Chapter 13 bankruptcy is a legal process that can be used to restructure debts and provide debtors with a way to make payments on their obligations over a period of time. It is one of the two types of bankruptcy available in the United States for individuals, the other being Chapter 7. Under Chapter 13, debtors file a petition for reorganization that outlines how they intend to pay back creditors over time. Generally, individuals are eligible for Chapter 13 if they have regular income and total secured and unsecured debts below certain limits (which vary by state). The court then appoints a trustee to handle the case, who will review all proposed payment plans. If approved, the court will enter an order that requires debtors to make set monthly payments over three or five years, depending on their financial circumstances. The debtor's disposable income will generally go toward these payments during this period. After the successful completion of payments, any remaining unsecured debts (such as credit card debt) may be discharged. Purchasing a car while in Chapter 13 bankruptcy is possible, but there are several important steps that must be taken before doing so. Speaking with your bankruptcy trustee is an essential step while in Chapter 13 bankruptcy. You must have their approval before any financial agreements can be made, as they will need to make sure that the terms and conditions of your repayment plan are not being compromised. Filing for a “Motion to Incur” involves asking the court for permission to incur additional debt related to the purchase of a car. This is a significant step that should be done in consultation with an attorney. Finding a dealership or lender who specializes in bankruptcy auto loans is crucial as it ensures you are getting the best possible financing terms and rates available to you in this situation. Be sure to do your research and compare different options before making a decision. Careful review of all loan documents is vital, regardless of what type of agreement you enter into, but especially when it comes to financial transactions like those involved in purchasing a car while in Chapter 13 bankruptcy. Make sure that you understand all terms and conditions associated with any loan agreements before signing anything – this could help save you from financial hardship down the road. Finally, always make timely payments on any loan agreements you enter into while in Chapter 13 bankruptcy – missing payments or defaulting on these kinds of agreements can have serious consequences and may put your repayment plan at risk. Purchasing a car while in Chapter 13 bankruptcy can be a complicated process, with several steps to consider before making any financial agreements. To ensure the safest and most secure option, it’s important to understand the different financing options available. When seeking out financing while in Chapter 13 bankruptcy, auto loans are the most common option. You can get approved by either a lender that specializes in bankruptcy loans or through a dealership. Additionally, you may find private lenders or friends and family members who are willing to finance your purchase. No matter which option you choose, make sure to carefully compare each one and do thorough research so that you can find the best deal for your situation. Before taking any action to purchase a car, it is essential to receive approval from your bankruptcy trustee and file for a “Motion to Incur” with the court. This will protect you from incurring more debt than allowed by the court as well as avoid potential pitfalls like paying excessive interest rates or being unable to pay off the loan agreement on time. By understanding all of your financing options and taking precautions, you can safely purchase a new car without incurring additional debt or negatively impacting your financial future. When it comes to working with creditors during Chapter 13 bankruptcy, communication is key. Before making any decisions or arrangements, make sure you have an understanding of your state’s laws and your rights as a debtor so that you know exactly what to expect. Your bankruptcy trustee will be able to provide information on this subject and guide you through the process. When it comes to post-purchase payments, you should ensure that all your payments are made on time and in accordance with the payment plan arranged with the creditor. Stay in contact with the creditor about any changes or issues that may arise due to circumstances outside your control, and keep them updated on your progress towards paying off the loan agreement. Additionally, if possible try to leave some extra room in your budget for additional costs such as insurance fees or maintenance costs related to the car purchase. Remember to maintain open communication channels during and after the process of purchasing so that you can protect yourself from late fees or unexpected costs while still obtaining a reliable transportation solution that fits your financial situation. Purchasing a car while in Chapter 13 bankruptcy can be a daunting process. However, with due diligence and careful planning, it is possible to navigate the different financing options and creditor communications to find the right solution for you. By understanding your rights under state laws and communicating with your creditors throughout the process, you can confidently purchase a reliable car that fits within your budget while still being able to maintain a positive financial outlook.Overview of Chapter 13 Bankruptcy

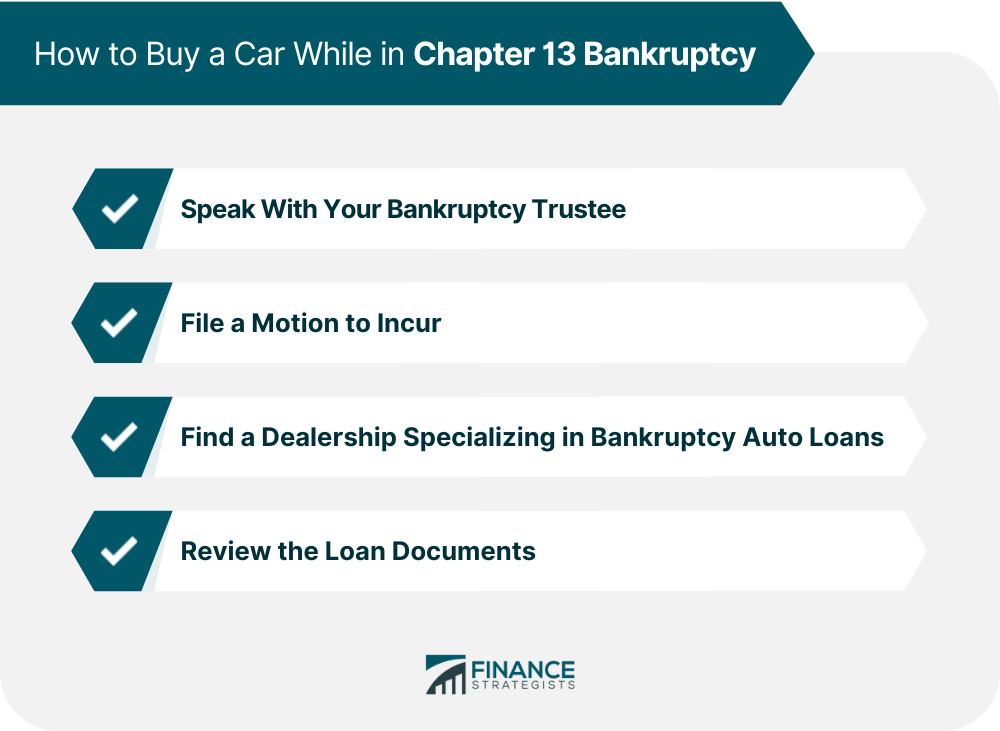

How to Buy a Car While in Chapter 13 Bankruptcy

Speak With Your Bankruptcy Trustee

File for a “Motion to Incur”

Find a Dealership That Specializes in Bankruptcy Auto Loans

Review the Loan Documents Carefully

Make Timely Payments

Financing Options When Buying a Car While in Chapter 13 Bankruptcy

Dealing With Creditors During and After the Process

Conclusion

Can You Buy a Car While in Chapter 13 Bankruptcy? FAQs

Yes, it is possible to buy a car while in Chapter 13 bankruptcy as long as you have permission from the court and have found an approved lender.

Buying a car during bankruptcy can help rebuild your credit score and provide more financial stability. Additionally, there may be lenders that offer more attractive interest rates and flexible repayment plans.

Yes, depending on your lender, you may be charged additional fees like taxes, title fees, or registration fees when purchasing a vehicle during Chapter 13 bankruptcy.

The process of purchasing a car while in Chapter 13 bankruptcy can take several weeks to complete as you must get court approval and find an approved lender before making the purchase.

Before making the purchase, make sure you research lenders thoroughly so you can find one that provides reasonable interest rates and flexible repayment plans that fit within your budget.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.