An inheritance is a sum of money or property that is passed down from one family member to another after someone dies. Usually, an inheritance is given to the deceased person's spouse, children, or parents. However, there are other ways to distribute an inheritance, such as through a will.

There are a number of reasons why you might want to give away your inheritance before you die. Here are just a few: People have a lot of different reasons for giving their inheritances before death, and many people who do so feel very good about what they have done. An inheritance is usually meant to ensure that loved ones are taken care of. There are some cases where people who receive an inheritance might not want to give it away before death. The reasons are as follows: However, there are many cases where people do not have a need for an inheritance, and it is given to those they care about as a form of legacy. There are many benefits to giving your inheritance before you die. Here are some: There are a few different ways to give away an inheritance before death. One way is to simply give the money or property away to the people you want to receive it. You can also establish a trust, which is a legal document that dictates how and when the money or property will be distributed. Another way is to sign a beneficiary designation form. With this document, you can give your life insurance beneficiaries or retirement accounts to the people you want to receive them. For some inheritances, it makes sense to create a special type of trust that helps bypass probate and ensures that the inheritance goes where you want it as quickly as possible after your death. You can put money or property into joint accounts with other people. This makes it easy to give the inheritance to the right people after you die. Additionally, this allows them access to that money or property while you are still alive. If it is something that is needed for daily living expenses, you might consider living trusts so your estate can be passed on without going through probate after you die. A third way is to create a will that includes provisions for your inheritance. There are also some steps you can take to make it easy for your executor and heirs to know what assets you have and where they are located so there won't be any problems. Stocks and bonds make great inheritances for people they can be turned into cash easily through a brokerage account. This makes it easy to transfer the stock or bond to someone else, whether you decide to directly transfer it or create a trust that holds the stock or bond. When you give stocks and bonds as an inheritance, it is important to make sure that the person who receives them understands how the stock or bond works. There are many reasons why people choose to give their inheritances away before death. Some do it out of a sense of generosity, while others do it in order to ease the burden on their loved ones. Whatever the reason, giving an inheritance before death can be a good thing for everyone involved. When thinking about whether or not to give an inheritance before death, keep in mind that it can affect your family's financial future. If you want to give money or property as an inheritance, determine if the person who will receive it really needs it and knows how to use it responsibly. If you want to give stocks and bonds as inheritances, make sure that the people receiving them understand how they work. You may also want to consider creating a special trust that helps the inheritance go where you want it as quickly as possible after your death. Whatever route you choose, make sure to talk to an estate planning lawyer to get help with the legal details.What Is an Inheritance?

Why Should You Give Your Inheritance Before Death?

When Might Someone Not Want to Give Their Inheritance Before Death?

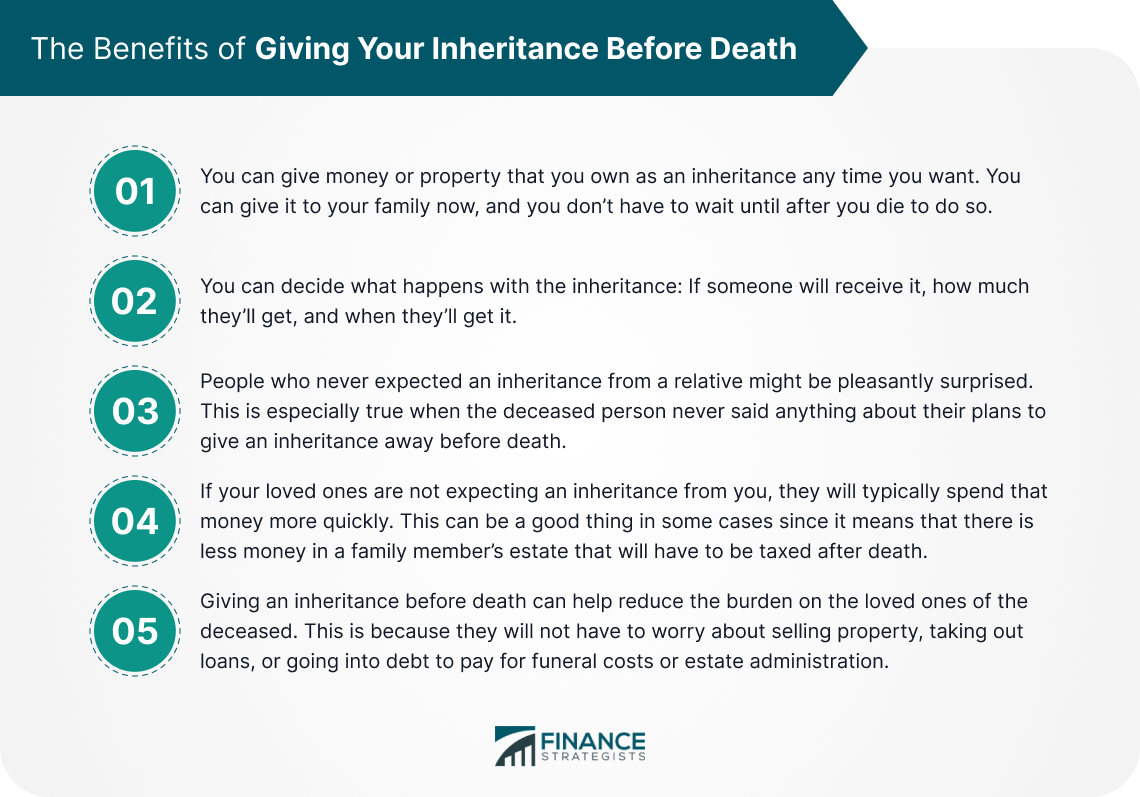

The Benefits of Giving Your Inheritance Before Death

This can be a good thing in some cases since it means that there is less money in a family member's estate that will have to be taxed after death.

This is because they will not have to worry about selling property, taking out loans, or going into debt to pay for funeral costs or estate administration.

How to Give Your Inheritance Before Death?

How Do I Give Money or Property as an Inheritance?

How Do I Give Stocks and Bonds as an Inheritance?

The Bottom Line

Distribution of Inheritance Before Death FAQs

An inheritance is a money or property that a person leaves to someone else when they die. This could be in their will, as part of their last wishes and directions about what should happen after they are gone. It may also be part of the way that probate works - if someone dies without leaving instructions on how to distribute their assets, the court may step in and award inheritances to certain individuals based on a set of pre-determined rules.

There are a few reasons why it might be a good idea to give away an inheritance before death. One reason is that it can help reduce the burden on the loved ones of the deceased. This is because they will not have to worry about selling property, taking out loans, or going into debt to pay for funeral costs or estate administration. Another reason is that it can help beneficiaries avoid probate. Probate is a legal process that can be expensive and time-consuming, and it's one of the main ways that the courts determine how to distribute an estate. I f you give your inheritance away before death, you can avoid probate and make sure that the money goes to the people you want it to.

There are several benefits to giving away an inheritance before death. Some of these include: - It can help avoid the costs and time associated with estate administration. - It can make sure that your property goes to the people you want it to, instead of being distributed according to a set of legal rules.

In order to give your inheritance away before death, you need to make a will or trust that outlines your wishes. This document should designate specific beneficiaries who will receive the inheritance, as well as how it will be distributed. It's important to work with an estate planning lawyer to make sure that the document is properly executed and that your wishes are followed after your death.

The most common way to give an inheritance before death is to write a will and designate specific beneficiaries. This may be done in one of two ways - either by leaving the property or money directly to the person who you want to get it or by placing it in trust so that it goes directly to them after your death.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.