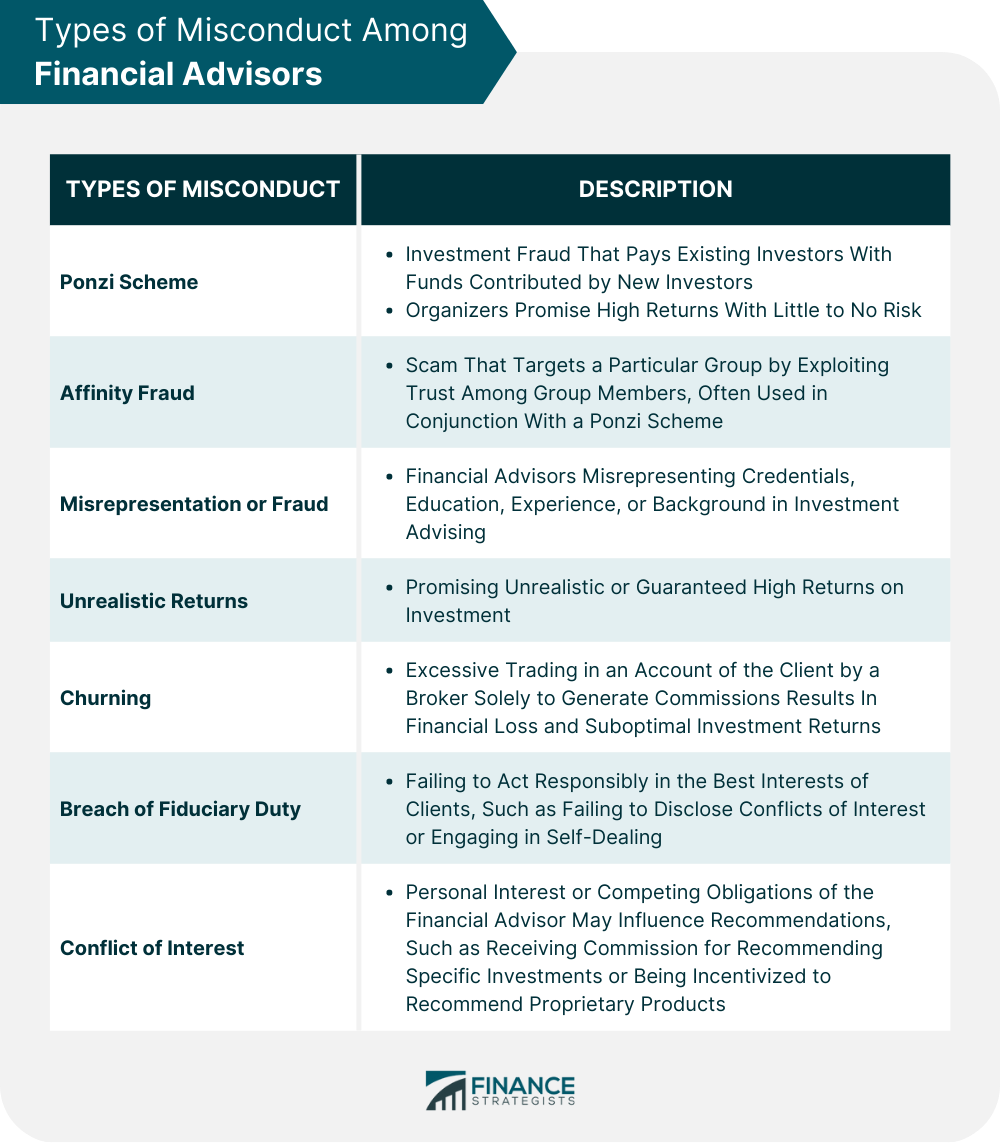

When individuals entrust their money with financial advisors, they do so with the expectation that their investments will be managed professionally and ethically. When financial advisors do not uphold these standards, disciplinary action may be taken against them. Disciplinary action can be taken against financial advisors who engage in unethical or illegal behavior. Below are some common examples of such behavior: The Securities and Exchange Commission (SEC) defines a Ponzi scheme as an investment fraud that pays existing investors with the funds contributed by new investors. Ponzi scheme organizers often attract new investors by promising high returns with little to no risk. The Ponzi scheme usually involves the initiator using the money of new investors to pay existing clients while siphoning off some of the proceeds to fund an extravagant lifestyle. Affinity fraud is another scam that targets a particular group by exploiting the trust that group members have in one another. The cohort group may share the same religion, cultural background, or geographic region. Scammers may belong to the group or pretend to be a member to con the participants further. The affinity scam is often used in conjunction with the Ponzi scheme. Misrepresentation of credentials is another way that financial advisors scam the public. The field of financial planning is rife with misconduct because there is no particular credential or licensing requirement to practice. The public may not be aware of the designations, titles, services, general roles, ethics, or certification requirements and may be receiving advice from someone with no education, experience, or background in the investment advising field. The practice of promising unrealistic or even guaranteed high returns on investment is a common trick used by some advisors, often preying on the desire of their clients for easy money. However, it is unlikely that an advisor can offer returns that are not available to the rest of the world, and clients should be cautious of anyone offering returns higher than 12-15%. The U.S. stock market, for example, has historically averaged around 9.5% returns, but this is not a safe or consistent return. Churning is a fraudulent practice involving excessive trading in a broker's account solely to generate commissions for themselves. This unethical activity is illegal and violates the trust between a broker and their client. The broker engages in churning by buying and selling securities excessively and without regard for the investment goals or risk tolerance of the clients. This behavior generates commissions for the broker but can result in significant financial losses for the client, as each trade incurs additional fees and transaction costs. In addition to the financial harm inflicted on the client, churning can also result in suboptimal investment returns. The frequent buying and selling of securities can cause the client to miss out on long-term growth opportunities and market gains, resulting in a lower return on investment. A breach of fiduciary duty occurs when a fiduciary fails to act responsibly in the best interests of their client. This can take many forms, such as failing to disclose a conflict of interest, engaging in self-dealing, or making investments that benefit the fiduciary financial advisor at the expense of the client. For example, a financial advisor who invests the funds of the clients in a high-risk investment solely to generate higher commissions without disclosing the risks involved would be considered a breach of fiduciary duty. A conflict of interest can occur when personal interest or competing obligations of financial advisors may influence the recommendations they provide to their clients. These conflicts can stem from different sources, including compensation arrangements, business relationships, or personal connections. In such situations, financial advisors may prioritize their own interests or those of a third party over the best interests of their clients. One common example of a conflict of interest is when an advisor receives a commission for recommending a particular investment to clients, even if it is not the most suitable option for their needs. Similarly, financial advisors may feel pressured to recommend certain financial products or services to generate more revenue for their firm, even if they are not the best fit for their clients. Financial advisors must be transparent about any potential conflicts of interest they may have and prioritize the best interests of their clients when making recommendations. Clients who believe their financial advisor has engaged in unethical or illegal behavior can file a complaint. Below are the steps involved in filing a complaint against a financial advisor: If you believe you have a legitimate dispute with your broker or advisor, it is important to take action to address it. The first step you should take is to contact the branch manager or compliance department of your firm to make them aware of the issue. Depending on the nature of the dispute, they may be able to resolve the matter for you. If the dispute involves an error that has cost you money, it is especially critical to make a formal complaint in writing. This helps ensure a record of the issue, which can be crucial if the dispute escalates or legal action is necessary. When you make your complaint, include all relevant information, such as the nature of the error, when it occurred, and how it impacted you. Keeping copies of all correspondence related to the dispute is also a good idea. This can include emails, letters, or any other documentation that you send or receive from your broker or advisor. Having a paper trail can help support your case if you need to escalate the matter further. If you are not satisfied with the response you receive from the branch manager or compliance department of your firm, you may want to consider filing a complaint with the appropriate regulatory authority. In the United States, this is typically the SEC or the Financial Industry Regulatory Authority (FINRA). They can investigate the matter and potentially take disciplinary action against the broker or advisor if necessary. If the regulator finds evidence of misconduct, they may take disciplinary action against the financial advisor, which can include revocation of their license, fines, and even criminal charges. Ultimately, if you have a legitimate dispute with your broker or advisor, it is important to take action and advocate for yourself. By making a formal complaint and keeping detailed records, you can help ensure that your concerns are taken seriously and that a fair resolution is reached. Before hiring a financial advisor, it is crucial to consider the potential risks and consequences of working with them. To reduce the chance of working with an unethical or fraudulent advisor, it is essential to thoroughly evaluate potential advisors before making a decision. There are several things you can do to evaluate a financial advisor before working with them. Here are some steps you can take: One of the first things you should do when considering a financial advisor is to ask for their credentials. This will help ensure that they have the necessary licenses and certifications to work in your state. For example, a financial advisor may need to have a Series 7 license or a Certified Financial Planner (CFP) certification to work with clients. Asking for credentials can also give you an idea of the experience and expertise of the financial advisor in the field. After you have received information on the credentials of the financial advisors, it is a good idea to verify their information through the SEC’s Investment Adviser Public Disclosure (IAPD) website and FINRA’s BrokerCheck website. These sites allow you to check if the advisor has any disciplinary actions or complaints filed against them. This can help you make an informed decision on whether to work with the advisor. It is crucial to verify if the investment approach of the financial advisor corresponds to your objectives and risk appetite. Some advisors may focus on long-term investing strategies, while others may specialize in short-term investment strategies. Additionally, some advisors may prefer to invest in certain sectors or asset classes, while others may have a more diversified portfolio. Understanding the investment style of the advisor can help you determine whether they are a good fit for your financial goals and objectives. Financial advisors are compensated in different ways, and it is important to understand how your advisor is compensated and any potential conflicts of interest that may arise. Some advisors may charge a flat fee, while others may charge a percentage of your assets under management. Additionally, some advisors may receive commissions on the financial products they recommend to clients. Understanding the fee structure of the advisor can help you make an informed decision on whether to work with them and ensure that you are comfortable with their compensation arrangement. By taking these steps to evaluate a financial advisor, you can help ensure that you choose an advisor who is a good fit for your financial goals and objectives. It is essential to do your research and ask questions to make an informed decision when choosing a financial advisor. Here are some red flags to watch for when evaluating a financial advisor: Financial advisors who concentrate excessively on short-term returns may prioritize generating commissions instead of providing sound financial advice. This approach may result in investment strategies that are not in line with the long-term financial goals and objectives of their clients. To ensure that the investment strategy of the advisor aligns with your risk tolerance and financial objectives, it is crucial to consider long-term and holistic financial planning and a diversified portfolio. Financial advisors who push annuities too early in the relationship may be more interested in earning a commission than providing sound financial advice. Annuities can be complex financial products that may not be suitable for every client, and the advisor should fully explain the features, fees, risks, and types of annuities before recommending them. Financial advisors who claim to outperform the market consistently may be making exaggerated or misleading claims. The market can be unpredictable, and no financial advisor can guarantee consistent returns. Therefore, it is important to ensure that the investment strategy of the advisor is grounded in sound financial principles and not based on unrealistic expectations or promises. While having a large client base can be impressive, it can also be a red flag if the financial advisor is unable to provide personalized attention to each client. It is essential to ensure that the advisor has the resources and capacity to provide individualized attention to your financial needs and goals. Financial advisors with a history of bankruptcy or complaints on record may be more likely to engage in unethical or fraudulent behavior. It is necessary to review the background of the advisor and verify their credentials through the IAPD website and BrokerCheck website. These sites provide information on any disciplinary actions or complaints filed against the advisor. If you encounter any of these red flags during the evaluation process, it is vital to take them seriously and consider when it is time to change the financial advisor or finding another one. Choosing a financial advisor is a significant decision, and it is essential to do your due diligence to ensure that you are working with an advisor who has your best interests in mind. The financial advice industry can be complex and difficult to navigate, and there are instances where financial advisors may engage in unethical or illegal behavior. Understanding what constitutes disciplinary action against financial advisors is essential, as is knowing how to file a complaint if necessary. It is also necessary to evaluate financial advisors before working with them and watch for red flags that could indicate unethical behavior. By staying informed and vigilant, you can protect yourself and your finances. If you have experienced harm due to the actions of a financial advisor, do not hesitate to take action. Contact their firm and the appropriate regulator to file a complaint. And if you are currently searching for a financial advisor, do your research, ask questions, and carefully evaluate your needs and options whether it is worth it to work with one before making a decision.What Constitutes Disciplinary Action Against Financial Advisors?

Ponzi Scheme

Affinity Fraud

Misrepresentation or Fraud

Unrealistic Returns

Churning

Breach of Fiduciary Duty

Conflict of Interest

How to File a Complaint Against Your Financial Advisor

Step 1: Contact Your Firm

Step 2: File a Complaint With the Appropriate Regulator

How to Evaluate Your Financial Advisor

Ask For Their Credentials

Verify Through SEC and FINRA

Review Their Investment Style

Understand Their Fee Structure

Red Flags to Watch for Financial Advisors

Excessive Focus on Short-Term Returns

Premature Promotion of Annuities

Claims of Outperforming the Market

Boasting a Large Client Base

Bankruptcy or Complaints on Record

The Bottom Line

Disciplinary Action Against Financial Advisor FAQs

If a client believes that a financial advisor has engaged in unethical or illegal behavior, they can file a complaint with the firm of the financial advisor and the appropriate regulator. The regulator will investigate the complaint and take appropriate action if necessary, which could include disciplinary action against the financial advisor.

In order to steer clear of financial advisors who participate in unethical or illegal activities, it is crucial to conduct a thorough assessment of potential advisors before enlisting their services. This entails verifying their qualifications, comprehending their approach to investing and fee arrangement, and investigating any warning signs that may point to unethical conduct. Additionally, it is imperative to rely on your intuition and steer clear of advisors who make impractical guarantees or push you into precipitous investment choices.

Clients may consider changing financial advisors if they are not happy with the service they are receiving, if their advisor engages in unethical or illegal behavior, or if their financial situation or investment goals change. It is important to carefully evaluate your reasons for wanting to change advisors and to do your research to find a new advisor who is a good fit for your needs.

The cost of changing financial advisors will depend on your specific situation and the terms of your contract with your current advisor. Some advisors may charge a fee for terminating their services, while others may not. It is imperative to review your contract carefully and to negotiate any termination fees if possible.

Choosing the right financial advisor requires careful research and evaluation. Start by asking for referrals from trusted friends, family members, or colleagues. Then, check the credentials of the advisors, including their experience, certifications, and any disciplinary history. Evaluate their investment style and fee structure, and ask about their approach to financial planning and risk management. Finally, trust your instincts and choose an advisor who you feel comfortable working with and who shares your investment goals and values.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.