Financial regulators are government entities or agencies responsible for overseeing and regulating financial markets and institutions. The main goal of financial regulators is to protect consumers, maintain financial stability, and promote fair and transparent financial practices. Financial regulators may have a variety of responsibilities, including: Supervising financial institutions such as banks, credit unions, and insurance companies to ensure that they comply with laws and regulations Enforcing laws and regulations related to financial products and services, such as consumer protection laws and anti-money laundering regulations Monitoring financial markets to detect and address potential risks or threats to financial stability Conducting investigations and imposing penalties on financial institutions or individuals that violate laws or regulations Examples of financial regulators include the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the European Central Bank (ECB) in the European Union. Financial regulators play a critical role in maintaining the stability, integrity, and efficiency of the financial system. By establishing and enforcing rules and standards, these institutions aim to protect consumers, promote fair competition, and prevent systemic risks. Central banks are responsible for implementing monetary policy and overseeing the stability and functioning of the financial system. They also act as lenders of last resort to ensure liquidity during times of crisis. Central banks' primary responsibilities include issuing currency, managing interest rates, controlling the money supply, and acting as a lender of last resort. They also play a crucial role in supervising and regulating the banking sector and other financial institutions. Monetary policy is the process by which central banks manage the money supply to achieve specific economic objectives, such as price stability, low inflation, and sustainable economic growth. This is typically achieved through tools such as open market operations, setting interest rates, and reserve requirements. Notable examples of central banks include the Federal Reserve in the United States, the European Central Bank in the Eurozone, and the Bank of England in the United Kingdom. Securities and Exchange Commissions (SECs) are responsible for regulating and overseeing securities markets, ensuring transparency and fairness. SECs are tasked with maintaining fair and efficient securities markets, preventing fraud, and protecting investors. Their responsibilities include registration and oversight of market participants, enforcement of securities laws, and promoting disclosure and transparency. SECs regulate and supervise securities markets to ensure that all participants adhere to the relevant laws and regulations. They also promote transparency by requiring companies to disclose accurate and timely financial information. Well-known SECs include the U.S. Securities and Exchange Commission and the Financial Conduct Authority in the United Kingdom. Insurance regulators oversee the insurance industry to ensure solvency and protect policyholders. These regulators are responsible for licensing, supervising, and monitoring insurance companies to ensure that they maintain adequate capital and follow sound business practices. They also establish standards for the treatment of policyholders and resolve disputes between insurers and their customers. Insurance regulators ensure that insurance companies have sufficient capital and reserves to meet their obligations to policyholders. They also protect policyholders by enforcing fair practices and resolving disputes. The National Association of Insurance Commissioners in the United States and the Prudential Regulation Authority in the United Kingdom are examples of insurance regulators. Banking supervisory authorities oversee the banking sector to maintain its safety, soundness, and compliance with applicable laws and regulations. Banking supervisory authorities are responsible for licensing, regulating, and supervising banks and other financial institutions. They ensure that banks maintain adequate capital, manage risk effectively, and follow prudent lending practices. Prudential regulation refers to the rules and standards designed to ensure the safety and soundness of financial institutions. Supervisory authorities enforce these regulations and monitor banks to ensure compliance. The Office of the Comptroller of the Currency in the United States and the European Banking Authority are examples of banking supervisory authorities. Risk management is a fundamental aspect of financial regulation, as it helps identify, assess, and mitigate risks that financial institutions may face. Regulators establish guidelines and standards for risk management practices to ensure that financial institutions can effectively manage credit, market, operational, and other types of risks. Capital adequacy is a measure of a financial institution's ability to absorb losses and meet its obligations to depositors and other stakeholders. Regulators establish capital adequacy requirements to ensure that institutions maintain sufficient capital buffers, enhancing the stability and resilience of the financial system. Consumer protection is a primary objective of financial regulation, aiming to safeguard the interests of consumers by promoting fair and transparent practices, preventing fraud, and ensuring the proper handling of complaints. Regulators enforce consumer protection laws and establish guidelines for financial institutions to follow. Corporate governance refers to the set of rules, practices, and processes by which companies are directed and controlled. Regulators establish corporate governance standards to ensure that financial institutions are managed in a transparent, ethical, and accountable manner, protecting the interests of stakeholders. AML/CFT regulations aim to prevent and detect the use of financial systems for money laundering and terrorist financing. Financial regulators establish and enforce AML/CFT rules, requiring institutions to implement robust controls and reporting procedures to identify and report suspicious transactions. Systemic risk refers to the potential for the failure of one financial institution or market to cause widespread disruption in the financial system. Macroprudential regulation focuses on addressing systemic risks by monitoring and mitigating risks that may arise from the interactions among financial institutions and markets. Financial stability is the overall health and resilience of the financial system. Regulators strive to maintain financial stability by ensuring that financial institutions and markets function smoothly, efficiently, and without significant disruptions. Financial technology (FinTech) and digital currencies have introduced new challenges for financial regulators, as they must adapt existing regulations and create new ones to accommodate these innovations. Regulators must strike a balance between fostering innovation and protecting consumers and the financial system. Climate change poses significant risks to the financial system, with potential impacts on asset values, credit risk, and market stability. Regulators are increasingly focused on assessing and addressing climate-related financial risks through the development of new reporting and risk management standards. As the financial industry becomes more reliant on digital technologies, cybersecurity and data privacy concerns have become increasingly important. Regulators must ensure that financial institutions implement robust cybersecurity measures and protect customer data in compliance with data privacy regulations. The globalization of financial markets has led to increased cross-border activities, requiring greater cooperation among financial regulators. Enhanced collaboration and information sharing are essential to effectively regulate global financial institutions and address cross-border risks and challenges. Regulatory sandboxes are controlled environments where businesses can test innovative products, services, and business models without the risk of violating regulatory requirements. These sandboxes help regulators better understand new technologies and adapt regulatory frameworks to encourage innovation while maintaining consumer protection and financial stability. Regulatory capture occurs when regulators become too closely aligned with the industries they are supposed to regulate, leading to decisions that favor industry interests over public welfare. Maintaining the independence and impartiality of financial regulators is essential to prevent regulatory capture and ensure effective regulation. Striking the right balance between over-regulation and under-regulation is a significant challenge for financial regulators. Over-regulation can stifle innovation, limit competition, and create unnecessary costs for financial institutions. On the other hand, under-regulation may expose consumers and the financial system to unnecessary risks and potential crises. Regulation can sometimes hinder financial innovation and competitiveness by creating barriers to entry and limiting the development of new products and services. Regulators must strike a balance between ensuring the safety and soundness of the financial system and fostering an environment that encourages innovation and competition. Financial regulators must navigate the delicate balance between maintaining financial stability and promoting economic growth. Excessive focus on stability may constrain credit availability and impede growth, while an emphasis on growth may lead to excessive risk-taking and financial instability. The evolving role of financial regulators in today's dynamic financial landscape underscores the importance of robust and adaptive regulatory frameworks. As new challenges and trends emerge, regulators must continue to collaborate and coordinate their efforts to protect consumers, maintain financial stability, and promote fair competition and innovation in the financial sector.What Are Financial Regulators?

Types of Financial Regulators

Central Banks

Functions and Roles

Monetary Policy

Examples: Federal Reserve, European Central Bank, Bank of England

Securities and Exchange Commissions

Functions and Roles

Market Supervision and Transparency

Examples: U.S. Securities and Exchange Commission, Financial Conduct Authority

Insurance Regulators

Functions and Roles

Solvency and Policyholder Protection

Examples: National Association of Insurance Commissioners, Prudential Regulation Authority

Banking Supervisory Authorities

Functions and Roles

Prudential Regulation and Supervision

Examples: Office of the Comptroller of the Currency, European Banking Authority

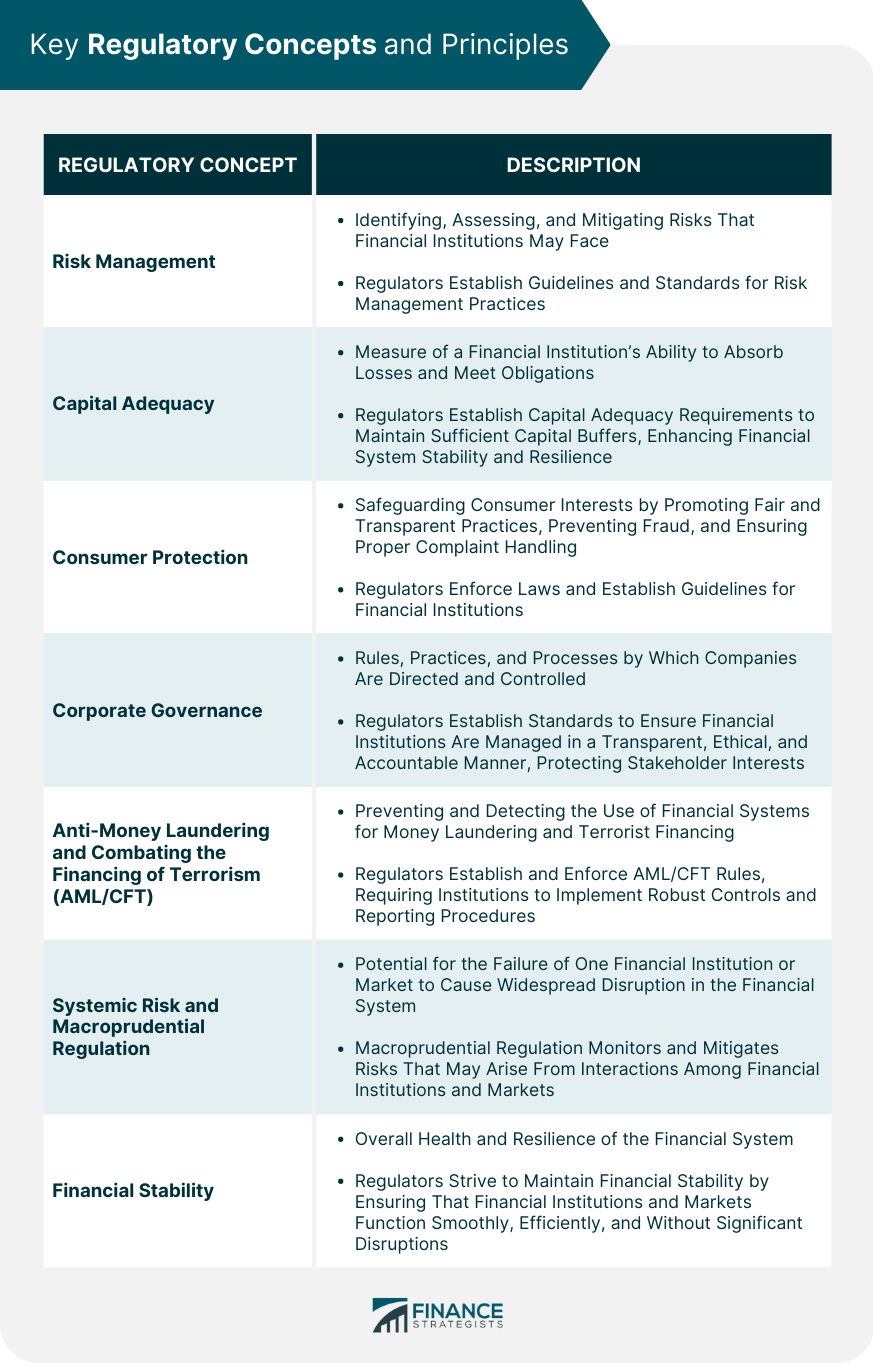

Key Regulatory Concepts and Principles

Risk Management

Capital Adequacy

Consumer Protection

Corporate Governance

Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT)

Systemic Risk and Macroprudential Regulation

Financial Stability

Regulatory Challenges and Emerging Trends

Financial Technology (FinTech) and Digital Currencies

Climate-Related Financial Risks

Cybersecurity and Data Privacy

Cross-Border Regulatory Cooperation

Regulatory Sandboxes and Innovation

Criticisms and Controversies

Regulatory Capture

Over-Regulation vs Under-Regulation

Impact on Financial Innovation and Competitiveness

Balancing Stability and Growth

Conclusion

Financial Regulators FAQs

Financial regulators are government agencies responsible for overseeing and enforcing laws and regulations that govern the financial industry. They work to ensure that financial institutions comply with regulations and operate fairly and transparently.

Examples of financial regulators include the Federal Reserve, the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Industry Regulatory Authority (FINRA).

Financial regulators play a critical role in maintaining the stability and integrity of the financial system. They help to prevent fraud and other abuses, protect consumers, and promote fair competition among financial institutions.

Financial regulators have the authority to conduct inspections, investigations, and audits of financial institutions to ensure compliance with regulations. They can also take enforcement actions, such as imposing fines, revoking licenses, or bringing legal action against violators.

Individuals and businesses can interact with financial regulators in a variety of ways, such as submitting complaints, requesting information, or participating in rulemaking processes. Financial regulators also provide educational resources to help individuals and businesses better understand financial regulations and how they apply to their specific situations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.