Irrevocable trusts are a type of estate planning trust agreement in which a grantor, or asset owner, establishes a trust for one or many beneficiaries with the help of a trustee, who is responsible for managing the trust. Irrevocable trusts cannot be amended or changed during their lifetime. They provide tax benefits and credit protection to grantors and beneficiaries and are mainly used to pass down wealth between generations. Have questions about Irrevocable Trusts? Click here.

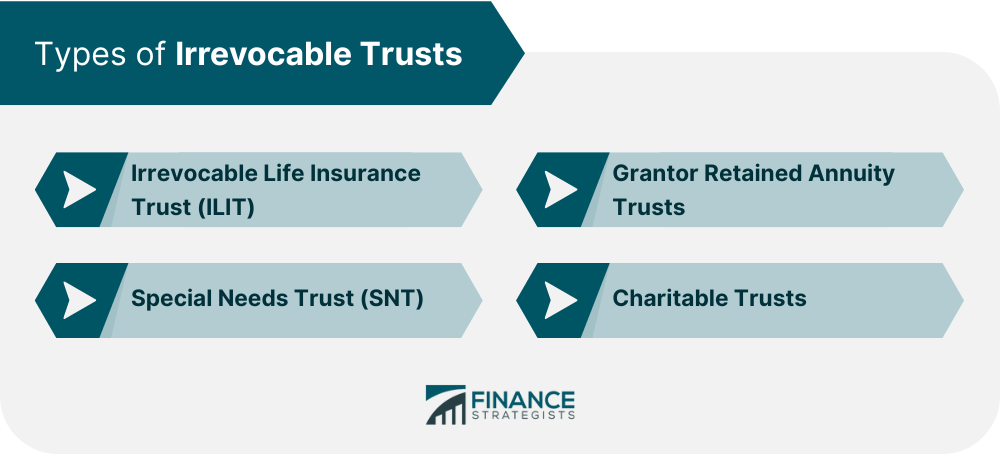

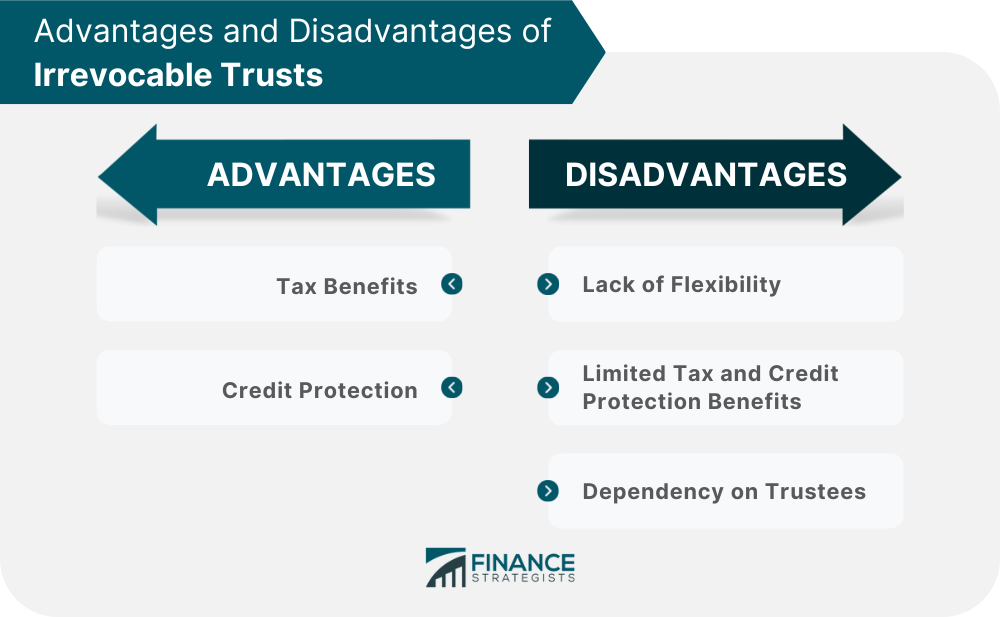

Irrevocable trusts are also known as management trusts because they are used to manage wealth across generations. They enable grantors to set terms for passing on wealth to beneficiaries and provide tax benefits in the process. Irrevocable trusts are a form of testamentary trusts. Along with revocable trusts, irrevocable trusts are also an example of inter vivos trust i.e., a trust created during a grantor’s lifetime and outside of a court-supervised process for asset settlements. This means that grantors and beneficiaries can avoid probate, a court-supervised process to determine beneficiaries and ensure proper distribution of assets. Unlike wills, which are automatically subject to the probate process, irrevocable trusts do not have to undergo a court-supervised distribution of assets. Therefore, resolution of such trusts consumes relatively less time and resources. Irrevocable trusts are mainly used to handle settlement of complex estates that span various asset classes and geographies. By transferring these disparate assets to a trust, grantors relinquish control and ownership of the assets and reduce their tax liabilities. At the same time, the trusts enable them to pass down wealth through generations. The main feature of irrevocable trusts is that they cannot be revoked, meaning the grantor cannot withdraw or manage assets after conveying them into a trust. This is different from revocable trusts, where grantors have the flexibility to change a trust’s composition even after it is created. The inflexible nature of irrevocable trusts is balanced by the tax advantages that they offer. For example, irrevocable trusts are often used as an instrument to cut down or escape estate taxes. In some instances, they also provide protection against creditors, such as government agencies or former partners, after the grantor’s death. Irrevocable trusts are best suited for individuals who are wealthy and are more interested in saving taxes than in collecting income from the trust. They are also useful for persons who have a disabled dependent because they enable grantors to designate a trustee, who is responsible for executing the grantor’s wishes after his or her death. It is possible to craft several types of irrevocable trusts. Some of them are outlined below: An ILIT is a life insurance policy that has been placed in an irrevocable trust for tax advantages. The primary beneficiary of the policy is the ILIT. Therefore, the death benefits of the policy are placed in the trust after the grantor’s death. Thereafter, they are distributed, either in a lump sum or regular payments, to the beneficiaries specified by the grantor. An SNT is a trust that is formed specially to preserve governmental benefits, such as Medicaid and Special Security Income (SSI), for those who are developmentally-disabled. The trust ensures that such persons remain eligible for government aid and are not made ineligible due to income restrictions. SNTs can be administered by the trust’s beneficiaries themselves or by third-parties. Grantor-retained annuity trusts are irrevocable trusts into which assets are placed to generate annuity. It provides tax advantages and an annual income to the beneficiary that is tax-free. Charitable trusts are examples of tax-exempt irrevocable trusts. In such trusts, income generated is distributed to the beneficiaries for a set duration of time specified in the terms. After that period, the remainder is distributed to charities identified by the trust’s grantors. Out of all irrevocable trusts, charitable trusts provide the maximum tax benefits. The most attractive feature of irrevocable trusts to estate planners are the tax benefits that accrue to such vehicles. Irrevocable trusts can reduce the overall estate tax liability for grantors and beneficiaries. They also provide other benefits, such as credit protection. Here are a couple of advantages of irrevocable trusts. Irrevocable trusts can help reduce the overall estate tax liability for grantors and their beneficiaries. There are two ways in which an irrevocable trust does this. An irrevocable trust can also help provide protection from creditors after a grantor’s death. Asset protection trusts are a type of irrevocable trust that provide protection from creditors to beneficiaries. The disadvantages of irrevocable trusts are outlined below: Irrevocable trusts cannot be changed. Once assets are put into a trust, they remain “locked” for the duration of the trust’s lifetime. This can be a problem when there is a change of circumstances. For example, a beneficiary may become incapacitated before the trust is due or there might be a change in the grantor’s circumstances that may require emergency cash. The inflexibility of an irrevocable trust means that, under both circumstances, the trust is not of much use to them. Irrevocable trusts can only be changed under special circumstances and, even then, only the trustee can make these changes. While irrevocable trusts promise more tax benefits as compared to revocable trusts, those benefits are only available after a grantor’s death or the expiry of the trust’s term period. This limits their utility as compared to other financial instruments that enable tax-saving. Access to irrevocable trusts, even for grantors, is only available through third-party trustees. Trustees also play an important role in distributing income from the trust to beneficiaries. After a grantor’s death, the trust’s distributions are solely the responsibility of trustees. This relationship can turn out to be problematic, if the beneficiary is dissatisfied with the arrangement. The main point of difference between revocable and irrevocable trusts is that the former can be altered or revoked but the latter lock in terms and assets for the trust’s entire duration. For all intents and purposes, grantors lose ownership and control of their assets after they are entered into a trust. But grantors can still exercise control over the assets by making changes to the trust’s terms and composition. For example, they might sell part of the stock holding contained in a revocable trust for income distribution purposes. This is not possible with an irrevocable trust. Here are three other differences between revocable and irrevocable trusts: Both trusts reduce estate taxes after the grantor’s death. The difference in the structure of the trusts ensures that irrevocable trusts offer more tax advantages, however. The grantor has to pay income tax for gains accruing from the trust’s holdings. Thus, changes to the trust’s composition, such as the sale of a real estate holding, can result in tax dues for the grantor. In an irrevocable trust, grantors forgo control of their holdings for the trust’s lifetime. As such, they are not liable for tax dues arising from changes to the trust’s holdings. In certain states, such as Nevada and North Dakota, stringent trust laws protect grantors from creditors. Asset protection trusts are a type of irrevocable trust that provides protection from creditors after the grantor’s death. The definition of creditors in this context is pretty broad and can include former partners, court claims, or, even, tax agencies collecting unpaid dues. Thus, irrevocable trusts are a great option for people in professions that are susceptible to lawsuits. In a revocable trust, trustees have a fiduciary duty only to act in the best interests of the grantor. They undertake actions or make decisions on behalf of the grantor during his or her lifetime or after their death. In an irrevocable trust, the fiduciary duties for trustees encompasses both grantors and beneficiaries. After the grantor’s death, the trustee is responsible for making sure that the trust is passed onto the beneficiaries not only based on the terms specified by the grantor but also in a manner that is fair and judicious to the beneficiary. There are three main parties involved in creating an irrevocable trust. They are as follows: Also referred to as a settlor or trustor, a grantor is the person who owns an estate and transfers property and rights of assets to beneficiaries upon their death. This act is known as conveyance of assets to a trust. In an irrevocable trust, the grantor is responsible for making critical decisions about the trust. These decisions relate to the trust’s terms, scope, and duration. For example, the grantor can decide which assets to include in the irrevocable trust and which ones to exclude. After the grantor’s death, the trustee makes distributions to an irrevocable trust’s beneficiaries based on the trust’s terms. The trustee is responsible for managing a grantor’s estate. In this role, they are responsible for making important investment decisions, paying trust fees, and ensuring that the trust’s funds and assets are distributed according to specified terms. A trustee can be an individual or an organization, such as a wealth management firm or a bank, experienced in estate management. Unlike revocable trusts, grantors cannot nominate themselves as trustees for their trust. The beneficiary is entitled to receive the trust’s proceeds after the grantor’s death. The beneficiary of a trust can be an individual, such as the grantor’s siblings or offspring, or organizations that serve various causes. The first step is to draft a Living Irrevocable Trust document. The document lists the essentials of your trust: grantor, trustee, and beneficiary, and your assets. Almost all types of assets, including real estate, stocks, and precious metals, can be included in trusts. Depending on the nature and number of assets in your trust, the deed can be a fairly straightforward or complex affair. While it can be manually prepared, the trust deed can also be written with trust software that contains boilerplate language customized based on your legal jurisdiction and the contents of your estate. Next, you must obtain a tax identification number (TIN) for your trust. The irrevocable trust is a separate legal entity with different tax liabilities. After the document is prepared and signed, it must be notarized. The process to create a trust deed for estates that involve complex transfer and distribution of assets is different and requires a careful and complete inventory of all assets as well as an analysis of applicable regulation in all jurisdictions. It might be wiser to call a lawyer or a wealth management expert in such cases.How Do Irrevocable Trusts Help in Estate Planning?

Types of Irrevocable Trusts

What Are the Advantages and Disadvantages of Irrevocable Trusts?

Most irrevocable trusts have separate tax identification numbers. Therefore, the grantor is not responsible for taxes that the trust may incur as the size of its holdings increases.

The estate tax exemption limit was $13.61 million in 2024. This means that estates below that amount are not liable for taxes.

By placing assets in an irrevocable trust, wealthy individuals can lower the total value of their living estate and make it eligible for exemption.

Theoretically, it is possible to retain assets in an irrevocable trust for generations and avoid an estate tax.

However, distributions from the trust, after a grantor’s death, are taxed at the prevailing estate tax rate.

In this context, the definition of creditors is pretty broad and can include former partners, court claims, or tax agencies collecting unpaid dues.

What Are the Differences Between Revocable Trusts and Irrevocable Trusts?

How to Create an Irrevocable Trust

Irrevocable Trust FAQs

Irrevocable trusts are a type of estate planning in which a grantor, or asset owner, establishes a trust for one or many beneficiaries with the help of a trustee, who is responsible for managing the trust.

An irrevocable trust provides tax benefits and credit protection to grantors and beneficiaries and are mainly used to pass down wealth between generations.

Irrevocable trusts cannot be amended or changed during their lifetime.

An irrevocable trust is created during a grantor’s lifetime and outside of a court-supervised process for asset settlements. This means that grantors and beneficiaries can avoid probate, a court-supervised process to determine beneficiaries and ensure proper distribution of assets.

A revocable trust allows for the flexibility to change composition even after it is created.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.