Medicaid is a federal and state-funded healthcare program that provides health insurance to individuals and families with low income and limited resources. It offers comprehensive healthcare coverage, including doctor visits, hospitalization, prescription drugs, and long-term care services. The program is administered by each state. Generally, individuals must meet certain income and asset limits to qualify for Medicaid. Eligibility requirements vary depending on factors such as age, disability status, family size, and the particular state. Medicaid is designed to help individuals and families who may not have access to healthcare coverage through an employer or who cannot afford private health insurance. Medicaid can also provide coverage for long-term care services, which can be costly. A Certified Medicaid Planner is a qualified and experienced professional who provides guidance and advice on navigating the Medicaid program. These professionals can help individuals and families plan for Medicaid eligibility by analyzing their finances, identifying exempt assets, and developing strategies to protect assets and income. They can also assist with the Medicaid application process. Additionally, they ensure compliance with Medicaid rules and regulations regarding asset transfers, which is crucial for protecting assets while qualifying for Medicaid benefits. An individual must have the necessary credentials and experience to provide guidance and advice on navigating the Medicaid program. It requires completing a training program and passing an exam. The CMP Governing Board is a professional organization that sets standards for Medicaid planning and provides continuous education and training for Certified Medicaid Planners. A Certified Medicaid Planner should have a graduate degree or higher in health finance, accounting, law, or social work. Bachelor’s or associate degree holders, insurance or other securities licensees, and Certified Financial Planners (CFPs) may also qualify if combined with at least two years of experience in Medicaid planning. CMPs are required to have at least two years of experience in the Medicaid planning fields. Others without the necessary educational background mentioned above qualify if they have at least four years of full-time experience. It ensures that Certified Medicaid Planners have ample experience and expertise to provide planning services to clients. The CMP Governing Board sets standards for all Certified Medicaid Planners, which include a commitment to confidentiality, professionalism, competence, transparency, integrity, and avoiding conflicts of interest. Here are some of the specific tasks that a CMP can do: CMPs can assist individuals and families in the process of arranging one's finances and assets to become eligible for Medicaid benefits while still protecting one's assets and income. They can analyze an individual's finances, identify exempt assets, and develop strategies to protect assets and income while qualifying for Medicaid benefits. CMPs can develop techniques to help individuals and families safeguard their assets while still being eligible for Medicaid benefits. These strategies may include establishing trusts, gifting assets, or transferring assets to a spouse in compliance with Medicaid guidelines and regulations. The Medicaid application process can be complex and overwhelming. CMPs can ensure all necessary documentation is submitted and help individuals navigate any issues that may arise during the application process. Medicaid has strict rules and regulations regarding asset transfers, and a Certified Medicaid Planner can ensure that asset transfers are made in compliance with Medicaid rules and regulations to avoid penalties. A CMP can refer clients to attorneys or financial advisors who can assist with other aspects of Medicaid planning, such as estate planning or financial management. Consider the following: CMPs have the necessary expertise and knowledge to provide guidance and advice on navigating the Medicaid program. They can help individuals and families understand the eligibility requirements, benefits, and coverage options for Medicaid. CMPs can create asset protection plans for individuals and families seeking Medicaid benefits. These plans are designed to safeguard the client's assets while ensuring eligibility for Medicaid. Examples of asset protection strategies include establishing trusts, transferring assets to a spouse, or gifting assets, all following Medicaid regulations. CMPs are knowledgeable about the complex requirements and necessary documentation for Medicaid applications and can help ensure that all necessary documentation is submitted correctly. Additionally, they can guide you with any issues or complications that may arise during the application process. CMPs can maximize eligibility for Medicaid benefits, develop asset protection strategies, provide guidance on reducing healthcare costs, and assist with long-term care planning. They can help individuals and families structure their assets and income in a way that complies with Medicaid regulations and guidelines while still receiving the best possible coverage. By working with a CMP, individuals, and families can feel more confident in their ability to navigate the Medicaid program and protect their assets and income. CMPs can alleviate some of the stress and anxiety associated with the Medicaid program, providing clients with greater peace of mind. Here are the common disadvantages associated with working with a CMP: The costs of CMP services can vary widely depending on their qualifications, experience, and location. Some CMPs may charge hourly rates, while others may charge flat fees. In some cases, the cost of hiring a CMP may outweigh the potential benefits. CMPs may not be available in all areas, which could limit an individual or family's ability to access their services. It is particularly true in rural areas or areas with a low population density. While CMPs must adhere to ethical standards set by the CMP Governing Board, there is still a potential for unethical behavior. It may include overcharging for services, providing incorrect or misleading advice, or engaging in fraudulent behavior. It is important to research and work with a CMP with a reputation for honesty, integrity, and professionalism. Hiring a CMP means that an individual or family must rely on the CMP's guidance and advice, which may limit their control over the Medicaid planning process. Some individuals may prefer to handle Medicaid planning on their own, without the help of a professional. CMPs may use industry jargon and terminology unfamiliar to clients, which could lead to miscommunication. It is essential to work with a CMP who takes the time to explain the Medicaid planning process in plain language and who is willing to answer questions and provide clarification as needed. Should you need the services of a CMP, you can look at online databases or ask for referrals. You should also interview potential candidates before hiring them. The best resource is the CMP Governing Board’s locator tool. It allows you to search for CMPs based on your area or ZIP code. It will provide you with contact information. The National Care Planning Council also has a database of Medicaid planning service providers. Solicit referrals from friends, family members, or healthcare professionals. They may know a qualified and experienced Certified Medicaid Planner. Word of mouth is a valuable resource that can give you more confidence in the CMP you hire. It is crucial to conduct interviews with several potential CMPs before hiring them. It will ensure that the CMP is the right fit for your needs. Ask about their experience, fees, and services provided. A Certified Medicaid Planner guides and advises clients on how to navigate the Medicaid program. They have the necessary qualifications and experience, including a graduate degree or equivalent, at least two years of experience in Medicaid planning, and certification from the CMP Governing Board. They can assist individuals and families in developing asset protection strategies, completing the Medicaid application process, ensuring compliance with Medicaid regulations, and providing referrals to other professionals. Hiring a CMP can provide numerous benefits, including expertise and knowledge, asset protection, Medicaid application assistance, cost savings, and peace of mind. However, potential drawbacks include fees, limited availability, potential for unethical behavior, lack of personal control, and potential for misunderstandings. You can find a CMP through online databases and referrals. You should interview multiple candidates before choosing. Consult a qualified financial advisor for further information on Certified Medicaid Planners.Medicaid Program Overview

What Is a Certified Medicaid Planner (CMP)?

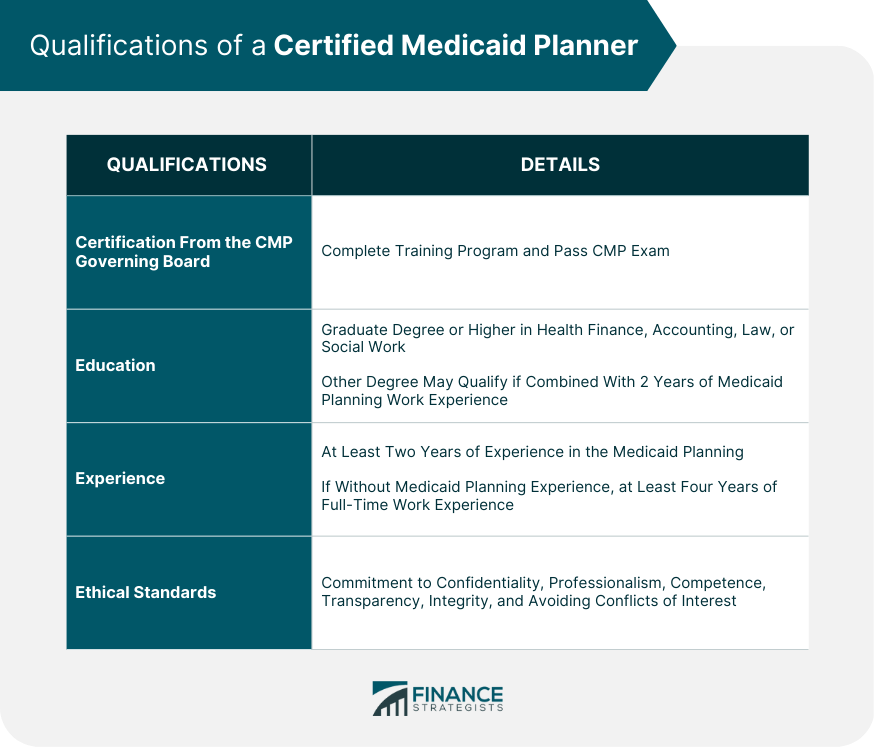

Qualifications of a Certified Medicaid Planner

Certification From the CMP Governing Board

Education

Experience

Ethical Standards

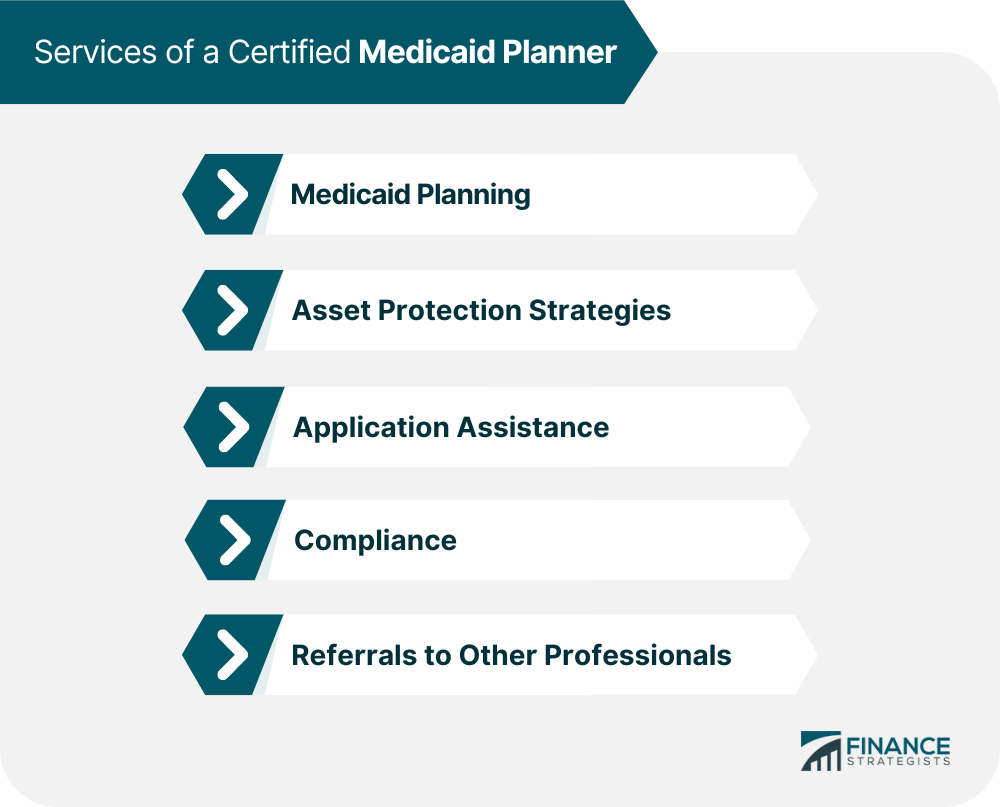

Services of a Certified Medicaid Planner

Medicaid Planning

Asset Protection Strategies

Application Assistance

Compliance

Referrals to Other Professionals

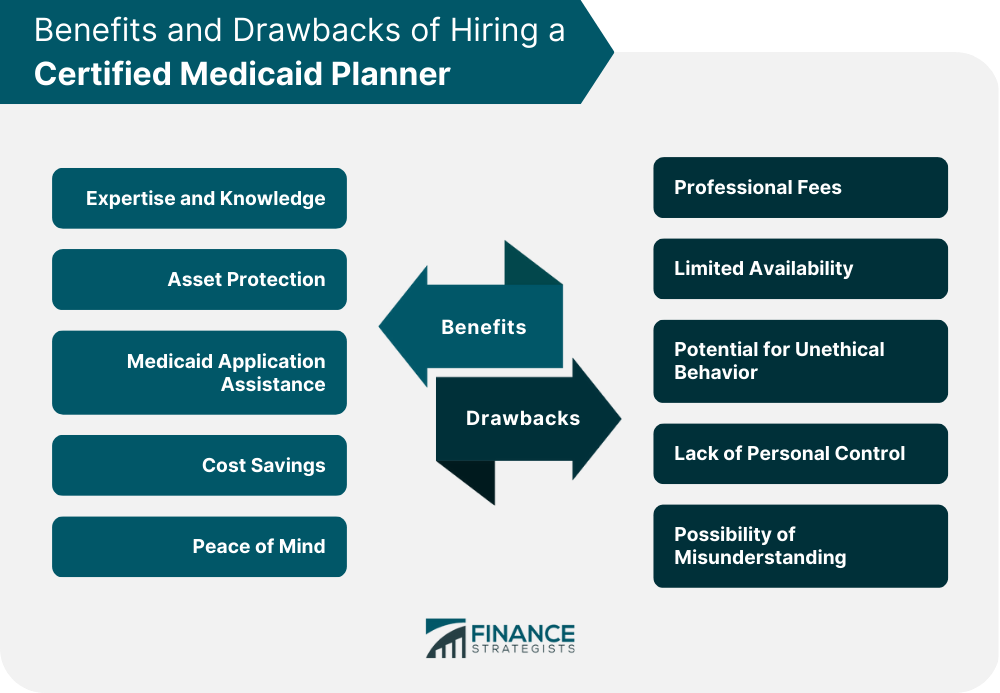

Benefits of Hiring a Certified Medicaid Planner

Expertise and Knowledge

Asset Protection

Medicaid Application Assistance

Cost Savings

Peace of Mind

Drawbacks of Hiring a Certified Medicaid Planner

Professional Fees

Limited Availability

Potential for Unethical Behavior

Lack of Personal Control

Possibility of Misunderstandings

Finding a Certified Medicaid Planner

Search Online Databases

Ask for Referrals

Interview Multiple Candidates

Final Thoughts

Certified Medicaid Planner FAQs

Certified Medicaid Planners provide a range of services, including Medicaid planning, asset protection strategies, application assistance, compliance with Medicaid regulations, and referrals to other professionals. They help individuals and families navigate the Medicaid program, understand eligibility requirements, and ensure compliance with Medicaid rules and regulations.

A Certified Medicaid Planner should have a graduate degree or higher in health finance, accounting, law, or social work. Bachelor’s or associate degree holders, insurance or other securities licensees, and Certified Financial Planners (CFPs) may also qualify if combined with at least two years of experience in Medicaid planning.

You can use the locator tool provided on the CMP Governing Board website. This tool enables you to search for CMPs based on your location. Alternatively, you can ask for recommendations from individuals you trust, including friends, family members, or healthcare professionals.

Certified Medicaid Planners adhere to ethical guidelines established by the CMP Governing Board, which emphasize confidentiality, professionalism, competence, transparency, integrity, and the avoidance of conflicts of interest.

Certified Medicaid Planners can help save costs by maximizing eligibility for Medicaid benefits, developing asset protection strategies, providing guidance on reducing healthcare costs, and assisting with long-term care planning. They can help individuals and families structure their assets and income to comply with Medicaid regulations and guidelines while still receiving the best possible coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.