Windfall management strategies are critical for anyone who receives a significant amount of money unexpectedly. A windfall is any unexpected or unplanned financial gain, such as an inheritance, a work bonus, or a lottery win. While it can be exciting to receive a windfall, it is important to have a plan in place to manage it effectively. One of the most significant reasons why windfall management strategies are essential is to avoid wasting money on frivolous purchases or expenses that will not benefit your financial future. Many people who receive a windfall tend to overspend and make impulsive purchases, which can quickly deplete their newfound wealth. One of the first steps after receiving a windfall is to maintain confidentiality. Sharing the news prematurely can lead to unwanted attention, unsolicited advice, and even potential scams. Before making any financial decisions, it is essential to consult with a professional financial advisor. They can provide personalized guidance, create a comprehensive financial plan, and offer strategies to maximize the benefits of windfall. One of the most effective ways to improve financial stability is to pay off high-interest debt, such as credit card balances and personal loans. Reducing debt can lead to significant savings in interest payments and improve overall financial health. Establishing an emergency fund can help protect against unexpected expenses and provide a safety net for unforeseen financial challenges. This fund should cover at least three to six months' worth of living expenses. Setting clear financial goals is crucial when managing a windfall. These goals should include both short-term objectives, such as paying off debt or purchasing a home, and long-term aspirations, such as funding retirement or providing for future generations. Creating a budget can help ensure that the windfall is used effectively and responsibly. A budget should include all sources of income, expenses, savings, and investments. Before making investment decisions, it is essential to understand personal risk tolerance and investment preferences. This will help guide the selection of suitable investment options and ensure a comfortable balance between risk and potential returns. Determining how much of the windfall should be allocated towards savings, investments, and philanthropic endeavors can help create a balanced financial plan. This allocation will depend on individual goals, risk tolerance, and personal values. Windfalls can have significant tax implications, depending on their source and size. Consulting with a tax professional can help navigate these complexities and minimize the tax burden. Implementing tax-efficient investment strategies, such as utilizing tax-advantaged accounts or investing in tax-exempt securities, can help maximize after-tax returns and preserve wealth. Incorporating estate planning and gifting strategies can help reduce the tax burden on beneficiaries and ensure that the wealth is distributed according to the recipient's wishes. Working with an estate planning attorney can help create a comprehensive plan that minimizes taxes and addresses potential challenges. Diversification and proper asset allocation are essential for managing risk and optimizing returns. A well-diversified portfolio includes investments from various asset classes, such as stocks, bonds, and real estate, to minimize the impact of market fluctuations. Choosing between passive and active investment strategies depends on personal preferences, risk tolerance, and investment goals. Passive strategies, such as index funds, aim to track the performance of a specific market index, while active strategies involve selecting individual investments with the goal of outperforming the market. In addition to traditional investments, such as stocks and bonds, recipients may consider real estate and alternative investments, such as private equity, hedge funds, or commodities, to further diversify their portfolio and potentially enhance returns. Regularly monitoring and adjusting the investment portfolio is crucial for maintaining a well-balanced and optimized asset allocation. Changes in financial goals, risk tolerance, or market conditions may necessitate adjustments to the portfolio. After receiving a windfall, it is essential to review existing insurance coverage to ensure it is adequate for the new financial situation. This may involve updating or purchasing new life, disability, or property insurance policies. A significant increase in wealth may necessitate additional insurance coverage to protect assets and minimize potential financial risks. This can include obtaining umbrella liability insurance, which provides coverage beyond the limits of standard policies. Liability insurance can help protect against potential lawsuits and other claims that could threaten the recipient's assets. Obtaining adequate coverage can provide peace of mind and financial security. Philanthropy can be an important aspect of windfall management for many recipients. Options for charitable giving include direct donations, donor-advised funds, and charitable trusts. Creating a charitable foundation or trust can provide a structured and tax-efficient way to support causes that align with the recipient's values and passions. Working with legal and financial advisors can help establish and manage these philanthropic entities. Incorporating charitable giving into estate planning can help reduce estate taxes, ensure the recipient's legacy, and create a lasting impact on the causes that matter most to them. To maintain financial health and stay on track with financial goals, it is essential to conduct regular financial reviews and make necessary adjustments to the financial plan. Continuing to learn about personal finance and staying informed about market trends can help windfall recipients make informed decisions and effectively manage their wealth. Adopting and maintaining disciplined spending habits is crucial for preserving wealth and achieving long-term financial stability. Windfall management strategies are essential to ensure that unexpected financial gains are managed effectively. The emotional impact of sudden wealth can be overwhelming, making it crucial to maintain confidentiality, avoid impulsive decisions and seek guidance from trusted individuals. Establishing short-term and long-term financial goals, developing a budget, and assessing risk tolerance are critical in creating a comprehensive financial plan. Tax planning, estate planning, and gifting strategies can minimize the tax burden and ensure the wealth is distributed according to the recipient's wishes. Diversification and proper asset allocation, choosing between passive and active investment strategies, and considering alternative investments are essential in investment strategies. Regularly monitoring and adjusting the investment portfolio, reviewing existing insurance coverage, and assessing additional coverage needs are vital in insurance and risk management. Overall, these strategies can help maximize the benefits of a windfall and ensure long-term financial stability.Importance of Windfall Management Strategies

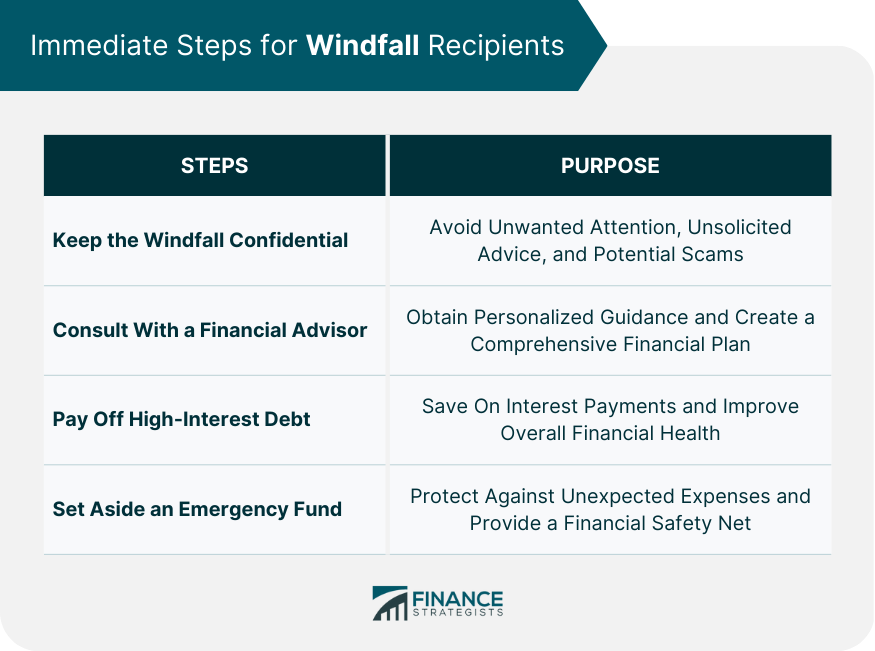

Immediate Steps for Windfall Recipients

Keep the Windfall Confidential

Consult With a Financial Advisor

Pay Off High-Interest Debt

Set Aside an Emergency Fund

Building a Comprehensive Financial Plan

Establish Short-Term and Long-Term Financial Goals

Develop a Budget

Assess Risk Tolerance and Investment Preferences

Allocate Funds for Savings, Investments, and Philanthropy

Tax Planning Strategies

Understanding Tax Implications of the Windfall

Employing Tax-Efficient Investment Strategies

Estate Planning and Gifting Strategies

Investment Strategies for Windfall Recipients

Diversification and Asset Allocation

Passive vs Active Investment Strategies

Real Estate and Alternative Investments

Monitoring and Adjusting the Investment Portfolio

Insurance and Risk Management

Reviewing Existing Insurance Coverage

Assessing Additional Coverage Needs

Protecting Assets With Liability Insurance

Philanthropy and Legacy Planning

Exploring Charitable Giving Options

Establishing a Charitable Foundation or Trust

Integrating Philanthropy Into Estate Planning

Maintaining Financial Health

Regular Financial Reviews and Adjustments

Continued Financial Education and Awareness

Practicing Disciplined Spending Habits

The Bottom Line

Windfall Management Strategies FAQs

Windfall Management Strategies in financial planning include understanding the psychological aspects, taking immediate steps to secure the windfall, building a comprehensive financial plan, implementing tax planning strategies, selecting investment strategies, managing risks through insurance, incorporating philanthropy and legacy planning, and maintaining long-term financial health.

Windfall Management Strategies are crucial for recipients of sudden wealth because they provide a structured approach to managing the newfound wealth responsibly. These strategies help prevent impulsive decisions, optimize tax and investment strategies, and ensure long-term financial stability and growth.

Windfall Management Strategies help recipients achieve their financial goals by providing guidance on creating a comprehensive financial plan, including setting short-term and long-term goals, developing a budget, and allocating funds for savings, investments, and philanthropy. The strategies also address tax planning, investment strategies, and risk management, which contribute to the overall financial success of the recipient.

Professional advisors play a vital role in Windfall Management Strategies by providing expert guidance, creating personalized financial plans, and recommending strategies tailored to the recipient's unique situation, goals, and risk tolerance. Advisors may include financial planners, tax professionals, and estate planning attorneys who help navigate the complexities of managing a windfall and ensure long-term financial stability.

Windfall Management Strategies help recipients maintain their financial health over time by emphasizing regular financial reviews and adjustments, continued financial education, and disciplined spending habits. These practices ensure that recipients stay informed, make sound financial decisions, and effectively manage their wealth to achieve long-term financial stability and growth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.