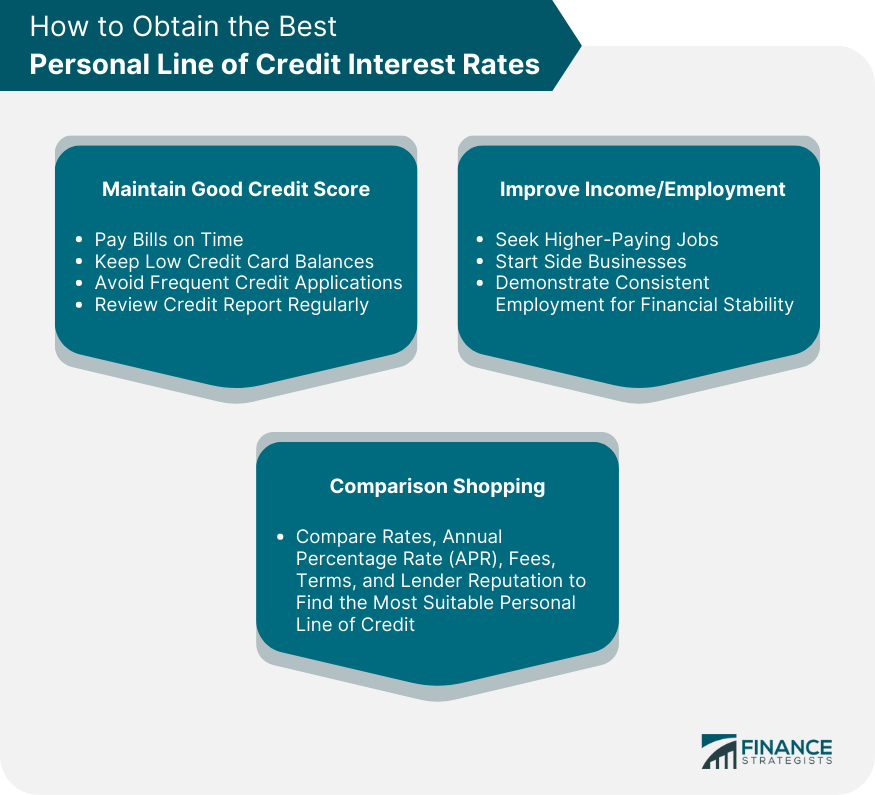

A personal line of credit, akin to a credit card, represents a flexible loan from a bank or a financial institution. It provides individuals with a set amount of money that they can draw from whenever required. Interest rates on personal lines of credit are typically lower than those on credit cards, making them a cost-effective solution for individuals with good credit scores who require flexible borrowing. The rate is expressed as a percentage of the amount borrowed and is usually charged annually, known as the Annual Percentage Rate (APR). While the interest rate may seem small at first glance, it can significantly affect the cost of borrowing over time. Interest rates for personal lines of credit are usually variable, meaning they can increase or decrease over time. This variability adds an element of risk for borrowers because the amount of interest they pay can fluctuate. This can be achieved by paying all bills on time, keeping credit card balances low, not applying for new credit frequently, and regularly checking your credit report for errors. A high credit score signals to lenders that you are a responsible borrower, which can make them more willing to offer you a lower interest rate. Even a small improvement in your credit score can result in significant savings over the life of your line of credit. Another way to obtain better interest rates is to improve your income and employment history. This could mean seeking a higher-paying job, starting a side business, or even asking for a raise at your current job. Similarly, maintaining steady employment over time can demonstrate financial stability and improve your appeal to lenders. While income and employment history are not the only factors that lenders consider, they can play a significant role in determining the interest rate for a personal line of credit. Improving these aspects of your financial profile can help you obtain more favorable rates. Different lenders offer different interest rates, and some may be willing to negotiate or match the rates offered by competitors. When comparing rates, be sure to consider all aspects of the line of credit, including the APR, fees, repayment terms, and lender reputation. By doing your homework and comparing different offers, you can find the best personal line of credit for your needs. A credit score is a numerical representation of an individual's creditworthiness, based on their credit history. Higher credit scores signify a lower risk for the lender, leading to more favorable interest rates. In contrast, lower credit scores reflect a higher risk of non-payment, compelling lenders to charge higher interest rates to compensate for the increased risk. Consequently, maintaining a high credit score is crucial for obtaining lower interest rates. Stable income and long-term employment suggest that the borrower can reliably repay the borrowed amount, reducing the lender's risk. On the other hand, sporadic income history or frequent job changes can signify financial instability, making lenders wary. To compensate for the increased risk, they may charge higher interest rates. Typically, larger loans pose a greater risk to lenders. If the borrower defaults, the lender stands to lose a more significant sum. Therefore, lenders often charge higher interest rates on larger loans to mitigate this risk. However, some financial institutions may offer lower rates on larger loans as a competitive strategy. They might view customers seeking large loans as potentially more profitable and hence offer them better rates. Longer repayment terms increase the lender's risk as it extends the period during which the lender's money is at risk. Hence, lenders often charge higher interest rates for longer-term loans. Shorter repayment terms imply lower risk and hence often come with lower interest rates. However, it's important to note that shorter terms also mean higher monthly payments. Fixed interest rates remain constant throughout the lifetime of the line of credit. This means borrowers can predict their future payments and budget accordingly without worrying about fluctuations in the market interest rate. The downside of fixed rates is that borrowers won't benefit from falling market interest rates. Moreover, fixed interest rates for personal lines of credit are generally higher than the initial rates offered by variable interest rate lines of credit. Variable interest rates for personal lines of credit fluctuate based on a reference interest rate, often the prime rate set by major banks. This means that the rate, and consequently, the interest cost, can increase or decrease over time. While variable rates can offer initial savings compared to fixed rates, they come with the risk of rising costs. If market rates increase significantly, borrowers could end up paying substantially more in interest than they anticipated. The prime rate is the interest rate that commercial banks offer to their most creditworthy customers. Most personal lines of credit use the prime rate plus a certain percentage, which varies depending on the lender and the borrower's creditworthiness. When the prime rate changes, the interest rate on a prime-based personal line of credit changes accordingly. If the prime rate falls, the interest rate on the line of credit decreases, reducing the cost of borrowing. Conversely, if the prime rate rises, the interest rate increases, making borrowing more expensive. With a lower rate, a larger portion of each payment goes toward reducing the outstanding balance, rather than paying interest. This allows borrowers to pay off their line of credit more quickly and with less financial strain. Moreover, lower monthly payments can free up cash for other purposes, such as saving, investing, or spending on necessities. It can make the line of credit a more manageable part of the borrower's overall financial situation. Lower rates mean that less money is paid in interest over the life of the line of credit. This can result in significant savings, especially for large loans or loans with longer repayment terms. The savings can be substantial and can be used for other financial goals, such as paying down other debts, investing, or building an emergency fund. By minimizing the total interest paid, borrowers can get the most value out of their line of credit. Lower interest rates can lead to increased savings in two ways. First, the money saved on interest payments can be directly added to savings. Second, lower monthly payments can leave more room in the budget for regular savings contributions. By reducing the cost of borrowing, lower interest rates can make a line of credit a more affordable financial tool. This can make it easier for borrowers to manage their finances, save for the future, and achieve their financial goals. Higher rates mean that a larger portion of each payment goes toward interest, rather than reducing the outstanding balance. This can make the line of credit more expensive to manage on a month-to-month basis and could strain the borrower's budget. Furthermore, if the interest rate on a variable rate line of credit increases significantly, the borrower could be faced with sharply higher payments. This could lead to financial hardship, particularly for those with tight budgets or limited incomes. Over time, higher interest rates can result in significantly greater total interest payments. The higher the rate, the more money is paid in interest over the life of the line of credit. This can make the line of credit much more expensive in the long run, even if the monthly payments seem manageable. Greater total interest payments mean that less money is available for other financial goals, such as paying down other debts, investing, or building an emergency fund. High interest rates can create financial strain, especially if they lead to high monthly payments or if the borrower has other substantial financial commitments. If the borrower struggles to make their payments, they may need to cut back on other expenses, incur more debt, or even default on the line of credit, which could harm their credit score. The stress of managing high-interest debt can also have psychological impacts, contributing to anxiety and stress. It's crucial for borrowers to consider the potential impact of high-interest rates on their overall financial and mental health. When comparing personal line of credit interest rates, it's important to consider the total cost of borrowing, which includes not only the interest rate but also any fees and charges. These can include annual fees, late payment fees, over-limit fees, and cash advance fees. Even if a line of credit offers a low-interest rate, high fees can significantly increase the overall cost of borrowing. Borrowers should therefore look at the APR, which includes both the interest rate and the effect of any fees and charges, to get a more accurate picture of the cost of borrowing. These can include the repayment term, the minimum monthly payment, the grace period for repayments, and the conditions under which the lender can change the interest rate or other terms. While it can be tempting to focus solely on the interest rate, borrowers should take the time to understand all the terms and conditions of a line of credit. This will help them avoid surprises and ensure that the line of credit fits their needs and financial situation. Some financial institutions offer lower interest rates or more favorable terms to existing customers or those who have other products with the institution, such as a checking or savings account. A good relationship with a lender can make it easier to negotiate better terms, resolve any issues that arise, or get help if you're struggling to make your payments. While the interest rate is certainly important, the quality of service and the relationship with the lender can also make a significant difference to the borrowing experience. Personal line of credit interest rates refer to the amount of interest charged on a personal line of credit, which is a flexible borrowing option. Various factors influence these interest rates, including the borrower's credit score, income and employment history, loan amount, and repayment term. One of the significant benefits of lower interest rates is the ability to enjoy lower monthly payments, reducing the strain on your budget. Additionally, lower interest rates can lead to reduced total interest payments over the course of the loan, ultimately saving you money. Higher interest rates can result in higher monthly payments and greater total interest payments, which may cause financial strain and impact your ability to repay the borrowed amount. To obtain the best personal line of credit interest rates, maintain a good credit score, improve your income and employment history, and engage in comparison shopping to find the most favorable terms and conditions. What Is a Personal Line of Credit?

How to Obtain the Best Personal Line of Credit Interest Rates

Maintain a Good Credit Score

Improve Income and Employment History

Comparison Shopping

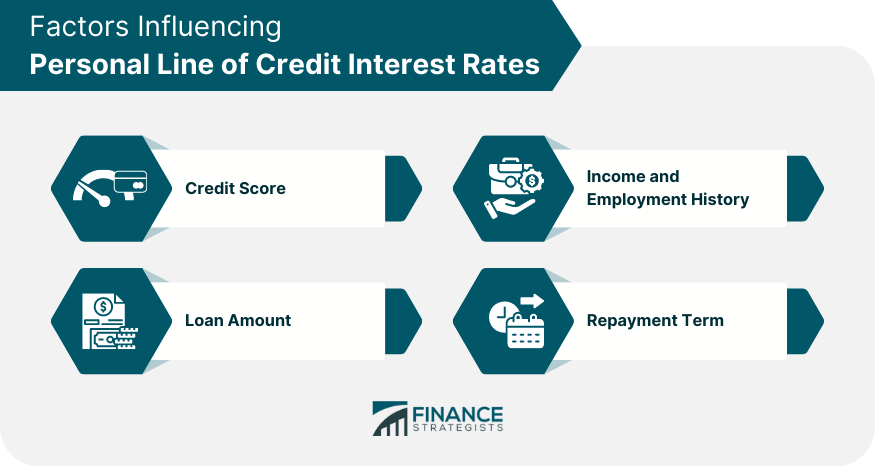

Factors Influencing Personal Line of Credit Interest Rates

Credit Score

Income and Employment History

Loan Amount

Repayment Term

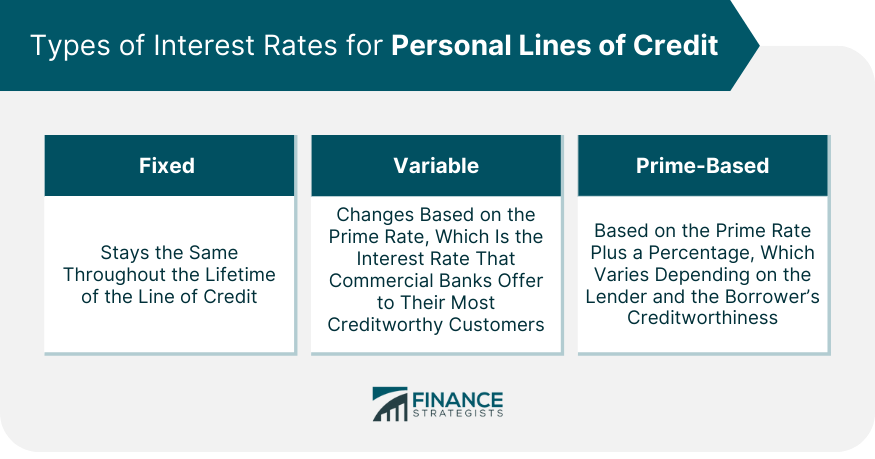

Types of Interest Rates for Personal Lines of Credit

Fixed Interest Rates

Variable Interest Rates

Prime-Based Interest Rates

Benefits of Lower Personal Line of Credit Interest Rates

Lower Monthly Payments

Reduced Total Interest Payments

Increased Savings

Risks of Higher Personal Line of Credit Interest Rates

Higher Monthly Payments

Greater Total Interest Payments

Financial Strain

Factors to Consider When Comparing Personal Line of Credit Interest Rates

Fees and Charges

Terms and Conditions

Relationship With Lender

Conclusion

Personal Line of Credit Interest Rates FAQs

A personal line of credit is a flexible loan from a bank or financial institution. Unlike a traditional loan, a personal line of credit allows you to borrow as much or as little as you need, up to a set limit, and only pay interest on the amount borrowed.

The interest rate is a crucial factor in the overall cost of a personal line of credit. It determines the amount of interest you pay over time. A lower interest rate can significantly reduce the cost of borrowing, while a higher rate can make the line of credit more expensive.

Several factors can influence the interest rate on a personal line of credit, including your credit score, income and employment history, the loan amount, and the repayment term.

To get the best interest rate on a personal line of credit, maintain a good credit score, demonstrate stable income and employment, and shop around to compare rates from different lenders.

When comparing personal line of credit interest rates, consider the total cost of borrowing, including both the interest rate and any fees or charges. Also, look at the repayment terms, and consider your relationship with the lender.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.