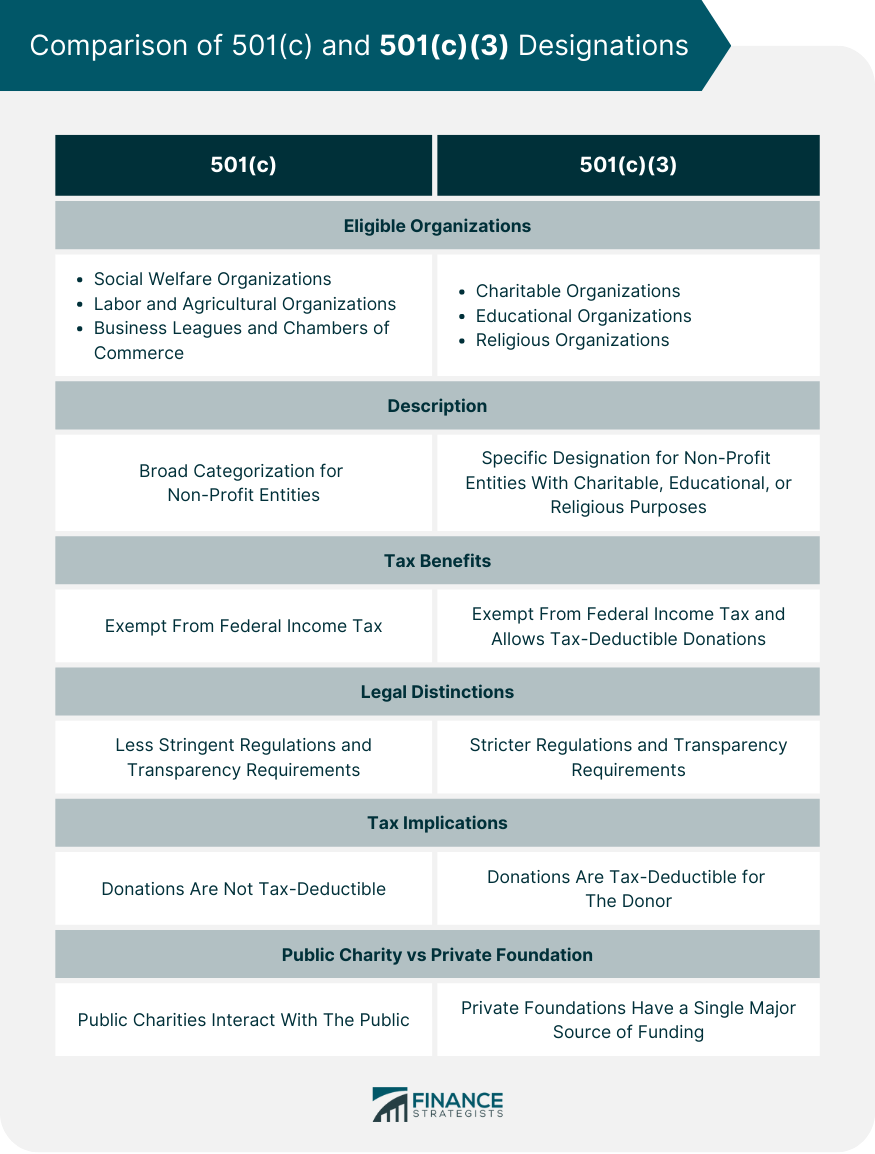

501(c) is a general designation that refers to non-profit organizations in the United States exempt from federal income tax. Under this broad umbrella, there are multiple different types, numbered from 501(c)(1) to 501(c)(29), each catering to specific kinds of organizations, with varied requirements and exemptions. These entities range from social welfare groups to religious and educational organizations.A 501(c)(3) is a specific type of non-profit organization that is also exempt from federal income tax. However, this designation is reserved for entities that operate for religious, charitable, scientific, literary, or educational purposes. Subsection 501(c) of the Internal Revenue Code is the "List of exempt organizations." Subsection (3) of subsection 501(c) outlines the specific organizations which are tax exempt under subsection 501(c)(3) and will receive that subsection's specific tax treatment (including tax write offs for donors). Here is a screenshot from the Internal Revenue Code section 501(c)(3) in context: Screenshot of 501(c)(3) of Internal Revenue Code[/caption] Discerning the difference between a general 501(c) and a specific 501(c)(3) is pivotal. Not only are there variances in tax implications for the organizations themselves, but also the tax treatment of contributions made to these organizations differs. It impacts the legal obligations and responsibilities that these entities must adhere to, ensuring their operations align with their tax-exempt purpose. The 501(c) designation is the broader categorization under which all the specific types of tax-exempt organizations fall. Understanding the nature of this designation is essential for non-profits. A 501(c) designation is granted to non-profit organizations that operate for purposes beyond generating profit. These organizations can range from social welfare organizations to business leagues, labor unions, and more. This broad categorization ensures that a variety of non-profits can operate without the burden of federal income tax, provided they meet specific criteria and serve a larger public purpose. Under the 501(c) classification, there are a variety of organizations that qualify. Social welfare organizations that fall under the 501(c) classification include entities like homeowners associations and volunteer fire companies. These organizations are generally formed to promote the common good and welfare of their community. Social welfare organizations must not be organized for profit, and their net earnings must not inure to the benefit of any private shareholder or individual. They should primarily engage in activities that promote social welfare. Labor organizations such as labor unions, and agricultural or horticultural organizations can also qualify as 501(c) entities. These organizations exist to better conditions of work, improve the grade of their products, develop a higher degree of efficiency in their respective occupations, or improve the conditions of persons engaged in these pursuits. These organizations must adhere to the requirement that their earnings do not benefit any member, and their activities must align with the mission of improving labor conditions or advancing the agricultural or horticultural sectors. Business leagues, chambers of commerce, real estate boards, and boards of trade may also fall under 501(c). These organizations aim to promote business conditions in their industry or geographical area. They are not organized for profit, and no part of their net earnings go to the benefit of any private shareholder or individual. These organizations primarily engage in activities aimed at improving business conditions for their members. They differ from social welfare organizations and labor/agricultural organizations in their focus on business advancement. This status is typically sought by organizations with charitable, educational, or religious purposes. A 501(c)(3) organization is a specific type of non-profit entity that is exempt from federal income tax. The 501(c)(3) designation is often what people think of when they refer to a non-profit organization. These organizations are not only exempt from paying federal income tax, but they also offer a tax advantage to donors, who can deduct their contributions on their personal tax returns. This designation includes entities that are organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes. It also includes organizations that focus on testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals. The key criterion for this designation is that the organization's purpose must be one or more of these exempt purposes. A wide range of organizations can qualify for the 501(c)(3) designation, given they align with its specified purposes. The following are just a few examples: charitable organizations, educational organizations, and religious organizations. Charitable organizations include those involved in relief of the poor, the distressed, or the underprivileged; advancement of religion; advancement of education or science; erecting or maintaining public buildings, monuments, or works; In addition they also cover those lessening the burdens of government; lessening neighborhood tensions; eliminating prejudice and discrimination; defending human and civil rights; and combating community deterioration and juvenile delinquency. Charitable can be broadly interpreted, and encompasses a wide variety of organizations that serve the public good. Educational organizations can include schools, research institutions, museums, and organizations providing educational services to the public. These organizations' primary function must be educational, and they must regularly conduct educational activities to qualify for this designation. Religious organizations can also qualify for 501(c)(3) status. This includes churches, synagogues, temples, and other houses of worship, as well as religious orders and organizations providing outreach or services that are religious in nature. A 501(c) organization and a 501(c)3 organization are similar in designation, however they differ slightly in their tax benefits. Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not. The legal distinctions and definitions between 501(c) and 501(c)(3) organizations lie primarily in their purposes and how they operate. While 501(c) serves as a broad categorization for tax-exempt non-profit organizations, 501(c)(3) organizations are specifically for religious, charitable, scientific, literary, or educational purposes. 501(c)(3) organizations face stricter regulations regarding their activities, particularly political and lobbying activities, and have additional public transparency requirements, such as making certain financial information publicly available. Both 501(c) and 501(c)(3) organizations are exempt from federal income tax. However, a significant distinction lies in the tax treatment of donations. Contributions to 501(c)(3) organizations are typically tax-deductible for the donor, providing a key incentive for potential contributors. In contrast, donations to most other types of 501(c) organizations are not tax-deductible. Within the realm of 501(c)(3) organizations, there's a further distinction between public charities and private foundations. Public charities generally receive a larger portion of their income from the public or governmental units, and have greater interaction with the public. Private foundations, on the other hand, typically have a single major source of funding, usually an individual, family, or corporation. Each type has its own legal and tax obligations and benefits. The 501(c) designation serves as a broad categorization for tax-exempt organizations, encompassing various types such as social welfare organizations, labor and agricultural organizations, and business leagues. On the other hand, the 501(c)(3) designation is specifically reserved for non-profit entities with charitable, educational, or religious purposes. This specific designation grants organizations the benefits of exemption from federal income tax and allows tax-deductible donations for donors. Additionally, 501(c)(3) organizations face stricter regulations and transparency requirements, particularly concerning political and lobbying activities, as well as additional public transparency obligations. Misclassification can lead to legal complications and may result in losing tax-exempt status, so it's essential for non-profit organizations to understand these classifications and choose the one that best aligns with their mission and activitiesOverview of 501(c) and 501(c)(3)

What Is a 501(c) Designation?

Eligible Organizations Under 501(c)

Social Welfare Organizations

Labor and Agricultural Organizations

Business Leagues and Chambers of Commerce

What Is a 501(c)(3) Designation?

Eligible Organizations Under 501(c)(3)

Charitable Organizations

Educational Organizations

Religious Organizations

Differences Between 501(c) and 501(c)(3)

Legal Distinctions

Tax Implications and Exemptions

Public Charity vs Private Foundation

Conclusion

What Is the Difference Between a 501(c) and a 501(c)3? FAQs

A 501(c)(3) organization is a non-profit organization with tax exempt status that is dedicated to the general well-being of society.

a 501(c)(3) is just a subsection of section 501(c) of the Internal Revenue Code. It describes tax exemption for certain nonprofits, but section 501(c) also includes other, broader categories.

A 501(c)(3) organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

501(c)(3) is the internal revenue code (IRC) section for organizations with tax exempt status. 501(c)(3) falls under internal revenue code 501(c).

The Internal Revenue Code states the following entities qualify for 501(c)(3) status: "(3) Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals, no part of the net earnings of which inures to the benefit of any private shareholder or individual, no substantial part of the activities of which is carrying on propaganda, or otherwise attempting, to influence legislation (except as otherwise provided in subsection (h)), and which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office."

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.