Deferred Sales Trusts (DST) are financial instruments designed to help property or business owners defer capital gains taxes upon the sale of their assets. DSTs is a type of financial arrangement that allows property or business owners to defer paying capital gains taxes when they sell their assets. Instead of immediately paying the taxes, the seller can transfer the ownership of the asset to a third-party trustee in exchange for a promissory note. The trustee then sells the asset to a buyer and holds the funds in a trust account, with the proceeds from the sale used to repay the promissory note over a set period. They offer a tax-efficient strategy to reinvest the proceeds into a diversified portfolio, providing a steady income stream over an agreed-upon term. The seller is the individual or entity that owns the property or business being sold. They initiate the process of establishing a Deferred Sales Trust to defer capital gains taxes and structure the future income stream. The buyer is the individual or entity that purchases the property or business from the Deferred Sales Trust. They play a crucial role in the DST process by providing the funds used to reinvest and generate income for the seller. The trustee is a qualified third-party professional responsible for managing the Deferred Sales Trust. They ensure that the trust is structured and operated in compliance with applicable laws and regulations. The Installment Sale Agreement is a legal contract between the seller and the trustee. It outlines the terms of the deferred sale, including the purchase price, payment structure, and duration of the agreement. Trust assets are the funds or property transferred to the trust as part of the DST process. These assets are used to generate income for the seller through various investment strategies. To establish a Deferred Sales Trust, the seller must own a property or business with significant capital gains potential. This typically includes real estate, closely-held businesses, and other high-value assets. The seller must select a qualified trustee with experience in managing Deferred Sales Trusts. This professional will be responsible for ensuring that the trust complies with applicable laws and regulations and managing the trust assets. There are two main legal documents required to establish a Deferred Sales Trust: Trust Agreement: This document outlines the trust's terms and conditions, including the trustee's duties and responsibilities. Installment Sale Agreement: This contract specifies the terms of the deferred sale, such as the purchase price, payment structure, and duration of the agreement. Once the legal documentation is in place, the seller transfers the property or business to the trust. The trustee then sells the asset to the buyer on behalf of the trust. After the property is transferred to the trust, the trustee sells it to the buyer. The trustee then reinvests the proceeds from the sale into a diversified portfolio of assets. The capital gains tax liability is deferred through the use of the Deferred Sales Trust. This is achieved by spreading the tax liability over the term of the Installment Sale Agreement rather than recognizing the entire gain in the year of the sale. The trustee reinvests the proceeds from the sale into a diversified portfolio of income-generating investments. This can include stocks, bonds, real estate, and other alternative investments. There are two main types of payment structures for a Deferred Sales Trust: Interest-Only Payments: The seller receives payments based solely on the interest generated by the trust's investments. Principal and Interest Payments: The seller receives payments that include both the interest generated by the trust's investments and a portion of the principal balance. Payments from the Deferred Sales Trust can be structured in various ways, depending on the seller's preferences and financial needs. Common payment frequencies include: Monthly: Payments are made to the seller each month. Quarterly: Payments are made to the seller every three months. Annually: Payments are made to the seller once per year. The Installment Sale Agreement typically determines the duration of the payment term. Depending on the seller's financial goals and preferences, it can range from a few years to several decades. One of the primary benefits of a Deferred Sales Trust is the deferral of capital gains taxes. By structuring the sale as an installment sale, the seller can spread their tax liability over the term of the agreement rather than recognizing the entire gain in the year of the sale. Payments received from the Deferred Sales Trust are subject to income tax. The tax treatment depends on the type of payment received, with interest payments typically taxed as ordinary income and principal payments taxed at the capital gains rate. The assets held in a Deferred Sales Trust may be included in the seller's estate for estate tax purposes. However, careful planning and using other estate planning strategies can help mitigate the potential estate tax liability. Sellers and trustees must comply with all applicable reporting requirements for Deferred Sales Trusts, including filing the necessary tax forms and providing annual statements to the seller. A 1031 Exchange is a tax-deferral strategy that allows property owners to defer capital gains taxes by exchanging one investment property for another. While 1031 Exchanges offer tax deferral benefits, they are limited to real estate transactions and require the investor to continue holding real estate assets. A Charitable Remainder Trust is a tax-advantaged strategy that allows individuals to transfer assets to a trust, which then provides an income stream to the individual for a specified term. At the end of the term, the remaining trust assets are distributed to a designated charity. While CRTs offer tax benefits, they require the individual to make a substantial charitable commitment. Seller financing is a strategy in which the seller provides financing to the buyer, allowing the buyer to make payments directly to the seller over an agreed-upon term. This approach can provide tax deferral benefits but also exposes the seller to credit risk if the buyer defaults on the payments. Selecting a qualified and experienced trustee is critical to the success of a Deferred Sales Trust. An incompetent trustee may need to manage the trust assets or comply with applicable regulations properly, putting the tax benefits at risk. Deferred Sales Trusts must be structured and operated in compliance with all relevant laws and regulations. Failure to comply with these requirements could result in the loss of tax benefits or other legal consequences. The performance of the trust's investments is subject to market risks, which could impact the trust's income and the trust assets' overall value. Once the assets are transferred to a Deferred Sales Trust, the seller may have limited access to the trust's principal balance. This reduced liquidity should be considered when evaluating the suitability of a DST for individual circumstances. Deferred Sales Trusts are commonly used in real estate transactions, allowing property owners to defer capital gains taxes and diversify their investments beyond real estate holdings. Deferred Sales Trusts can be utilized in the sale of closely-held businesses, enabling business owners to defer capital gains taxes and secure a steady income stream for retirement or other financial goals. DSTs can be employed in the sale of high-value assets, such as artwork, collectibles, or intellectual property. They provide a tax-efficient method for monetizing these assets while generating an ongoing income stream. Deferred Sales Trusts can play a role in estate planning by allowing individuals to transfer assets to a trust, defer capital gains taxes, and generate income for themselves or their heirs. They can also be used in conjunction with other estate planning strategies to minimize estate tax liabilities. Deferred Sales Trust (DST) is a financial instrument that offers property or business owners a way to defer capital gains taxes upon the sale of their assets. DSTs involve a third-party trustee holding the proceeds from the sale in a trust account, and the seller receives a promissory note in exchange. DSTs provide a tax-efficient strategy to reinvest the proceeds into a diversified portfolio, generating a steady income stream over an agreed-upon term. The key components of a DST include the seller, buyer, trustee, installment sale agreement, and trust assets. The DST process involves eligibility criteria for sellers, selecting a qualified trustee, preparing legal documentation, and transferring property to the trust. The mechanics of a DST include the sale of the property by the trust, calculation of capital gains tax, reinvestment of the trust proceeds, and receiving payments from the DST. Potential risks and considerations of DSTs include trustee competency, regulatory compliance, market risks, and liquidity concerns. Overall, DSTs provide a valuable tool for property or business owners to defer capital gains taxes and generate an ongoing income stream while diversifying their investments.What Are Deferred Sales Trusts?

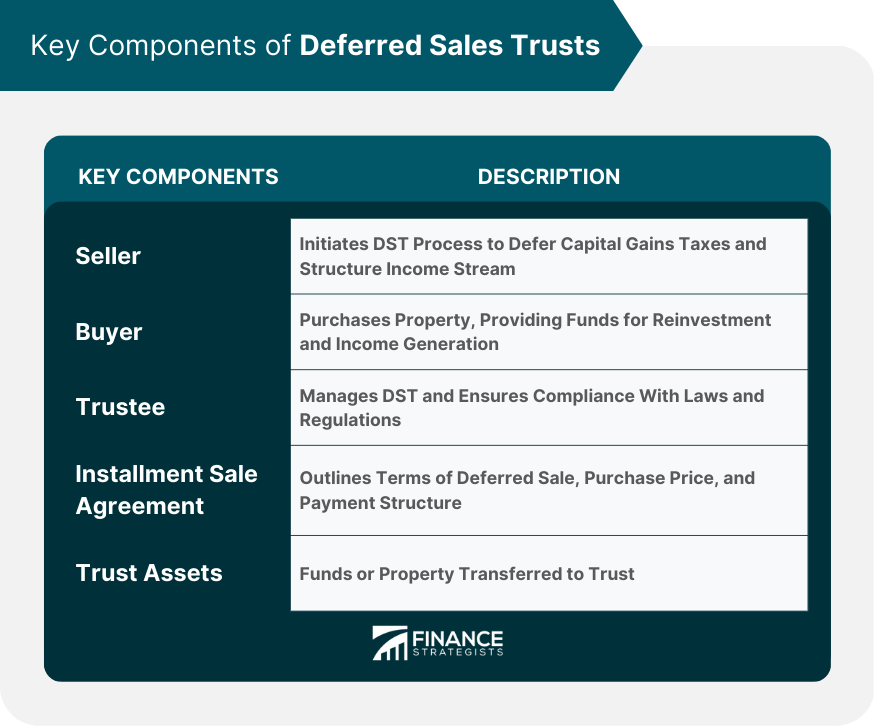

Key Components of Deferred Sales Trusts

Seller

Buyer

Trustee

Installment Sale Agreement

Trust Assets

Establishing a Deferred Sales Trust

Eligibility Criteria for Sellers

Selecting a Qualified Trustee

Preparing Legal Documentation

Transferring Property to the Trust

Mechanics of a Deferred Sales Trust

Sale of the Property by the Trust

Calculation of Capital Gains Tax

Reinvestment of the Trust Proceeds

Receiving Payments from a Deferred Sales Trust

Payment Structure

Frequency of Payments

Duration of the Payment Term

Tax Implications of Deferred Sales Trusts

Capital Gains Tax Deferral

Income Tax Considerations

Estate Tax Implications

Reporting Requirements

Comparing Deferred Sales Trusts to Other Tax-Deferred Strategies

1031 Exchange

Charitable Remainder Trusts (CRT)

Seller Financing

Potential Risks and Considerations of Deferred Sales Trusts

Trustee Competency

Regulatory Compliance

Market Risks

Liquidity Concerns

Applications of Deferred Sales Trusts

Real Estate Sales

They provide an alternative to 1031 Exchanges, especially when suitable replacement properties are not readily available, or the seller wishes to exit the real estate market.Business Sales

High-Value Asset Sales

Estate Planning

Conclusion

Deferred Sales Trusts (DST) FAQs

A Deferred Sales Trust is a tax-deferral strategy that allows property or business owners to defer capital gains taxes upon selling their assets. By transferring the asset to a trust and selling it through an installment sale agreement, the seller can spread the tax liability over an extended period while generating income from the trust's investments.

A Deferred Sales Trust works by transferring the property or business to a trust managed by a qualified trustee. The trustee then sells the asset to a buyer, and the proceeds are reinvested into a diversified portfolio. The seller receives payments from the trust, structured according to the installment sale agreement, which can include interest, principal, or a combination of both.

The primary tax benefit of a Deferred Sales Trust is the deferral of capital gains taxes. By structuring the sale as an installment sale, the seller can spread their tax liability over the term of the agreement rather than recognizing the entire gain in the year of the sale. Additionally, the seller may reduce their overall tax burden by receiving payments taxed at a combination of ordinary income and capital gains rates.

While both Deferred Sales Trusts and 1031 Exchanges allow for the deferral of capital gains taxes, there are key differences between the two strategies. A 1031 Exchange is limited to real estate transactions and requires the property owner to reinvest in like-kind property. In contrast, a Deferred Sales Trust can be used for various asset types, including businesses and high-value assets, and allows for diversification into a wider range of investments.

Some potential risks associated with a Deferred Sales Trust include trustee competency, regulatory compliance, market risks, and liquidity concerns. To minimize these risks, selecting a qualified and experienced trustee is essential, ensuring that the trust is structured and operated in compliance with all relevant laws and regulations and carefully considering the seller's financial goals and risk tolerance before entering into a Deferred Sales Trust arrangement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.