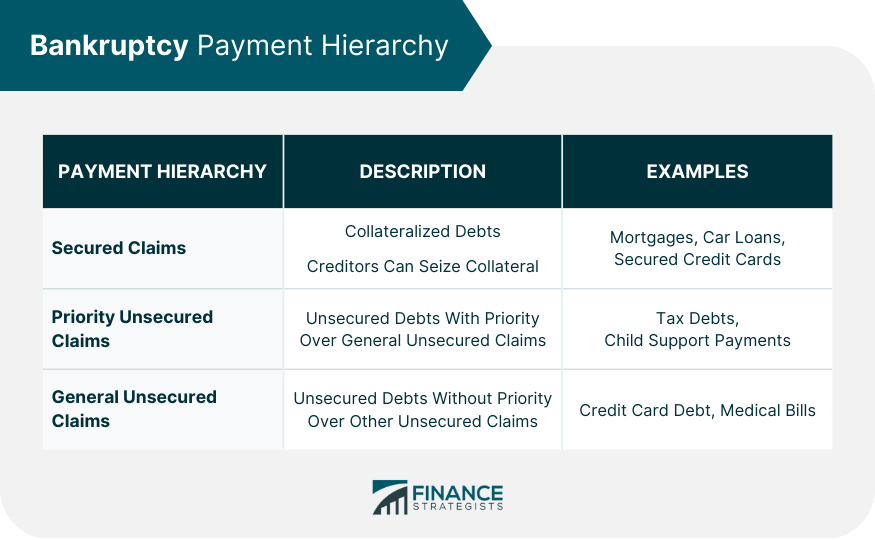

Bankruptcy is a legal procedure that allows individuals and businesses to restructure or eliminate their debts. Bankruptcy is not easy, but it can provide relief to those who are struggling with overwhelming debt. The bankruptcy process is complex and can be confusing for those who need to become more familiar with it. One of the most essential aspects of bankruptcy is who gets paid first. The payment hierarchy in bankruptcy determines the order in which creditors are paid. Before delving into the payment hierarchy in bankruptcy, it is essential to understand the bankruptcy process. Bankruptcy is a legal process that is governed by federal law. There are different types of bankruptcy, but the most common types are Chapter 7 and Chapter 13. Liquidation bankruptcy is another name for Chapter 7 bankruptcy. It is designed for individuals and organizations that need to pay off their debts. In Chapter 7 bankruptcy, a trustee is appointed to oversee liquidating the debtor's non-exempt assets. The proceeds from the sale of these assets are used to pay off the debtor's creditors. Chapter 13 bankruptcy is also known as "reorganization" bankruptcy. It is designed for individuals with a regular income who can pay off their debts over time. In Chapter 13 bankruptcy, a repayment plan allows the debtor to pay off their debts over three to five years. The bankruptcy payment hierarchy determines the order in which creditors are paid. Creditors are divided into three categories: secured claims, priority unsecured claims, and general unsecured claims. Secured claims are debts that are secured by collateral. The creditor has the right to take possession of the collateral if the debtor does not pay the debt. Secured claims are paid first in bankruptcy. The collateral is sold, and the proceeds are used to pay off the secured claim. Examples of secured claims include mortgages and car loans. If a debtor defaults on their mortgage, the bank has the right to foreclose on the property. If a debtor defaults on their car loan, the bank has the right to repossess the car. Priority unsecured claims are debts not secured by collateral but given priority over general unsecured claims. Priority unsecured claims are paid second in bankruptcy. Examples of priority unsecured claims include tax debts and child support payments. If a debtor owes back taxes or child support payments, those debts are given priority over general unsecured claims. General unsecured claims are debts not secured by collateral and are not prioritized over other unsecured claims. General unsecured claims are paid last in bankruptcy. Examples of general unsecured claims include credit card debt and medical bills. These debts are not secured by collateral and are not given priority over other unsecured claims. If there are insufficient funds to pay off all of the general unsecured claims, the creditors will receive a percentage of the debt based on the amount owed. While the bankruptcy payment hierarchy determines the order in which creditors are paid, other factors can affect the payment order. The chapter of bankruptcy filed can affect the payment order. In Chapter 7 bankruptcy, secured claims are paid first, followed by priority unsecured and general unsecured claims. In Chapter 13 bankruptcy, priority unsecured claims are paid first, followed by secured, and then general unsecured claims. The timing of the claim can also affect the payment order. If a claim is filed before the bankruptcy case is filed, it is considered a pre-petition claim and is given priority over post-petition claims. If a claim is filed after the bankruptcy case is filed, it is regarded as a post-petition claim and is given a lower priority. The ability to pay can also affect the payment order. If the debtor can pay off their debts, they may be required to pay off their debts in a different order than the bankruptcy payment hierarchy dictates. Understanding the bankruptcy payment hierarchy and who gets paid first is crucial when filing for bankruptcy. Secured claims are paid first, followed by priority unsecured claims and general unsecured claims. While the bankruptcy payment hierarchy determines the payment order, other factors, such as the chapter of bankruptcy filed, the timing of the claim, and the ability to pay, can also affect the payment order. By thoroughly understanding these factors, debtors and creditors can navigate the bankruptcy process more clearly and confidently. However, bankruptcy is a complex process, and seeking the help of a financial advisor can be beneficial in ensuring a successful outcome. A financial advisor can provide expert guidance and help navigate the complicated bankruptcy process. Do not hesitate to hire a financial advisor to help you make informed decisions and find the best path forward.Who Gets Paid First During Bankruptcy?

The Bankruptcy Process

Bankruptcy Payment Hierarchy

Secured Claims

Priority Unsecured Claims

General Unsecured Claims

Other Factors Affecting Payment Order

Conclusion

Bankruptcy - Who Gets Paid First? FAQs

Bankruptcy is a legal process designed to help individuals and businesses that cannot pay off their debts. It is important to understand who gets paid first in bankruptcy because the payment hierarchy determines the order in which creditors are paid.

The payment hierarchy in bankruptcy determines the order in which creditors are paid. Creditors are divided into three categories: secured claims, priority unsecured claims, and general unsecured claims.

Secured claims are paid first, followed by priority unsecured claims and general unsecured claims.

Examples of secured claims in bankruptcy include mortgages and car loans. If a debtor defaults on their mortgage, the bank has the right to foreclose on the property. If a debtor defaults on their car loan, the bank has the right to repossess the car.

Yes, other factors can affect the payment order in bankruptcy. The chapter of bankruptcy filed, the timing of the claim and the ability to pay are all factors that can affect the payment order.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.