A financial plan is a comprehensive roadmap that outlines an individual's financial goals and strategies to achieve them. It typically includes budgeting, investments, retirement planning, insurance, and estate planning components. Regularly updating your financial plan is crucial to ensuring that it remains aligned with your personal circumstances, financial goals, and the ever-changing economic landscape. Regular updates help to keep your financial strategies on track and adjust them as needed to achieve your objectives. The primary objectives of updating a financial plan are to adapt to changes in personal circumstances, respond to economic and market changes, and reassess financial goals and strategies. Changes in marital status can have a significant impact on your financial plan. Marriage often leads to joint financial goals, while divorce requires a division of assets and a reassessment of individual financial objectives. The addition of a new family member can change your financial priorities, such as saving for education expenses, increasing life insurance coverage, and updating your estate plan. A new job, promotion, or job loss can alter your income and affect your budget, savings, and investment strategies. Entering retirement necessitates a shift from wealth accumulation to wealth preservation and income generation, as well as adjustments to tax and estate planning strategies. Inflation erodes the purchasing power of your money, necessitating adjustments to your savings and investment strategies to maintain your desired lifestyle. Changes in interest rates can influence borrowing costs, investment returns, and the overall economy, affecting your financial plan. Updates to tax laws can impact your financial strategies, such as retirement planning, investments, and estate planning. Market volatility can affect your investment portfolio and may require rebalancing to maintain your desired risk tolerance and investment objectives. Buying a new home or undertaking a significant renovation can alter your financial priorities, requiring adjustments to your budget, savings, and debt repayment strategies. Planning for education expenses, such as college tuition, may require adjustments to your savings and investment strategies. Incorporating travel and leisure goals into your financial plan may require changes to your budget and savings plans. If charitable giving is a priority, your financial plan should include strategies for tax-efficient donations and planned giving. Changes in income necessitate adjustments to your budget, savings, and debt repayment strategies. Regularly monitoring and managing your expenses can help you identify areas for improvement and ensure your budget remains aligned with your financial goals. Paying off debt is essential for achieving financial stability. Updating your financial plan should include assessing your current debt and creating a strategy to pay it off efficiently. A well-diversified investment portfolio can help manage risk and improve long-term returns. Regularly reviewing and adjusting your investments can ensure proper diversification. Your risk tolerance may change over time or with changes in personal circumstances. Updating your financial plan should include assessing your current risk tolerance and adjusting your investments accordingly. As you approach your financial goals, your investment time horizon shortens, necessitating adjustments to your portfolio's risk and return profile. As you approach retirement or experience changes in your financial circumstances, it's essential to reassess your retirement age and income goals. This may involve adjusting your savings and investment strategies to ensure a comfortable retirement. Understanding and maximizing your Social Security and pension benefits can be crucial to a successful retirement plan. Regular updates to your financial plan should include a review of these benefits and their impact on your retirement income. Contribution limits for retirement accounts, such as IRAs and 401(k)s, can change over time. Updating your financial plan should involve adjusting your contributions to take full advantage of these limits and any available tax benefits. Developing a tax-efficient withdrawal strategy can help you minimize taxes during retirement and maximize your retirement income. Regular updates to your financial plan should include a review of your withdrawal strategies in light of any changes in tax laws or personal circumstances. Regularly reviewing and updating your wills and trusts can ensure your estate plan remains aligned with your wishes and any changes in your personal circumstances or the tax code. Keeping beneficiary designations up-to-date on retirement accounts, life insurance policies, and other financial assets is crucial to ensuring that your assets are distributed according to your wishes. Understanding and planning for the tax implications of your estate plan can help minimize the tax burden on your heirs and maximize the assets they inherit. Regularly reviewing your life insurance needs and updating your coverage can ensure that your loved ones are adequately protected in the event of your death. As your financial circumstances change, it's essential to reassess your disability insurance needs and adjust your coverage to protect your income in the event of a disabling illness or injury. Planning for long-term care expenses is a critical component of a comprehensive financial plan. Regular updates should include a review of your long-term care insurance needs and coverage options. Regularly reviewing and updating your property and casualty insurance coverage can ensure that your assets are adequately protected against potential risks and liabilities. A financial planner or advisor can help you develop, implement, and update your financial plan to ensure it remains aligned with your goals and personal circumstances. A CPA can provide valuable tax planning and compliance advice, helping you make informed decisions and navigate changes in tax laws that may affect your financial plan. An estate planning attorney can help you create and update your estate plan, ensuring it complies with current laws and effectively addresses your wishes and objectives. Establishing a regular review schedule for your financial plan can help you proactively address changes in your personal circumstances, financial goals, and the economic environment. Tracking your progress towards your financial goals can help you identify areas for improvement and make adjustments to your plan as needed. Being proactive in addressing changes in your personal circumstances, such as job changes, family additions, or health issues, can help ensure your financial plan remains aligned with your goals and needs. Maintaining open communication with your financial professionals can help you stay informed about changes in the financial landscape and ensure that your financial plan remains up-to-date and effective. Regularly updating your financial plan is crucial to ensuring its ongoing effectiveness and alignment with your personal circumstances, financial goals, and the ever-changing economic landscape. By proactively addressing changes and working with financial professionals, you can better position yourself for financial success. Maintaining an updated financial plan can help you achieve your financial goals, protect your assets, and provide peace of mind for you and your family. In the long run, a well-maintained financial plan can contribute to a more secure and fulfilling financial future.What Are Financial Plan Updates?

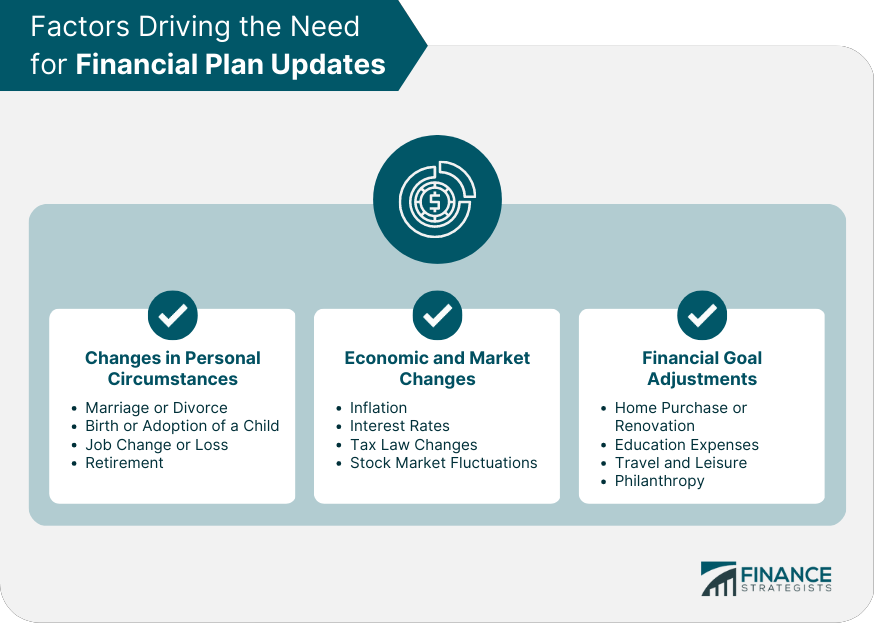

Factors Driving the Need for Financial Plan Updates

Changes in Personal Circumstances

Marriage or Divorce

Birth or Adoption of a Child

Job Change or Loss

Retirement

Economic and Market Changes

Inflation

Interest Rates

Tax Law Changes

Stock Market Fluctuations

Financial Goal Adjustments

Home Purchase or Renovation

Education Expenses

Travel and Leisure

Philanthropy

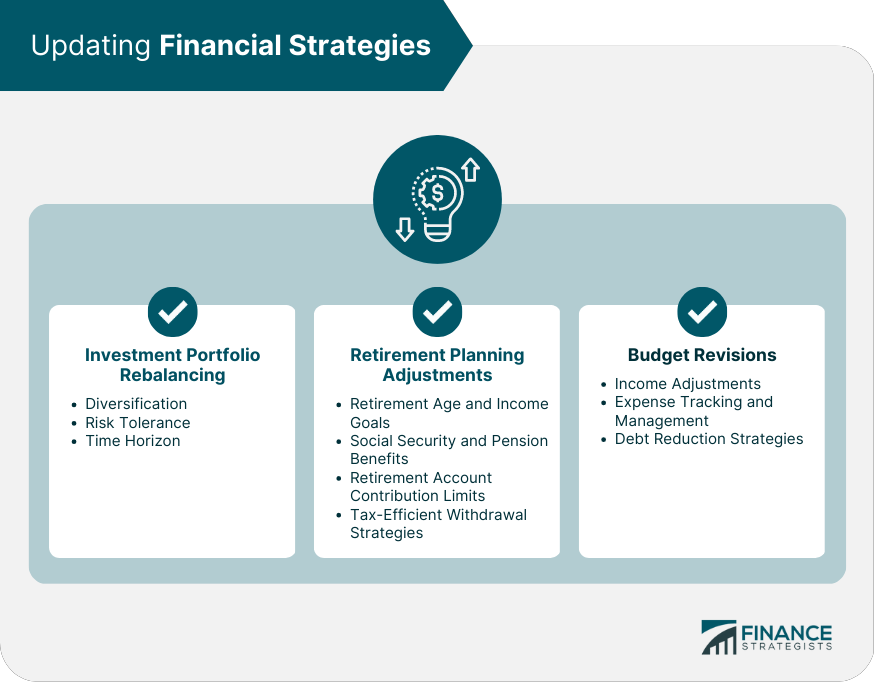

Updating Financial Strategies

Budget Revisions

Income Adjustments

Expense Tracking and Management

Debt Reduction Strategies

Investment Portfolio Rebalancing

Diversification

Risk Tolerance

Time Horizon

Retirement Planning Adjustments

Retirement Age and Income Goals

Social Security and Pension Benefits

Retirement Account Contribution Limits

Tax-Efficient Withdrawal Strategies

Updating Estate Planning and Insurance Needs

Estate Plan Revisions

Wills and Trusts

Beneficiary Designations

Tax Implications

Insurance Coverage Adjustments

Life Insurance

Disability Insurance

Long-Term Care Insurance

Property and Casualty Insurance

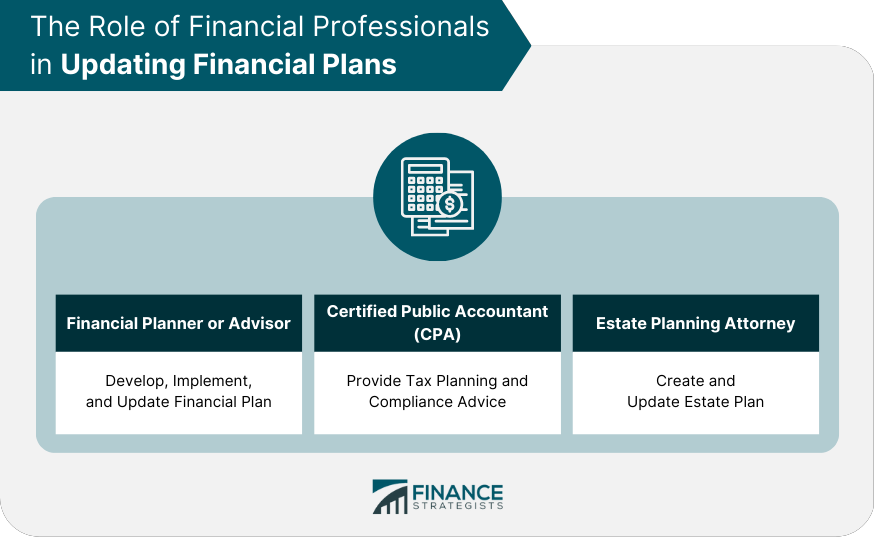

The Role of Financial Professionals in Updating Financial Plans

Financial Planner or Advisor

Certified Public Accountant (CPA)

Estate Planning Attorney

Best Practices for Financial Plan Updates

Regular Review Schedule

Monitoring Progress Towards Financial Goals

Proactively Addressing Changes in Personal Circumstances

Open Communication With Financial Professionals

Conclusion

Financial Plan Updates FAQs

Updating your financial plan is important because your financial situation and goals may change over time. Regular updates ensure that your plan remains aligned with your current objectives and helps you stay on track towards achieving your financial goals.

It is recommended that you review and update your financial plan at least once a year, or whenever there is a significant change in your financial situation or goals. Examples of significant changes may include a change in income, a major life event such as marriage or divorce, or a change in investment strategy.

Updating your financial plan can help you identify potential gaps or areas of improvement in your current financial strategy. It can also help you stay on track towards your long-term financial goals, adjust for changes in your financial situation or goals, and ensure that you are making the most of your financial resources.

To update your financial plan, you should first review your current financial situation and goals. This may involve analyzing your income, expenses, assets, liabilities, and investments. You can then identify any changes that need to be made to your financial strategy and adjust your plan accordingly. It is also recommended that you seek the guidance of a financial advisor or planner to ensure that your plan is comprehensive and effective.

When updating your financial plan, you should consider factors such as changes in your income or expenses, retirement planning, investment strategy, tax planning, and estate planning. You should also consider any major life events that may impact your financial situation, such as marriage, divorce, or the birth of a child.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.