A special needs trust is a legal arrangement that provides support and care for individuals with disabilities. It is designed to protect the assets of the individual with disabilities while ensuring that their government benefits are preserved. Special needs trusts can be set up by families, guardians, or attorneys and can be an essential tool for ensuring the financial security of disabled individuals. Families of individuals with disabilities often face financial challenges that require careful planning and management. One of the most significant challenges is ensuring that the individual with disabilities receives adequate care and support, especially after the parents or guardians are no longer able to provide this care. Special needs trusts can provide a solution to this challenge. A special needs trust allows families to set aside funds for their disabled loved ones' future care and support while protecting their eligibility for government benefits. The assets held in the trust are managed by a trustee, who has a fiduciary duty to use the funds solely for the benefit of the beneficiary. This ensures that the beneficiary's care and support are adequately provided for and that they remain eligible for government benefits such as Medicaid and Supplemental Security Income (SSI).

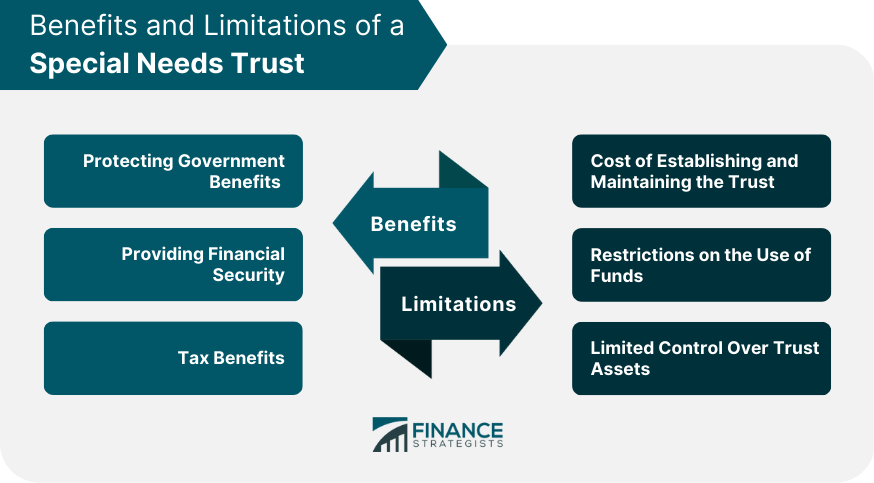

There are three main types of special needs trusts: first-party trusts, third-party trusts, and pooled trusts. First-party trusts are funded with assets that belong to the beneficiary. These assets may include a settlement or inheritance. The trust is established and managed by a trustee, who must be a person or institution other than the beneficiary. The funds held in the trust must be used to pay for the beneficiary's care and support, and any remaining funds must be used to reimburse the government for any benefits received by the beneficiary. Third-party trusts are established and funded by someone other than the beneficiary. This type of trust is often set up by parents or grandparents for the benefit of their disabled child or grandchild. The trust is managed by a trustee who is responsible for using the funds for the beneficiary's care and support. Any remaining funds can be distributed to other beneficiaries named in the trust document. Pooled trusts are established and managed by a nonprofit organization. The trust funds are pooled with other funds from other beneficiaries, and the organization acts as the trustee. The beneficiary's funds are used to pay for their care and support, and any remaining funds are used to benefit other beneficiaries in the trust. The trustee of a special needs trust is responsible for managing the trust assets and ensuring that they are used for the beneficiary's care and support. The trustee has a fiduciary duty to act in the beneficiary's best interest, and any decisions made must be consistent with the terms of the trust document. The trust can be funded with a variety of assets, including cash, stocks, bonds, and real estate. The funding source will depend on the type of trust and whether the funds belong to the beneficiary or someone else. The trustee is responsible for making distributions from the trust to pay for the beneficiary's care and support. These distributions can include payments for medical expenses, housing, education, and other necessities. The trustee must ensure that the distributions are consistent with the terms of the trust document and comply with any legal requirements. The choice of trustee is critical to the success of the special needs trust. The trustee must be someone who is capable of managing the trust assets effectively and making decisions that are consistent with the beneficiary's best interests. Many families choose a family member or close friend as the trustee, but it is also possible to use a professional trustee such as a bank or trust company. The trust document is a legal document that outlines the terms and conditions of the special needs trust. The document must comply with specific legal requirements and must include provisions that ensure the trust's effectiveness. The document must also specify the trustee, the beneficiary, and the purpose of the trust. Funding a special needs trust can be done in several ways. For a first-party trust, the beneficiary's assets can be used to fund the trust. For a third-party trust, the trust can be funded with cash or other assets donated by the settlor. Pooled trusts are usually funded with cash or assets donated by the beneficiary or their family. One of the most significant benefits of a special needs trust is its ability to protect the beneficiary's eligibility for government benefits. Individuals with disabilities may be eligible for government benefits such as Medicaid and SSI. A special needs trust can provide financial security for a disabled individual. The trust can be used to pay for the beneficiary's care and support, ensuring that they receive the necessary services and resources. Special needs trusts can provide tax benefits for the beneficiary and the settlor. The trust can be structured to minimize taxes on the income earned by the trust assets, providing more funds for the beneficiary's care and support. Special needs trusts can be expensive to establish and maintain. The cost will depend on the type of trust, the trustee, and the assets held in the trust. Additionally, the trustee may charge a fee for managing the trust, which can reduce the funds available for the beneficiary's care and support. Special needs trusts are subject to restrictions on the use of funds. The trustee must ensure that the funds are used solely for the beneficiary's care and support and cannot be used for other purposes. The beneficiary has limited control over the assets held in the special needs trust. The trustee is responsible for managing the assets and making decisions about their use. A special needs trust is a legal arrangement that allows families to provide for the care and support of disabled individuals without jeopardizing their eligibility for government benefits. Establishing a special needs trust can be a complex process that requires careful planning and execution. Families should seek the advice of an experienced attorney who can guide them through the process and ensure that the trust complies with all legal requirements. A special needs trust is a long-term commitment that requires continual management. The trustee must be diligent in managing the trust assets and ensuring that the funds are used for the beneficiary's care and support. The trustee should also be prepared to make changes to the trust as circumstances change, such as if the beneficiary's needs or eligibility for government benefits change. Special needs trusts have become an essential tool for families with disabled individuals, providing a way to protect government benefits and provide financial security. As the population of individuals with disabilities continues to grow, the demand for special needs trusts is likely to increase. Additionally, changes to government benefits programs and tax laws may impact the effectiveness and popularity of special needs trusts in the future.What Is a Special Needs Trust?

Types of Special Needs Trusts

First-Party Trusts

Third-Party Trusts

Pooled Trusts

How Special Needs Trusts Work

Establishing a Special Needs Trust

Choosing a Trustee

Creating the Trust Document

Funding the TrustBenefits of Special Needs Trusts

Protecting Government Benefits

These benefits are means-tested, meaning that the beneficiary's income and assets must be below a certain level to qualify. If the beneficiary receives a lump-sum settlement or inheritance, it could disqualify them from receiving these benefits.

A special needs trust can prevent this from happening by holding the assets in trust and using them solely for the beneficiary's care and support.Providing Financial Security

The trust can also be structured to provide a stream of income for the beneficiary, which can supplement their government benefits and provide a source of financial stability.Tax Benefits

Additionally, if the trust is funded with assets that would have been subject to estate taxes, the trust can be used to reduce the settlor's estate tax liability.Limitations of Special Needs Trusts

Cost of Establishing and Maintaining the Trust

Restrictions on Use of Funds

This can limit the beneficiary's ability to use the funds for non-essential expenses, such as travel or entertainment.Limited Control Over Trust Assets

While the beneficiary can request distributions from the trust, the trustee has the final say on how the funds are used.

Final Thoughts

Special Needs Trust FAQs

A special needs trust is a legal arrangement that allows funds to be set aside to care for a person with disabilities, without affecting their eligibility for government benefits.

Individuals with disabilities, chronic illnesses, or special needs who rely on government benefits can benefit from a special needs trust.

A special needs trust holds assets that can be used for the benefit of the beneficiary with disabilities, without disqualifying them from receiving government benefits.

Special needs trusts protect the assets of the beneficiary while allowing them to receive government benefits, and can provide a reliable source of funding for their ongoing care.

Setting up a special needs trust can be complicated and expensive, and it may limit the beneficiary's access to funds. It's important to consult with a qualified attorney to determine if it's right for your situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.