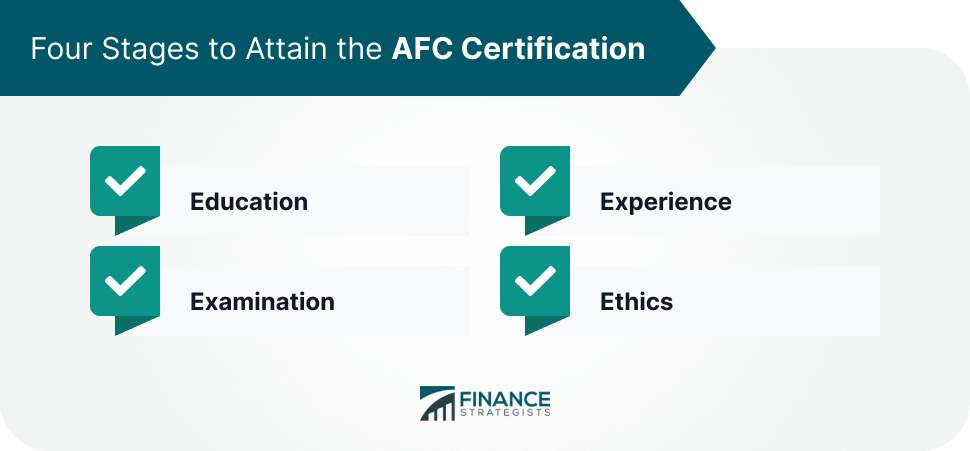

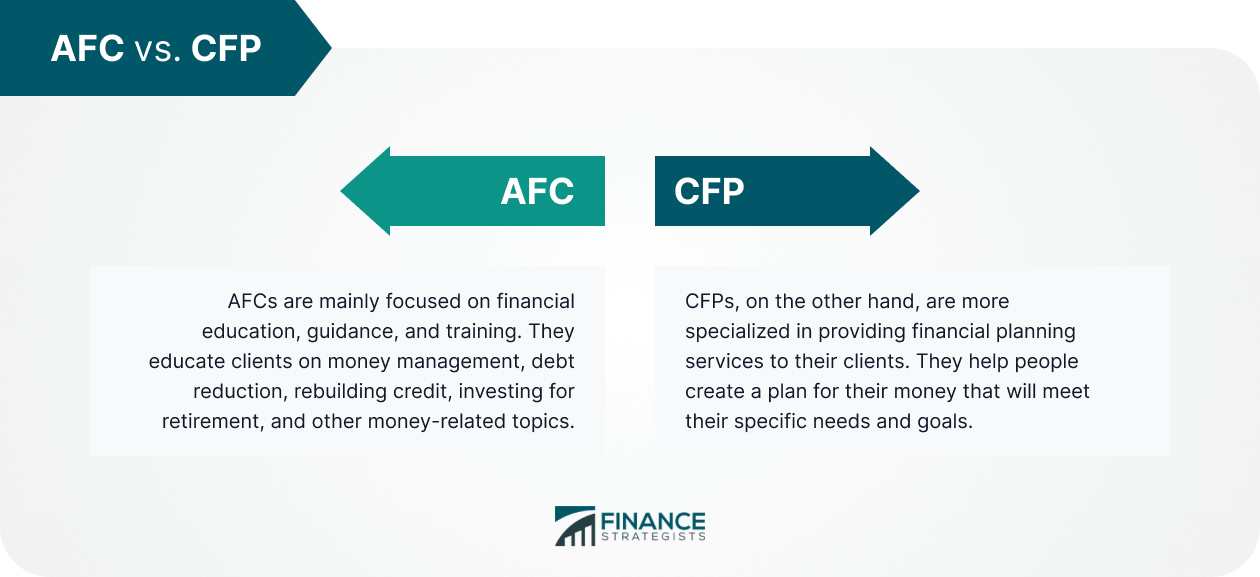

An Accredited Financial Counselor (AFC) is a designation given to financial professionals who pass an exam demonstrating their ability to educate clients about complex financial matters. The AFC designation is issued by the Association for Financial Counseling and Planning Education (ACFPE). The Association for Financial Counseling and Planning Education (ACFPE) is a nonprofit organization that sets the standard for AFC training and certification. ACFPE sets forth a code of ethics, tells universities what they should be teaching within financial counseling programs, and accredits such programs that meet their standards. The ACFPE mainly focuses on financial education, guidance, and training. It educates clients on money management, debt reduction, rebuilding credit, investing for retirement, and other money-related topics. Have a financial question? Click here. There are four stages to attain the AFC certification: The education requirements of this designation may be completed in a number of ways: 1. Self-Paced Study This option requires that the program be completed within three years from the date of registration and it costs $1,350-$2,000. 2. Financial Education Challenge This option requires that the educational program should be completed within one year from the date of registration. This option costs $800. 3. Professional Designation Similar to the Financial Education Challenge option, this program also should be completed within one year from the date of registration but this option costs $1,075 to $1,625. 4. University Program Option This program costs $490. 5. Distance Learning Program Similar to the University Program option, this option also costs $490. The three-hour-long computer-based AFC examination may be taken after the education requirement has been completed by the applicant. It consists of 165 multiple-choice questions. In case an applicant fails the exam, he or she will have to wait for 30 days until the exam can be retaken. Applicants have up to five chances to take the exam. A 30-hour continuing education every three years has to be completed in order to maintain the designation as AFC. A fee of $55 also needs to be paid each year. Along with the education requirement that needs to be fulfilled to get the AFC certification, candidates should also be able to complete 1,000 hours of experience in the area of financial counseling. This may be done simultaneously with the education program or after completion of the examination given that they are all completed within the designated time frame. AFC designation holders are to follow a code of ethics that emphasizes high standards of conduct, integrity, and objectivity. One advantage of being an AFC is that it opens up career opportunities for financial counselors due to the increasing need for qualified professionals in this field. Having this designation also allows people to specialize in certain areas of financial counseling, such as credit counseling, debt counseling, or retirement planning. Another advantage is that the ACFPE provides continuing education opportunities for AFCs to stay up-to-date with the latest changes in the financial industry. This means that AFCs are not only knowledgeable about personal finance but also current with the latest trends in the field. While these two are both important designations in the field of personal finance, AFCs and CFPs have different areas of focus. AFCs are mainly focused on financial education, guidance, and training. They educate clients on money management, debt reduction, rebuilding credit, investing for retirement, and other money-related topics. CFPs, on the other hand, are more specialized in providing financial planning services to their clients. They help people create a plan for their money that will meet their specific needs and goals. The CFP designation is also more popular and well-known than the AFC designation. CFPs also cater to high-income clients who are looking for financial security, whereas AFCs focus on low- to middle-income clients who need help with financial challenges. There is no straightforward answer to this question. It mainly depends on which area of personal finance you need help with and what your budget is. If you are looking for someone to help you create a financial plan, then hiring a CFP would be the best option. However, if you need someone to educate you on money management and teach you how to reduce your debt, then an AFC would be a better choice. Overall, both the AFC and CFP designations are valuable and important in the field of personal finance. They both offer different areas of focus and benefits that can be helpful for individuals and businesses alike. The AFC designation is a good option for those who want to specialize in financial counseling and gain knowledge about personal finance. The ACFPE offers high standards of conduct, integrity, and objectivity that AFC holders are expected to follow. The continuing education opportunities provided by the ACFPE are also beneficial for AFCs to stay current with the latest changes in the industry. The CFP designation is more popular and well-known than the AFC designation. It is mainly focused on providing financial planning services to high-income clients. However, it also offers continuing education opportunities that can benefit those who are looking to specialize in a certain area of personal finance. Just like any other course or designation, it is important to take the time to educate yourself about what each designation offers so that you can choose the right one for your needs. How to Become an Accredited Financial Counselor

Education

Examination

Experience

Ethics

Advantages of Being an Accredited Financial Counselor

AFC vs CFP

Which One Should I Hire?

Final Thoughts

Accredited Financial Counselor FAQs

An Accredited Financial Counselor (AFC) is a professional who has completed the Accredited Financial Counseling Professional Education program and is certified by the Association for Financial Counseling & Planning Education (ACFPE). They specialize in providing financial guidance, education, and training to clients on topics such as money management, budgeting, debt reduction, rebuilding credit, and investing for retirement.

Yes. But in terms of popularity, the AFC designation is not as widely recognized as the CFP designation. However, it is becoming more popular and many employers are starting to recognize it as a valuable certification.

Accredited Financial Counselors (AFCs) are mainly focused on financial education, guidance, and training. They specialize in teaching clients how to manage their money, reduce their debt, rebuild credit, and invest for retirement. Certified Financial Planners (CFPs) are more specialized in providing financial planning services to their clients. They help people create a plan for their money that meets their specific needs and goals.

Accredited Financial Counselors have the knowledge, experience, and resources to provide sound financial advice and guidance on topics such as money management, budgeting, debt reduction, rebuilding credit, and investing for retirement. They are also held to high standards of integrity and objectivity by the ACFPE, which means that clients can trust them to provide unbiased advice and guidance. In addition, Accredited Financial Counselors also offer continuing education opportunities for their clients in order to stay up-to-date on the latest changes in the industry.

The Accredited Financial Counselor (AFC) designation is a professional certification given by the Association for Financial Counseling & Planning Education (ACFPE). It certifies individuals who have completed the Accredited Financial Counseling Professional Education program and demonstrate mastery of competency-based knowledge and skills in the area of financial counseling.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.