Debt settlement is a process through which individuals and businesses can negotiate with their creditors to reduce the amount of debt owed, often by a significant percentage. It is a viable option for those who are struggling to make minimum payments on their debts and are seeking an alternative to bankruptcy. Debt settlement is often used to manage and reduce high-interest credit card debt. Credit card companies are typically more willing to negotiate and settle for a lower amount, as they would prefer to recover a portion of the debt rather than risk a total loss in the event of bankruptcy. Unforeseen medical expenses can result in large debts that may be difficult to repay. Medical debt is another common type of debt that can be settled through negotiations with healthcare providers or collection agencies, as they are often more inclined to accept a reduced payment instead of risking non-payment. Personal loans, which include unsecured loans from banks or other financial institutions, can also be eligible for debt settlement. As with credit card debt, lenders may be willing to settle for a lesser amount to avoid the possibility of the borrower filing for bankruptcy. Debts that have been sold to collection agencies can be negotiated for a lower settlement amount. Collection agencies typically buy debts for a fraction of the original amount owed, which means they may be open to settling for a reduced amount to ensure they make a profit. Before pursuing debt settlement, it is essential to assess your financial situation to determine if this option is the best fit for your circumstances. Review your income, expenses, and total debt to understand your ability to make payments and save for a potential settlement. If you decide to proceed with debt settlement, research and select a reputable debt settlement company. The company should have a history of successful negotiations, be accredited by recognized industry organizations, and be transparent about fees and potential outcomes. Once you have chosen a debt settlement company, you will be asked to set up a dedicated savings account where you will deposit funds regularly. These funds will be used for settlement payments once an agreement has been reached with your creditors. The debt settlement company will negotiate with your creditors on your behalf to reach an agreement on a reduced debt amount. This process can take several months, during which you should continue to make payments into your dedicated savings account. Once an agreement has been reached, the debt settlement company will use the funds in your dedicated savings account to make the agreed-upon payment to your creditors. Depending on the terms of the settlement, this may be a lump-sum payment or a series of installment payments. After completing the debt settlement process, it is crucial to focus on rebuilding your credit. This may include paying off remaining debts on time, using credit responsibly, and monitoring your credit report for inaccuracies. Debt settlement can significantly reduce the total amount of debt owed, making it a more manageable burden for the debtor. By reducing the debt amount, debt settlement can help individuals and businesses recover financially more quickly than if they continued to make minimum payments or filed for bankruptcy. Debt settlement typically results in a one-time payment or a manageable payment plan, making it easier for the debtor to clear the outstanding debt and move forward with their financial goals. Debt settlement can have a negative impact on your credit score, as the settled debts will be reported as "settled" or "paid as agreed" rather than "paid in full," which can lower your credit rating. In some cases, the forgiven debt from a debt settlement may be considered taxable income, resulting in additional tax liability for the debtor. There are some unscrupulous debt settlement companies that may charge excessive fees, make unrealistic promises, or engage in fraudulent practices. It is crucial to research and choose a reputable company to avoid falling victim to scams. Debt consolidation involves combining multiple debts into a single loan, often with a lower interest rate, to make repayment more manageable. This can be a suitable alternative for those who can still make regular payments but wish to simplify their debt management. Credit counseling is a service provided by certified credit counselors who help individuals develop a personalized plan to manage and pay off their debts. They can also negotiate with creditors for lower interest rates or payment plans. Bankruptcy is a legal process that provides debt relief to individuals or businesses unable to repay their debts. While it can offer a fresh financial start, bankruptcy has long-lasting consequences on credit scores and should be considered as a last resort. Some individuals may prefer to manage their debts independently by negotiating directly with creditors, creating a budget, and implementing a debt repayment plan. This option requires discipline and organization but can be effective for those committed to improving their financial situation. Understanding your rights and protections under the Fair Debt Collection Practices Act (FDCPA) and other relevant laws can help you navigate the debt settlement process more effectively. Maintain a record of all communication with creditors, including phone calls, emails, and written correspondence. This documentation can be valuable during negotiations and in the event of a dispute. Focus on paying off debts with the highest interest rates or fees first, as they will cost you more in the long run. Developing and adhering to a budget, along with regularly saving money in your dedicated savings account, is crucial to the success of a debt settlement plan. Debt settlement is a process where individuals or businesses negotiate with creditors to reduce the amount of debt owed, which can be a viable option for those struggling to make minimum payments on their debts. It involves assessing financial situations, researching and choosing a reputable debt settlement company, establishing a dedicated savings account, negotiating with creditors, and settling debts. Debt settlement can have pros, such as reduced overall debt, a faster path to financial recovery, and a one-time payment or manageable payment plan, but also cons, including a negative impact on credit scores, possible tax implications, and scams. Alternatives to debt settlement include debt consolidation, credit counseling, bankruptcy, and DIY debt management strategies. Tips for successful debt settlement include knowing your rights and protections under the law, keeping detailed records of communication with creditors, prioritizing paying off the most expensive debts first, and staying disciplined in saving and budgeting.What Is Debt Settlement?

Types of Debt Suitable for Settlement

Credit Card Debt

Medical Debt

Personal Loans

Collection Accounts

Debt Settlement Process

Step 1: Assessing Your Financial Situation

Step 2: Researching and Choosing a Debt Settlement Company

Step 3: Establishing a Dedicated Savings Account

Step 4: Negotiating With Creditors

Step 5: Settling the Debt and Making Payments

Step 6: Rebuilding Credit After Debt Settlement

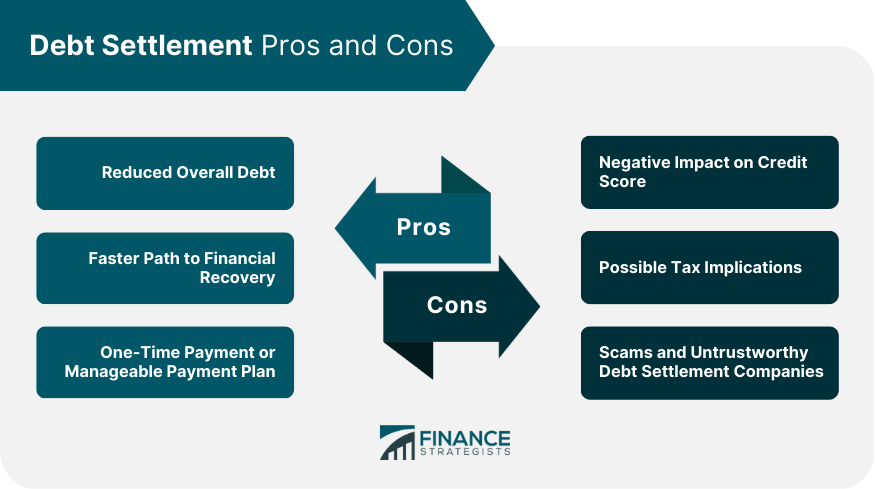

Pros and Cons of Debt Settlement

Pros

Reduced Overall Debt

Faster Path to Financial Recovery

One-Time Payment or Manageable Payment Plan

Cons

Negative Impact on Credit Score

Possible Tax Implications

Scams and Untrustworthy Debt Settlement Companies

Alternatives to Debt Settlement

Debt Consolidation

Credit Counseling

Bankruptcy

DIY Debt Management Strategies

Tips for Successful Debt Settlement

Know Your Rights and Protections Under the Law

Keep Detailed Records of Communication With Creditors

Prioritize Paying Off the Most Expensive Debts First

Stay Disciplined in Saving and Budgeting

Conclusion

Debt Settlement FAQs

Debt settlement is a process in which individuals or businesses negotiate with their creditors to reduce the amount of debt owed. The process involves assessing your financial situation, choosing a reputable debt settlement company, establishing a dedicated savings account, negotiating with creditors, settling the debt, and rebuilding your credit after the settlement.

Debt settlement is most suitable for unsecured debts like credit card debt, medical debt, personal loans, and collection accounts. It may not be as effective for secured debts, such as mortgages or auto loans, or for certain types of debt like student loans and tax debts.

Debt settlement can have a negative impact on your credit score, as settled debts are reported as "settled" or "paid as agreed" instead of "paid in full." This can lower your credit rating, making it more challenging to obtain credit or loans in the future.

Alternatives to debt settlement include debt consolidation, credit counseling, bankruptcy, and DIY debt management strategies. Each option has its pros and cons, so it's essential to evaluate your financial situation and goals before choosing the best approach for you.

To succeed in debt settlement, it's important to know your rights and protections under the law, keep detailed records of communication with creditors, prioritize paying off the most expensive debts first, and stay disciplined in saving and budgeting. Choosing a reputable debt settlement company is also crucial to ensure a smooth and successful negotiation process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.