Family business transition planning is the process of planning and preparing for the transfer of ownership and management of a family-owned business to the next generation of family members or to non-family members. It involves developing a comprehensive strategy that addresses the financial, legal, and emotional aspects of passing on the business to the next generation.

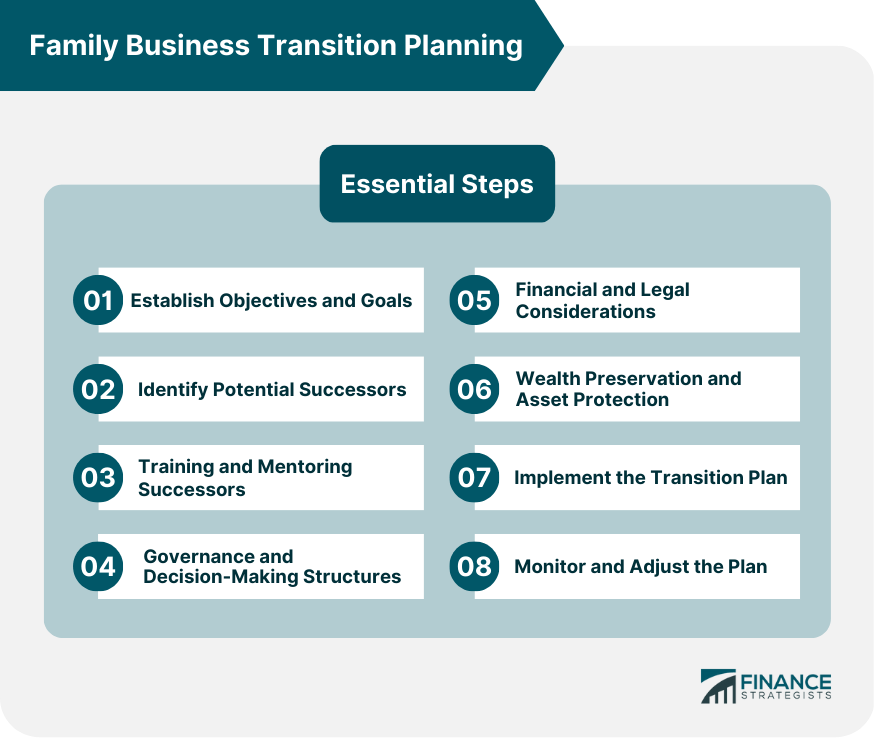

A successful transition plan starts with a clear understanding of the family's values and vision. Family business owners should engage in open discussions to identify shared values and articulate a collective vision for the future of the business. This process will help create a strong foundation for the transition plan and ensure that all stakeholders are aligned with their objectives. Once the family's values and vision are established, the next step is to identify the business objectives. This includes defining the strategic direction of the business, setting growth targets, and identifying opportunities for expansion or diversification. By clearly outlining the business objectives, the family can ensure that the transition plan supports the long-term success of the business. In addition to business objectives, it's essential for family business owners to establish personal financial goals. This includes assessing their retirement needs, determining the desired level of involvement in the business, and identifying other sources of income or investments. By setting personal financial goals, the family can ensure that the transition plan addresses their financial security and well-being. As part of setting personal financial goals, family business owners should evaluate their retirement needs. This involves estimating the necessary retirement income, considering the lifestyle they wish to maintain, and planning for potential healthcare and long-term care expenses. Assessing retirement needs helps ensure that the transition plan provides adequate financial resources for the retiring family members. A critical aspect of family business transition planning is identifying potential successors. The first step in this process is evaluating the interest and qualifications of family members. Family business owners should assess the skills, experience, and commitment of potential successors, while also considering their alignment with the family's values and vision. In some cases, family members may not be interested or qualified to take over the business. In these situations, it's essential to consider external candidates. Family business owners should create a process for identifying, vetting, and selecting potential external successors. This may involve working with professional advisors or executive search firms to find the right fit for the business. Once potential successors have been identified, the family should develop a succession timeline. This includes setting milestones for the handover of responsibilities, outlining the expected time frame for the transition, and establishing deadlines for critical decisions. A clear succession timeline helps ensure a smooth and orderly transfer of ownership and management. Preparing potential successors for their future roles is a vital part of the transition planning process. Family business owners should develop a comprehensive training plan that addresses the knowledge and skills required for the successor's position. This may include formal education, on-the-job training, and exposure to different aspects of the business. Mentoring programs can play a significant role in the development of potential successors. By pairing experienced family members or external mentors with potential successors, the family can ensure that valuable knowledge and experience are passed down to the next generation. Mentoring programs also provide opportunities for building relationships and fostering collaboration among family members. It's essential to address any knowledge and skills gaps that potential successors may have. Family business owners should conduct a thorough assessment of the skills and expertise required for each role and identify areas where additional training or development is needed. By addressing these gaps, the family can ensure that potential successors are well-prepared for their future responsibilities. As potential successors develop their skills and gain experience, it's crucial to provide them with opportunities for growth and leadership. This may involve assigning them to challenging projects, giving them decision-making authority, or involving them in strategic planning sessions. By offering these opportunities, the family can help potential successors build the confidence and competence needed to lead the business in the future. A strong governance structure is essential for the successful transition of a family business. Establishing a family council or board of directors can help ensure that decisions are made in the best interest of the business and the family. These governance bodies should include a diverse group of stakeholders, including family members, non-family executives, and independent advisors, to provide a balanced perspective on the business's challenges and opportunities. In addition to establishing a governance structure, it's essential to create a clear decision-making process. This includes defining the roles and responsibilities of different stakeholders, setting decision-making criteria, and outlining a process for resolving disputes or disagreements. By creating a transparent and efficient decision-making process, the family can avoid potential conflicts and ensure that the business operates smoothly during the transition. As part of the governance and decision-making process, it's crucial to define the roles and responsibilities of each family member and stakeholder. This includes outlining the specific duties and expectations for each position, as well as establishing lines of authority and reporting relationships. Clearly defined roles and responsibilities help ensure that everyone understands their role in the transition and contributes effectively to the business's success. Open communication and effective conflict resolution are critical to the success of any family business transition. Family members should be encouraged to express their opinions, concerns, and ideas openly, and a process should be in place for addressing disagreements or disputes. By fostering a culture of open communication and constructive dialogue, the family can work together to address challenges and ensure a successful transition. A crucial step in the transition planning process is assessing the business's value. This involves conducting a thorough valuation, which considers factors such as the company's financial performance, market conditions, and industry trends. By understanding the business's value, the family can make informed decisions about the transition and ensure that the financial interests of all stakeholders are protected. Transitioning a family business can have significant tax implications for both the outgoing and incoming owners. It's essential to work with a qualified tax advisor to understand and address these implications, which may include estate taxes, capital gains taxes, and gift taxes. By addressing tax issues proactively, the family can minimize their tax liability and preserve the wealth of the business. Buy-sell agreements are a critical component of the transition planning process. These agreements outline the terms and conditions under which ownership interests can be transferred, including triggering events, valuation methods, and payment terms. By developing a comprehensive buy-sell agreement, the family can ensure a smooth transition and protect the interests of all stakeholders. No transition plan is complete without a contingency plan for unexpected events, such as the death or disability of a key stakeholder. The family should work with their advisors to develop a contingency plan that addresses potential risks and outlines the necessary steps to ensure the business's continuity. This may include identifying temporary leadership, arranging for the transfer of ownership interests, and securing insurance coverage to protect against financial losses. One key aspect of preserving family wealth during a business transition is diversifying investments. By spreading investments across a variety of asset classes, industries, and geographical locations, the family can mitigate risk and protect their wealth from market fluctuations. Diversification also helps ensure that the family has access to liquidity and maintains financial stability during the transition. In addition to diversifying investments, implementing risk management strategies is essential for preserving family wealth. This may include conducting regular risk assessments, developing risk mitigation plans, and establishing a process for monitoring and addressing emerging risks. By proactively managing risk, the family can protect their assets and ensure the long-term success of the business. Insurance coverage plays a crucial role in wealth preservation and asset protection. Family business owners should review their insurance policies regularly to ensure they have adequate coverage for various risks, including property damage, liability claims, and business interruption. Additionally, the family should consider life insurance and disability insurance policies to protect against the financial impact of unexpected events. Protecting personal assets from business liabilities is another critical aspect of wealth preservation and asset protection. Family business owners should consult with legal and financial advisors to implement strategies for separating personal and business assets, such as forming a limited liability company or establishing a trust. By taking these steps, the family can safeguard their personal wealth and minimize the potential impact of business-related risks. Once the transition plan has been developed, it's essential to communicate it to all stakeholders, including family members, employees, customers, and suppliers. Transparent communication helps build trust and ensures that everyone is aligned in their understanding of the transition process. Regular updates and open dialogue also enable the family to address any concerns or questions that may arise during the transition. As the transition progresses, it's crucial to monitor progress and make adjustments as needed. This may involve revisiting the succession timeline, reassessing the development of potential successors, or adjusting the governance and decision-making structures. By continually evaluating the transition plan and making necessary adjustments, the family can ensure a successful and smooth handover of responsibilities. Recognizing and celebrating milestones and achievements during the transition process can help maintain momentum and foster a positive atmosphere. Celebrations can be as simple as a family dinner or a more formal event, depending on the preferences of the family. Acknowledging accomplishments and progress helps build confidence and strengthens the bonds among family members. The final step in the transition process is the actual handover of responsibilities to the successor. This should be a well-organized and structured process, with clear communication of expectations and a thorough review of ongoing projects and initiatives. By ensuring a smooth handover, the family can minimize disruption to the business and set the stage for continued success under new leadership. After the transition has taken place, it's essential to continue monitoring and adjusting the plan as needed. Regular reviews of the plan can help identify any areas that may require further attention, and adjustments can be made to address new challenges or opportunities. As the business and family circumstances change, it's important to update the transition plan's objectives and strategies accordingly. This may involve revisiting growth targets, adjusting the governance structure, or reevaluating the roles and responsibilities of family members. By staying flexible and adapting the plan as needed, the family can ensure the ongoing success and sustainability of the business. Maintaining open lines of communication with family members is crucial throughout the transition process and beyond. Regular family meetings, updates, and discussions can help address any concerns or challenges that may arise, foster collaboration, and ensure that all family members remain aligned in their objectives and values. Even after the transition is complete, it's essential to continue seeking professional advice when necessary. Financial, legal, and business advisors can provide valuable insights and guidance on various aspects of the business, including tax planning, risk management, and strategic decision-making. By working with experienced professionals, the family can ensure the ongoing success and growth of the business. Family business transition planning is a complex and multifaceted process that requires careful consideration and planning. By establishing clear objectives and goals, identifying and preparing potential successors, addressing financial and legal considerations, and implementing a well-structured transition plan, family business owners can ensure the continuity of their business for generations to come. Ongoing monitoring and adjustment of the plan, as well as open communication and collaboration among family members, are critical to achieving a successful and smooth transition.Family Business Transition Planning Overview

Establishing Objectives and Goals

Clarifying Family Values and Vision

Identifying Business Objectives

Setting Personal Financial Goals

Assessing Retirement Needs

Identifying Potential Successors

Evaluating Family Members' Interests and Qualifications

Considering External Candidates

Developing a Succession Timeline

Training and Mentoring Successors

Developing a Comprehensive Training Plan

Implementing Mentoring Programs

Addressing Knowledge and Skills Gaps

Providing Opportunities for Growth and Leadership

Governance and Decision-Making Structures

Establishing a Family Council or Board of Directors

Creating a Clear Decision-Making Process

Defining Roles and Responsibilities

Encouraging Open Communication and Conflict Resolution

Financial and Legal Considerations

Assessing the Business Valuation

Addressing Tax Implications

Developing Buy-Sell Agreements

Creating a Contingency Plan for Unexpected Events

Wealth Preservation and Asset Protection

Diversifying Investments

Implementing Risk Management Strategies

Ensuring Proper Insurance Coverage

Protecting Personal Assets from Business Liabilities

Implementing the Transition Plan

Communicating the Plan to All Stakeholders

Monitoring Progress and Adjusting as Needed

Celebrating Milestones and Achievements

Ensuring a Smooth Handover of Responsibilities

Monitoring and Adjusting the Plan

Regularly Reviewing the Transition Plan

Updating Objectives and Strategies as Circumstances Change

Engaging in Ongoing Communication With Family Members

Seeking Professional Advice When Necessary

The Bottom Line

Family Business Transition Planning FAQs

Establishing clear objectives and goals in family business transition planning helps align stakeholders, ensures the plan supports the business's long-term success, and addresses the financial security and well-being of the family members involved.

You can identify and prepare potential successors by evaluating family members' interest and qualifications, considering external candidates, developing a succession timeline, creating a comprehensive training plan, and implementing mentoring programs.

Governance plays a crucial role in family business transition planning, as it helps ensure decisions are made in the best interest of the business and family. Establishing a family council or board of directors, creating a clear decision-making process, and defining roles and responsibilities are essential components of effective governance.

To address financial and legal considerations in family business transition planning, assess the business valuation, work with a qualified tax advisor to address tax implications, develop buy-sell agreements, and create a contingency plan for unexpected events.

Strategies for wealth preservation and asset protection during a family business transition include diversifying investments, implementing risk management strategies, ensuring proper insurance coverage, and protecting personal assets from business liabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.