Gig economy financial planning is the process of managing your finances when you work in the gig economy. It involves creating a financial plan that accounts for the unique financial challenges that come with gig work, such as irregular income, uncertainty about future earnings, and the need to cover expenses that would typically be covered by an employer in traditional employment. The goal of gig economy financial planning is to help gig workers achieve financial stability and security while working independently. Some common strategies for gig economy financial planning may include budgeting for the irregular nature of income, setting aside money for taxes, creating an emergency fund to cover unexpected expenses, and planning for retirement through contributions to a retirement savings account. Additionally, gig economy workers may want to consider working with a financial planner who can help them develop a personalized financial plan that addresses their unique needs and goals. Ultimately, gig economy financial planning is essential for anyone who wants to succeed as an independent worker and achieve long-term financial stability. Freelancing: Professionals such as writers, graphic designers, and web developers offering their services on a project-by-project basis. Ridesharing: Drivers partnering with platforms like Uber and Lyft to provide transportation services. Home-sharing: Homeowners or renters offering their properties for short-term rentals through platforms like Airbnb. Task-based services: Individuals offering various services like handyman work, cleaning, and personal shopping through platforms like TaskRabbit. Flexibility: Gig workers enjoy the ability to choose their work hours, locations, and projects. Income variability: Gig work can lead to inconsistent and unpredictable earnings, making financial planning essential. Lack of traditional benefits: Gig workers often do not receive benefits such as health insurance, paid time off, or retirement plans from their employers. Work-life balance: Gig work may require additional effort to maintain a healthy work-life balance. Emergency fund: Building a cash reserve to cover unexpected expenses or income fluctuations. Paying off high-interest debt: Prioritizing the repayment of high-interest loans or credit card balances. Retirement savings: Ensuring a comfortable retirement by regularly saving and investing. Homeownership: Saving for a down payment and maintaining good credit to secure a mortgage. Education funding: Saving for children's college education or personal skill development. Entrepreneurial ventures: Accumulating capital to start or expand a business. A well-planned budget helps gig workers manage their finances, cope with income variability, and achieve financial goals. Envelope system: Allocating cash for specific expense categories in physical or digital envelopes. Zero-based budgeting: Assigning every dollar earned to a specific expense category, ensuring no money is unaccounted for. 50/30/20 rule: Allocating 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. Apps and software: Utilizing budgeting tools like Mint, YNAB, or Quicken to track expenses and manage finances. Diversifying income streams: Pursuing multiple gig work opportunities to spread risk and ensure a steadier income. Building a cash reserve: Maintaining a larger emergency fund to cover expenses during lean times. Adjusting expenses: Reducing discretionary spending during periods of lower income. Prioritizing debt payments: Focusing on high-interest debt and minimum payments to avoid penalties or damage to credit. Gig workers are typically considered self-employed, and thus responsible for paying self-employment taxes and income taxes. Gig workers may need to make quarterly estimated tax payments to avoid underpayment penalties. Claiming eligible deductions and credits can help gig workers reduce their taxable income and tax liability. Maintaining organized records of income, expenses, and receipts is essential for accurate tax reporting and efficient tax preparation. Marketplace plans: Purchasing individual or family health insurance plans through government-run health insurance exchanges. Group plans: Joining a group health insurance plan through professional organizations or unions. Short-term policies: Obtaining short-term health insurance policies to bridge gaps in coverage. Gig workers should consider obtaining life and disability insurance to protect themselves and their families from financial hardship in case of injury, illness, or death. Individual Retirement Accounts (IRAs): Contributing to traditional or Roth IRAs, which offer tax advantages for retirement savings. Solo 401(k): Establishing a one-participant 401(k) plan designed for self-employed individuals. SEP IRA: Setting up a Simplified Employee Pension (SEP) IRA, which allows for higher contribution limits compared to traditional IRAs. SIMPLE IRA: Creating a Savings Incentive Match Plan for Employees (SIMPLE) IRA, designed for small businesses and self-employed individuals. A good credit score can help gig workers secure better interest rates on loans, credit cards, and mortgages, as well as qualify for rental agreements and utility services. Paying bills on time: Consistently making on-time payments to maintain a positive payment history. Keeping credit utilization low: Minimizing credit card balances relative to credit limits to reduce credit utilization ratios. Monitoring credit reports: Regularly reviewing credit reports for errors and taking steps to correct any inaccuracies. Financial planning for gig workers involves understanding the unique challenges and opportunities presented by the gig economy. By establishing financial goals, budgeting and tracking expenses, managing income variability, planning for taxes, obtaining insurance and benefits, and maintaining good credit, gig workers can achieve financial stability and success. As the gig economy continues to evolve, staying informed and adapting to new financial planning strategies will help gig workers thrive in the long run.What Is Gig Economy Financial Planning?

Understanding the Gig Economy Landscape

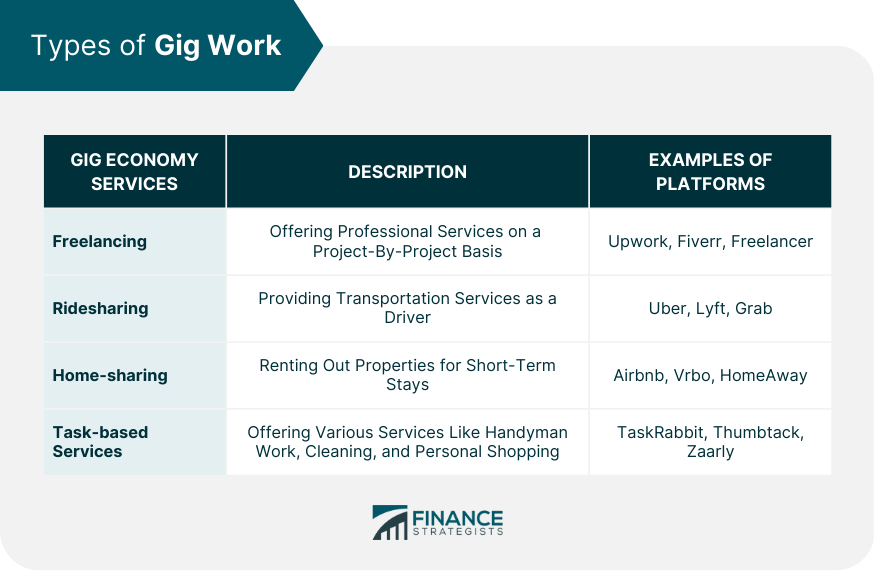

Types of Gig Work

Pros and Cons of Gig Work

Establishing Financial Goals

Short-Term Goals

Long-Term Goals

Budgeting and Tracking Expenses

Importance of Budgeting for Gig Workers

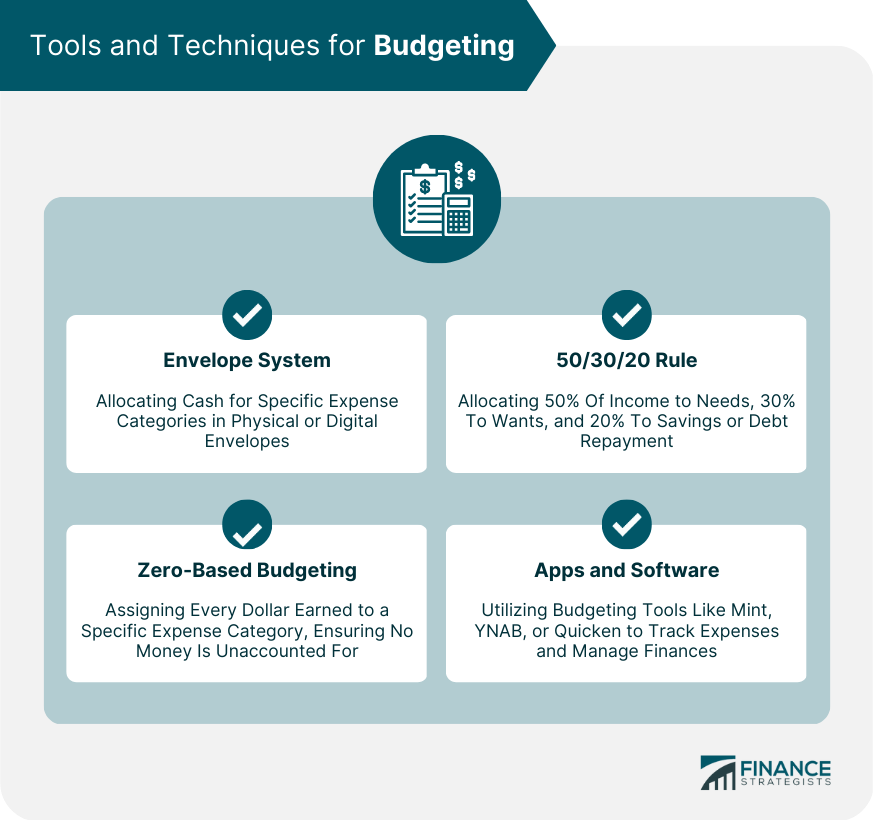

Tools and Techniques for Budgeting

Managing Income Variability

Strategies for Income Smoothing

Planning for Lean Times

Tax Planning and Preparation

Understanding Tax Obligations for Gig Workers

Quarterly Estimated Tax Payments

Deductions and Credits

Record-Keeping and Organization

Insurance and Benefits

Health Insurance Options for Gig Workers

Life and Disability Insurance

Saving for Retirement

Building and Maintaining Good Credit

Importance of Good Credit for Gig Workers

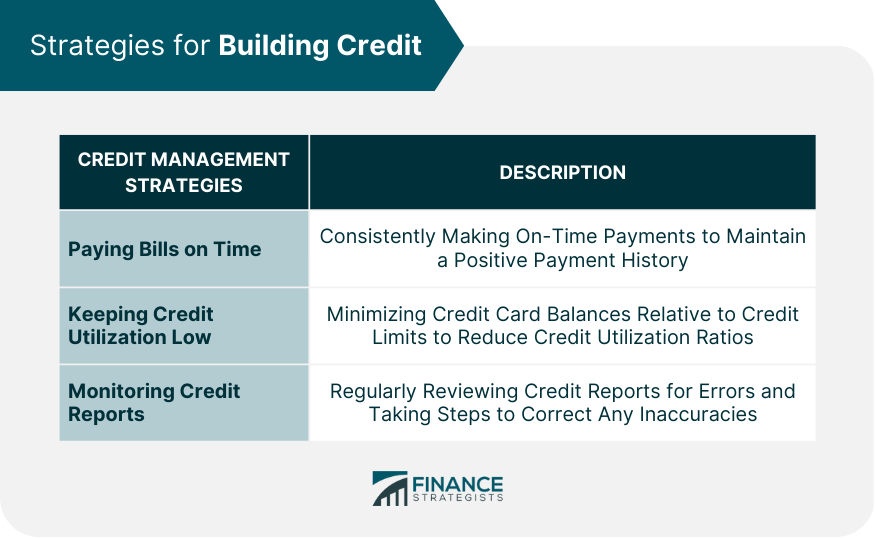

Strategies for Building Credit

Conclusion

Gig Economy Financial Planning FAQs

Gig economy financial planning refers to the process of managing your finances when you work in the gig economy. This type of work often involves working as an independent contractor or freelancer, and it can present unique financial challenges that require specific planning strategies.

Some common financial challenges faced by gig economy workers include irregular income, uncertainty about future earnings, difficulty saving for retirement, and the need to cover their own expenses (such as healthcare and taxes) that would typically be covered by an employer in traditional employment.

Gig economy workers can plan for retirement by creating a budget that allows for regular contributions to a retirement savings account, such as an IRA or 401(k). They may also want to consider working with a financial planner who can help them identify other retirement planning strategies that are specific to their unique situation.

Yes, gig economy workers may be subject to self-employment taxes, which means they'll need to set aside a portion of their income to cover these taxes. They may also be eligible for certain tax deductions related to their work, such as home office expenses or mileage expenses for business-related travel.

Some tips for managing finances as a gig economy worker include creating a budget, setting aside money for taxes and emergencies, tracking income and expenses, and considering insurance options (such as liability insurance or disability insurance) to protect against unexpected financial setbacks. It can also be helpful to work with a financial planner who has experience working with gig economy workers and can offer tailored advice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.