501(c)(3) churches are often referred to as "non-profit" organizations, and they provide important services to their communities. Although the term "501(c)(3)" does not appear in the United States Code, it is commonly used to describe churches that have qualified for tax exemption under section 501(c)(3) of the Internal Revenue Code. By becoming a 501(c)(3) church, your church will be exempt from paying federal income taxes on earned income like donations received directly from donors as well as interest and dividends generated on investments made into projects run by the church itself. Additionally, donors can deduct contributions made to your church when filing their own personal taxes, which provides an extra incentive for them to support your non-profit organization financially. Finally, having non-profit status also allows churches access grants that are only available for eligible organizations with this special designation. Once you are officially recognized as a 501(c)(3) church, it is necessary that you maintain this status throughout the year by filing regular reports on finances with appropriate authorities. This means tracking all funds including those paid out or received through donations or grants, as well as ensuring transparency around financial records which can easily be done with accounting software designed specifically for churches. Before starting on this journey, it is essential to know the legal requirements for being considered a church. In most states, churches must register with their state government before they can receive official recognition as a religious organization — and this means filling out paperwork and meeting certain requirements. Organizations are typically required to submit their name, address, contact person's name, type of religious organization, articles of faith, or other documents that outline the basic values of the group (such as those found in sections 501(c)(3) and 508 of the US Tax Code). Depending on the state you live in, there may be additional paperwork such as a certificate of incorporation or an application for nonprofit status, along with evidence demonstrating qualified non-profit status under both federal and state law. Once you’ve gone through the process of submitting your paperwork to your state government, your church will need to meet certain legal criteria in order to maintain its recognition. In general, these include: Holding regular worship services Offering spiritual instruction Ministering Engaging in charitable activities Teaching principles of morality Practicing good works Maintaining an appropriate place of worship Filing annual reports with appropriate authorities Employing clergy or other authorized personnel Paying taxes Providing adequate housing for members Aside from legal obligations, churches should consider creating written by-laws that outline important guidelines such as how financial decisions are made, qualifications for membership, etc. Such a document helps ensure that operations within each particular church run smoothly over time. All members should be aware of its contents so that everyone is working together towards common goals outlined within it. Becoming a legally recognized church can have many benefits. For one thing, the tax-exempt status enables churches to use more of their funds towards furthering their mission instead of paying taxes on income received. Donors can also deduct the contributions they make when filing personal taxes. Additionally, churches get access to grants from government agencies and private donors who target non-profits exclusively. They also get increased visibility within the community and opportunities to recruit new parishioners/members. Lastly, churches gain the ability to offer services or programs that would otherwise be difficult due to insufficient funding or resources. There are also certain disadvantages to being recognized as a 501(c)(3) church that need to be considered. Firstly, these churches must remain uninvolved in political activities such as campaigning on behalf of a political candidate or supporting a particular party. They are also required to submit a disclosure of financial information and regularly file paperwork to appropriate agencies. Furthermore, administrative costs associated with obtaining and maintaining 501(c)(3) status can be expensive and time-consuming. There’s also their inability to advocate for policy changes through lobbying or attempting to influence legislation, and the potential lack of connection that comes along with becoming a non-profit organization instead of remaining strictly charitable. Applying for 501(c)(3) tax-exempt status for a church can be a daunting process, but with the proper steps and resources, it can go much smoother. The first step to becoming a 501(c)(3) organization is obtaining an Employer Identification Number (EIN). This number is necessary to open up a bank account as well as to contact the IRS. You can obtain this number by filling out Form SS-4. Once you have received your EIN, you are ready to file form 1023 with the IRS. This form will ask for detailed information about your church’s operations, financial statements, and governing board. Once this form has been submitted and accepted, you are eligible for tax-exempt status and will receive a letter from the IRS. The final step is receiving the official approval from the IRS. This process can take several months, or in some cases, even over a year. The approval letter from the IRS will state that your organization has been granted tax exemption under section 501(c)(3). It may also require that any donations made to your church are accounted for appropriately and filed with relevant agencies on time. While the process can be complicated and time-consuming, taking the appropriate steps and understanding the requirements for obtaining 501(c)(3) church tax-exempt status can help to ensure a smooth transition into receiving official approval from the IRS. With this approval comes many benefits that can help churches to operate more effectively and efficiently, including potential tax benefits and access to additional funding sources. However, keep in mind that there are also certain limitations that come with this status, like having to remain apolitical and being required to disclose financial information publicly. Nonetheless, it’s vital to take note of what you will need to apply for the 501(c)(3), like obtaining an Employer Identification Number and filing form 1023 to the IRS. As long as everything is in order, you can expect to get the official approval within a couple of months to a year.501(c)(3) Church Explained

Legal Requirements to Be Considered a Church

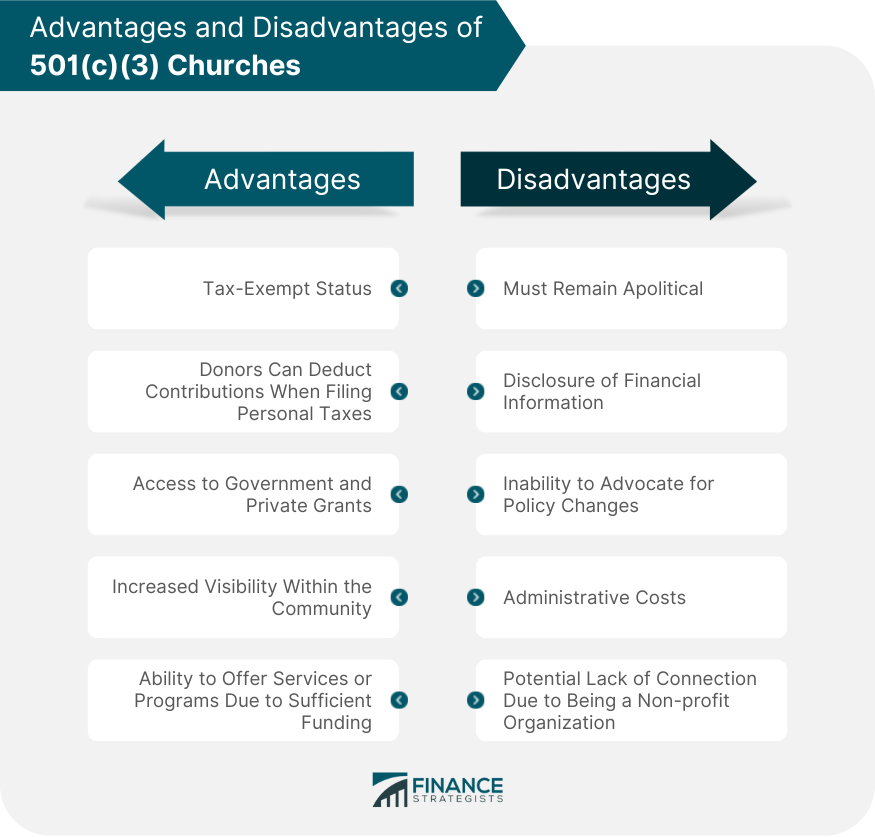

Benefits of a 501(c)(3) Church

Drawbacks of a 501(c)(3) Church

Steps in Applying for 501(c)(3) Church Tax-Exempt Status

Step 1: Get an Employer Identification Number (EIN)

Step 2: File IRS Form 1023

Steps 3: Receive IRS Approval

Final Thoughts

What Is a 501(c)(3) Church? FAQs

501(c)(3) church tax-exempt status is a federal designation that exempts a qualified church from federal income tax, including income from donations and other sources of income related to the organization's activities.

To apply for 501(c)(3) church tax-exempt status, an organization must complete and submit IRS Form 1023 or 1023-EZ, as well as provide all relevant supporting documentation requested by the IRS.

The main benefits of obtaining 501(c)(3) church tax-exempt status are potential financial savings through taxes and access to additional funding sources like grants and donations. Additionally, churches with this designation may take advantage of additional legal protections against liabilities that may come up related to their activities.

Yes, there is a fee associated with applying for 501(c)(3) exemption that varies depending on the type and size of your organization. The standard fee for form 1023 is $600, while the fee for form 1023-EZ is $275.

It typically takes between three and twelve months to receive approval from the IRS for 501(c)(3) exemption if all necessary information is provided correctly and in a timely manner.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.