Those who have filed for bankruptcy may have concerns about when they will be able to make major purchases like buying a car. The solution to this issue is dependent on various factors like the type of bankruptcy and credit score. Individuals have the option of filing for two primary types of bankruptcy: Chapter 7 or Chapter 13. Liquidation bankruptcy, also referred to as Chapter 7 bankruptcy, necessitates the liquidation of assets to pay off debts, and once the bankruptcy process concludes, the person is released from their debts. The waiting period for purchasing a car after filing for Chapter 7 bankruptcy is typically around 4-6 months. However, it is important to note that some lenders may have their own waiting periods before they will finance a car for someone who has filed for Chapter 7 bankruptcy. Chapter 13 bankruptcy, also known as reorganization bankruptcy, involves the creation of a repayment plan to pay off debts over a period of 3-5 years. Once the repayment plan is complete, the individual is discharged from their debts. The waiting period for purchasing a car after filing for Chapter 13 bankruptcy is typically around 2 years, although it is possible to get a car loan during the repayment period if the bankruptcy court approves it. In addition to the waiting period, there are several other factors that can impact the ability to buy a car after bankruptcy. One of the most significant factors is credit score and credit report. After bankruptcy, individuals may have a lower credit score and negative information on their credit report. This can make it more difficult to qualify for a car loan or get favorable financing terms. Having a steady source of income and a down payment can also affect financing options. Lenders may be more willing to finance a car for someone who has a steady income and can make a down payment. A down payment can also reduce the amount of financing needed, which can make it easier to get approved for a loan. It is important to note that some lenders may have additional requirements or limitations for financing a car after bankruptcy. For example, they may require a co-signer, charge higher interest rates, or limit the type of car that can be purchased. For those who are looking to buy a car after bankruptcy, there are several steps that can be taken to increase the chances of getting approved for a car loan and getting favorable financing terms. The first step is to work on improving credit score and credit report. This can be done by paying bills on time, keeping credit card balances low, and disputing any errors on credit reports. Saving for a larger down payment can also be beneficial. The larger the down payment, the less financing is needed, which can make it easier to get approved for a loan and get better financing terms. Research lenders and car options thoroughly. Not all lenders are willing to finance a car for someone who has filed for bankruptcy, so it is important to research lenders that specialize in working with individuals who have gone through bankruptcy. It is also important to research car options to find one that fits within a budget and meets the needs of the individual. Creating and sticking to a budget is also crucial to avoid falling into financial trouble again. Understand that monthly payments can be comfortably made, factoring in car-related expenses and avoiding unnecessary expenses. In conclusion, buying a car after bankruptcy is possible, but it requires careful planning and consideration. The waiting period after bankruptcy varies depending on the type of bankruptcy filed, and there are several other factors that can impact the ability to buy a car after bankruptcy, such as credit score, income, and down payment. However, by taking steps to improve credit score, save for a down payment, and research lenders and car options, it is possible to get approved for a car loan and get favorable financing terms. It is important to create and stick to a budget to avoid falling into financial trouble again. Ultimately, seeking a financial advisor can be helpful for those who are struggling with bankruptcy or other financial difficulties.How Long After Bankruptcy Can I Buy a Car?

Waiting Periods After Bankruptcy

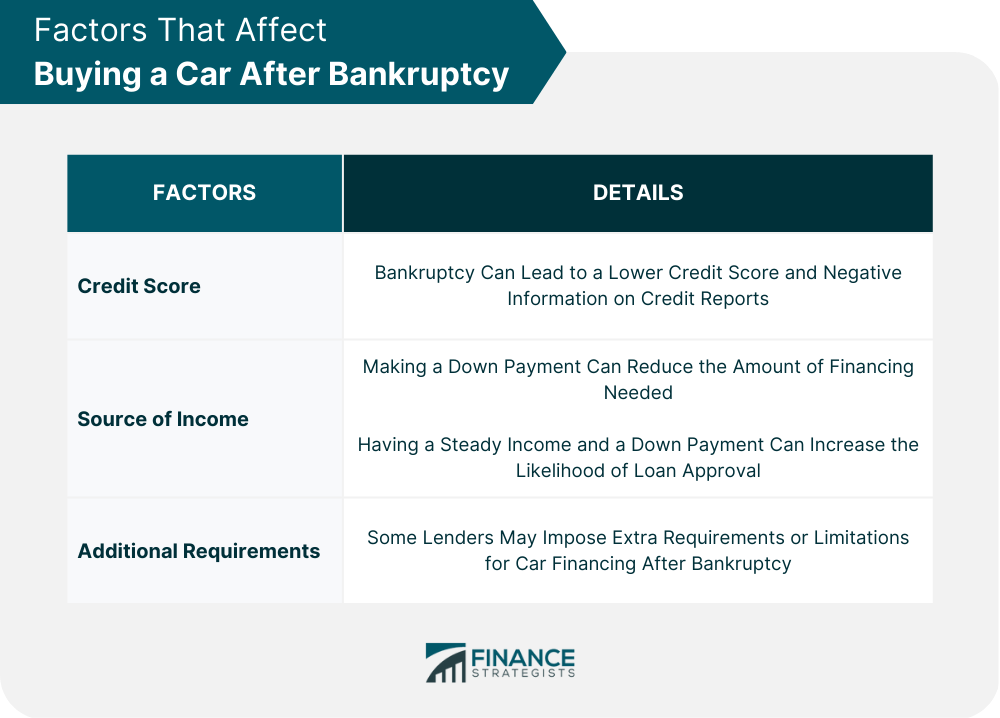

Factors That Affect Buying a Car After Bankruptcy

Credit Score

Source of Income

Additional Requirements

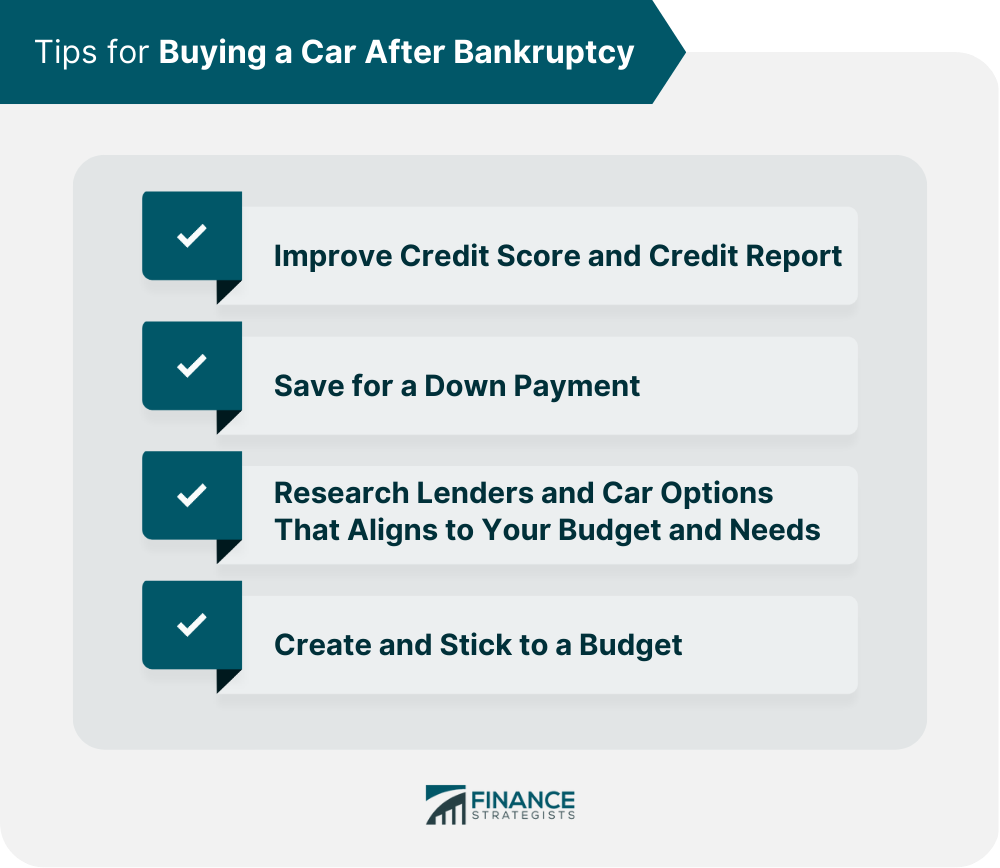

Tips for Buying a Car After Bankruptcy

Final Thoughts

How Long After Bankruptcy Can I Buy a Car? FAQs

The waiting period for purchasing a car after filing for bankruptcy varies depending on the type of bankruptcy filed. For Chapter 7 bankruptcy, the waiting period is typically around 4-6 months, while for Chapter 13 bankruptcy, it is typically around 2 years.

Bankruptcy can negatively impact credit scores and credit reports. It can lower credit score and leave negative information on the credit report, making it more difficult to qualify for a car loan or get favorable financing terms.

To improve credit score after bankruptcy, it is important to pay bills on time, keep credit card balances low, and dispute any errors on credit reports.

Yes, some lenders may have additional limitations or requirements for financing a car after bankruptcy. For example, they may require a co-signer, charge higher interest rates, or limit the type of car that can be purchased.

To avoid falling into financial trouble again, it is important to create and stick to a budget, understand what monthly payments can be comfortably made and factoring in car-related expenses like insurance and maintenance, and avoid unnecessary expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.