater chances of securing loans for businesses or investments and the eligibility for higher returns. With this, they can purchase expensive items such as luxury cars and jewelry without waiting for financing. Data from the 2022 Global Wealth Report reveals that HNWIs account for just 1.2% of the global population but control approximately 48% of the world’s wealth. There are 62.5 million individuals globally who fit the criteria as high-net-worth individuals. North America has the most HNWIs, accounting for 7.9 million individuals. Followed by Asia-Pacific with 7.2 million, then Europe with 5.72 million. The other regions follow far behind. The United States is home to 24.5 million HNWIs, accounting for 39.2% of the HNWI globally, followed by China with 6.2 million HNWIs, and Japan with 3.4 million. In 2026, there will be roughly 40% more millionaires worldwide. China will become a competitive player, with the number of HNWIs expected to increase dramatically by 2026, reaching more than 17 million. The road to becoming a high-net-worth individual starts with having a stable source of income or investments. Additionally, here are some of the ways to acquire wealth and become an HNWI: While saving may seem difficult initially, establishing a monthly target will help you save diligently and avoid impulse purchases. Such a habit will pay off in the long run. This will enable you to eventually invest in stocks, bonds, real estate, and other assets that could generate additional income. Diversifying is also beneficial as you can spread risk and maximize portfolio returns over time. Investing in stocks can provide higher returns than traditional savings accounts but involve more risk. Index funds or ETFs are other options that offer a broader range of stocks. Bonds provide more consistent returns over time but with less volatility than stocks. This makes them ideal for conservative investors. Be mindful that you use debt to build wealth rather than diminish it. Refrain from taking too much debt at once and consider paying on time. Late payments can reduce your credit score and affect your chances of securing future loans. Watch out for high-interest rate debt, such as credit cards, as interest accrues over time if not paid timely. A high-net-worth individual is someone who has a wealth of at least $1 million in liquid assets. Aside from HNWI, there are those belonging to the very-high-net-worth and ultra-high-net-worth categories. The benefits of becoming an HNWI are vast, from having exclusive privileges to participating in more profitable investments. Data from the Global Wealth Report reveals that HNWIs account for just 1.2% of the global population but possess approximately 48% of the world’s wealth. Diligent savings and wise investments can help you grow your wealth over time and become a high-net-worth individual. It is common for HNWIs to consult with wealth management service providers or financial advisors who can facilitate their wealth preservation and advise them on investment strategies. These experts usually have specialized knowledge and access to exclusive services.What Is a High-Net-Worth Individual (HNWI)?

Types of High-Net-Worth Individuals (HNWIs)

Benefits of Being a High-Net-Worth Individual (HNWI)

Exclusive Access

Investment and Loan Privileges

High-Net-Worth Individual (HNWI) Statistics

Regional Statistics

Global Statistics

Global Forecast

How to Become a High-Net-Worth Individual (HNWI)

Diligent Saving

Strategic Investing

Responsible Use & Management of Debt

Final Thoughts

High-Net-Worth Individual (HNWI) FAQs

HNWIs enjoy a wide range of benefits, from having more financial security to being able to invest in higher-return projects. They are also more likely to have access to resources, exclusive opportunities, and services that may not otherwise be available.

Anyone with at least $1 million in liquid assets is considered an HNWI. Those with more than $5 million and $30 million are categorized as very-high-net-worth individuals and ultra-high-net-worth individuals, respectively.

There are three main categories of HNWIs: high-net-worth individuals (those with $1 million to $5 million in liquid assets), very-high-net-worth individuals (those with more than $5 million), and ultra-high-net-worth individuals (those with more than $30 million).

To calculate your net worth, subtract all your liabilities (debts) from your assets (cash, investments, properties, and other sources). The difference is known as your net worth.

The amount of a person's liquid assets are often used to figure out if they are an HNWI. This usually means cash or assets easily turned into cash, like stocks and bonds, in addition to their checking, savings, and money market accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.