Comprehensive financial planning is a holistic approach to managing personal finances, covering various aspects of an individual's financial life. It involves setting financial goals, creating a plan to achieve those goals, and monitoring progress along the way. This approach ensures financial stability and growth, leading to long-term financial success. In today's complex financial environment, comprehensive financial planning is essential for financial success. It enables individuals to make informed decisions, minimize risks, and optimize financial resources. Additionally, it helps in achieving financial goals such as buying a house, funding education, or securing a comfortable retirement. Budgeting and cash flow management are crucial components of comprehensive financial planning. A well-designed budget helps individuals track income and expenses, ensuring they live within their means. Proper cash flow management enables individuals to allocate resources efficiently and make informed financial decisions. Risk management and insurance planning help individuals protect their financial assets from unforeseen events. This involves identifying potential risks, such as job loss or medical emergencies, and taking appropriate measures to mitigate their impact. Insurance policies, such as life, health, and disability insurance, can provide financial protection in case of unexpected events. Investment planning is a key aspect of comprehensive financial planning, focusing on building and managing an investment portfolio. It involves selecting appropriate investments based on risk tolerance, financial goals, and time horizon. A well-diversified portfolio can help individuals grow their wealth and achieve long-term financial objectives. Tax planning aims to minimize tax liabilities and maximize after-tax returns on investments. It involves understanding tax laws and regulations, taking advantage of available deductions and credits, and choosing tax-efficient investment strategies. Effective tax planning can save individuals significant amounts of money and improve their overall financial situation. Retirement planning is the process of preparing for life after one's working years. It involves setting retirement goals, estimating retirement expenses, and determining the required savings and investments to achieve those goals. Comprehensive retirement planning ensures individuals have enough resources to maintain their desired lifestyle during retirement. Estate planning focuses on the transfer of assets to heirs and beneficiaries after an individual's death. It involves creating a will, setting up trusts, and minimizing estate taxes. Proper estate planning ensures that an individual's financial legacy is preserved and passed on according to their wishes. The financial planning process begins with establishing a relationship between the client and the financial planner. This involves discussing the planner's services, fees, and responsibilities, as well as the client's expectations and financial goals. A strong relationship built on trust is essential for successful financial planning. The next step involves gathering relevant financial data from the client, such as income, expenses, assets, liabilities, and risk tolerance. This information is used to help the client set realistic and achievable financial goals. Clear financial goals serve as the foundation for creating a tailored financial plan. The financial planner then analyzes and evaluates the client's financial data to determine their current financial status. This involves assessing the client's net worth, cash flow, and financial ratios. Based on this analysis, the planner can identify areas of improvement and develop strategies to help the client reach their financial goals. Using the collected data and analysis, the financial planner creates a comprehensive financial plan tailored to the client's needs and goals. The plan includes recommendations for budgeting, investments, risk management, tax planning, retirement planning, and estate planning. The planner presents the plan to the client, explaining the rationale behind the recommendations and addressing any concerns or questions. Once the client approves the financial plan, the next step is to implement the recommended strategies. This may involve opening investment accounts, purchasing insurance policies, adjusting budgets, or making changes to the client's estate plan. The financial planner may assist the client with these tasks or coordinate with other professionals as needed. Financial planning is an ongoing process, requiring regular monitoring and adjustments as the client's financial situation, goals, and market conditions change. The financial planner and client should review the plan periodically and make necessary adjustments to stay on track to achieve the client's financial goals. Financial planners and advisors must adhere to high ethical and professional standards to ensure they provide the best possible advice and services to their clients. This includes maintaining confidentiality, avoiding conflicts of interest, and acting in the best interest of their clients. Various organizations, such as the CFP Board and the Financial Planning Association, establish and enforce these standards. Choosing the right financial planner is critical to the success of comprehensive financial planning. Clients should consider factors such as the planner's qualifications, experience, fee structure, and communication style. It's essential to work with a planner who understands the client's needs and can provide personalized advice and guidance. Collaboration and communication are key when working with a financial planner. Clients should be transparent about their financial situation, goals, and concerns, while planners should actively listen and respond to their clients' needs. This partnership helps create a comprehensive financial plan that aligns with the client's unique circumstances and objectives. Comprehensive financial planning provides a clear roadmap to achieve long-term financial security. By addressing various financial aspects and creating a tailored plan, individuals can navigate through different life stages and financial challenges with confidence and peace of mind. Through effective budgeting, cash flow management, and investment planning, comprehensive financial planning helps individuals maximize their savings and investment returns. This, in turn, accelerates wealth accumulation and improves the chances of achieving financial goals. Proper tax planning, as part of comprehensive financial planning, enables individuals to minimize their tax liabilities and make the most of available deductions and credits. This ensures that more of their hard-earned money is retained and invested for future financial goals. Comprehensive financial planning addresses potential risks through risk management and insurance planning. This helps individuals protect their financial assets and maintain financial stability, even in the face of unexpected events. By incorporating retirement and estate planning into a comprehensive financial plan, individuals can ensure a comfortable retirement and leave a lasting financial legacy for their loved ones. This holistic approach provides peace of mind for both the individual and their family. Market volatility and economic uncertainty can impact the performance of investments and overall financial plans. It's essential to regularly review and adjust financial plans to adapt to changing market conditions and ensure they continue to align with the individual's financial goals. Tax laws and regulations are constantly changing, which can affect financial planning strategies. Individuals must stay informed of these changes and work with their financial planner to adjust their plans accordingly, ensuring they continue to optimize their tax situation. An individual's personal and financial circumstances can change over time, impacting their financial goals and plans. Life events such as marriage, divorce, job loss, or birth of a child can significantly alter one's financial situation. Regularly reviewing and updating the financial plan to accommodate these changes is crucial for staying on track to achieve financial goals. A lack of financial literacy and education can limit the effectiveness of comprehensive financial planning. Individuals must have a basic understanding of financial concepts and principles to make informed decisions and actively participate in the planning process. Financial planners can play a vital role in educating their clients and promoting financial literacy. Comprehensive financial planning is an essential tool for achieving financial success and long-term stability. By addressing multiple aspects of personal finance and creating a tailored plan, individuals can navigate through financial challenges and achieve their goals. It's crucial to recognize the importance of comprehensive financial planning and take control of one's financial future. Taking control of one's financial future requires commitment, discipline, and a willingness to learn. By engaging in comprehensive financial planning and working with a qualified financial planner, individuals can gain the knowledge and confidence needed to make sound financial decisions. Embracing comprehensive financial planning is the first step toward securing a prosperous financial future and achieving lasting financial success.What Is Comprehensive Financial Planning?

Key Components of Comprehensive Financial Planning

Budgeting and Cash Flow Management

Risk Management and Insurance

Investment Planning

Tax Planning

Retirement Planning

Estate Planning

The Financial Planning Process

Establishing Client-Planner Relationship

Gathering Client Data and Setting Goals

Analyzing and Evaluating Financial Status

Developing and Presenting Financial Plan

Implementing Financial Plan

Monitoring and Adjusting Financial Plan

Role of Financial Planners and Advisors

Ethics and Professional Standards

Selecting the Right Financial Planner

Working With a Financial Planner

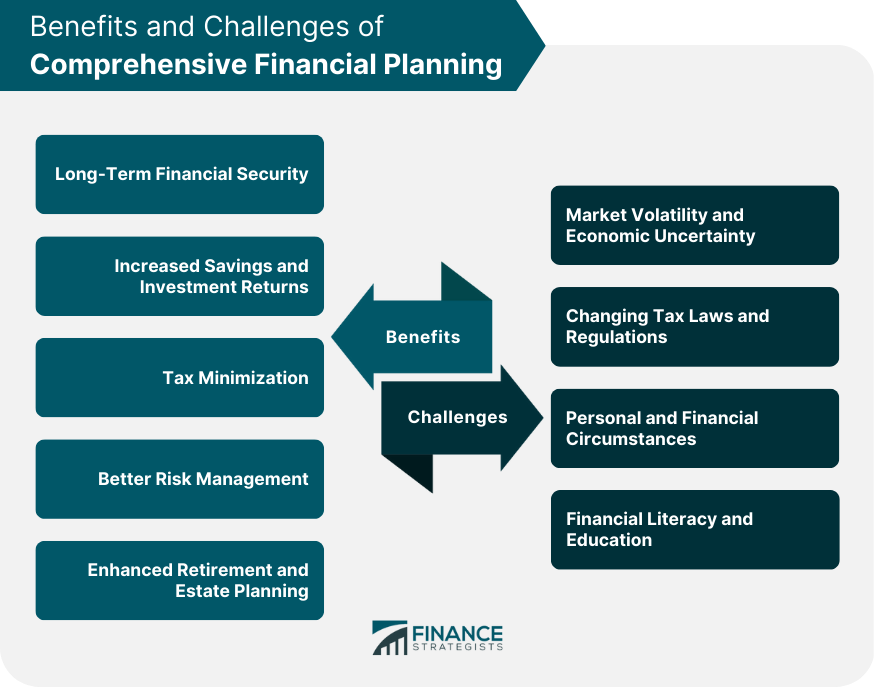

Benefits of Comprehensive Financial Planning

Long-Term Financial Security

Increased Savings and Investment Returns

Tax Minimization

Better Risk Management

Enhanced Retirement and Estate Planning

Challenges and Limitations of Comprehensive Financial Planning

Market Volatility and Economic Uncertainty

Changing Tax Laws and Regulations

Personal and Financial Circumstances

Financial Literacy and Education

Bottom Line

Comprehensive Financial Planning FAQs

Comprehensive financial planning is a process that involves assessing an individual's current financial situation, identifying their goals, and developing a plan to achieve those goals.

Comprehensive financial planning is important because it helps individuals make informed financial decisions, maximize their wealth, and plan for their future financial goals.

The key components of comprehensive financial planning include financial goal setting, cash flow management, tax planning, retirement planning, investment planning, insurance planning, and estate planning.

Anyone can benefit from comprehensive financial planning, regardless of their income or net worth. It is particularly beneficial for those who want to achieve financial security and long-term financial success.

To get started with comprehensive financial planning, you should find a qualified financial planner who can guide you through the process. They will help you identify your financial goals and develop a personalized plan to achieve them.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.