A fee-based advisor is a finance professional who is paid by the fees they charge their clients. While they are primarily compensated through client fees, they may also earn commissions when recommending a specific product or other asset purchase. Fee-based advisors can prepare comprehensive financial plans, assist clients in selecting investments, analyze assets and liabilities, and provide detailed investment advice. Financial advisors typically generate income through advisory fees, commissions on investment products, and asset management fees. Here are some ways fee-based financial advisors make money: Some advisors charge a fixed amount, also known as flat fees, paid regularly – monthly, quarterly, or annually regardless of the services provided. Clients can access advice and financial services without worrying about additional costs, as the retainer fees are consistent and predictable. General financial services and oversight may range from $2,000 to $7,000 annually. Financial advisors may charge higher rates for the more complex scope of services. Some fee-based financial advisors charge an hourly rate for their services. This means the client pays a certain amount for each hour or fraction of an hour the advisor spends working on their behalf. Hourly fees are charged for specific services performed and can vary based on the complexity of the work. Typically hourly fees range from $200 to $400 per hour. AUM fees are based on a percentage of the total value of assets under management and are calculated annually. They can be charged on a yearly, quarterly, or monthly basis. Generally, in-person financial advisors charge 1.00% annually, depending on the portfolio size. Managing a $1 million portfolio might charge an AUM fee of $10,000 annually. Commissions from selling securities such as stocks or bonds are another way financial advisors earn. Brokerage commissions may come from executing trades on the client's behalf, handling account transfers, or making investment recommendations. The financial institution trading the products pays the advisors commissions. Mutual funds can come with commission rates of up to 1%. In comparison, depending on the type of annuity, cost can range between 1% to 10%, which varies whether it is a single premium or a periodic fixed index. Fee-based financial advisors can make money from commissions selling life insurance products. These commission payments are usually a percentage of the product's total cost, ranging from 3% to 5% per year for so long as the contract is active. Generally, the more expensive or complex the product, the higher the commission earned by financial advisors. Investors can access information about financial advisor fees and know whether they are fee-only or fee-based by checking the Form ADV filings with the Securities and Exchange Commission (SEC) Investment Adviser Public Disclosure website. Form ADV Part 1 and Part 2 are relevant to evaluating advisor costs. ADV Part 1 provides general information such as the total number of assets under management, the number of accounts, compensation arrangements, and other business activities. ADV Part 2 is an overview of the firm, fees, various services, typical client profile, and investment strategies. It is always a good idea to work with a financial advisor who makes their fee schedule readily accessible online. Otherwise, feel free to ask questions about how they calculate fees and what services are included. When it comes to getting financial advice, there is no one-size-fits-all solution. The type of advisor you choose depends on your specific goals and needs. Fee-based advisors charge a fee for their advice and commission on stocks and other investments they recommend. This type of advisor is great if you are looking for comprehensive financial planning services—from investment advice to budgeting tips. Fee-only advisors are paid solely on a fee basis; there is no commission for any products recommended. Fee-only advisors provide more limited services, such as investment advice and portfolio management. They are ideal for those who do not need comprehensive financial planning help but still want sound advice from a qualified professional. Those who are fee-only advisors are consistently held to high fiduciary standards. In comparison, those selling products or earning commissions are never fiduciary. But if they earn on fees and commissions, such as fee-based advisors, they can sometimes be fiduciary. You should also consider your financial goals and needs when deciding which type of advisor is best for you. With the right advisor in place, you can be well on your way to achieving your financial goals. A fee-based financial advisor is a professional who provides clients with holistic financial planning and investment management services in exchange for a fee. They may provide investment advice, tax planning, estate planning, retirement planning, coaching, and mentoring. They typically generate income through advisory fees, commissions on investment products, assets under management fees, brokerage commissions, insurance commissions, and mutual fund shares. The cost of a financial advisor can be evaluated by checking the Form ADV filings with the SEC, which provides information about the financial advisor's services, fees, qualifications, and other information. Fee-based advisors charge fees for their services and earn commissions on stocks and other investments they recommend. On the other hand, fee-only advisors are paid solely on a fee basis. Talking to a financial advisor about your investment and other financial planning needs increases your chances of meeting your financial goals.What Is a Fee-Based Advisor?

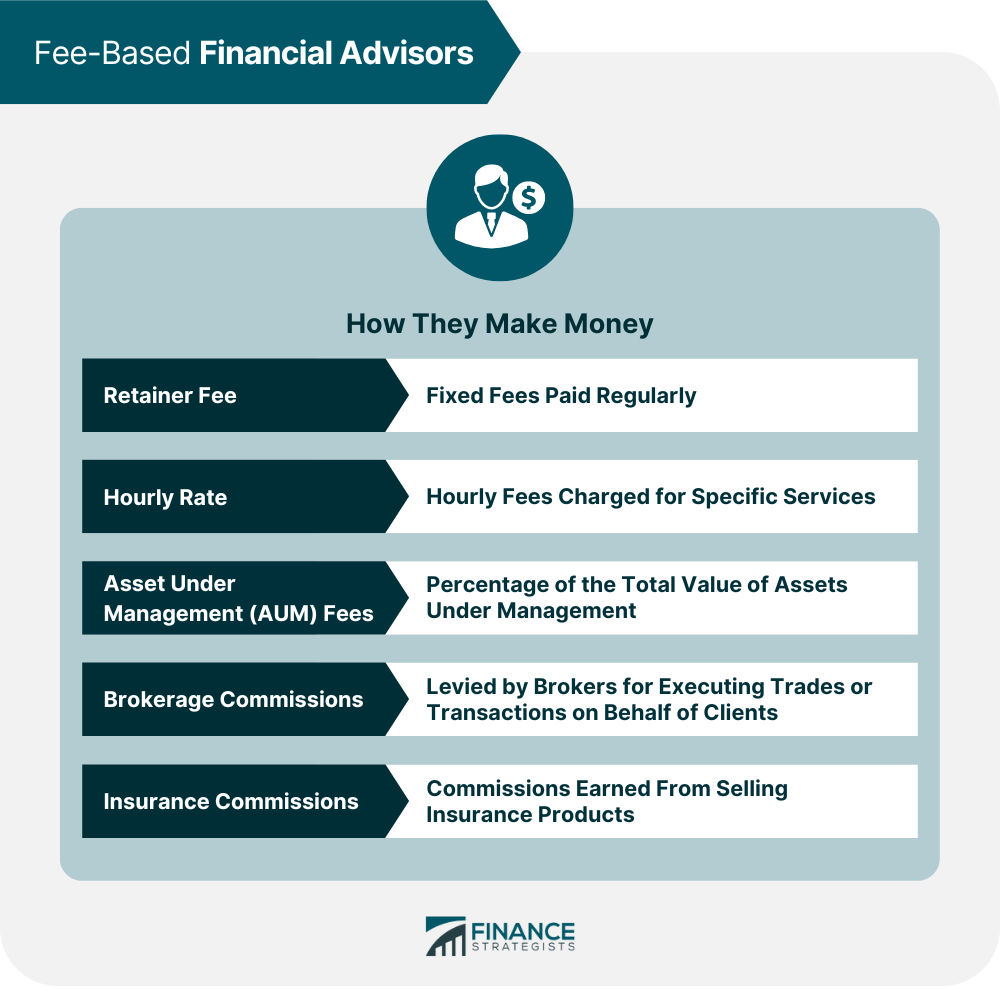

How Fee-Based Advisors Make Money

Retainer Fee

Hourly Rate

Assets Under Management (AUM) Fees

Brokerage Commissions

Insurance Commissions

How to Check Financial Advisor Costs

Fee-Based vs Fee-Only Financial Advisors: Which Is Best For You?

Final Thoughts

Fee-Based Advisor FAQs

Yes, having an experienced financial professional can provide valuable guidance when planning your finances. Financial advisors are highly trained professionals who understand the complexity of money management. They can help identify areas for improvement and provide sound advice on setting short-term and long-term goals.

The average cost of a financial advisor varies depending on the type of services offered. They charge an annual fee based on a percentage of your total assets under management, typically 1%. Costs can increase if you require more personalized advice or additional services, such as tax or retirement planning. Some advisors may charge an hourly or flat fee for their services. This could range from $200 to $400 an hour.

Yes, it is possible to negotiate financial advisor fees, especially if you are working with an independent advisor or a firm that offers flexible fee structures.

Fee-based financial advisors make money through brokerage and insurance commissions for the sale of stocks and insurance products. They also make money managing a portfolio of assets through asset under-management fees and by giving financial services by charging professional fees.

The main difference between fee-based and fee-only advisors is that fee-based advisors may receive commissions for selling certain products. In contrast, fee-only advisors cannot accept any form of commission or payment from an outside party. This means that fee-only advisors must charge their clients a flat fee for their services, while fee-based advisors may charge a combination of fees and commissions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.