When it comes to financing options, understanding the differences between a line of credit and a loan is crucial. A line of credit is a flexible form of borrowing that allows individuals or businesses to access funds up to a predetermined credit limit. It operates on a revolving basis, meaning that borrowers can withdraw, repay, and borrow again within the established limit. This flexibility is advantageous for managing fluctuating expenses or unexpected financial needs. On the other hand, a loan provides a fixed amount of money that is typically repaid in installments over a specified period. Loans are suitable for one-time expenses or larger investments, offering a predictable repayment schedule with fixed interest rates. While a line of credit provides ongoing access to funds, loans are more structured and better suited for specific purposes. A line of credit is a type of credit facility offered by banks and financial institutions that allows borrowers to draw funds up to a pre-set limit. Unlike a traditional loan, where the entire amount is disbursed at once, a line of credit gives the borrower flexibility to use funds as per their needs, up to the maximum limit. The borrower only pays interest on the amount they draw from the line of credit. The convenience of a line of credit is echoed in its flexible nature. The borrower can continue to access funds, repay, and withdraw again within the predefined limit. This credit facility is particularly advantageous when the financial requirement is unpredictable or fluctuating, such as in the case of small business expenses, education costs, or home renovations. This arrangement offers a pool of money that can be accessed whenever needed, providing a financial safety net for unexpected expenses. The continuous availability of funds makes it ideal for unpredictable, recurring, or ongoing expenses. Interest rates on lines of credit are often variable, meaning they can fluctuate over time based on changes in the benchmark interest rate set by the Federal Reserve. This can result in changes in the amount of interest you owe, making it harder to predict future payments. The variable interest rate characteristic could potentially work for or against the borrower. In a falling interest rate environment, the cost of borrowing decreases. Unlike traditional loans, where interest starts accruing on the full loan amount immediately after disbursement, a line of credit only requires you to pay interest on the money you actually draw. This feature can save you a significant amount of money, especially if you don’t need to use the entire credit limit. Lines of credit usually require a minimum monthly payment that includes a portion of the principal along with the accrued interest. The minimum payment provides some flexibility, allowing you to repay the balance more slowly if necessary. However, keep in mind that making only the minimum payments means you'll pay more in interest over time. Additionally, some lines of credit have a draw period, after which you must begin repaying the full balance. Lines of credit are often set up for a shorter term compared to loans. This feature makes them well-suited to meeting short-term or intermittent financial needs. Despite their shorter term, some lines of credit are renewable, meaning that once you've paid off your balance, you can draw funds again up to your credit limit. This revolving nature can provide ongoing support for your financial needs, provided you manage it responsibly. A line of credit shines when it comes to managing ongoing, unpredictable expenses. The inherent flexibility of this credit facility allows borrowers to effectively manage and navigate situations with varying cash flow requirements. Whether it's unexpected medical bills, urgent home repairs, or uneven business cash flows, a line of credit provides the financial buffer needed to meet these challenges. However, it requires careful management to avoid overspending and escalating debt. Unlike traditional loans, which provide funds in one lump sum, a line of credit allows you to draw funds as and when required. This availability can be especially beneficial in managing ongoing expenses or navigating uncertain financial periods. It allows you to effectively handle financial obligations without overborrowing or incurring unnecessary interest costs. Generally, lines of credit offer lower interest rates than credit cards, making them a more cost-effective option for borrowing. They can serve as a valuable financial tool for those needing access to funds for ongoing expenses, while avoiding the high-interest debt often associated with credit cards. Lines of credit are designed so that you only pay interest on the amount you borrow, not on the entire credit limit. This feature can result in substantial savings, particularly if you only need a portion of the available credit line. This borrowing structure fosters greater flexibility and cost efficiency, particularly when compared to traditional loans, where interest is charged on the total loan amount from the disbursement date. The ready availability of funds might tempt some individuals to draw more money than necessary, leading to higher debt levels. Given the ease of accessing funds, maintaining discipline in spending and borrowing habits becomes critical when using a line of credit. It's important to remember that any money borrowed must be repaid, often with interest. These fluctuations can make it more difficult to predict your future payment obligations, potentially complicating your budgeting efforts. If you're considering a line of credit, make sure you understand how its variable interest rate works, including how often the rate may change and how rate changes will affect your payments. Obtaining a line of credit often requires either collateral or a strong credit history. Unsecured lines of credit, which don't require collateral, typically require good to excellent credit scores for approval. On the other hand, secured lines of credit, backed by assets such as your home, can be easier to obtain but come with the risk of losing your collateral if you default on repayments. A loan, on the other hand, is a fixed amount of money that a lender provides to a borrower with the expectation that it will be paid back with interest over a set period of time. Once the loan is disbursed, the borrower must begin making regular payments until the loan is fully paid off. Loans are typically used for larger, one-time expenses, such as buying a car or a home. This form of financing has a clear repayment schedule, and the interest rate is typically fixed, allowing borrowers to anticipate and plan for their payments. However, it's worth noting that once a loan is paid off, you can't access additional funds without applying for a new loan. One of the defining features of a loan is the provision of funds in a lump sum. Once the loan agreement is finalized, the lender provides the borrower with the entire loan amount upfront. This structure is ideal for larger, one-time expenses, such as buying a house, a car, or funding a major project. However, once the funds are disbursed, you can't access additional money without applying for another loan. This means the rate stays constant over the life of the loan, providing predictability in terms of monthly payments. Knowing exactly what your payment will be each month simplifies budgeting, as the payment amount remains unchanged over the repayment period. However, if interest rates fall after you've taken out your loan, you could end up paying more in interest than with a variable rate loan. With a loan, interest begins accruing on the entire loan amount as soon as it's disbursed. Regardless of how much of the loan you've used, you'll be charged interest on the full amount from day one. While this can make a loan more expensive than a line of credit for short-term or variable financing needs, it might still be a cost-effective option for larger, long-term purchases or projects. Loans come with consistent, scheduled monthly payments that include both the principal and the interest. These payments are calculated at the beginning of the loan term and remain constant over the loan's life. The predictability of a fixed payment schedule can be beneficial for budgeting purposes. You'll know exactly how much you need to set aside each month for your loan payment, and you can rest assured that your debt will be paid off by a specific date. Loans are usually set up for longer terms compared to lines of credit. These extended repayment periods, often measured in years, make them suitable for larger purchases or investments. With a longer term, borrowers can spread out their payments over a longer period of time, potentially making each payment more manageable. However, a longer term also means you could end up paying more in interest over the life of the loan. Loans are generally better suited for single, substantial expenses or for situations where the total cost is known in advance. This might include paying for a wedding, purchasing a vehicle, or funding a home renovation project. When the total expense is known, a loan can provide the exact funds needed without the temptation or possibility of overborrowing that can come with a line of credit. Plus, the consistent repayment schedule and fixed interest rate make managing the debt straightforward and predictable. Once you take out a loan, the lender provides a schedule that details how much you'll pay each month, the interest and principal components of each payment, and the date your loan will be paid off. This structure provides predictability and allows for easy budgeting. You know exactly when and how much to pay, ensuring that as long as you make your payments on time, you'll pay off your loan by a certain date. Loans offer predictable monthly payments. Because most loans have fixed interest rates, your payment amount stays the same throughout the life of the loan. This consistency can be a significant advantage when it comes to budgeting and financial planning. You know exactly how much to set aside each month for your loan payment, making it easier to plan your finances and avoid missed payments. Loans are ideal for larger one-time expenses, where the total cost is known upfront. Because loans provide a lump sum of money, they allow you to cover these costs without worrying about borrowing more money later. Whether it's for a new car, home renovations, or a big life event like a wedding, a loan can offer the funds you need with a clear repayment plan. However, it's crucial to borrow responsibly and ensure you can afford the repayments before taking out a loan. Unlike a line of credit, a loan offers limited flexibility when it comes to borrowing additional funds. Once you receive the loan amount, you can't borrow more money without applying for a new loan. This limitation can be challenging if your financial needs change or you encounter unexpected expenses. In such situations, you might need to seek additional financing, which could lead to higher debt levels and potentially strain your budget. This is particularly true for unsecured personal loans, where the interest rate can be significantly higher than that of a secured line of credit, such as a home equity line of credit. Higher interest rates can lead to higher borrowing costs over the life of the loan. It's important to carefully consider the interest rate when choosing between a loan and a line of credit and to factor in the potential interest costs when making your decision. Some loans come with prepayment penalties or fees for repaying the loan early. These charges can add to the overall cost of the loan and make it less cost-effective to pay off your debt ahead of schedule. It's always important to read the fine print and understand the terms and conditions of your loan before signing the agreement. If you think there's a chance you'll want to pay off your loan early, look for a loan without prepayment penalties. When deciding between a line of credit and a loan, your specific financial goals and needs should be a primary consideration. A line of credit may be suitable if you need flexible access to funds over time, while a loan may be a better choice for large, one-time expenses. It's important to consider your own financial situation, including your income, expenses, and existing debts. Always consider your ability to repay the borrowed money before deciding to take on additional debt. Your usage patterns and borrowing habits can also influence which type of credit is best for you. If you're disciplined and only borrow what you need, a line of credit can offer a flexible and potentially less expensive way to meet your financial needs. However, if you're prone to overspending or have trouble managing debt, a loan with its fixed repayment schedule and predictable payments may be a safer choice. A line of credit, particularly one with a variable interest rate, can be riskier due to the possibility of interest rate increases and the potential for overspending. On the other hand, a loan provides predictability in terms of payment amounts and repayment schedule, but might come with higher interest rates or penalties for early repayment. It's crucial to weigh these risks against your personal risk tolerance and financial stability. Finally, your ability to repay the borrowed funds, as well as your preferred timeline for repayment, should play a key role in your decision. If you're confident in your ability to repay the funds quickly, a line of credit may be a good choice. However, if you prefer a longer repayment period and fixed monthly payments, a loan might be a better option. In any case, it's essential to ensure the repayment schedule aligns with your budget and won't put undue strain on your finances. The decision between a line of credit and a loan depends on several factors. A line of credit offers flexibility, continuous access to funds, and lower interest rates compared to credit cards. It is suitable for managing unpredictable or recurring expenses. However, there is a risk of overspending, variable interest rates, and the potential need for collateral or a strong credit history. On the other hand, a loan provides a lump sum amount, predictable monthly payments, and a clear repayment schedule. It is better for larger one-time expenses but lacks flexibility in borrowing additional funds. Loans come with fixed interest rates but may have higher rates than lines of credit. Consider your financial goals, borrowing habits, risk tolerance, and repayment capacity when choosing between the two options. Careful evaluation of your needs and financial situation is crucial to make an informed decision.Overview of Line of Credit vs Loan

Definition of Line of Credit

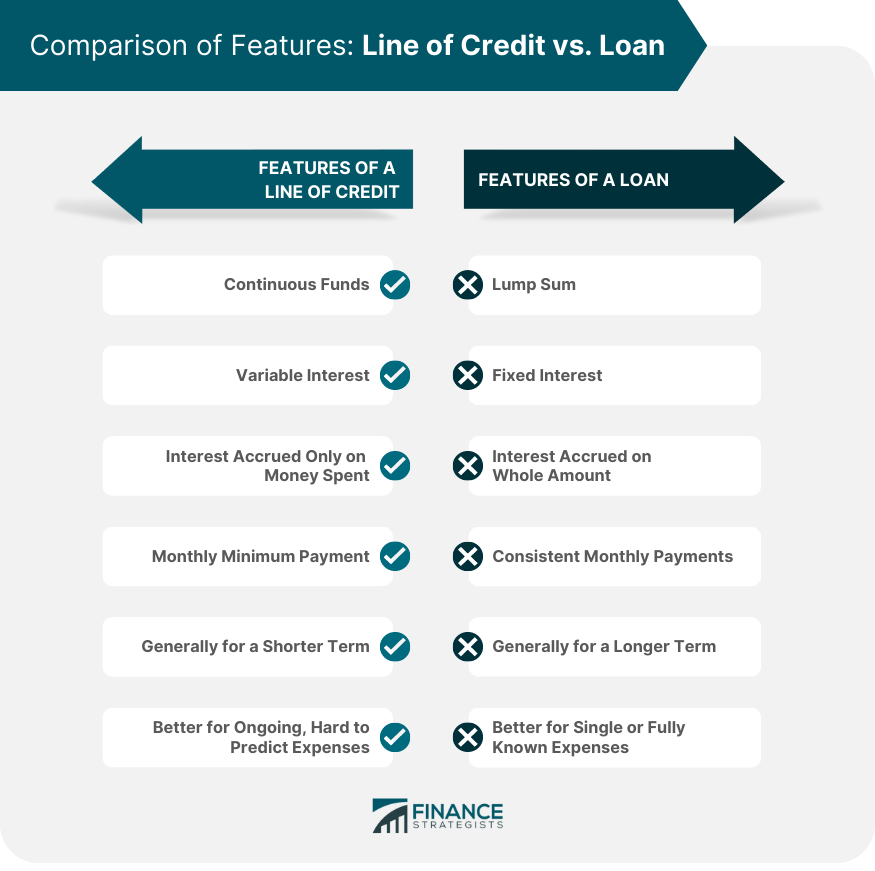

Features of a Line of Credit

Continuous Funds

Variable Interest

Interest Accrued Only on Money Spent

Monthly Minimum Payment

Generally for a Shorter Term

Better for Ongoing, Hard to Predict Expenses

Advantages of a Line of Credit

Access to Funds When Needed

Lower Interest Rates Compared to Credit Cards

Only Pay Interest on the Amount Borrowed

Disadvantages of a Line of Credit

Potential for Overspending

Variable Interest Rates Can Increase Borrowing Costs

May Require Collateral or a Strong Credit History

Definition of Loan

Features of a Loan

Lump Sum

Fixed Interest

Interest Accrued on Whole Amount

Consistent Monthly Payments

Generally for a Longer Term

Better for Single or Fully Known Expenses

Advantages of a Loan

Clear Repayment Schedule

Predictable Monthly Payments

Suitable for Larger One-Time Expenses

Disadvantages of a Loan

Limited Flexibility in Borrowing Additional Funds

Higher Interest Rates Compared to Lines of Credit

Potential for Penalties or Fees for Early Repayment

Choosing Between Line of Credit and Loan

Financial Goals and Needs

Usage Patterns and Borrowing Habits

Risk Tolerance

Repayment Capacity and Timeline

Conclusion

Line of Credit vs Loan FAQs

A line of credit is an agreement with a financial institution that allows you to borrow up to a certain amount whenever you need it while paying interest only on the amount you use. A loan, on the other hand, is a lump sum given to you when the contract is signed and must be paid back in fixed payments over time.

A line of credit works by allowing customers to withdraw funds from their account when needed, up to the maximum limit set by their lender. Interest will only be charged for amounts drawn down from the account and not for any unused portion of the limit. Repayment of the borrowed funds is usually required every month.

A line of credit offers flexibility compared to other types of financing, allowing customers to withdraw and repay funds as needed without paying interest on any unused portion of their limit. In addition, customers can typically access larger amounts than they would be able to with a loan or other type of financing.

One disadvantage associated with a line of credit is that it often carries higher interest rates than traditional loans, making it more expensive in the long run if not managed carefully. Additionally, customers may be tempted to overspend if they have access to a larger amount of funds than they can realistically afford to repay.

The type of financing that's best for you will depend on your individual needs and situation. In general, lines of credit are better suited for short-term needs (e.g., seasonal purchases or unexpected expenses) due to their flexibility and the ability to access large amounts of funds quickly. Loans may be more suitable for longer-term needs (e.g., financing home improvements or purchasing a car). It is important to compare rates and repayment terms before making any decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.