Blind trusts are trusts in which the grantor or beneficiaries are unaware of the content of their trusts. They are designed to serve two purposes: The two types of blind trusts are revocable and irrevocable blind trusts. The steps to create a blind trust are the same as those for conventional trusts. Different states have different guidelines for blind trust creation.

Blind trusts are generally used by people in public positions or by wealthy and prominent individuals who wish to preserve their privacy and the contents of their trust holdings. The grantors and beneficiaries of such trusts are not privy to its holdings or value. The trust is considered blind in that the grantor does not have knowledge of its contents and their value. Communication between the grantor and the trustee relating to the trust is prohibited by law. The trustee is bound by fiduciary duty to act in the best interests of the trust. Depending on whether the trust is revocable or irrevocable, the grantor takes control of the blind trust by terminating it or after it has run its duration. There are two main types of blind trusts. They are as follows: Consider the case of a wealthy businessman elected to public office. As a public official, he has the power to formulate and sway policy that affects his business. To prevent such conflicts of interest, he might place his business and investment holdings into an irrevocable blind trust for the duration of his term to be managed by a third-party trustee. After he has completed his term, the blind trust is no longer blind and he can view its holdings and balances. Another instance can be that of an individual who has won the lottery and come into great wealth. They might create a blind trust in order to hide their wealth from journalists and prying relatives. A rich person may also create a blind trust to pass on wealth to beneficiaries anonymously. The beneficiary does not have knowledge about the trust’s contents or its holdings but receives a fixed income from it every month. In all the above cases, the grantor is aware of the contents of the blind trust only at the time of its creation. The beneficiary does not know about the trust’s holdings or value. The initial process to create a blind trust is similar to the one for creating a living trust. First, you need to determine the assets that you will put into the trust. Next, you have to identify appropriate documentation for the assets and take them to a financial planner or lawyer to draw up a blind trust. Some of the documents required to create a blind trust are notarized claims of ownership for assets that are included in the trust and proof of identity. A power of attorney that sets out specific terms for the trust is drawn up. These terms define whether the trust is revocable or irrevocable, its duration, and associated legalese relating to its assets and operations. The Office of Government Ethics (OGE) sets down guidelines to follow regarding elected members of the federal government. Violation of guidelines is considered a criminal offense. Elected government officials must seek approval from the Senate subcommittee for their blind trusts. They are also required to provide documentation containing details about the trust. Some of the required documents are as follows: While the process to create a blind trust seems like a simple process, it is, in fact, quite a complex endeavor. Different states have different sets of requirements for creation of a blind trust. The grantor of a blind trust also has to take into account federal regulations regarding the topic. As such, it is best to seek legal help to draw up a blind trust document. You will also need to pay expensive maintenance fees for blind trusts. Blind trusts may seem like a good idea to avoid conflicts of interest and separate business interests from official duty. But they are not always effective at delineating these boundaries. For example, the trustor can designate a close relative or kin as a trustee. The interests of both are aligned in this case and there is a good chance that the trustee may be familiar with the trustor’s thinking and strategies. Even though they may not be in touch, the arrangement will ensure that the businessman’s wishes are carried out by proxy. The grantor is also privy to the trust’s original composition. Therefore, they can take policy decisions to benefit the trust (and create circumstances for the trustee to act in the trust’s best interests). Blind trusts also do not provide much anonymity to lottery winners after a certain amount of winnings. For example, only 11 states within the United States have laws that allow lottery winners to remain anonymous. Other states have laws in place that require winners to disclose their identities even if they collect the prize through a trust.

Basics of Blind Trusts

Types of Trusts

Examples of Blind Trusts

How to Create a Blind Trust

Why Blind Trusts Are Not Always Effective

Blind Trust FAQs

Blind trusts are trusts in which the grantor or beneficiaries are unaware of the content of their trusts. They are designed to serve two purposes: Protect the privacy of grantors and beneficiaries and separate business interests of public officials from their official role.

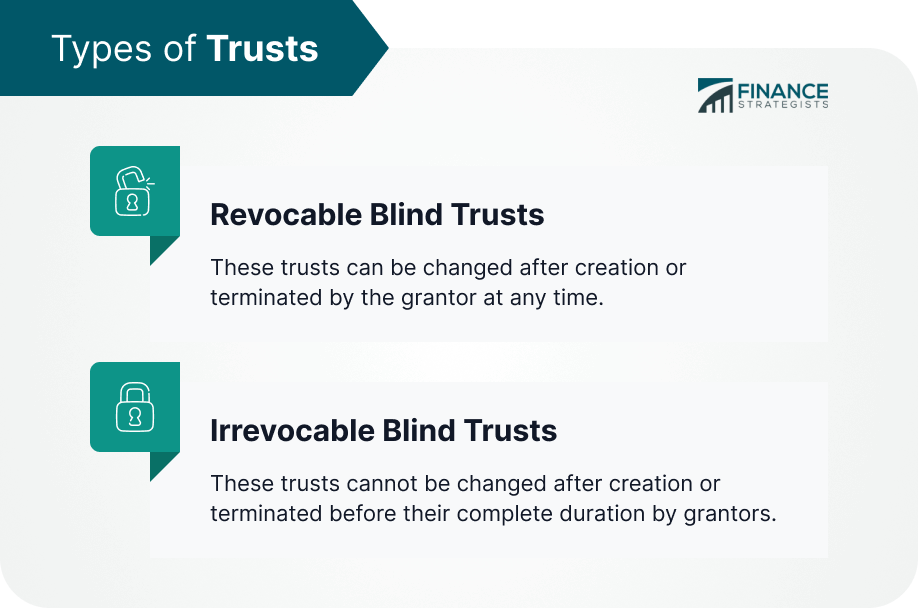

The two types of blind trusts are revocable trusts, or trusts that can be changed after creation, and irrevocable trusts, or trusts that cannot be changed after they are created.

The creator of a blind trust can designate a close relative or kin as trustee. The interests of both are aligned in this instance and each is familiar with the other's style of thinking. Hence, they may not always lead to proper delineation of business and personal interests.

The initial process to create a blind trust is similar to the one for creating a living trust. First, you need to determine the assets that you will put into the trust. Next, you have to identify appropriate documentation for the assets and take them to a financial planner or lawyer to draw up a blind trust. Some of the documents required to create a blind trust are notarized claims of ownership for assets that are included in the trust and proof of identity.

A lottery winner might create a blind trust in order to hide their wealth from journalists and prying relatives but that isn't always a foolproof solution. Only 11 states within the United States have laws that allow lottery winners to remain anonymous. Other states have laws in place that require winners to disclose their identities even if they collect the prize through a trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.