Divorce financial planning is the process of analyzing and addressing the financial issues that arise during a divorce. It involves working with a financial planner or advisor to evaluate the financial implications of a divorce, including the division of assets and debts, spousal and child support, tax consequences, and other financial matters. Divorce financial planning may also involve developing a post-divorce budget, identifying sources of income and assets, and developing a long-term financial plan for the future. The goal of divorce financial planning is to help individuals navigate the complex financial aspects of divorce and make informed decisions that support their financial well-being and long-term goals. It can be particularly helpful for individuals with complex financial situations or high-net-worth couples, where the stakes of a divorce can be particularly high.

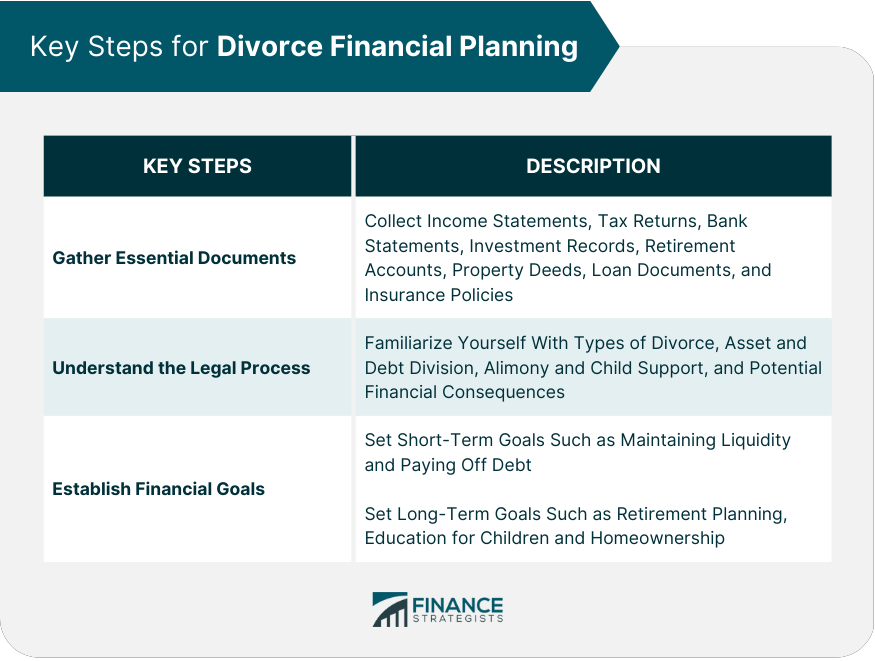

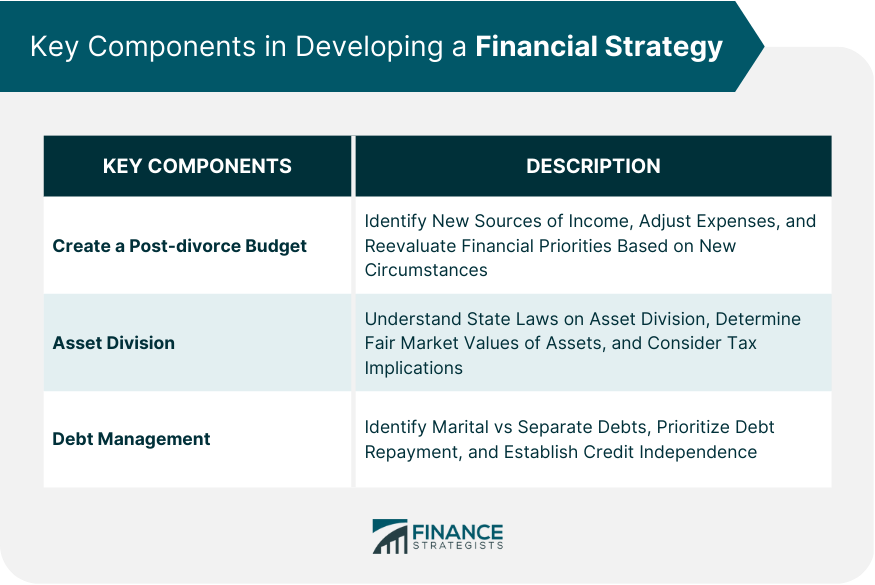

Before diving into the financial planning process, it is crucial to gather all relevant financial documents. These may include: Income statements, such as pay stubs or W-2s Tax returns from recent years Bank statements for all accounts Investment records, including stocks, bonds, and mutual funds Property deeds for real estate holdings Loan documents, including mortgages, car loans, and personal loans Insurance policies, including life, health, and property insurance An essential part of divorce financial planning is understanding the legal process and its potential financial consequences. Consider the following aspects: Types of Divorce: contested, uncontested, collaborative, or mediated Division of Assets and Debts: equitable distribution vs community property Alimony and Child support: determining eligibility and payment amounts Financial Consequences of Divorce: tax implications and credit impact Setting short-term financial goals is critical for maintaining stability during and immediately after the divorce. These goals may include: Maintaining Liquidity: ensuring access to cash for immediate needs Paying off Immediate Debts: prioritizing high-interest or essential debts Long-term financial goals help guide your financial planning for the years following the divorce. These goals may include: Retirement Planning: assessing and adjusting retirement savings strategies Education Funding for Children: planning for college expenses Homeownership: purchasing or maintaining a home post-divorce A post-divorce budget is essential for adapting to new financial circumstances. Consider the following: Identifying New Sources of Income: employment, alimony, or child support Adjusting Expenses: reducing or reallocating spending based on new circumstances Reevaluating Financial Priorities: focusing on essential needs and goals Asset division is a critical component of the divorce process. Consider the following factors: Equitable Distribution vs Community Property: understanding state laws on asset division Valuation of Assets: determining fair market values for property and investments Tax Implications: considering the tax consequences of asset division Managing debts during and after a divorce is crucial for financial stability. Consider the following strategies: Identifying Marital vs Separate Debts: understanding each party's responsibility Prioritizing Debt Repayment: focusing on high-interest or essential debts Establishing Credit Independence: separating joint accounts and building individual credit Addressing retirement accounts during divorce is essential to ensure future financial security. Consider the following: QDROs and Division of Retirement Assets: understanding the legal process for dividing retirement accounts Social Security Benefits: assessing eligibility for spousal benefits Insurance coverage is crucial for protecting against unforeseen events. Consider the following types of insurance Coverage: Health Insurance: exploring options for maintaining coverage after divorce Life Insurance: adjusting policies and beneficiaries as needed Disability Insurance: ensuring continued protection against loss of income due to disability Property Insurance: reviewing and updating coverage for homes, vehicles, and other property Working with financial professionals can provide valuable guidance and support during the divorce financial planning process. Consider the following types of advisors: Financial Advisors: professionals who can assist with overall financial planning and management Divorce Financial Planners: specialists in addressing the unique financial challenges of divorce A Certified Divorce Financial Analyst (CDFA) is a financial professional with specialized training in divorce-related financial issues. They can provide invaluable assistance in navigating the complex financial aspects of divorce and help develop comprehensive financial strategies for the future. In addition to financial professionals, working closely with divorce attorneys and other experts can ensure a well-rounded approach to divorce financial planning. This collaboration can help protect your financial interests and secure a more favorable outcome. After the divorce is finalized, it is crucial to adapt to new financial circumstances and implement the strategies developed during the planning process. Continuously monitoring and adjusting your financial plan will help ensure long-term stability and success. Post-divorce, it is essential to update your estate plan, including wills, trusts, and powers of attorney, to reflect your new circumstances. Additionally, review and update beneficiary designations on life insurance policies, retirement accounts, and other relevant financial products. As life changes, so do your financial needs and goals. Regularly reviewing and adjusting your financial plan can help you stay on track and achieve your objectives. Divorce financial planning can be a challenging and emotional process, but it is crucial for achieving financial stability and success in the aftermath of a divorce. To ensure the best possible outcome, individuals should work with financial professionals, attorneys, and other experts to gather essential documents, understand the legal process, establish financial goals, and develop a comprehensive financial strategy that addresses all relevant issues. Key factors to consider during the divorce financial planning process include creating a post-divorce budget, dividing assets and debts, managing debt, addressing retirement and insurance considerations, and adjusting estate plans and beneficiary designations. Ultimately, the goal of divorce financial planning is to help individuals navigate the complex financial aspects of divorce and make informed decisions that support their financial well-being and long-term goals. By leveraging professional guidance and support and continuously monitoring and adjusting their financial plans, individuals can adapt to their new circumstances and achieve long-term financial stability and success.What Is Divorce Financial Planning?

Preparing for Divorce Financial Planning

Gathering Essential Documents

Understanding the Legal Process

Establishing Financial Goals

Short-Term Goals

Long-Term Goals

Developing a Financial Strategy

Creating a Post-divorce Budget

Asset Division

Debt Management

Navigating Retirement and Insurance Considerations

Retirement Accounts

Insurance Coverage

Seeking Professional Advice

Financial Advisors and Divorce Financial Planners

Certified Divorce Financial Analyst (CDFA)

Collaborating With Attorneys and Other Professionals

Post-divorce Financial Planning

Adjusting to New Financial Circumstances

Revising Estate Plans and Beneficiary Designations

Continuously Monitor and Adjust Financial Goals and Strategies

Conclusion

Divorce Financial Planning FAQs

Divorce financial planning is the process of managing finances, assets, and debts during and after a separation. It is crucial for ensuring a smooth transition to a post-divorce life and maintaining long-term financial stability. By addressing potential financial challenges, individuals can avoid unnecessary stress and secure their financial future.

Divorce financial planning allows you to identify and set both short-term and long-term financial goals. Short-term goals, such as maintaining liquidity and paying off immediate debts, ensure financial stability during and immediately after the divorce. Long-term goals, including retirement planning, education funding for children, and homeownership, help guide your financial strategies for the years following the divorce.

Financial professionals, such as financial advisors, divorce financial planners, and Certified Divorce Financial Analysts (CDFAs), can provide valuable guidance and support during the divorce financial planning process. They can help you navigate the complex financial aspects of divorce and develop comprehensive strategies for the future. It is advisable to seek their advice early in the divorce process to ensure a well-rounded approach and protect your financial interests.

Divorce financial planning addresses retirement and insurance considerations by examining the division of retirement assets, potential eligibility for spousal Social Security benefits, and insurance coverage adjustments. This process involves understanding legal procedures like Qualified Domestic Relations Orders (QDROs) for dividing retirement accounts and reviewing health, life, disability, and property insurance policies to ensure continued protection and coverage.

After completing the divorce financial planning process, it is essential to adjust to your new financial circumstances, revise your estate plans and beneficiary designations, and continuously monitor and adjust your financial goals and strategies. By actively managing your finances and adapting to changes in your life, you can maintain long-term financial stability and success.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.