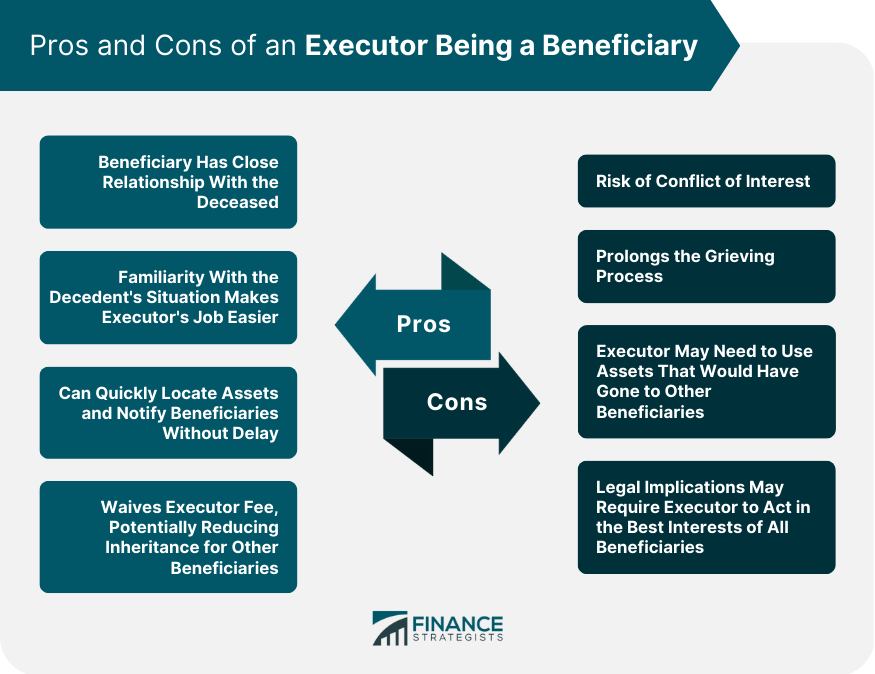

The short answer to the question of whether an executor of a will can be a beneficiary is yes. Serving as an executor of a will involves significant time commitment and responsibility. Executors are responsible for overseeing the transfer of assets to the designated beneficiaries, paying debts, closing accounts, and wrapping up miscellaneous affairs of the deceased. In many cases, the executor may be a close relative or spouse of the decedent and, thus, also named as a beneficiary in the will. Although this may seem unusual, it is actually a common occurrence. In fact, it is common for an executor also to be named as one of the beneficiaries in a will. This arrangement makes sense as the executor, being someone who is familiar with the decedent's situation, would be better equipped to carry out the duties and responsibilities of an executor. It is worth noting that probate court systems in several states favor beneficiaries serving as executors in some cases. However, there are situations where a beneficiary cannot also serve as an executor, such as when the individual is generally unqualified to do so. An executor is an individual who is appointed to administer the last will and testament of a deceased person. The executor's primary duty is to ensure that the wishes of the deceased are carried out according to the instructions laid out in their will or trust documents. This involves managing the affairs of the deceased, including accounting for all assets listed in the will, such as financial holdings, real estate, direct investments, or collectibles like art. Additionally, the executor must ensure that all debts and taxes of the deceased are paid off. The executor is legally obligated to act in the best interests of the deceased and meet their wishes. Although anyone can be an executor, the executor is usually a lawyer, accountant, or family member, provided they are over the age of 18 and have no prior felony convictions. Being an executor is a large responsibility, and potential hazards and complications may arise during the estate administration process. A beneficiary is an individual or entity designated to receive benefits from the property of someone else, often as part of an inheritance. Beneficiaries can be named in various financial products such as life insurance policies, retirement accounts, brokerage accounts, bank accounts, and other financial products. It is crucial to designate beneficiaries for financial assets to ensure that they are distributed according to the benefactor's wishes after their passing. The beneficiary can have tax consequences when inheriting certain financial assets, such as life insurance policies, where accrued interest may be taxed. If a benefactor fails to name beneficiaries for their financial accounts or in their will, it can cause financial institutions to make decisions about asset distribution, or the property may be tied up in probate potentially for years. In either case, the intended beneficiaries may not receive the financial support the benefactor intended, or they may have to wait an extended period. It is important to note that beneficiaries designated on financial account paperwork override any beneficiaries listed in a will. The relationship between an executor and a beneficiary is an important one in the context of estate planning and administration. In the context of estate administration, the executor and the beneficiary may have overlapping roles, particularly if the executor is also named as a beneficiary in the will. This is a common occurrence, as executors who are beneficiaries may have a more intimate understanding of the deceased's situation and wishes, which can make their job easier. However, having an executor who is also a beneficiary can create conflicts of interest. For example, the executor may prioritize their own interests over those of the other beneficiaries or engage in behaviors that benefit them at the expense of others. This can drag out the grieving process and complicate the estate administration process. It is important to note that the executor's role is to act in the best interests of the deceased and carry out their wishes according to their instructions. The executor has a legal obligation to manage the affairs of the deceased, including accounting for all assets in the will, estimating the value of the estate, and ensuring that all debts and taxes are paid off. In contrast, the beneficiary's role is to receive the benefits of the deceased's property as specified in the will or other estate planning documents. While the executor and the beneficiary may have overlapping roles in estate administration, their responsibilities and priorities differ. Ultimately, the relationship between an executor and a beneficiary requires trust and transparency to ensure that the wishes of the deceased are carried out in the most efficient and effective way possible. Having a beneficiary serve as the executor of a will has several potential upsides. If the beneficiary were also a close relative or a spouse of the deceased, they would have had a close relationship with the deceased. It is unlikely that the deceased would have left a bequest to someone they did not trust or have a strong connection with. As a result, the beneficiary's familiarity with the decedent's situation can make their job as executor much easier. For instance, they can quickly locate the deceased's assets and notify other beneficiaries, likely family members or close friends, without delay. In contrast, an executor who is an attorney or accountant with little exposure to the decedent before the appointment could face challenges in carrying out the wishes of the deceased. Moreover, if the beneficiary is serving as both the executor and sole beneficiary, they can waive the executor fee, which would come out of the estate and potentially reduce the inheritance that the beneficiaries receive. Estates are only taxed above a certain threshold, and executor fees are taxed as ordinary income. The estate can avoid losing any of its value to taxes by waiving the fee. Having a beneficiary serve as executor can make the estate administration process smoother and more efficient. However, it is vital to note that potential conflicts of interest can arise when an executor is also a beneficiary. While having a beneficiary serve as the executor of a will can be advantageous, there are also potential downsides to consider. Losing someone close is always difficult, and having to administer their estate may prolong the grieving process. If the executor is also a beneficiary, there is a risk of a conflict of interest arising. For example, if the estate has substantial debts, the executor may need to use the assets that would have gone to other beneficiaries. This can create a difficult situation where the executor must balance their interests with those of the other beneficiaries to avoid conflict of interest. Choosing an executor whom you trust deeply and who can act impartially is imperative, ensuring that all beneficiaries receive what they are entitled to. In addition to these concerns, there may also be legal implications to consider. In some cases, the law may require that the executor act in the best interests of all beneficiaries, which can be challenging if the executor is also a beneficiary. While having a beneficiary serve as an executor can be beneficial, it is important to consider the potential downsides carefully and to choose an executor who is trustworthy, competent, and able to act in the best interests of all beneficiaries. An executor is responsible for administering the last will and testament of a deceased person, while beneficiaries are designated to receive benefits from the property of the deceased. Although it is common for an executor also to be named as one of the beneficiaries, this arrangement can lead to potential conflicts of interest. Selecting an executor who can act impartially and be trusted deeply to ensure all beneficiaries receive what they are entitled to is crucial. While having a beneficiary serve as an executor can make the estate administration process smoother and more efficient, it is essential to weigh the potential downsides carefully. In any case, an executor can also be a beneficiary of a will, which can have advantages and disadvantages. However, choosing an executor who can act impartially, be trusted deeply, and seek professional guidance when necessary is important. Seeking the guidance of a financial advisor can help navigate the complexities of estate planning and administration and ensure the appointed executor is qualified to carry out their duties. Can an Executor Be a Beneficiary?

What Is an Executor?

What Is a Beneficiary?

Relationship Between an Executor and a Beneficiary

Advantages of an Executor Being a Beneficiary

Disadvantages of an Executor Being a Beneficiary

The Bottom Line

Can an Executor Be a Beneficiary? FAQs

The role of an executor is to administer the last will and testament of a deceased person. Their primary responsibility is to ensure that the wishes of the deceased are carried out according to the instructions laid out in their will or trust documents. Additionally, the executor must ensure that all debts and taxes of the deceased are paid off. On the other hand, the role of a beneficiary is to receive the benefits of the deceased's property as specified in the will or other estate planning documents.

Yes, an executor can also be a beneficiary. In fact, it is common for an executor to be named as one of the beneficiaries in a will, particularly if they are a close relative or spouse of the decedent.

Having a beneficiary serve as executor can make the estate administration process smoother and more efficient. The beneficiary's familiarity with the decedent's situation can make their job easier, such as quickly locating the deceased's assets and notifying other beneficiaries. If the beneficiary is serving as both the executor and sole beneficiary, they can waive the executor fee.

If the executor is also a beneficiary, there is a risk of a conflict of interest arising, such as when the estate has substantial debts, and the executor must balance their interests with those of other beneficiaries. Additionally, the executor's role is to act in the best interests of the deceased and meet their wishes, which may conflict with the interests of other beneficiaries.

It is important to choose an executor whom you trust deeply and who can act impartially, ensuring that all beneficiaries receive what they are entitled to. Working with a financial advisor to build out an estate plan is also recommended to ensure that the appointed executor is qualified to carry out the necessary responsibilities and that the wishes of the deceased are properly followed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.