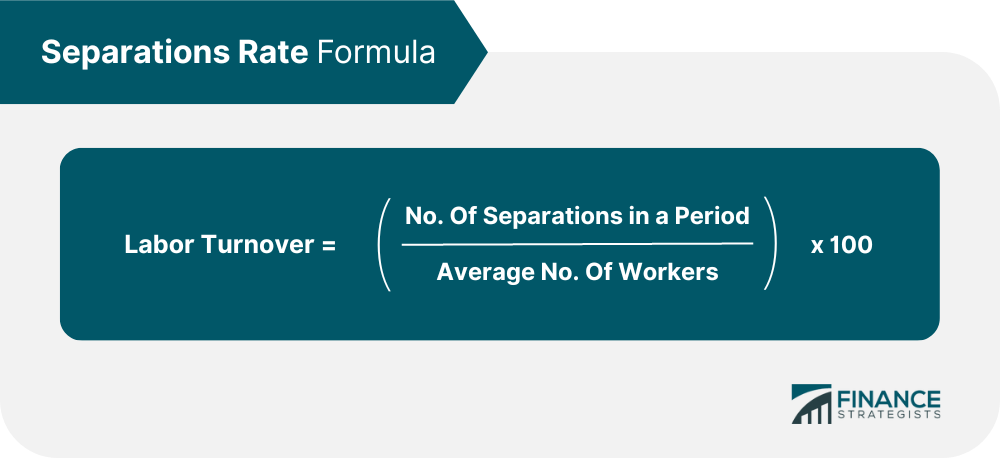

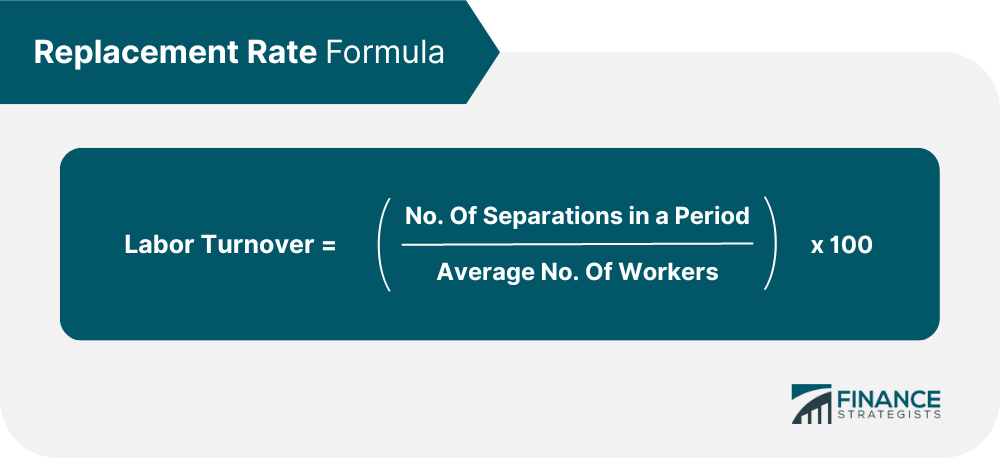

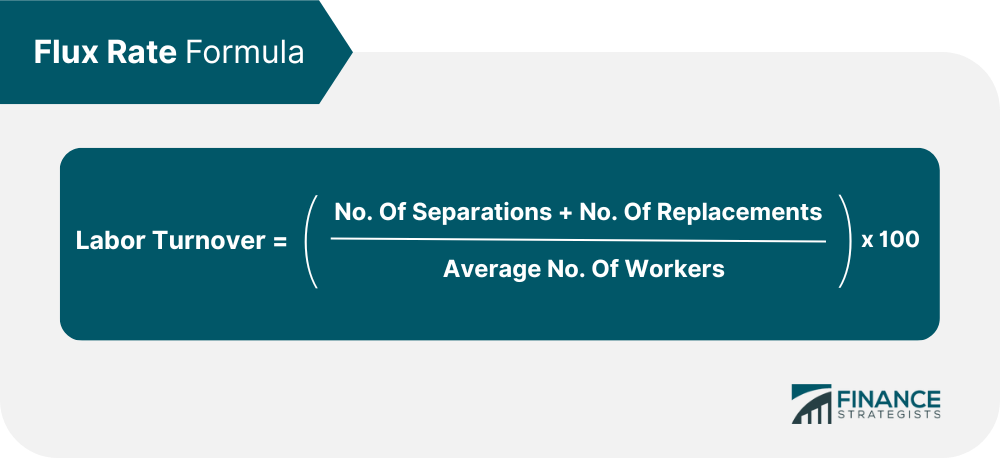

Labor costing is the process of calculating the cost of labor for a product or service. It is a crucial part of business operations and can significantly impact profitability. Labor costs are typically broken down into direct and indirect costs. Different methods, techniques, and formulas are used to calculate labor costs. A high labor turnover rate can indicate several issues within a company, such as poor working conditions, low wages, or a lack of opportunities for advancement. It can also be caused by factors outside of the company’s control, such as the overall economy or changes in the industry. Regardless of the cause, a high labor turnover rate can be costly for a company. Three principal methods can be used to measure labor turnover: This method considers the number of employees who leave the company divided by the average number of employees during the period. The formula for separations rate is: Labor turnover = (No. of separations in a period / Average no. of workers) x 100 LT = (NS / ANW) x 100 So if a company currently has 100 employees and ten leave during the year, the separation rate would be 10%. This method looks at the number of workers replaced during the month/year divided by the average number of employees during the period. The formula for replacement rate is: Labor turnover = (No. of replacements in a period / Average no. of workers) x 100 LT = (NR / ANW) x 100 For example, if a firm has 200 employees and ten are replaced during the year, the replacement rate would be 20%. This method accounts for the number of employees who left and the number of new employees divided by the average number of employees during the period. The formula for flux rate is: Labor turnover = ((No. of separations + No. of replacements) / Average no. of workers) x 100 LT = ((NS + NR) / ANW) x 100 For instance, if a business has 1000 employees and a hundred of them leave and a hundred are replaced during the year, the flux rate would be 20%. Labor productivity measures how much output (in terms of goods or services) is produced by one unit of labor input. It is typically calculated as output per hour of work. Labor productivity can be measured at the level of an individual worker, a team, a department, a company, an industry, or even an economy. Labor productivity = Output / Actual hours worked This method of labor costing assigns a specific cost to each unit produced. The total labor cost is then divided by the number of units produced to calculate the labor cost per unit. Labor cost per unit = Direct wages / No. of units It is a period given to complete a task or work. Standard time + Incentive allowance It measures how a given workforce efficiently accomplishes a task compared to the standard set in finishing certain tasks. It is measured by dividing the actual output by the standard output multiplied by 100 to get the percentage. A higher percentage means higher efficiency. Labor efficiency = (Actual output / Standard output) x 100 This is the most commonly used method in businesses to calculate the cost of labor. In this method, the labor cost is calculated by multiplying the time taken to complete a task by the hourly pay rate. Earnings = Hours worked x Rate per hour For example, if an employee takes 5 hours to complete a task and their hourly rate of pay is $10, then the cost of labor for that task would be $50. A type of wage system is known as payment by result. In this method, employees’ output (worker’s efficiency) will be multiplied by the rate per piece finished rather than the time involved in doing the work. Earnings = Output x Rate per unit For example, if an employee produces ten widgets in an hour and their rate per widget is $1, then the cost of labor for that task would be $10. It is a wage payment in which a worker gets a high piece rate for completing the job within the allotted time and a lower piece rate for completing the job beyond the allotted time. Fredrick Winslow Taylor developed this system. It follows the principle that the efficient worker is rewarded while the worker who performs below the standard gets penalized. Here is how this method is calculated: Earnings = 80% of price rate when below standard Earnings = 120% of price rate when at or above standard W.H. Merrick developed this system. It is similar to Taylor’s system with a slight variation. Instead of penalizing the worker, a lower differential price rate is paid for work done below the standard time. Henry L. Gantt developed it. In this system, workers are given a bonus for completing the task before the deadline. The amount of bonus is generally a percentage of the wages earned. Halsey, Doolittle, and Emerson developed it. In this system, workers are given a bonus for completing the task before the deadline. The amount of bonus is generally a percentage of the wages earned. In this system, he is paid a bonus of 50% for the time saved plus the salary for the actual time spent on the job. The formula for this method is: Earnings = (Hours worked x Rate per hour) + (Time saved x Rate per hour x 50%) E = (HW x RH) + (TS x RH x 50%) It is a modification of the Halsey premium plan. In this system, a standard time is determined, and if a worker saves time by finishing a job earlier, he is paid a bonus of 30%, plus wages for the actual time spent on the job. The formula for this method is: Earnings = (Hours worked x Rate per hour) + (Time saved x Rate per hour x 30%) E = (HW x RH) + (TS x RH x 30%) In the Rowan system, if the time taken by the worker to finish the task is more than the set period, he is paid according to the time rate, but when the worker finishes the work earlier than the standard time; then he is entitled to a bonus along with the time wages. The formula for this method is: Earnings = Hours worked x Rate per hour + (Time saved / time allowed x Hours worked x Per hour rate) E = HW x RH + (TS / TA x HW x RH) It was developed by Barth and Co. In this system, the time rate is not guaranteed, which means workers are not paid for the hours worked more than the standard hours. Earnings = rate per hour x √(Standard hours x Hours worked) E = RH x √(SH x HW)What Is Labor Costing?

Measurement of Labor Turnover

Separation Method

Replacement Method

Flux Method

Labor Productivity

Labor Costing per Unit

Time Allowed

Labor Efficiency

Time Rate Method

Straight Rate Method

Differential Piece Rate System

F.W. Taylor's System

Merrick Differential Price Rate System

Output % Standard

Payment

Up to 83%

Ordinary piece rate

83% to 100%

110% of ordinary piece rate

Above 100%

120% of Ordinary Piece Rate

Gantt Task Bonus Plan

Output % Standard

Payment

Output below standard

Guaranteed time rate

Output at standard

120% of time rate

Output above standard

120% of ordinary piece rate

Halsey Premium Plan

Halsey-Weir Plan

Rowan System

Barth Variable Sharing Plan

Labor Costing FAQs

Labor Costing is the process of tracking and accounting for the wages and benefits associated with employing workers in a given organization or business. It involves understanding how wages, hours worked, overtime pay, bonuses, and other compensation affect profitability.

To calculate labor costs, you must determine an employee's hourly wage rate (including any overtime or bonus payments) and add relevant taxes, contributions to pension plans, health insurance premiums, and other employee-related expenses. Once these have been identified and calculated, total labor costs can be determined by multiplying the number of hours worked by each employee during a given period with their total wage rate.

The key components of Labor Costing include wages and salaries, overtime pay, bonuses and incentives, holiday pay, taxes, and contributions to pension plans or health insurance premiums. All of these factors must be taken into account when calculating labor costs.

The purpose of Labor Costing is to accurately track and manage expenses associated with hiring employees to maximize profitability. By understanding how much each employee costs an organization over time, businesses can better allocate resources and optimize their workforce according to budget constraints while maintaining quality output.

There are several ways to reduce labor costs, including hiring temporary staff for specific projects instead of full-time employees, automating certain processes to reduce the amount of human labor needed, and using performance-based incentives to reward high-performing workers. Additionally, businesses can improve efficiency by restructuring their workforce and eliminating redundant or unnecessary roles.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.