Family limited partnerships (FLPs) and buy-sell agreements are two essential tools used by family businesses to protect their assets, plan for the future, and ensure business continuity. FLPs are legal entities that allow family members to pool resources and manage a business together, with general partners handling management and limited partners providing investment with limited liability. On the other hand, buy-sell agreements are contracts between business owners that outline the terms for transferring an owner's interest in the business, ensuring a smooth transition and protecting business continuity. FLPs and buy-sell agreements offer benefits such as asset protection, tax advantages, succession planning, smooth ownership transitions, and favorable tax implications when structured properly. By understanding the structure, benefits, and challenges of these tools and by integrating them effectively into their business operations, families can better position themselves for long-term success.

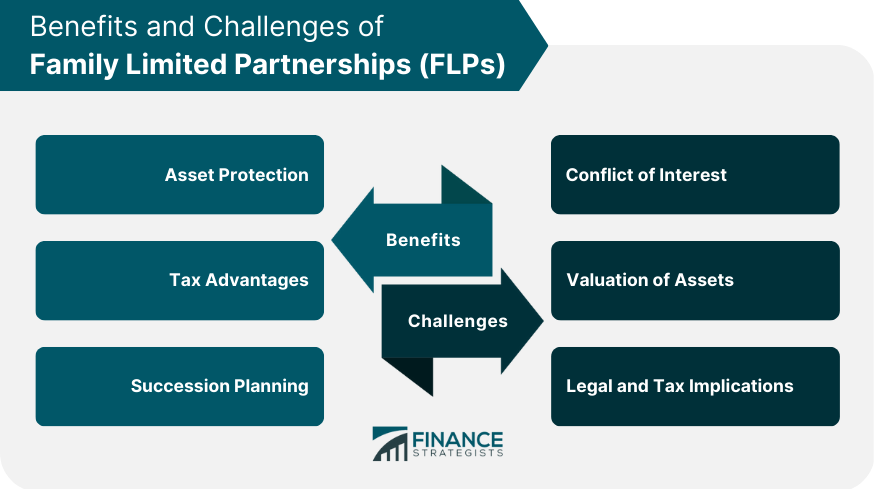

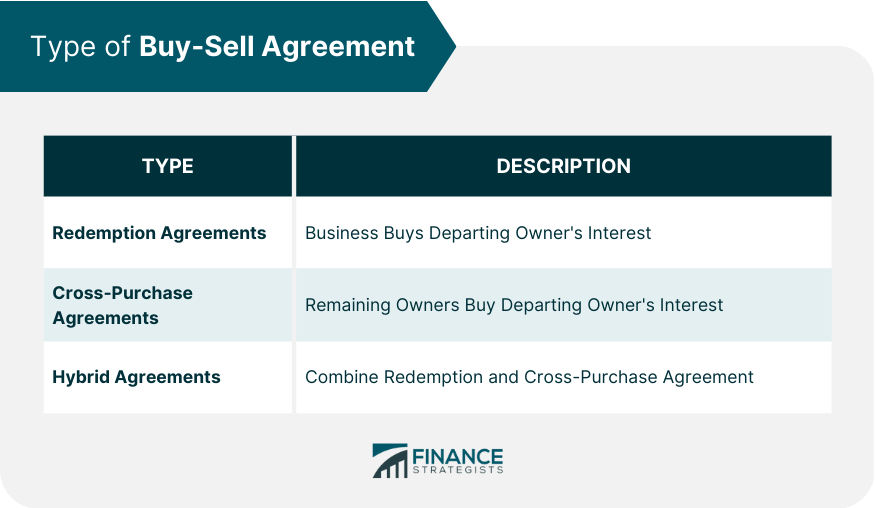

Family Limited Partnerships are legal entities that allow family members to pool their resources and manage a business together. FLPs provide several benefits, such as asset protection, tax advantages, and succession planning. These benefits make FLPs useful for family businesses looking to protect their assets, plan for the future, and ensure business continuity. Family limited partnerships are legal entities that enable family members to pool their resources and manage a business together. FLPs consist of two types of partners: general partners and limited partners. General Partners are responsible for the day-to-day management of the business and have unlimited liability. Limited Partners, on the other hand, have limited liability and typically do not participate in business management. There are several benefits to using FLPs in a family business context: 1. Asset Protection: FLPs provide an additional layer of asset protection by limiting the liability of limited partners. This means that the personal assets of limited partners cannot be used to satisfy the debts or obligations of the partnership. 2. Tax Advantages: FLPs can offer tax advantages, such as shifting income to lower-income family members and reducing estate taxes. Additionally, the FLP structure may allow for favorable valuation discounts on the transfer of business interests. 3. Succession Planning: FLPs can serve as a useful tool for succession planning by allowing families to transfer business interests to the next generation in a controlled manner. FLPs are not without challenges and potential pitfalls: 1. Conflicts of Interest: Disagreements may arise among family members, particularly if some hold management positions while others do not. 2. Valuation of Assets: Determining the fair market value of partnership assets can be challenging, particularly when those assets include non-liquid business interests. 3. Legal and Tax Implications: FLPs are subject to various legal and tax requirements, and failure to comply with these requirements can result in significant consequences for the partnership and its partners. Forming an FLP requires several legal steps: 1. Legal Requirements: FLPs must be established under state law. This typically involves filing a certificate of limited partnership with the appropriate state agency and paying any required fees. 2. Documentation: A partnership agreement should be drafted to outline the terms of the FLP, including the roles and responsibilities of the partners, allocation of profits and losses, and any restrictions on the transfer of partnership interests. Effective management of an FLP requires a clear delineation of roles and decision-making authority: 1. Roles of General and Limited Partners: General partners should be responsible for the day-to-day management of the business, while limited partners should be kept informed of major decisions and developments. 2. Voting Rights and Control: The partnership agreement should clearly define the voting rights of each partner and the process for making decisions that affect the partnership. A buy-sell agreement is a legally binding contract between the owners of a business that outlines the terms under which an owner's interest in the business may be transferred. These agreements help ensure a smooth ownership transition and protect the continuity of the business. There are three main types of buy-sell agreements: 1. Redemption Agreements: In this type of agreement, the business agrees to purchase a departing owner's interest. 2. Cross-Purchase Agreements: With a cross-purchase agreement, the remaining owners agree to purchase a departing owner's interest. 3. Hybrid Agreements: A hybrid agreement combines elements of both redemption and cross-purchase agreements. For example, the business may have the first option to purchase a departing owner's interest. If the business declines, the remaining owners may then have the option to buy the interest. A comprehensive buy-sell agreement should address several key components: 1. Valuation Methods: The agreement should establish a method for determining the fair market value of an owner's interest in the business. Common valuation methods include formulas based on revenues or earnings, comparisons to similar businesses, and independent appraisals. 2. Triggering Events: The agreement should specify the events that trigger the buy-sell provisions, such as the death, disability, retirement, or divorce of an owner. 3. Funding Mechanisms: The agreement should outline how the purchase of a departing owner's interest will be financed. Common funding mechanisms include life insurance policies, cash reserves, and loans. Buy-sell agreements offer several benefits for family businesses: 1. Smooth Ownership Transitions: By establishing clear rules for the transfer of ownership interests, buy-sell agreements help prevent disputes and ensure a smooth transition when an owner departs. 2. Protection of Business Continuity: A well-crafted buy-sell agreement can protect the business's ongoing operations by preventing the unplanned transfer of ownership interests to external parties or inexperienced family members. 3. Tax Implications: Properly structured buy-sell agreements can minimize the tax consequences associated with the transfer of ownership interests. To be effective, buy-sell agreements must be properly implemented and maintained: 1. Legal Requirements: The agreement should be drafted by an experienced attorney to ensure compliance with applicable laws and regulations. 2. Regular Reviews and Updates: The agreement should be reviewed periodically to ensure it remains current with the changing needs of the business and its owners. Updates may be needed to account for changes in ownership, business valuation, or other circumstances. Successfully integrating FLPs and buy-sell agreements into a family business requires careful planning and coordination: It is essential for families to align their FLP and buy-sell agreements with their overall business strategy. This includes ensuring that the agreements support the family's goals for growth, succession, and wealth preservation. Effective tax planning and coordination of legal structures are critical to maximizing the benefits of FLPs and buy-sell agreements. Families should consult with legal and tax advisors to ensure that their FLP and buy-sell agreements are structured to optimize tax outcomes and comply with applicable laws. Clear and open communication among family members and partners is vital to the successful integration of FLPs and buy-sell agreements. Regular meetings, clear expectations, and transparent decision-making processes can prevent misunderstandings and conflicts. Family limited partnerships and buy-sell agreements are essential tools for family businesses looking to protect their assets, plan for the future, and ensure business continuity. By understanding the structure, benefits, and challenges of these tools and by integrating them effectively into their business operations, families can better position themselves for long-term success. It is highly recommended that families considering using FLPs and buy-sell agreements consult with a knowledgeable financial advisor. A professional advisor can provide invaluable guidance and assistance in tailoring these strategies to meet the unique needs of each family and their business, ensuring a smooth transition and a successful future. Take the first step toward securing your family's legacy by seeking expert advice today.Family Limited Partnerships (FLPs) and Buy-Sell Agreements: Overview

What Are Family Limited Partnerships (FLPs)?

Structure of FLPs

Benefits of FLPs

Common Challenges and Pitfalls

Formation of FLPs

FLP Management and Decision-Making

What Are Buy-Sell Agreements?

Types of Buy-Sell Agreements

Key Components of Buy-Sell Agreements

Benefits of Buy-Sell Agreements

Implementation and Maintenance

Integration of FLPs and Buy-Sell Agreements in Family Businesses

Aligning FLP and Buy-Sell Agreements With Overall Business Strategy

Coordinating Tax Planning and Legal Structures

Ensuring Effective Communication Among Family Members and Partners

Final Thoughts

Family Limited Partnerships (FLPs) and Buy-Sell Agreements FAQs

Family Limited Partnerships (FLPs) offer benefits such as asset protection, tax advantages, and succession planning. Buy-Sell Agreements, on the other hand, provide smooth ownership transitions, protection of business continuity, and favorable tax implications when structured properly.

Family Limited Partnerships (FLPs) are legal entities that allow family members to pool resources and manage a business together, with general partners handling management and limited partners providing investment with limited liability. Buy-Sell Agreements are contracts between business owners that outline the terms for transferring an owner's interest in the business, ensuring a smooth transition and protecting business continuity.

For FLPs, it's important to establish the legal structure, define the roles and responsibilities of general and limited partners, and outline the decision-making process. For Buy-Sell Agreements, the key components include valuation methods, triggering events, and funding mechanisms.

To effectively integrate FLPs and Buy-Sell Agreements, families should align these agreements with their overall business strategy, coordinate tax planning and legal structures, and ensure effective communication among family members and partners.

Families should consult with knowledgeable financial advisors and legal and tax professionals to ensure that their FLPs and Buy-Sell Agreements are structured optimally, comply with applicable laws and regulations, and provide the desired benefits for their unique business needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.