Financial independence refers to a state where an individual has enough personal wealth or passive income to cover all living expenses without relying on active employment. It is the ability to maintain your desired lifestyle without having to work. This can be achieved through a variety of means, including building wealth through investments, creating passive income streams, and reducing expenses. It allows you to make choices that align with your values and priorities, rather than being limited by the need to work for income. Achieving financial independence requires discipline, patience, and a long-term mindset. Dividends are payments made by corporations to their shareholders, usually from the company's profits. Investing in dividend-paying stocks can provide a steady stream of passive income. Owning rental properties can generate passive income through monthly rent payments from tenants. Investing in real estate can provide long-term appreciation and a stable income source. Owning a business, either solely or as a partner, can provide passive income if the business generates consistent profits. Business income may require some active involvement but can still contribute to financial independence. Royalties are payments made to individuals for the use of their intellectual property, such as books, music, or patents. Creating intellectual property with long-term value can generate passive income through royalty payments. An emergency fund is a savings account dedicated to covering unexpected expenses. It is essential to have three to six months' worth of living expenses in an easily accessible account. Saving for retirement is crucial for financial independence. Contribute to retirement accounts, such as a 401(k) or an IRA, to ensure financial security in your later years. Utilize tax-advantaged accounts, like Health Savings Accounts (HSAs) and 529 plans, to save for specific expenses while reducing your tax liability. A diversified investment portfolio can include stocks, bonds, real estate, and alternative investments to minimize risk and optimize returns. Understanding the difference between good and bad debt is essential. Good debt, such as mortgages and student loans, typically has lower interest rates and may provide long-term benefits. Bad debt, like credit card debt, usually carries high interest rates and can hinder financial independence. Create a plan to tackle high-interest debt first, such as the avalanche or snowball methods, to minimize interest expenses and achieve financial independence sooner. A healthy credit score is vital for securing favorable loan terms, renting properties, and even employment. Monitor your credit report, make timely payments, and minimize credit utilization to maintain a good credit score. Monitor your income and expenses to understand your financial situation and make informed decisions about allocating resources. Establish short-term, medium-term, and long-term financial goals to create a roadmap for achieving financial independence. Allocate your income towards essential expenses, savings, investments, and discretionary spending to balance your financial priorities. Distinguish between essential needs and discretionary wants to help reduce expenses and increase savings. Identify areas where you can reduce discretionary spending, such as eating out, entertainment, and vacations, to increase savings. Consider making lifestyle adjustments, such as downsizing your home or car, to reduce expenses and move closer to financial independence. Negotiate your salary to ensure you are fairly compensated for your work and increase your income. Pursue side hustles, such as freelancing or part-time work, to supplement your primary income and accelerate your path to financial independence. Develop additional passive income streams, as mentioned in the Passive Income section, to diversify your income sources and achieve financial independence faster. Establishing an emergency fund should be a priority to ensure financial stability during unexpected events. Focus on paying off high-interest debt, such as credit card debt, to reduce interest expenses and improve your financial health. Work on building your credit score through responsible credit management, including timely payments and maintaining a low credit utilization ratio. Set aside money for large purchases, such as a home or a car, to avoid taking on excessive debt. Invest in income-producing assets, like dividend-paying stocks and rental properties, to grow your wealth and generate passive income. Invest in yourself by pursuing continuing education or skill development opportunities to increase your earning potential and improve your financial situation. Plan for retirement by contributing to tax-advantaged retirement accounts and building a diversified investment portfolio. Develop an estate plan to ensure your assets are distributed according to your wishes and minimize tax liabilities for your heirs. Consider incorporating philanthropy into your long-term financial plans to support causes you are passionate about and leave a lasting impact. Educate yourself about personal finance through books, podcasts, and blogs to build a strong foundation for achieving financial independence. Attend financial courses and workshops to deepen your understanding of complex financial topics and make informed decisions about your finances. Select a financial advisor or planner who aligns with your financial goals and has the appropriate credentials and experience. Understand the fee structures and fiduciary responsibility of financial professionals to ensure your best interests are being served. Utilize budgeting and expense tracking apps to monitor your financial progress and stay on track with your financial goals. Take advantage of investment platforms to research, buy, and manage your investments efficiently and cost-effectively. Use credit monitoring tools to keep an eye on your credit score and report, identify errors, and address potential issues promptly. Achieving financial independence is a lifelong journey that requires discipline, perseverance, and a commitment to continuous learning. By understanding the components of financial independence, creating a budget, setting financial goals, and utilizing available tools and resources, you can make steady progress towards a more secure and fulfilling financial future. Ultimately, the journey towards financial independence is not only about achieving a specific monetary goal but also about cultivating a sense of empowerment and self-reliance that can have a lasting impact on your life.What Is Financial Independence?

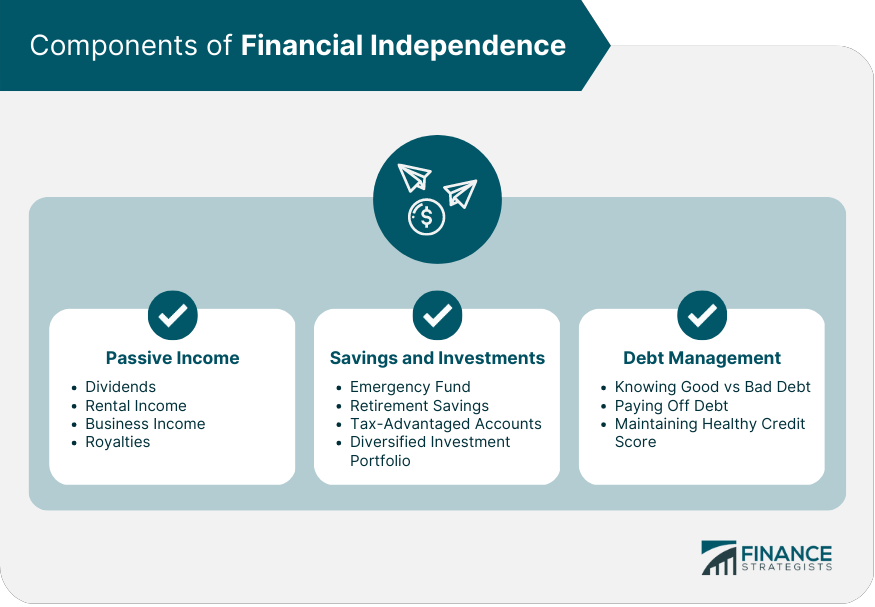

Components of Financial Independence

Passive Income

Dividends

Rental Income

Business Income

Royalties

Savings and Investments

Emergency Fund

Retirement Savings

Tax-Advantaged Accounts

Diversified Investment Portfolio

Debt Management

Good vs Bad Debt

Strategies for Paying off Debt

Maintaining a Healthy Credit Score

Budgeting and Expense Management

Creating a Budget

Tracking Income and Expenses

Identifying Financial Goals

Allocating Resources

Reducing Expenses

Needs vs Wants

Cutting Discretionary Spending

Lifestyle Adjustments

Increasing Income

Negotiating Salary

Side Hustles

Passive Income Streams

Financial Planning

Short-Term Goals

Saving for Emergencies

Paying Off High-Interest Debt

Building Credit

Medium-Term Goals

Saving for Large Purchases

Investing in Income-Producing Assets

Continuing Education or Skill Development

Long-Term Goals

Retirement Planning

Estate Planning

Philanthropy

Tools and Resources for Achieving Financial Independence

Financial Education

Books, Podcasts, and Blogs

Financial Courses and Workshops

Financial Advisors and Planners

Choosing the Right Professional

Fee Structures and Fiduciary Responsibility

Technology

Budgeting and Expense Tracking Apps

Investment Platforms

Credit Monitoring Tools

Conclusion

Financial Independence FAQs

Financial independence refers to a state where an individual has sufficient personal wealth or passive income to cover all living expenses without relying on active employment. In other words, it's the ability to maintain your desired lifestyle without having to work.

Achieving financial independence involves creating a plan and taking action towards increasing your income, reducing your expenses, and building wealth over time through investments and other financial vehicles. It requires discipline, patience, and a long-term mindset.

Financial independence offers individuals the freedom to make choices that align with their values and priorities, rather than being restricted by the need to work for income. It can provide a sense of security, reduce stress, and increase overall well-being.

Yes, anyone can achieve financial independence with the right mindset, strategies, and discipline. It's important to start early and be consistent with savings and investment habits.

The amount of money needed for financial independence varies depending on individual circumstances, including living expenses, lifestyle, and future goals. Generally, experts recommend accumulating enough wealth to cover 25-30 times your annual expenses, which would provide a safe withdrawal rate of 3-4% annually.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.