Individual Retirement Accounts (IRAs) is an excellent way to save for retirement. They provide tax-deferred growth, which means you do not have to pay taxes on the earnings until you withdraw them. However, when the account holder passes away, the assets in the IRA must be distributed to the beneficiary designated on the account. A trust that has been designated as the beneficiary of an IRA receives the IRA upon the death of the IRA owner. The IRA would then be kept as a separate trust asset account.

Various kinds of trusts can serve as IRA beneficiaries, each with its own benefits and drawbacks. The prevalent types of trusts used for this purpose are: A conduit trust is a type of trust that requires all distributions from the IRA to be distributed to the beneficiary each year. The trustee cannot accumulate or retain any of the funds in the trust, and any funds not distributed to the beneficiary are subject to income tax. This type of trust is commonly used when the beneficiary is a spouse who is under the age of 59½ and needs access to the funds before they reach retirement age. An accumulation trust is a type of trust that allows the trustee to accumulate distributions from the IRA and invest them on behalf of the beneficiary. This type of trust is useful when the beneficiary is a minor or has special needs and may not be able to manage the funds themselves. A discretionary trust is a type of trust that gives the trustee broad discretion over distributions from the IRA. The trustee can distribute funds to the beneficiary as needed or hold them in the trust for future use. This type of trust is useful when the beneficiary is an adult who may need assistance managing the funds or has a high risk of being sued. A hybrid trust is a combination of the above types of trusts and allows the trustee to have some discretion over distributions from the IRA while still requiring some distributions to be made to the beneficiary each year. This type of trust is useful when the beneficiary has some special needs but also needs some flexibility in managing the funds. The decision to name a trust as an IRA beneficiary may result in notable tax and legal ramifications. Important factors to keep in mind are: When an IRA is inherited directly by an individual, they are required to take minimum distributions from the account each year starting at age 73. When an IRA is held in a trust, the RMD rules can be more complex. The trustee must make sure that the trust meets certain requirements to allow for stretch distributions over the beneficiary's lifetime. Stretch IRA rules allow beneficiaries to take distributions from an inherited IRA over their lifetime, potentially reducing the tax burden on the beneficiary. When an IRA is held in a trust, the trustee must make sure that the trust meets the requirements for stretch distributions, including the requirement that the beneficiary is an individual and not an entity like a trust. When a trust is named as the beneficiary of an IRA, the trustee has significant responsibilities and fiduciary duties. The trustee must manage the IRA on behalf of the beneficiary, follow the IRS rules for required distributions, and make investment decisions that are in the best interests of the beneficiary. Additionally, the trustee must keep accurate records and provide annual statements to the beneficiary and the IRS. When distributions are made from an IRA held in a trust, they are subject to income tax. The tax rate and timing of the tax liability will depend on the type of trust that is used and the distribution schedule. It is important to consult with an expert in tax services to ensure that the tax implications are fully understood. Assigning a trust as the IRA beneficiary is a complicated process and requires professional guidance from an experienced attorney or financial advisor. The steps involved in the process may include: Step 1: Drafting the Trust. The first step in naming a trust as the beneficiary of an IRA is to create a trust document that meets the IRS requirements for IRA trusts. Step 2: Naming the Trust as the Beneficiary. Once the trust is created, the account holder must name the trust as the beneficiary of the IRA. This can typically be done using a beneficiary designation form provided by the IRA custodian. Step 3: Providing the Necessary Information. The beneficiary designation form will typically require information about the trust, including the name of the trust, the date it was created, and the name of the trustee. Step 4: Reviewing and Updating the Beneficiary Designation. It is important to review the beneficiary designation regularly and update it as needed. Updates to the beneficiary designation may be necessary due to changes in circumstances, such as the birth of a child or the death of a beneficiary. Assigning a trust as the beneficiary of an IRA can provide significant benefits, including asset protection, control over the distribution of assets, estate tax planning, and protection against incapacity or disability. A trust can provide a layer of protection from creditors, lawsuits, and other financial risks. When a beneficiary inherits an IRA directly, the assets become part of their personal assets and can be subject to creditors' claims. In contrast, if the IRA is held in a trust, the assets are protected from the beneficiary's creditors. Additionally, if the beneficiary is involved in a divorce or remarries, a trust can help protect the inherited assets from being split with their ex-spouse or a new spouse. When an IRA is inherited directly by an individual, they have full control over the assets and can withdraw them all at once if they choose. This can result in a substantial tax bill and could leave the beneficiary without sufficient funds for their own retirement. With a trust, the account holder can specify how the assets are to be distributed to the beneficiary. For example, they can set up a schedule of distributions over a certain number of years or require that the beneficiary only receive the earnings from the IRA, not the principal. A trust can also provide estate tax planning benefits. When an IRA is inherited directly, the assets are included in the beneficiary's estate and can be subject to estate tax. If the beneficiary's estate is large enough, the tax bill could be substantial. By assigning a trust as the beneficiary of the IRA, the assets can be kept separate from the beneficiary's estate, potentially reducing their estate tax liability. If the account holder becomes incapacitated, they may not be able to manage their IRA account or make decisions about who should inherit it. With a trust in place, a trustee can step in and manage the IRA on behalf of the account holder. Additionally, if the beneficiary has a disability or special needs, a trust can be set up to provide for their care without jeopardizing their eligibility for government benefits. There are also potential disadvantages, including the potential loss of tax benefits, complicated tax rules, and administrative burdens and expenses. IRAs provide significant tax benefits, including tax-deferred growth and the ability to stretch out distributions over a beneficiary's lifetime. However, when an IRA is held in a trust, some of these benefits may be lost. For example, if the trust does not meet certain IRS requirements, the beneficiary may be required to take distributions from the IRA more quickly than they would if they inherited it directly. The IRS has specific rules governing how trusts must be set up and administered when they are named as the beneficiary of an IRA. If the trust does not meet these requirements, the beneficiary may be subject to penalties or forced to take distributions from the IRA more quickly than they would if they inherited it directly. Additionally, the tax rules for trusts are complex, and the trustee may need to seek professional advice to ensure that they are following the rules correctly. A trustee will need to manage the IRA on behalf of the beneficiary, which can be time-consuming and require specialized knowledge. Additionally, there may be fees associated with setting up and administering the trust, which can reduce the amount of assets that ultimately pass to the beneficiary. Naming a trust as the beneficiary of an IRA can offer significant advantages, such as asset protection, control over the distribution of assets, tax planning, and protection against incapacity or disability. However, it is essential to consider the potential disadvantages, including the loss of tax benefits, complicated tax rules, and administrative burdens and expenses. Therefore, it is advisable to seek professional advice from an attorney or financial advisor before making any decisions. By following the necessary steps and guidelines, you can ensure that your assets are distributed according to your wishes and that your loved ones are protected. Ultimately, with careful planning and informed decision-making, you can maximize the benefits of estate planning and secure your financial future.Trust as Beneficiary of IRA

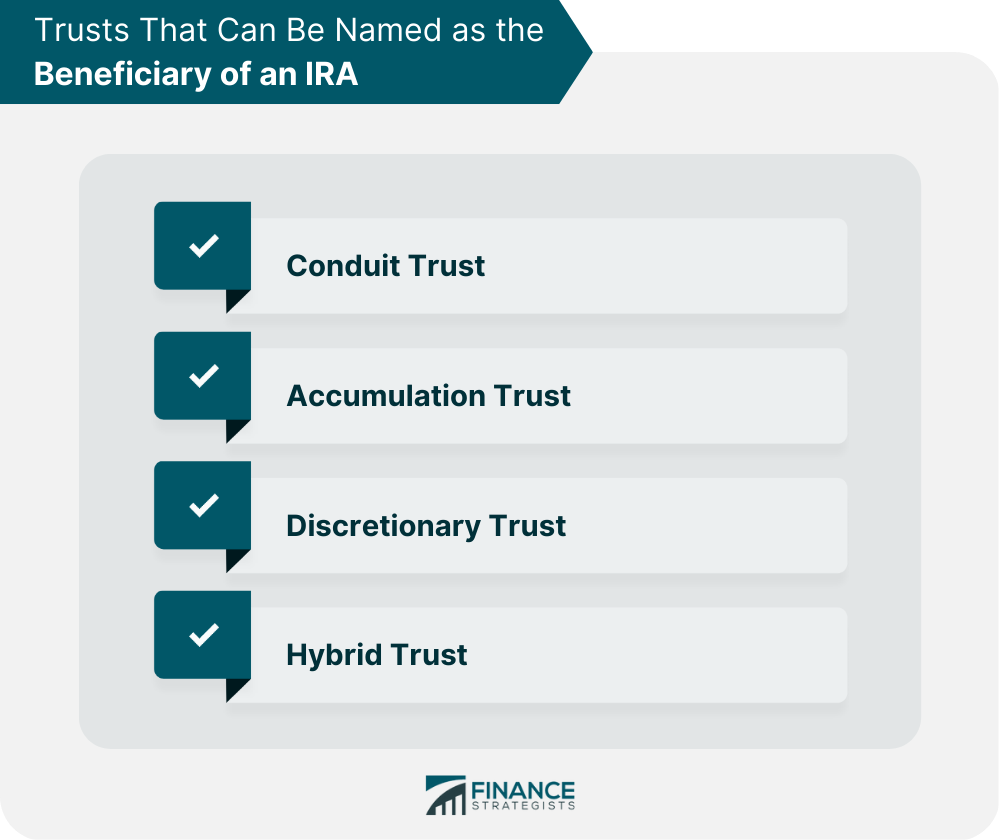

Types of Trusts That Can Be Named as the Beneficiary of an IRA

Conduit Trust

Accumulation Trust

Discretionary Trust

Hybrid Trust

Tax and Legal Implications of Naming a Trust as the Beneficiary of an IRA

Required Minimum Distributions (RMDs)

Stretch IRA Rules

Trustee Responsibilities and Fiduciary Duties

Taxation of Trust Distributions

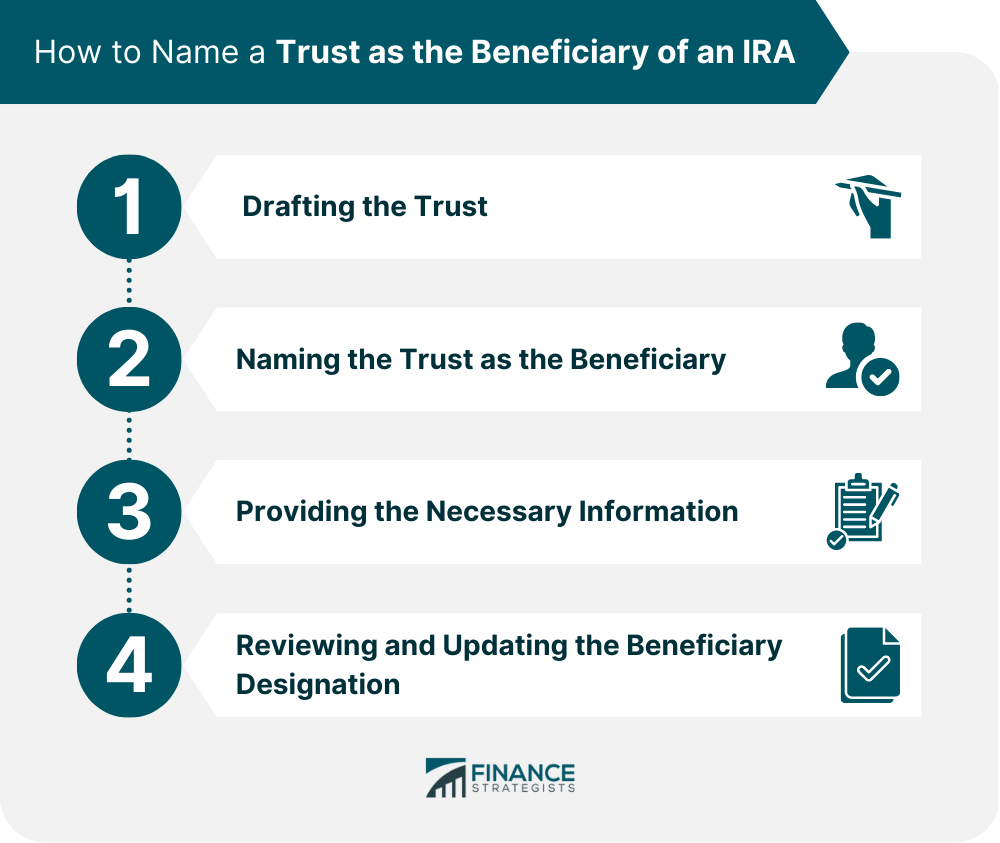

How to Name a Trust as the Beneficiary of an IRA

This will typically involve working with an attorney to draft a document that specifies the terms of the trust and the duties of the trustee.

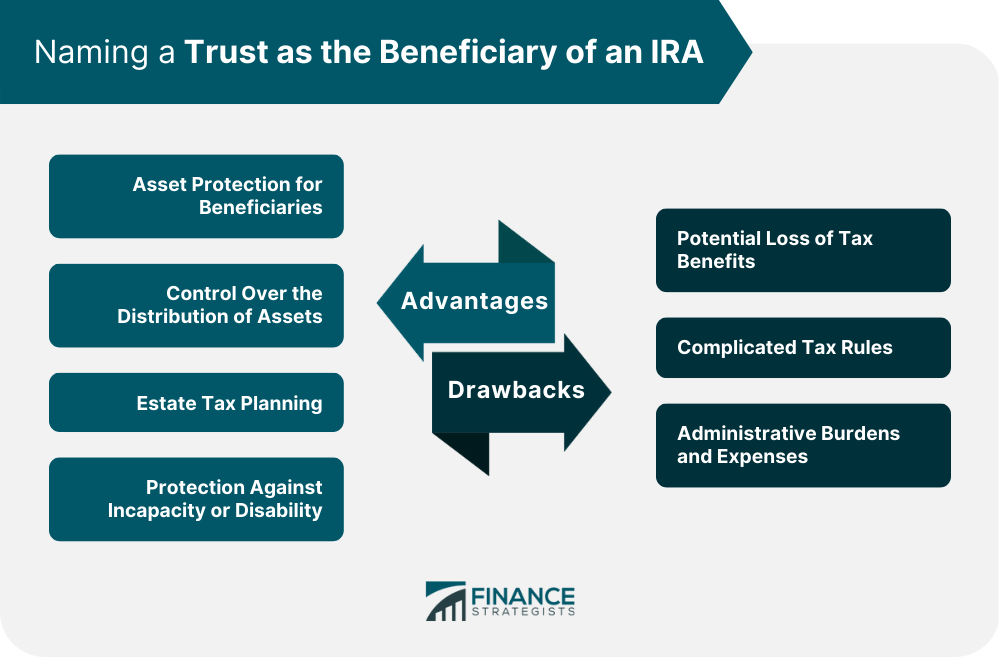

Advantages of Naming a Trust as the Beneficiary of an IRA

Asset Protection for Beneficiaries

Control Over the Distribution of Assets

Estate Tax Planning

Protection Against Incapacity or Disability

Disadvantages of Naming a Trust as the Beneficiary of an IRA

Potential Loss of Tax Benefits

Complicated Tax Rules

Administrative Burdens and Expenses

Final Thoughts

Designating a Trust as an IRA Beneficiary FAQs

Naming a trust as the beneficiary of an IRA can provide advantages such as asset protection for beneficiaries, control over the distribution of assets, estate tax planning, and protection against incapacity or disability.

Yes, there are potential disadvantages, including the loss of tax benefits, complicated tax rules, and administrative burdens and expenses.

The most common types of trusts used for this purpose include conduit trust, accumulation trust, discretionary trust, and hybrid trust.

Tax and legal implications may include required minimum distributions (RMDs), stretch IRA rules, trustee responsibilities and fiduciary duties, and taxation of trust distributions.

The process of naming a trust as the beneficiary of an IRA involves drafting the trust document, naming the trust as the beneficiary, providing the necessary information, and reviewing and updating the beneficiary designation regularly. It is essential to seek professional advice from an attorney or financial advisor before making any decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.