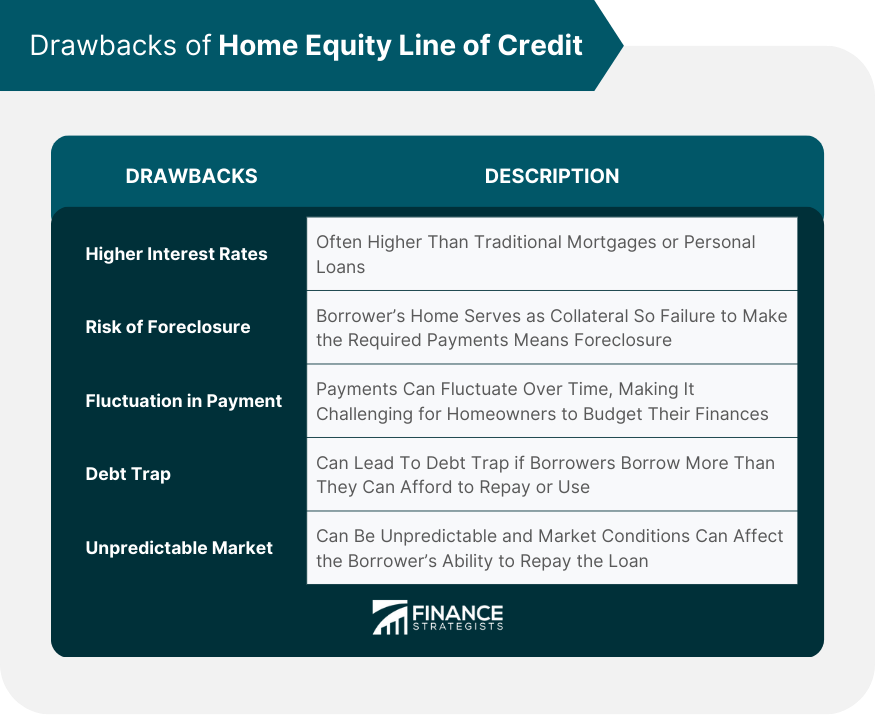

Home Equity Line of Credit (HELOC) is a popular financing option for homeowners who need access to funds for various purposes such as home renovations, debt consolidation, and emergencies. HELOC allows homeowners to borrow against the equity they have built in their homes. While there are many benefits of HELOC, there are also several disadvantages that homeowners need to be aware of before deciding to take out a HELOC. One of the main disadvantages of HELOC is the higher interest rates compared to other types of loans. HELOC interest rates are usually variable and tied to the prime rate, which means they can fluctuate over time. This can make it difficult for homeowners to budget their monthly payments, as they can increase or decrease depending on the market conditions. Furthermore, the interest rates on HELOCs are typically higher than those of traditional mortgages or personal loans. The higher interest rates mean that homeowners end up paying more in interest charges over the life of the loan, which can significantly increase the total cost of the loan. Factors that can affect the interest rates on HELOC include the borrower's credit score, the amount of equity in the home, the loan-to-value ratio, and the overall market conditions. Homeowners should carefully consider these factors before taking out a HELOC to ensure they can afford the loan payments over the long term. Another significant disadvantage of HELOC is the risk of foreclosure. HELOC is a secured loan, which means that the borrower's home serves as collateral for the loan. If the borrower fails to make the required payments, the lender can foreclose on the home to recoup the outstanding balance. The risk of foreclosure is higher with HELOC because the loan amount is often significant, and the repayment terms are flexible. This can make it challenging for homeowners to keep up with their payments, especially if they experience financial hardship or a change in their financial situation. For example, if a homeowner takes out a HELOC to pay for home renovations but then loses their job, they may not be able to make the required payments on the loan. If they continue to miss payments, the lender may initiate foreclosure proceedings, which can result in the homeowner losing their home. HELOC payments can also fluctuate over time, which can make it difficult for homeowners to budget their finances. Unlike traditional loans that have fixed payments, HELOC payments can vary depending on the outstanding balance and interest rate. This can make it challenging for homeowners to plan for their monthly expenses, especially if they rely on a fixed income. Furthermore, fluctuation in payment can affect the borrower's credit score. Late payments or missed payments can have a negative impact on the borrower's credit score, which can affect their ability to borrow money in the future. Homeowners should carefully consider their ability to make consistent payments before taking out a HELOC. HELOCs can also lead to a debt trap if not used wisely. The flexible repayment terms and low initial payments can make a HELOC an attractive financing option for homeowners. However, if homeowners borrow more than they can afford to repay or use the funds for non-essential expenses, they can quickly find themselves in a debt trap. Debt traps occur when borrowers become trapped in a cycle of debt and are unable to make the required payments on their loans. This can lead to missed payments, late fees, and penalties, which can significantly increase the total cost of the loan. Additionally, a debt trap can have a negative impact on the borrower's credit score, making it harder for them to borrow money in the future. Finally, the HELOC market can be unpredictable, and market conditions can affect the borrower's ability to repay the loan. The market conditions can affect the interest rate, the home value, and the borrower's ability to access funds. For instance, if the home value decreases, it can affect the amount of equity available to the borrower, and if the interest rate increases, it can increase the monthly payments. The market conditions can also impact the borrower's employment status, income, and financial stability. For example, if there is a recession or a job loss, it can make it challenging for borrowers to make the required payments on the loan. Therefore, borrowers need to be aware of the market conditions and have a backup plan to handle unforeseen circumstances. This includes having an emergency fund, exploring alternative financing options, and making timely payments to avoid defaulting on the loan. HELOC is a popular financing option for homeowners who need access to funds. However, there are several disadvantages that homeowners need to consider before taking out the loan. These include higher interest rates, the risk of foreclosure, fluctuation in payment, debt trap, and unpredictable market conditions. Homeowners should carefully weigh the pros and cons of HELOC and explore alternative financing options before making a decision. They should also ensure that they can make timely payments on the loan to avoid defaulting and losing their home. By taking a cautious approach, homeowners can use HELOC to their advantage and achieve their financial goals without putting their home at risk.Home Equity Line of Credit Defined

Higher Interest Rates

Risk of Foreclosure

Fluctuation in Payment

Debt Trap

Unpredictable Market

Conclusion

What Are the Disadvantages of Home Equity Line of Credit? FAQs

The biggest disadvantage of a HELOC is the risk of foreclosure. Since the loan is secured by the borrower's home, if they fail to make the required payments, the lender can foreclose on the property.

The interest rate for a HELOC is typically higher than that of a traditional mortgage or personal loan. The interest rate is often variable and tied to the prime rate, which means it can fluctuate over time.

Yes, fluctuation in payment can have a negative impact on the borrower's credit score. Late payments or missed payments can lower the credit score, which can affect the borrower's ability to borrow money in the future.

HELOC can lead to debt trap if borrowers borrow more than they can afford to repay or use the funds for non-essential expenses. This can result in missed payments, late fees, and penalties, which can significantly increase the total cost of the loan.

If homeowners can't make the required payments on their HELOC, they should contact their lender immediately. They may be able to negotiate a repayment plan or explore alternative financing options to avoid defaulting on the loan. It is essential to take action as soon as possible to avoid foreclosure and losing their home.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.