Student loan planning refers to the process of evaluating your financial needs, exploring funding options, selecting the right loan, and creating a repayment strategy to manage your student loans effectively. It involves assessing your financial situation and estimating your future earning potential to determine the amount of funding you need, researching various types of loans and funding sources, and developing a repayment plan that fits your budget and financial goals. When planning for student loans, it is essential to have a clear understanding of your financial needs. This includes considering the cost of tuition and fees, living expenses, and books and supplies. Make sure to research the costs associated with attending your desired institution and create a budget that accounts for all expenses. Tuition and fees are the primary costs associated with attending a college or university. These costs can vary significantly depending on the type of institution (public or private) and the degree program. Research the specific costs for your desired program and factor these into your budget. Living expenses include the costs of housing, food, transportation, and personal items. When budgeting for living expenses, consider whether you will be living on-campus or off-campus, and research the cost of living in the area surrounding your chosen institution. Books and supplies are an often-overlooked cost of attending college. Textbooks, lab materials, and other necessary supplies can quickly add up. Be sure to include these costs in your budget and explore options for saving money, such as purchasing used books or renting textbooks. In addition to student loans, it is crucial to consider personal and family resources when planning for college expenses. This includes savings and investments, contributions from family members, and other sources of funding. Evaluate any savings or investments you or your family may have set aside for college expenses. This can help reduce the amount of student loans needed to cover your educational costs. Discuss with your family members the extent to which they can contribute to your college expenses. This may include direct financial support or assistance with living expenses. Explore other sources of funding that may be available, such as employer-sponsored tuition assistance programs or veteran benefits. An essential factor to consider when planning for student loans is your future earning potential. Research the average starting salary for your chosen field and consider how this may impact your ability to repay student loans. Federal student loans are often the most favorable option for students due to their low interest rates and flexible repayment options. Subsidized loans are need-based and do not accrue interest while the student is enrolled in school. Unsubsidized loans are not need-based and begin accruing interest immediately after disbursement. PLUS loans are available to parents of undergraduate students and to graduate students. These loans have higher interest rates and may require a credit check. Perkins loans are low-interest, need-based loans that are awarded by participating colleges and universities. Note that the availability of Perkins loans depends on the institution and federal funding. Private student loans are offered by banks and other financial institutions. While they can help fill funding gaps, they typically have higher interest rates and less flexible repayment options compared to federal loans. Private loans may offer additional funding when federal options are exhausted, but they often come with higher interest rates, stricter repayment terms, and fewer borrower protections. Private loan interest rates can be fixed or variable, and repayment terms vary by lender. Be sure to compare interest rates and repayment terms among different private loan providers to find the best option for your needs. Private student loans often require a credit check, and borrowers with a higher credit score are more likely to receive favorable interest rates. Some lenders may also require a co-signer, who is responsible for the loan if the borrower fails to repay. Scholarships and grants are an ideal source of funding, as they do not need to be repaid. There are various types of scholarships and grants available, including merit-based, need-based, and those offered by institutions and organizations. Merit-based scholarships are awarded based on academic achievement, athletic performance, or other talents. Research and apply for scholarships in your areas of strength. Need-based grants are awarded based on financial need. The most well-known need-based grant is the Pell Grant, which is provided by the federal government. Many colleges and universities also offer their own need-based grants. Many colleges, universities, and organizations offer scholarships to students based on various factors such as academic achievement, community involvement, or intended major. Research and apply for these scholarships to help reduce your reliance on student loans. Work-study programs and part-time employment can provide additional financial support while also offering valuable work experience. Explore on-campus work-study opportunities or seek part-time jobs in the surrounding community. When choosing a student loan, compare interest rates among different loan options. Lower interest rates can result in significant savings over the life of the loan. Carefully review the repayment terms and conditions of each loan, including grace periods, deferment options, and the availability of income-driven repayment plans. Be aware of any loan fees or penalties associated with each loan option. Some loans may have origination fees or prepayment penalties, which can increase the overall cost of borrowing. Deferment and forbearance options allow you to temporarily postpone loan payments in certain circumstances, such as financial hardship or returning to school. Consider the availability of these options when selecting a loan. Some loans may be eligible for consolidation or refinancing, which can simplify repayment or potentially lower your interest rate. Be aware of the potential benefits and drawbacks of these options. There are various repayment plans available for federal student loans, including standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. Understand your options and choose the plan that best fits your financial situation. Under the standard repayment plan, you will make fixed monthly payments over a 10-year period. This plan results in the lowest overall interest paid but may have higher monthly payments. Graduated repayment plans start with lower monthly payments that gradually increase over time, typically every two years. This plan can be a good option for borrowers who expect their income to increase over time. Extended repayment plans allow you to make smaller monthly payments over a longer period, up to 25 years. While this plan can reduce your monthly payments, it will result in more interest paid over the life of the loan. Income-driven repayment (IDR) plans base your monthly payments on your income and family size, with any remaining balance forgiven after 20-25 years of payments. IDR plans can be beneficial for borrowers with low or variable income. When repaying multiple student loans, prioritize paying off loans with the highest interest rates first. This strategy, known as the "debt avalanche" method, can help minimize the total amount of interest paid over the life of your loans. Consider various strategies for paying off your student loans early, which can save you money on interest and reduce your overall debt burden. Making extra payments toward your student loans can help reduce the principal balance and the amount of interest paid over the life of the loan. Even small additional payments can make a significant difference over time. Refinancing involves taking out a new loan with a lower interest rate to pay off your existing student loans. This can potentially save you money on interest and help you pay off your loans more quickly. However, refinancing may not be suitable for everyone, particularly if you have federal loans with borrower protections and flexible repayment options. Loan forgiveness programs can help eligible borrowers reduce or eliminate their student loan debt. Explore the various forgiveness programs available to determine if you qualify. The PSLF program forgives the remaining balance on federal student loans after 120 qualifying monthly payments while working full-time for a qualifying employer in the public sector. This program can be particularly beneficial for borrowers pursuing careers in government or non-profit organizations. The Teacher Loan Forgiveness program provides forgiveness for eligible federal student loans for teachers who work in low-income schools for five consecutive years. The amount of forgiveness varies depending on the subject and grade level taught. IDR forgiveness programs forgive the remaining balance on federal student loans after 20-25 years of qualifying payments under an income-driven repayment plan. Note that any forgiven balance may be considered taxable income. Borrowers who become permanently disabled may be eligible for a total and permanent disability (TPD) discharge, which cancels the outstanding balance on their federal student loans. If your school closes while you are enrolled or shortly after you withdraw, you may be eligible for a discharge of your federal student loans. Staying informed and proactive in your student loan planning is crucial for successfully managing your educational expenses and minimizing your debt burden. Regularly re-evaluate your loan repayment strategy and seek help and advice when needed. By thoroughly understanding your financial situation, exploring funding options, and creating a well-informed repayment plan, you can successfully navigate the world of student loans and invest in your future.What Is Student Loan Planning?

Assessing Your Financial Situation

Understanding Your Financial Needs

Tuition and Fees

Living Expenses

Books and Supplies

Evaluating Personal and Family Resources

Savings and Investments

Contributions From Family Members

Other Sources of Funding

Estimating Future Earning Potential

Exploring Funding Options

Federal Student Loans

Subsidized and Unsubsidized Loans

PLUS Loans for Parents and Graduate Students

Perkins Loans (If Available)

Private Student Loans

Pros and Cons

Interest Rates and Repayment Terms

Credit Requirements

Scholarships and Grants

Merit-Based Scholarships

Need-Based Grants

Institutional and Organizational Scholarships

Work-Study Programs and Part-Time Employment

Selecting the Right Loan

Comparing Interest Rates

Repayment Terms and Conditions

Loan Fees and Penalties

Deferment and Forbearance Options

Consolidation and Refinancing Possibilities

Creating a Repayment Strategy

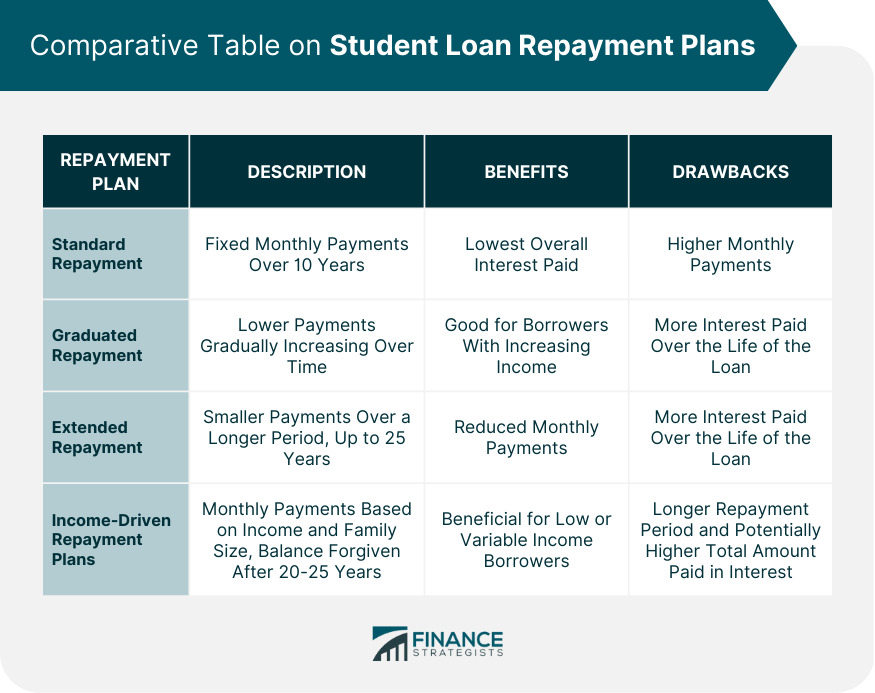

Understanding Different Repayment Plans

Standard Repayment

Graduated Repayment

Extended Repayment

Income-Driven Repayment Plans

Prioritizing Loan Payments

Strategies for Paying Off Loans Early

Extra Payments

Refinancing

Loan Forgiveness Programs

Navigating Loan Forgiveness and Cancellation Programs

Public Service Loan Forgiveness (PSLF)

Teacher Loan Forgiveness

Income-Driven Repayment (IDR) Forgiveness

Disability Discharge

Closed School Discharge

Conclusion

Student Loan Planning FAQs

Student loan planning is the process of evaluating your student loan options and creating a repayment strategy that fits your financial situation.

Student loan planning is important because it helps you avoid financial pitfalls and manage your student loan debt effectively. It can save you money in interest over time and prevent default.

To start student loan planning, gather information about your loans, including the repayment terms, interest rates, and monthly payments. Then, create a budget to determine how much you can afford to pay each month and consider exploring repayment options such as income-driven repayment plans.

Income-driven repayment plans are a type of student loan repayment plan that adjusts your monthly payments based on your income and family size. These plans can help you manage your student loan debt more effectively by reducing your monthly payment amount.

Yes, there are resources available to help you with student loan planning. You can consult with a financial advisor or student loan counselor, explore online resources, or contact your loan servicer for information about repayment options and strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.