The Series 65 is a financial industry exam and licensing requirement designed for individuals who wish to become registered investment advisors in the United States. This examination is created by the North American Securities Administrators Association (NASAA) and administered by the Financial Industry Regulatory Authority (FINRA). The exam is also known as the Uniform Investment Adviser Law Examination. It covers a broad range of topics related to investment advisory services, including economic factors, investment vehicles, ethics and legal guidelines, portfolio management, and retirement planning. It consists of 130 multiple-choice questions, which candidates are given 180 minutes to complete. Individuals seeking to become registered investment advisors must also meet additional requirements, such as having a certain level of education and experience in the field. The purpose of the Series 65 exam is to make sure that investment advisors have a comprehensive understanding of the legal and ethical standards involved in providing investment advice to clients. This exam ensures that only qualified individuals are permitted to provide investment advice. Once an individual successfully passes the exam and the registration process, they are licensed to provide investment advisory services to clients in the United States. Most state securities regulators have stipulated that passing the Series 65 exam is the least qualification necessary for an individual to become an investment advisor representative (IAR). Individuals who provide investment advice to clients for a fee need to pass the Series 65 exam. This includes people who give their clients personalized investment advice in exchange for money, such as commissions. This exam is also for individuals who manage client portfolios and those with discretionary authority over clients' investment portfolios. These representatives are responsible for communicating with current and potential clients of registered investment advisor firms (RIAs). Having a Series 65 qualification could also benefit those pursuing a career as a financial advisor. Individuals seeking to take the Series 65 exam do not need to meet any prerequisites and do not have to be affiliated with or endorsed by a FINRA member firm to register for the exam. Candidates sponsored by a firm must complete and submit Form U4. Meanwhile, enrolling or registering for the exam is enough for those who are not sponsored. Candidates, however, should be at least 18 years of age to take the Series 65 exam. There are no specific education requirements to take the Series 65 exam. A strong background in finance, accounting, economics, or business may be helpful in understanding the exam material. Applicants must also be in good standing with regulatory authorities. They should not have been convicted or been found to have engaged in unethical practices in the financial industry. The Series 65 has 130 multiple-choice questions. There are also ten pretest questions that do not count toward the candidate's final score. These pretest questions are randomly placed throughout the exam, so candidates should answer all questions to the best of their ability. The exam has a time limit of 180 minutes or three hours. The questions cover various investment advisory topics, including economic factors, investment vehicle characteristics, types of securities, and fiduciary responsibilities. It also tests candidates' knowledge of state and federal securities laws and regulations, which are critical components of the Series 65 exam. Candidates should be familiar with state securities laws and regulations in the states where they plan to conduct business. The Series 65 exam is a computer-based test. Candidates must schedule a test appointment at a qualified testing center. A passing score for the exam is 72.3%, which requires candidates to get 94 out of the 130 questions correct. At the testing center, they will be provided with a basic electronic calculator with four functions, which is the only calculator allowed during the exam. Dry-erase boards and markers are also provided for candidates to use during the exam. The Series 65 exam covers several topics related to investment advice and regulations. The content is broken down into four main sections: This section covers economic and financial concepts, such as monetary and fiscal policy and financial statements. It also includes topics such as quantitative methods and analysis and risk management. The exam assesses the candidate's knowledge of the distinctive features of various investment vehicles. The exam covers topics including cash and equivalents, equities, fixed-income securities, derivative securities, pooled investments, and insurance-based products. This section examines the applicant's understanding of portfolio development, portfolio theory, and client suitability. This contains topics related to investment recommendations and strategies, including retirement planning, tax planning, and performance measurement. Candidates should know about the laws and regulations related to investment advice, including securities laws, fiduciary duty, and ethical practices. It also includes topics such as compliance and regulatory requirements and the role of the Securities and Exchange Commission (SEC). Obtaining a Series 65 license enables individuals to legally offer investment advice and related services to clients, expanding their professional opportunities and allowing them to build their careers in the investment industry. It gives clients confidence in their investment advisor's competency and professionalism. Clients are more likely to trust individuals who have obtained this license, as it demonstrates their knowledge and understanding of the industry. Additionally, having a Series 65 license can open up new business opportunities. Many financial services companies require investment advisor representatives to hold this license to be considered for certain positions. The Series 65 is an important licensing requirement for individuals seeking to become registered investment advisors in the United States. It has comprehensive coverage of investment advisory topics and legal guidelines governing investment advisory services. It is a minimum requirement for individuals seeking to become investment advisor representatives. This applies to people who provide personalized investment advice for a fee, manage client portfolios, or have discretionary authority over clients' investment portfolios. Those with a Series 65 qualification can effectively communicate with current and potential clients, making it valuable for those pursuing a role as a financial advisor. The Series 65 exam requires no prerequisites or sponsorship by a FINRA member firm. The exam is a three-hour computer-based test consisting of 130 multiple-choice questions. To pass the exam, candidates must score at least 72.3%, or 94 out of 130 correct questions. The exam covers four main topics related to investment advice and regulations. These include economics and business information, investment vehicle characteristics, client investment recommendations and strategies, and laws, regulations, and guidance. Having a Series 65 license provides individuals with the legal right to offer investment advice. The license enhances clients' trust in the investment advisor's competence and professionalism, as it proves their knowledge and understanding of the industry. Additionally, holding a Series 65 license opens up new business opportunities.What Is the Series 65?

Who Needs the Series 65?

Series 65 Eligibility

Series 65 Exam Structure

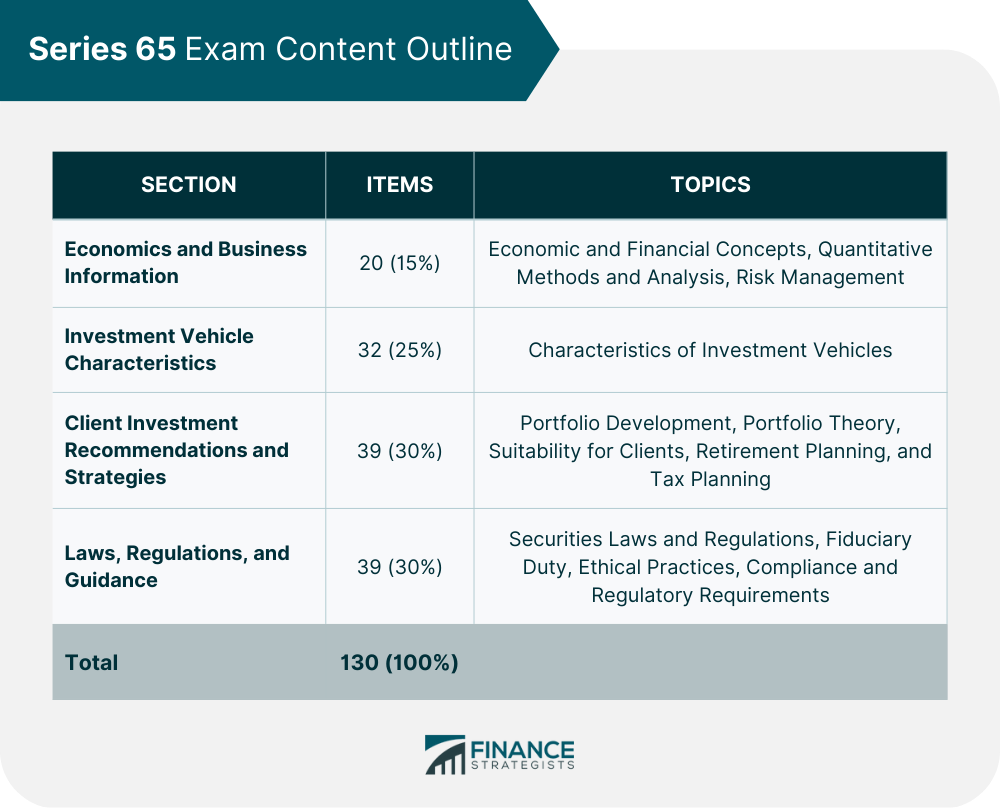

Series 65 Exam Content Outline

Economics and Business Information

Investment Vehicle Characteristics

Client Investment Recommendations and Strategies

Laws, Regulations, and Guidance

Importance of Having a Series 65 License

Final Thoughts

Series 65 FAQs

Individuals who do not provide securities advice for a fee regularly may not need to obtain a Series 65 license. Instead of passing the Series 65 exam, some states may accept certain licenses or certifications, such as the Certified Financial Planner (CFP) designation. Additionally, possessing both Series 7 and Series 66 licenses may be deemed sufficient training and exempt one from having to take the Series 65 exam in most states.

Series 7 is a license that enables individuals to sell securities products such as stocks, bonds, and mutual funds. In contrast, the Series 65 license is required for professionals who provide investment advice or manage client assets but do not engage in the sale of securities products. The Series 7 exam focuses on securities trading and investment banking, while the Series 65 exam covers a broad range of investment advisory topics.

Yes, non-US citizens can take the Series 65 exam if they meet certain requirements. They must have a valid Social Security number and be in the United States or its territories at the time of the exam.

A Series 65 license is used to legally offer investment advice and related services to clients in the United States and get paid for it. It is a securities license that allows individuals to work as investment advisor representatives, provide advice on securities such as stocks, bonds, and mutual funds, and manage client portfolios. The license demonstrates that the individual has passed a comprehensive exam and is knowledgeable about securities laws and regulations, as well as ethical practices and fiduciary responsibilities.

The cost of the Series 65 exam is $187. Some states have additional fees that may be charged for registering with their securities regulator, which must be paid separately from the test fee.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.