An executor of a will is an individual appointed by the deceased to manage their estate after they have passed away. They are responsible for ensuring that the deceased's debts are paid, their assets are distributed according to their will, and their wishes are carried out. A power of attorney is a legal document that gives an individual the authority to make decisions on behalf of someone else. The individual who is given a power of attorney is known as the agent. It is often used when someone is unable to make decisions for themselves due to a medical condition or other reasons. The key difference between the executor of a will and a power of attorney is their authority and responsibility. An executor of a will is responsible for managing and distributing the assets of a deceased person's estate, following the instructions outlined in their will. In contrast, a power of attorney is responsible for managing the legal, financial, and healthcare decisions of a person who is still alive but incapacitated. The executor of a will is responsible for managing the estate of the deceased. The executor is appointed by the deceased and is named in the will. The executor's role is to ensure that the deceased's wishes are carried out according to the instructions in their will. They are responsible for managing the estate through the probate process, which involves filing the will with the probate court, identifying and valuing assets, paying off debts and taxes, and distributing assets to beneficiaries according to the will. The duties and responsibilities of an executor of a will include the following: Filing the Will With the Probate Court. The executor is responsible for filing the will with the probate court and initiating the probate process. Collecting and Valuing Assets. The executor is responsible for identifying and valuing all of the assets of the estate, including property, bank accounts, investments, and personal belongings. Paying Debts and Taxes. The executor is responsible for paying any debts owed by the deceased, including outstanding bills and taxes owed to the government. Distributing Assets to Beneficiaries. The executor is responsible for distributing the assets of the estate to the beneficiaries named in the will, according to the instructions of the deceased. Keeping Accurate Records. The executor is responsible for keeping detailed records of all financial transactions related to the estate, including income, expenses, and distributions to beneficiaries. Reporting to the Beneficiaries and the Court. The executor is responsible for providing regular reports to the beneficiaries and the probate court on the progress of the estate administration. Being an executor of a will requires a range of skills, including: Strong Organizational Skills. The executor must be able to manage complex financial and legal matters and keep accurate records of all financial transactions related to the estate. Attention to Detail. The executor must be detail-oriented and able to review and manage all aspects of the estate carefully. Good Communication Skills. The executor must be able to communicate effectively with beneficiaries, legal professionals, and government agencies involved in the probate process. Financial Management Skills. The executor must be able to manage the assets of the estate and make sound financial decisions in the best interests of the beneficiaries. Legal Knowledge. While not required, having a basic understanding of estate and probate law can be helpful for an executor in managing the estate. The probate process is the legal process of settling the estate of the deceased. It is designed to ensure that the debts of the estate are paid and that the remaining assets are distributed to the beneficiaries named in the will. The executor of a will plays a key role in managing the estate through the probate process. The probate process typically involves several steps, including: The first step in the probate process with a will is for the executor to file a petition for probate in the court of the county where the deceased person lived. The petition outlines the decedent's assets and liabilities, identifies any heirs or creditors that need to be notified, and requests permission from the court to administer the estate. After filing the probate petition, the court issues a letter of administration to confirm the executor's appointment. This letter gives the executor power over all assets owned by the deceased and any income generated from those assets during probate. The executor must then identify the deceased's assets and debts owed. This step involves a thorough assessment of the estate, including real estate properties and financial accounts such as bank accounts, stocks, bonds, and other investments. Creditors must also be informed about the probate process, as they have a legal right to make claims against the estate. After identifying the assets and debts, the executor pays off any debts and taxes owed from the estate funds. This step may require the executor to sell assets to generate funds to pay off the debts. Once all debts and taxes are paid, the executor distributes assets as specified in the will. This step may involve selling assets and dividing the proceeds among the beneficiaries or transferring assets directly to the beneficiaries. The executor must ensure that the distribution is carried out properly and that the beneficiaries receive their rightful share of the assets. A power of attorney is a legal document that grants an individual the authority to make decisions on behalf of another person, often when the latter person is incapacitated or unable to make their own decisions. The person who grants a power of attorney is called the principal or grantor, while the person granted the power is called the agent or attorney-in-fact. There are two primary types of Powers of Attorney (POAs) - financial and healthcare. If an individual wants to grant someone the authority to make healthcare-related decisions on their behalf, they can sign a Durable Power of Attorney for Healthcare, also known as a Healthcare POA. This document is legally binding and outlines the individual's consent to give their agent POA privileges if they become incapacitated or unable to make healthcare decisions independently. The HCPOA is responsible for overseeing medical care decisions on behalf of the individual, and their authority kicks in only when the principal can no longer make healthcare-related decisions independently. A financial POA allows an individual to grant an agent the power to manage their financial and business affairs, such as signing checks, filing tax returns, depositing and mailing Social Security checks. Similarly, the individual is tasked to manage investment accounts in the event that they become unable to make decisions or understand what is happening. The agent under a financial POA is required to carry out the principal's wishes to the best of their ability, and their responsibilities are outlined in the agreement. A financial POA provides the agent with significant control over the principal's bank account, including the ability to make deposits and withdrawals, sign checks, and make or change beneficiary designations. There are different subtypes of financial POAs: the general power of attorney, the limited power of attorney, and the durable power of attorney. A general power of attorney allows an agent to act on behalf of the principal in any matters allowed by state laws. The agent under this agreement may be authorized to handle bank accounts, sign checks, sell property, manage assets, and file taxes for the principal. A limited power of attorney allows the agent to act on behalf of the principal in specific matters or events. For example, the agent may only be authorized to manage the principal's retirement accounts, and the POA may only be in effect for a specific period, such as when the principal is out of the country for two years. A durable power of attorney is a legal document that authorizes an agent to handle certain financial, legal, or property-related matters specified in the agreement, even if the principal becomes mentally incapacitated. The agent can pay medical bills, but they cannot make health-related decisions for the principal, such as taking them off life support. When the agent makes investment decisions through a broker, a copy of the DPOA is required to confirm their authorization. While both the executor of a will and a power of attorney deal with managing affairs when a person is unable to, they have distinct differences. The main contrast between the executor and the agent lies in the timing of their roles. Power of attorney is applicable to times when you are still alive but cannot make decisions, while the executor only performs duties after your death. Power of attorney comes into effect immediately upon signing the legal document, while the executor of the will's duties begins after the person has passed away. Power of attorney enables a designated agent to make decisions on behalf of the principal when they are still alive but are incapacitated and cannot make decisions for themselves. The job description for each role is slightly different, even though both deal with managing a person's affairs when they are unable to do so. The executor of the will has a very specific and limited job, which is making sure there is enough money in the estate to pay off any debts and then distributing what remains to the heirs. The executor is responsible for managing the estate throughout the probate process. This includes filing the deceased's will with the appropriate probate court, locating and collecting all the assets, paying off all debts associated with the estate, and distributing what’s left to the proper beneficiaries. On the other hand, the job of an agent with power of attorney is more wide-ranging and depends on the powers granted in the legal document. The job could involve ruling on all kinds of financial, legal, and medical decisions. A power of attorney can either be healthcare or financial. A healthcare power of attorney allows an agent to make healthcare-related decisions on behalf of the principal, while a financial power of attorney grants an agent the authority to manage the financial affairs of the principal. One person can serve as both the executor of a will and have power of attorney. This is not uncommon, especially if the individual has chosen a child or another trusted relative for the roles. However, it is essential to remember that these are both significant jobs with a lot of responsibility. Appointing the same person to both roles may be asking a lot of him or her. It is important to note that the two roles will not overlap. Power of attorney is only effective while the individual is alive and unable to make decisions, while the executor of the will's duties begins only after the person has passed away. Choosing one person to serve as both executor and power of attorney can have advantages, such as streamlining the decision-making process and ensuring that one trusted individual controls the estate. However, it is also critical to consider the potential disadvantages, such as overburdening one person with too much responsibility and the possibility of conflicts of interest arising. Ultimately, it is up to the individual to weigh the pros and cons and decide whether or not to appoint one person to both roles or separate individuals for each role. There are several pros and cons to consider when deciding whether to appoint one person to fulfill the roles of the executor of a will and power of attorney. Some of these include: Streamlined Decision-Making. It ensures that the same individual is responsible for managing both the individual's affairs during their lifetime and their estate after their passing. Cost Savings. Appointing the same person in both roles can help save costs that would otherwise be incurred by hiring separate individuals. Consistency. Having one person oversee both the individual's lifetime affairs and their estate can help ensure consistency in decision-making and management of their affairs. Overburdening the Individual. The responsibilities of both executors of a will and a power of attorney are significant and time-consuming. Appointing one person to both roles may overburden them with too much responsibility. Conflict of Interest. There is a risk of conflicts of interest arising if one person is responsible for managing both the individual's affairs during their lifetime and their estate after their passing. Lack of Specialization. Appointing one person to both roles may result in a lack of specialization, as the individual may not have expertise in both financial management and healthcare decision-making. Choosing an executor of a will and a power of attorney is crucial in estate planning. These individuals will be responsible for managing an individual's affairs during their lifetime and ensuring their estate is distributed according to their wishes after their passing. Here are some factors to consider when choosing an executor of a will and power of attorney: Trustworthiness. The chosen individuals should be trustworthy and have the individual's best interests at heart. They should be reliable, honest, and responsible. Competence. The executor of a will and power of attorney should have the necessary skills and knowledge to fulfill their roles effectively. For example, an executor of a will should be organized, detail-oriented, and knowledgeable about the probate process. Availability. The individuals should be available to carry out their duties as required. They may not be the best choice for the role if they live far away or have other significant responsibilities. Communication Skills. Good communication skills are essential for both roles. The executor of the will and power of attorney should be able to communicate effectively with family members, beneficiaries, and other parties involved in the estate. Willingness to Serve. The chosen individuals should be willing to take on the responsibilities of an executor of a will and power of attorney. It is important to have a frank discussion with them to ensure they are comfortable with the role and understand the responsibilities involved. Familiarity With the Individual's Wishes. The chosen individuals should be familiar with the individual's wishes and preferences, as outlined in their will and other estate planning documents. Compatibility With Family Members. Considering how the chosen individuals will get along with family members and other beneficiaries is critical. They should be able to work collaboratively and be respectful of everyone involved. Choosing an executor of a will and a power of attorney requires careful consideration of several factors. An executor of a will manages the estate of a deceased person, while a power of attorney is responsible for making decisions on behalf of someone who is still alive but incapacitated. The job descriptions and duties of each role are different, and appointing the same person to both roles can have pros and cons. Pros include streamlined decision-making, cost savings, and consistency, while cons include overburdening the individual, conflicts of interest, and a lack of specialization. It is imperative to choose individuals who are trustworthy, competent, and willing to serve to ensure that one's wishes are carried out as intended. Suppose you need help in making informed choices or have questions about managing your financial and legal matters. In that case, it is advisable to seek the advice of a financial advisor or a professional who specializes in estate planning.Executor of a Will vs Power of Attorney: Overview

What Is an Executor of a Will?

Duties and Responsibilities of an Executor of the Will

Skills Required to Be an Executor of the Will

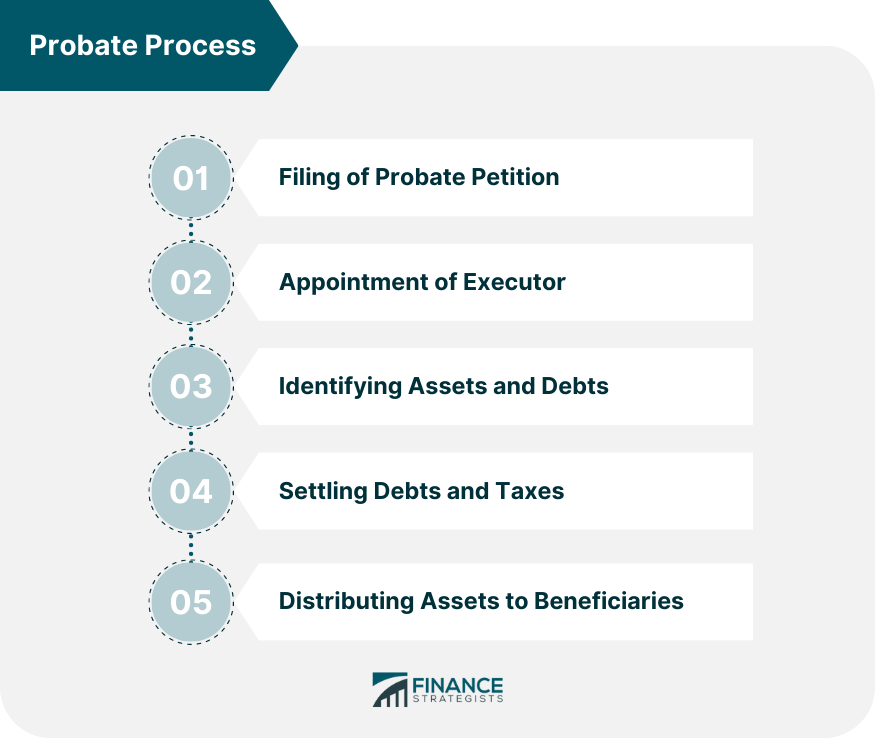

Probate Process and How It Relates to the Role of an Executor of the Will

Step 1: Filing of Probate Petition

Step 2: Appointment of Executor

Step 3: Identifying Assets and Debts

Step 4: Settling Debts and Taxes

Step 5: Distributing Assets to Beneficiaries

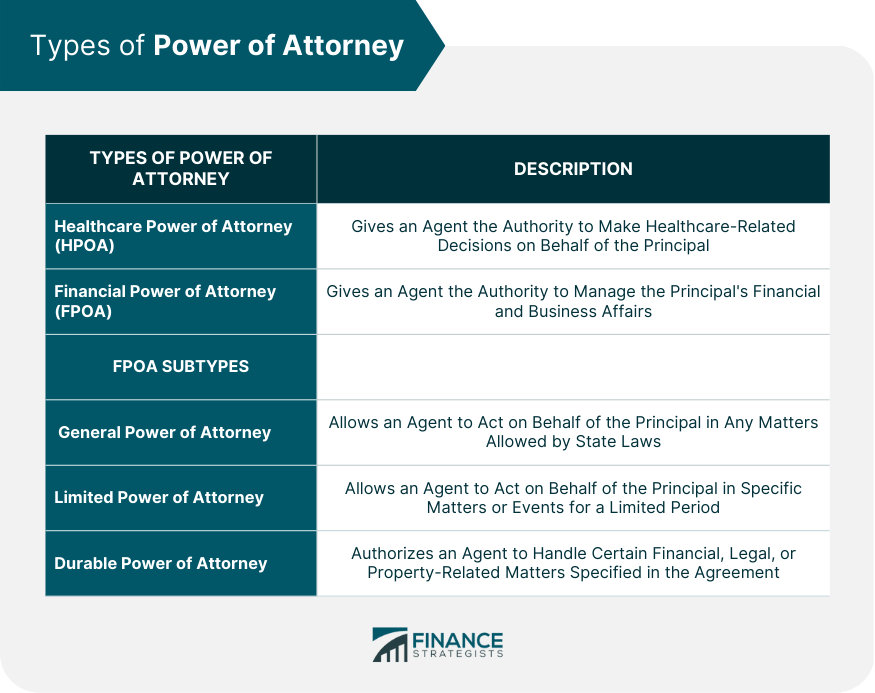

What Is a Power of Attorney?

Types of Power of Attorney

Healthcare Power of Attorney (HCPOA)

Financial Power of Attorney

General Power of Attorney

Limited Power of Attorney

Durable Power of Attorney

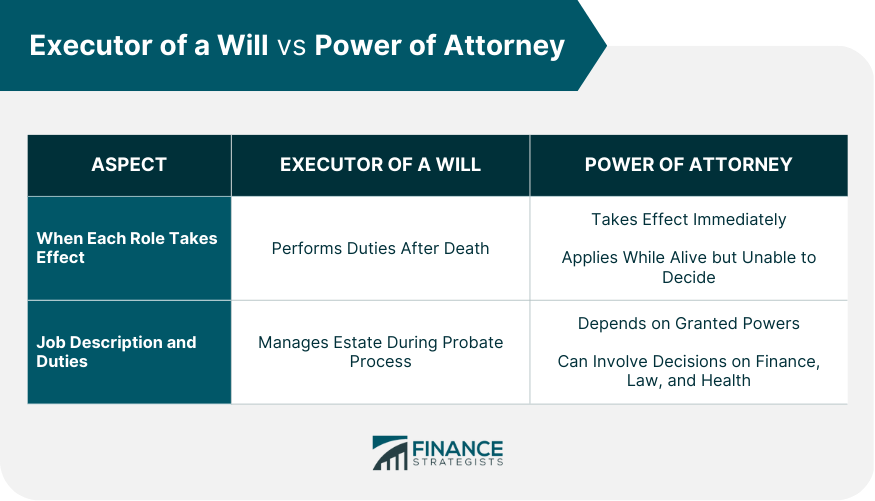

Differences Between an Executor of a Will and a Power of Attorney

Main Difference Between the Two Roles

When Each Role Takes Effect

Job Description and Duties of Each Role

Can One Person Be an Executor of a Will and Power of Attorney?

Pros and Cons of Having One Person Fulfill Both Roles

Pros of Having One Person Fulfill Both Roles

Cons of Having One Person Fulfill Both Roles

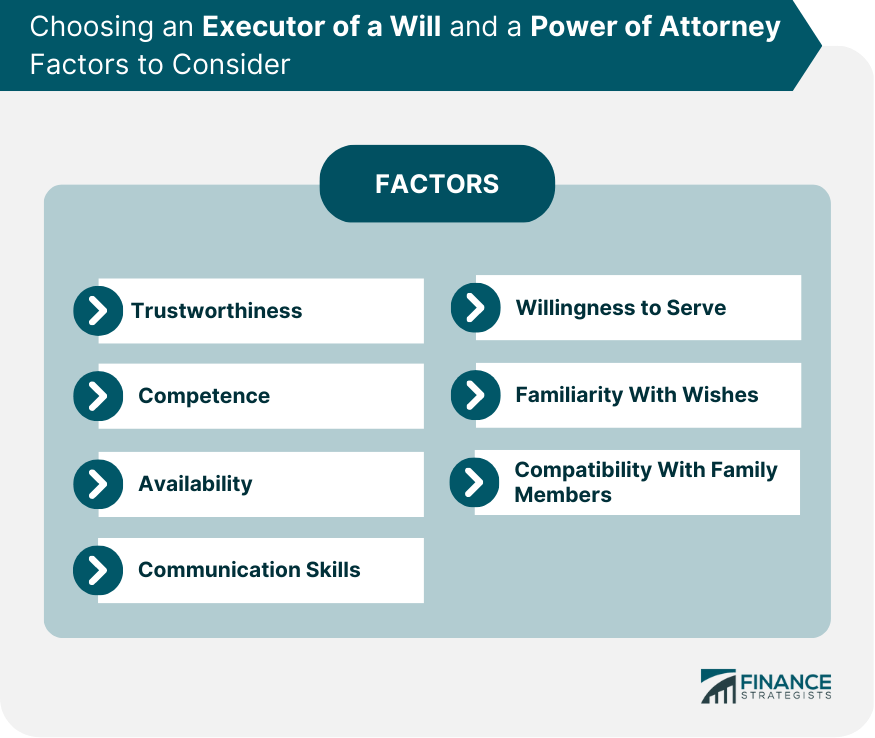

Choosing an Executor of a Will and a Power of Attorney

The Bottom Line

Executor of a Will vs Power of Attorney FAQs

The main difference is that an executor of a will manages the estate of a deceased person, while a power of attorney makes decisions on behalf of someone who is still alive but unable to make decisions.

The duties of an executor include filing the will with the probate court, collecting and valuing assets, paying debts and taxes, distributing assets to beneficiaries, keeping accurate records, and reporting to beneficiaries and the court.

Skills required include strong organizational skills, attention to detail, good communication skills, financial management skills, and a basic understanding of estate and probate law.

A power of attorney is a legal document that grants an individual the authority to make decisions on behalf of another person, often when the latter person is incapacitated or unable to make their own decisions.

Yes, one person can serve in both roles, but it is important to consider the potential advantages and disadvantages, such as overburdening one person with too much responsibility and the possibility of conflicts of interest arising.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.