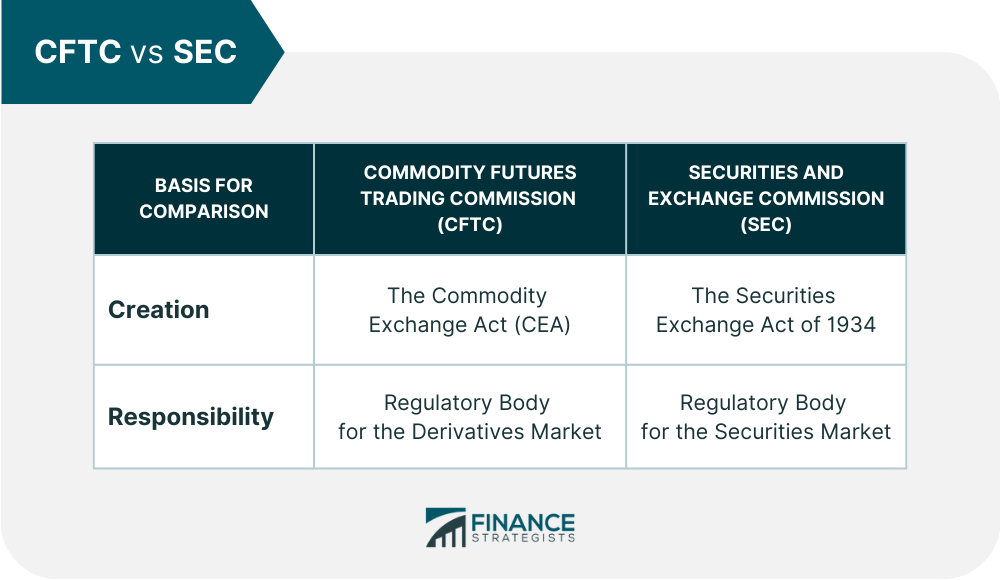

Established in 1974, the Commodity Futures Trading Commission (CFTC) is an independent government agency that regulates the commodities, futures, and options markets in the United States. The work of the CFTC makes a crucial contribution to the stability of the American economy because it ensures that the derivative markets are monitored and efficiently regulated. Thus, participants in these markets can confidently act when trading or investing. The CFTC works both independently and in partnership with other institutions, such as the U.S. Securities and Exchange Commission (SEC), to protect against fraud and manipulation, guarantee market integrity, impart market transparency, and enhance customer protection. As an organization, the CFTC consists of five commissioners appointed by the President and confirmed by the Senate, with a maximum of only three representatives from any one political party. Among the five appointees, a Chairman is selected to act as the organization's leader, setting its vision and overseeing executive decisions. However, each commissioner, including the Chairman, is assigned to sponsor one of the following advisory committees: Energy and Environmental Markets Advisory Committee Agricultural Advisory Committee Markets Risk Advisory Committee Global Markets Advisory Committee Technology Advisory Committee A sixth committee, the CFTC-SEC Joint Advisory Committee, is currently inactive. The Commodity Futures Trading Commission consists of many different divisions and offices, including the following. The Division of Clearing and Risk (DCR) aims to guarantee financial integrity and prevent systemic risk in the derivatives market. It also manages the clearing of swaps, futures, and options while overseeing all participants who may influence the clearing process. Its tasks include safeguarding investors against the bankruptcy of service providers, reviewing registration applications, conducting annual risk assessments, examining compliance requirements, and addressing malfunctions that may impact clearing. The Division of Enforcement (DOE) is responsible for investigating and enforcing violations of the Commodity Exchange Act (CEA) and CFTC regulations and aiding civil actions that may arise from these breaches. DOE has also implemented a specialized Whistleblower Program to enable those with insight into possibly fraudulent activities to report them without fear of retribution. It works hard to protect commodities markets from illegal activities for the benefit of everyone involved. The Division of Market Oversight (DMO) works to ensure transparency, promote fair competition and deter monopolization or fraudulent activities. To fulfill its mission, this division monitors the health of the derivatives market, creates rules to protect market stability and ensures that both new and existing products are not vulnerable to exploitation. Previously known as the Division of Swap Dealer and Intermediary Oversight (DSIO), the Market Participants Division (MPD) aims to educate the general public about the derivatives market. The MPD also partners with self-regulatory organizations to manage all CFTC-registered entities that deal, trade, invest, or provide advice about the derivatives market. The Division of Data (DOD) manages the Commodity Futures Trading Commission’s strategies and approaches toward the analysis, visualization, and storage of data. It is said to achieve its mission through four different types of activities. First, it collaborates with all parties to ensure data quality. Next, it integrates data to produce an accurate picture of the market. It also trains CFTC members on how to handle data. Finally, it performs data analysis, visualization, and software development tasks for the commission. The Division of Administration (DA) operates an array of services that collectively aim to ensure efficient and effective internal operations throughout the agency. The DA oversees business operations, administrative proceedings, financial management, human resources, information technology, and security operations. The Office of the Chief Economist (OCE) forms policy recommendations on fiscal and market-related matters, utilizing insights from economic research to establish sound governance and risk management. OCE is also responsible for keeping abreast of changing regulatory and economic landscape to ensure their analyses are kept up-to-date. Its activities provide a valuable data source that can be used for monitoring markets and assessing new economic developments. The Office of the General Counsel (OGC) provides legal advice to educate and support decisions made by the Commission. The CFTC relies on the expertise of OGC to ensure organizational success through practical legal guidance. This team assists with federal legislative requirements, negotiates with counterparties to resolve cases, and prepares for enforcement cases that are taken to court. The Office of International Affairs (OIA) is responsible for engaging with industry counterparts to help facilitate information sharing and promote strong market oversight on a global scale. For instance, the OIA contributes to several international publications, provides information on foreign products that may be sold in the United States, and helps organize an annual international regulators symposium. The Office of Public Affairs (OPA) ensures that communication between the CFTC and the general public is effective and efficient. The office works to support the objectives of the CFTC by providing brand strategy advice, engaging in strategic partnerships with press entities, and managing the CFTC’s website and social media platforms. The Office of Legislative and Intergovernmental Affairs (OLIA) aims to promote a better understanding and coordination with members of Congress, other federal agencies, and the Administration. The OLIA creates and implements legislative strategy on behalf of the CFTC, manages congressional testimonies, and provides technical legislative advice to other divisions. The Commodity Futures Trading Commission promotes diversity, inclusion, and fair hiring throughout its organization. To that end, it established the Office of Minority and Women Inclusion (OMWI). This office also supports the following employee affinity groups: The Association of Asian Americans & Pacific Islanders, The Hispanic Employee Association, The Association of African Americans, CFTC Pride, Women at Work, and the Veterans Affinity Group. The Office of Technology Innovation (OTI) is dedicated to incorporating innovative financial technologies into CFTC operations. Aside from advocating for responsible innovation, it also supports collaboration within the industry and education for the general public. OTI aims to bridge the gap between technological advancement, operational efficiency, and customer satisfaction. Utilizing cutting-edge digital solutions, OTI improves service delivery while helping to ensure that the CFTC meets its obligations most safely and securely possible. The CFTC is mainly involved in regulating the following: Derivatives are financial vehicles whose value is determined partly by price movements in underlying assets, including commodities, stocks, bonds, or currencies. Examples of derivatives include forwards, options, swaps, and futures. There are several different derivatives markets that the CFTC regulates, including the options, swaps, and commodity futures markets. By regulating these markets, CFTC seeks to ensure integrity and fairness in these markets and protect traders from abuse and manipulation. The CFTC is also responsible for overseeing and regulating certain market intermediaries. The CFTC's job is to carefully monitor and manage these intermediaries as they seek to participate in or conduct derivatives transactions or activities involving customers or their accounts. These intermediaries include, but are not limited to, futures commission merchants, introducing brokers (IBs), swap dealers (SDs), commodity pool operators (CPOs), and commodity trading advisors (CTA). The different U.S. financial markets are regulated by two separate agencies: the CFTC and the SEC. The CFTC’s primary responsibility is to regulate the derivatives market. On the other hand, the SEC regulates the securities market. Aside from their coverage, the two agencies also vary in terms of how they were established. The CFTC was created by the Commodity Exchange Act, while the SEC was created by The Securities Exchange Act of 1934. Both commissions have similar goals – to promote market integrity, investor protection, and fair competition between companies–but their respective jurisdictions can vary significantly according to different products or services being bought or sold in their respective markets. The CFTC is an independent United States government agency responsible for regulating the derivatives market and its intermediaries. Established in 1974, this agency protects market participants by enforcing regulations that promote fair trading practices and prevent fraud. The CFTC consists of five commissioners appointed by the President and confirmed by the Senate, with a maximum of only three representatives from any one political party. Among the five appointees, a Chairman is selected to act as the organization's leader. Each commissioner, including the Chairman, is assigned to sponsor one of the five advisory committees. To support the commissioners, the CFTC has many different divisions and offices, such as the Office of the Chief Economist and the Division of Market Oversight. Both CFTC and the SEC are assigned to regulate specific financial markets. These agencies differ in terms of their responsibilities and the laws that created them. Despite these differences, they have similar goals and play crucial roles in the financial sector. If you want to invest in the derivatives market, learning about the CFTC and how it protects your investment is an excellent first step. You can also consult a financial advisor to guide you through diversifying your portfolio by entering this market as an investor. What Is the Commodity Futures Trading Commission (CFTC)?

CFTC Organization

CFTC Operating Divisions & Offices

Division of Clearing and Risk (DCR)

Division of Enforcement (DOE)

Division of Market Oversight (DMO)

Market Participants Division (MPD)

Division of Data (DOD)

Division of Administration (DA)

Office of the Chief Economist (OCE)

Office of the General Counsel (OGC)

Office of International Affairs (OIA)

Office of Public Affairs (OPA)

Office of Legislative and Intergovernmental Affairs (OLIA)

Office of Minority and Women Inclusion (OMWI)

Office of Technology Innovation (OTI)

What CFTC Regulates

Derivative Markets

Intermediaries

CFTC vs SEC

Final Thoughts

Commodity Futures Trading Commission (CFTC) FAQs

The CFTC regulates the U.S. derivatives market and its intermediaries. It ensures that these markets are efficient, fair, and transparent and that all market participants comply with applicable laws and regulations. The agency also fosters healthy competition among market participants and protects investors from fraudulent activities.

The Securities and Exchange Commission (SEC) regulates the securities market, while the Commodity Futures Trading Commission (CFTC) oversees the derivatives market. Both agencies work to protect investors by enforcing laws and regulations.

All persons or entities engaged in transactions involving derivatives in the U.S. are subject to CFTC oversight. This includes market participants such as brokers, traders, exchanges, and clearing houses.

The CFTC is entirely funded by fees and charges collected from the entities it regulates. It does not receive any funds from general revenue sources.

Persons or entities engaging in transactions involving derivatives must register with the CFTC. This can include brokers, traders, exchanges, and clearinghouses. Registration requirements vary depending on the type of activity being conducted.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.