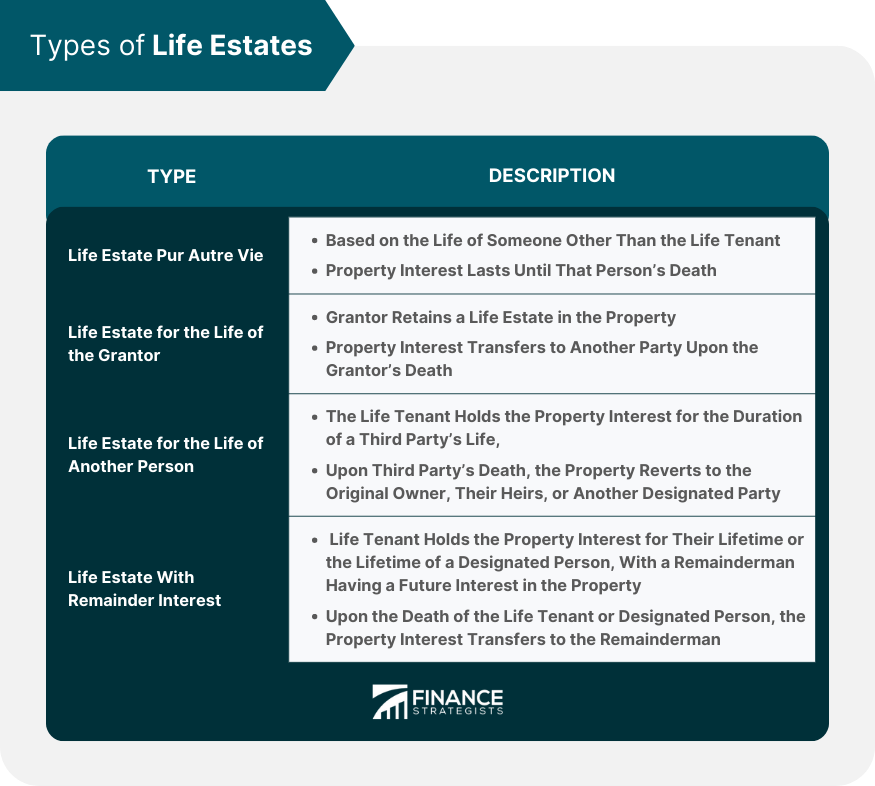

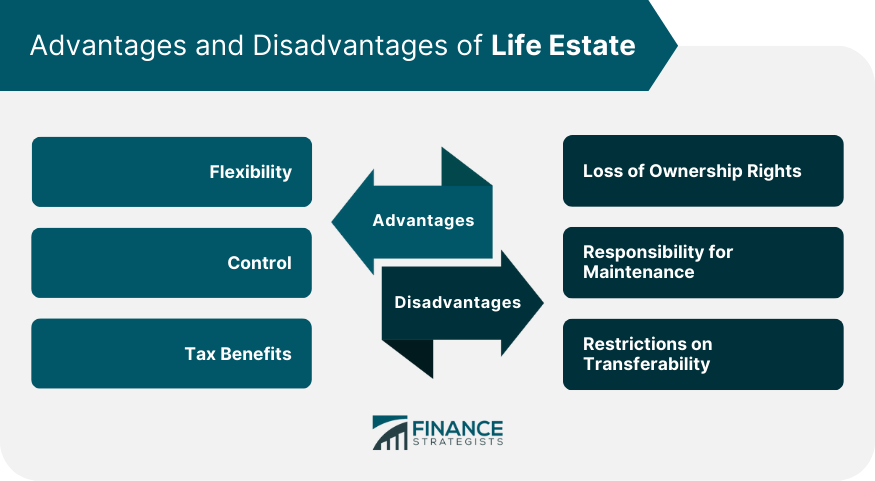

A life estate is a legal arrangement in which an individual, called the life tenant, is granted the right to use and possess a property for the duration of their life or the life of another designated person. Upon the death of the life tenant or the designated person, the property reverts to the original owner, their heirs, or another designated party. Life estates have their roots in medieval England, where they were used as a means of transferring property without the complexities of land inheritance laws. They provided a way for landowners to control their property during their lifetime while ensuring that it passed to their desired heirs upon their death. Today, life estates continue to be used as an estate planning tool and a means of transferring property interests. A life estate can be created through a deed, which is a legal document that transfers the property interest from the grantor (the person giving the life estate) to the life tenant. The deed must include specific language indicating that the life estate is being created and must be recorded with the appropriate government office. A life estate can also be created through a will, which is a legal document that outlines how a person's property should be distributed upon their death. The testator (the person making the will) can designate that a specific property be given as a life estate to a named beneficiary, with the property interest transferring upon the testator's death. Another method of creating a life estate is through a trust, which is a legal arrangement in which a trustee holds and manages property for the benefit of one or more beneficiaries. The trust document can specify that a life estate is to be created for a beneficiary, with the property interest transferring according to the terms of the trust. The life tenant has the right to possess and use the property during their lifetime or the duration of the designated measuring life. This includes the right to live in the property, rent it out, and make improvements, subject to any restrictions outlined in the life estate agreement. The life tenant is generally responsible for maintaining the property and making any necessary repairs during their tenancy. This includes ensuring that the property is kept in good condition and not allowed to fall into disrepair. Life tenants are typically responsible for paying property taxes, insurance premiums, and any other charges associated with the property during their tenancy. Failure to pay these charges can result in the termination of the life estate. Life tenants have a duty not to commit waste, which is the legal term for causing significant damage to the property or depleting its value. This includes actions such as removing valuable resources from the property, demolishing structures, or allowing the property to fall into disrepair. A life estate pur autre vie is a life estate that is based on the life of someone other than the life tenant. In this type of life estate, the life tenant holds the property interest for the duration of the designated person's life, rather than their own. In a life estate for the life of the grantor, the grantor retains a life estate in the property, with the property interest transferring to another party upon the grantor's death. This type of life estate allows the grantor to maintain control of the property during their lifetime while ensuring its eventual transfer to a designated beneficiary. A life estate for the life of another person is a life estate in which the life tenant's property interest is based on the life of a designated third party. The life tenant holds the property interest for the duration of the third party's life, and upon the death of the third party, the property reverts to the original owner, their heirs, or another designated party. A life estate with remainder interest involves a life tenant holding the property interest for their lifetime or the lifetime of a designated person, with a remainderman (a designated third party) having a future interest in the property. Upon the death of the life tenant or the designated person, the property interest transfers to the remainderman. A life estate naturally terminates upon the death of the life tenant or the expiration of the measuring life. When this occurs, the property interest reverts to the original owner, their heirs, or another designated party. A life tenant can choose to surrender their life estate, voluntarily giving up their property interest before their death or the expiration of the measuring life. In this case, the property interest reverts to the original owner, their heirs, or another designated party. A life estate may be terminated through a merger, which occurs when the life tenant acquires the future interest in the property, effectively merging the life estate and remainder interest. This results in the life tenant becoming the outright owner of the property. A life tenant can sell their life estate interest, but the buyer would only acquire the property interest for the duration of the life tenant's life or the designated measuring life. Upon the death of the life tenant or the expiration of the measuring life, the property interest would revert to the original owner, their heirs, or another designated party. A life estate terminates when the measuring life, which may be the life tenant's life or the life of another designated person, comes to an end. At this point, the property interest reverts to the original owner, their heirs, or another designated party. Life estates provide flexibility for both the grantor and the life tenant, as they allow for the transfer of property interests without the need for an outright sale. This can be beneficial for estate planning purposes or for allowing a family member to live in a property while ensuring its eventual transfer to another beneficiary. Life estates allow the grantor to maintain control over the property during their lifetime, ensuring that it is used and maintained according to their wishes. Life estates can offer potential tax benefits, as they may reduce the value of the grantor's taxable estate and help avoid probate. Additionally, the life tenant may be eligible for certain property tax exemptions or deductions during their tenancy. By creating a life estate, the grantor gives up certain ownership rights to the property, including the ability to sell or mortgage the property without the life tenant's consent. The life tenant is responsible for maintaining the property and making any necessary repairs during their tenancy, which can be a financial burden. A life estate may limit the transferability of the property, as the life tenant can only sell or transfer their interest in the property for the duration of their life or the designated measuring life. Life estates are a versatile estate planning tool that can provide flexibility, control, and potential tax benefits for both grantors and life tenants. However, they come with restrictions on transferability. They also result in a loss of ownership rights and increased responsibility for property maintenance. They can be created through deeds, wills, or trusts, and come with various rights and responsibilities for the life tenant, including possession and use of the property, maintenance. Life estates also come in various types, including life estate pur autre vie, life estate for the life of the grantor, life estate for the life of another person, and life estate with remainder interest. Termination of a life estate can occur naturally, through surrender, merger, sale, or expiration of the measuring life. Creating a life estate involves complex legal considerations and should be done with the help of an experienced attorney. It is important to ensure that the life estate is created correctly and that all parties understand their rights and responsibilities. What Is a Life Estate?

Methods Creating a Life Estate

Deed

Will

Trust

Rights and Responsibilities of the Life Tenant

Possession and Use of the Property

Maintenance and Repairs

Payment of Taxes and Other Charges

Waste

Types of Life Estates

Life Estate Pur Autre Vie

Life Estate for the Life of the Grantor

Life Estate for the Life of Another Person

Life Estate With Remainder Interest

Termination of a Life Estate

Natural Termination

Surrender

Merger

Sale

Expiration of the Measuring Life

Advantages of a Life Estate

Flexibility

Control

Tax Benefits

Disadvantages of a Life Estate

Loss of Ownership Rights

Responsibility for Maintenance

Restrictions on Transferability

Final Thoughts

Life Estate FAQs

A life estate is a type of estate that grants the holder the right to possess and use a property for the duration of their lifetime.

A life estate can be created by a deed, will, or trust. It designates a life tenant who has the right to use and enjoy the property.

There are four types of life estates: life estate pur autre vie, life estate for the life of the grantor, life estate for the life of another person, and life estate with remainder interest.

The advantages of a life estate include flexibility, control, and tax benefits.

The disadvantages of a life estate include loss of ownership rights, responsibility for maintenance, and restrictions on transferability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.