The recent 2022 data from the Bureau of Labor Statistics (BLS) says that the median salary of a financial advisor is $95,390. This is above the median annual wage of all workers in the United States. However, the compensation of financial advisors varies because of different factors including location, education, and experience. In order to become a financial advisor, you must have work experience in the field. Experience can come from working with clients or in banks or brokerage firms. To become a financial advisor, you must complete the following requirements: A standard financial advisor can have several career options by expanding their business in a certain direction. Some of these options include: This career allows you to sell and trade securities such as stocks or bonds. You can work for a firm or become an independent broker, which usually requires slightly higher fees. In order to sell insurance products, a financial advisor must be licensed. This allows them to sell life insurance, long-term care insurance, and annuities. Working as an investment manager allows you to manage the investments of others. In this profession, you can work for a brokerage firm or an independent company that focuses on mutual funds or hedge funds. This career allows you to advise clients on how to best save and invest for retirement goals. Some brokers may offer this service, but it is easier to do if you specialize in it. You must also be qualified and certified by your company or employer. Several factors affect the pay of a financial advisor. These include: Financial advisors make a very good living. However, there's no specific number of dollars an advisor can point to and say "That's how much I make". What makes the salary such a hard figure to pin down? Well, for starters, fee-based financial advisors get paid in many different ways: commissions, fees, and/or salaries. Ultimately, financial advisors' compensation is dependent on many factors, including the type of work they do, their experience level, and where they are located in terms of geography. The key point to remember is that if you are a good advisor who brings value to your clients, you can make a lot of money. Some financial advisors may be paid a salary, while others may only be paid on commission. A typical pay scale looks like this: $25,000 - $30,000 a year / Assistant Financial Advisor $50,000 - $80,000 a year / Financial Planner $90,000- plus a year / Senior Financial Advisor A financial advisor is a specifically qualified financial specialist who underwent training and certifications to best serve their clients. Their services do come with a cost and may differ from each other depending on the financial advisor you are working with. Learn more about how financial advisors are getting paid in this article: Financial Advisor Fees There are many different careers in the financial industry, but none of them will pay you an entry-level salary. That is why it is imperative to gain as much experience as possible early on so your education and hard work can be rewarded with a successful career. A financial advisor can make anywhere from $25,000 to $100,000-plus (or more) per year as an entry-level advisor. However, how much financial advisors make is dependent on many factors, including their location, education level, experience, and connections. If you are interested in the financial services industry--either personal finance or investment management--know that it is a career field where you can achieve true success if you work hard and build your skills.

Have a question for a Financial Advisor? Click here.How to Become a Financial Advisor?

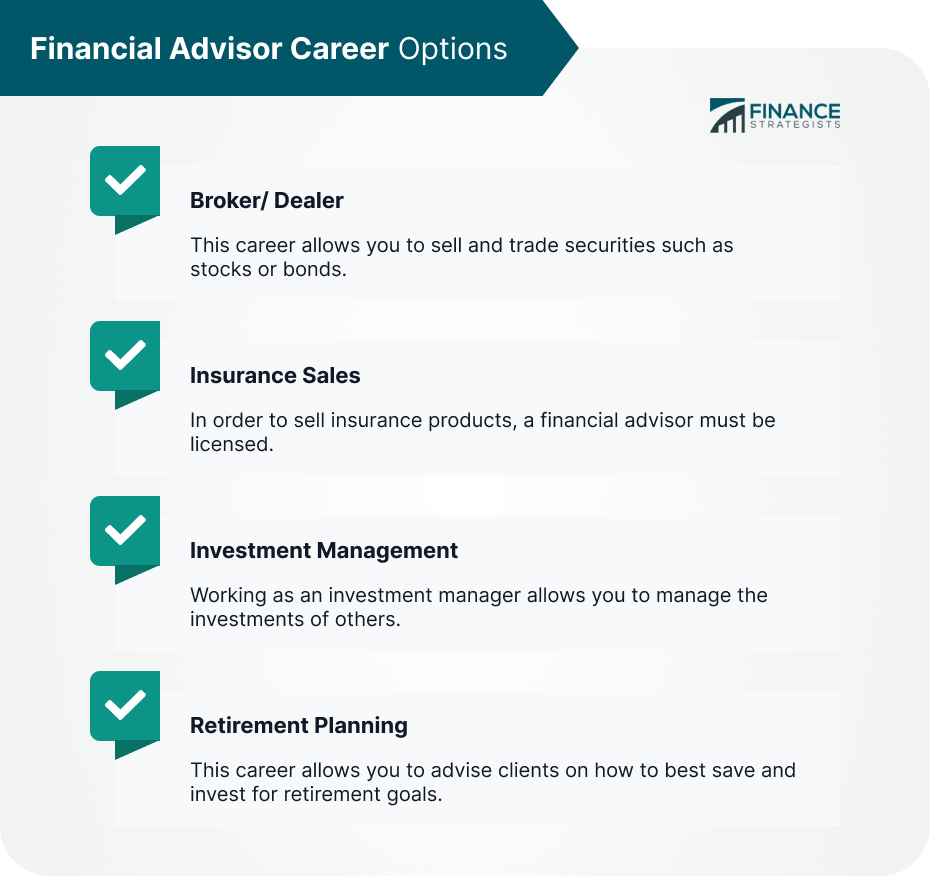

Financial Advisor Career Options

Broker/ Dealer

Insurance Sales

Investment Management

Retirement Planning

Factors that Influence a Financial Advisor's Pay

How Much do Financial Advisors Make?

Advisors who work for insurance companies don't make the same level of base salary, but their risk may be offset by commissions on products they sell or bonuses based on their production.Financial Advisors Pay Scale

Ways that a Financial Advisor Can Increase Their Earnings

The Bottom Line

Financial Advisors Careers and Compensation FAQs

Financial advisors need to hold at least a bachelor's degree in finance, accounting, or another related field. In addition, many states require financial advisors to obtain licensure and/or certification through various organizations such as the Certified Financial Planner Board of Standards (CFP).

Salaries for financial advisors vary widely depending on experience, geographic location, and the specific job position. According to the Bureau of Labor Statistics, the median annual wage for personal financial advisors was $95,390 in May 2022.

Financial advisors provide advice related to investments, insurance products, estate planning, and taxes. They also assist clients in setting and reaching their financial goals.

Yes, many financial advisors specialize in certain areas such as retirement planning, financial planning, investments, or asset management.

Financial advisors can enjoy a variety of job benefits including flexible working hours, high job satisfaction, and the potential to earn a significant income. Additionally, financial advisors have the opportunity to build long-term relationships with their clients.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.